On 12/5/23, Schlumberger will trade ex-dividend, for its quarterly dividend of $0.25, payable on 1/11/24. As a percentage of SLB’s recent stock price of $52.04, this dividend works out to approximately 0.48%.

Start slideshow: 10 Stocks Going Ex-Dividend »

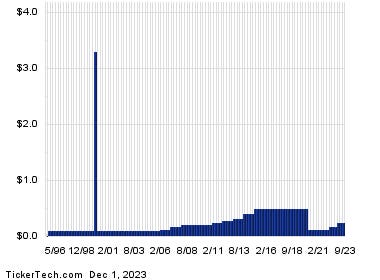

Below is a dividend history chart for SLB, showing historical dividends prior to the most recent $0.25 declared by Schlumberger:

In general, dividends are not always predictable; but looking at the history above can help in judging whether the most recent dividend from SLB is likely to continue, and whether the current estimated yield of 1.92% on annualized basis is a reasonable expectation of annual yield going forward. The chart below shows the one year performance of SLB shares, versus its 200 day moving average:

Looking at the chart above, SLB’s low point in its 52 week range is $42.73 per share, with $62.78 as the 52 week high point — that compares with a last trade of $52.36.

Special Offer: Join the income investing conversation on ValueForum.com with a special Seven Days for Seven Dollars invitation.

In Friday trading, Schlumberger shares are currently up about 0.3% on the day.

Read the full article here