A Quick Take On Telos

Telos Corporation (NASDAQ:TLS) reported its Q3 2023 financial results on November 9, 2023, beating both revenue and consensus earnings estimates.

The firm provides cybersecurity software and related services for government agencies of all types and commercial enterprises.

I previously wrote about Telos with a Hold outlook.

Given Telos Corporation’s continued poor performance and revenue decline trajectory, my outlook in the near term is Bearish [Sell].

Telos Overview And Market

Virginia-based Telos has developed cybersecurity and information systems for federal and state government entities as well as for large businesses.

The firm is led by Chairman and Chief Executive Officer John B. Wood, who has been with the firm since 1992 and previously worked on Wall Street for Dean Witter Reynolds and UBS Securities.

Telos’ primary offerings include:

Security Solutions:

-

Information Assurance / Xacta

-

Secure Communications

-

TSA PreCheck system.

Secure Networks:

-

Secure Mobility

-

Network Management and Defense.

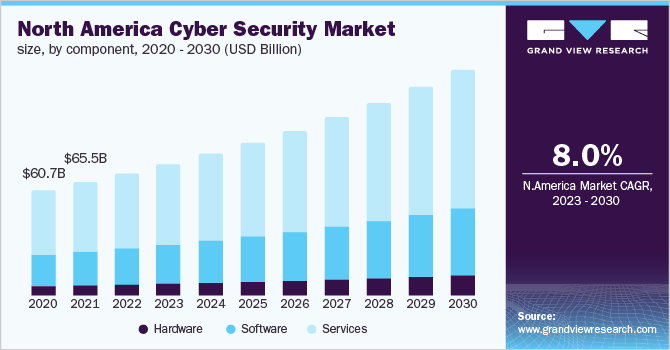

According to a 2023 market research report by Grand View Research, the global market for cybersecurity products and services was an estimated $203 billion in 2022 and is forecasted to reach $513 billion by 2030.

This represents a forecast CAGR of 12.3% from 2023 to 2030.

The primary reason for this expected growth is an increasing proliferation of online threats pursuing greater potential payoffs in the form of stolen information.

A continued transition of enterprises and agencies from legacy on-premises systems to the cloud presents new security challenges that the industry must address.

Additionally, the COVID-19 pandemic exposed firms to greater security threats and complexity due to greater dispersion of company personnel in ‘work from home’ environments.

Below is a chart indicating the historical and projected future North American cybersecurity market growth forecast through 2030 by component:

Grand View Research

Major competitive or other industry participants include:

-

CLEAR

-

Cutting Edge

-

IDEMIA

-

MetricStream

-

Palantir Technologies

-

RSA Archer

-

ServiceNow

-

Unisys

-

Booz Allen Hamilton

-

General Dynamics

-

Lockheed Martin

-

Northrop Grumman

-

Science Applications International.

Telos’ Recent Financial Trends

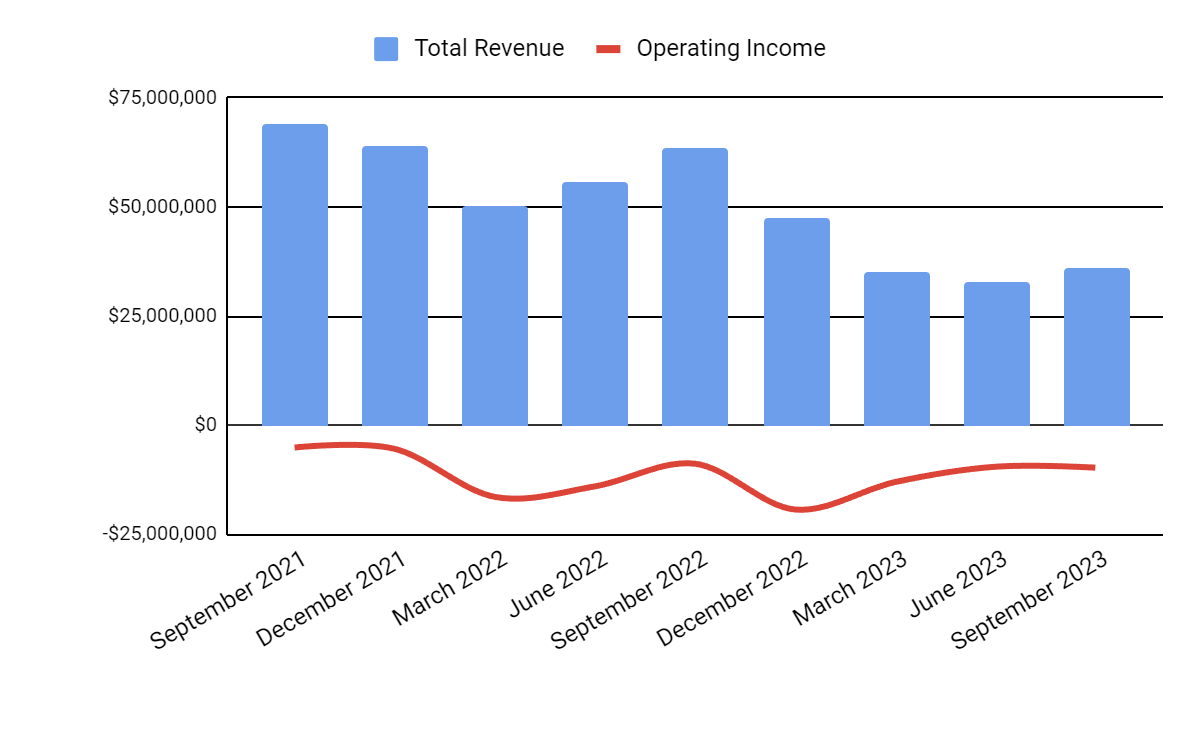

Total revenue by quarter (blue columns) has continued to decline substantially; Operating income by quarter (red line) has remained materially negative:

Seeking Alpha

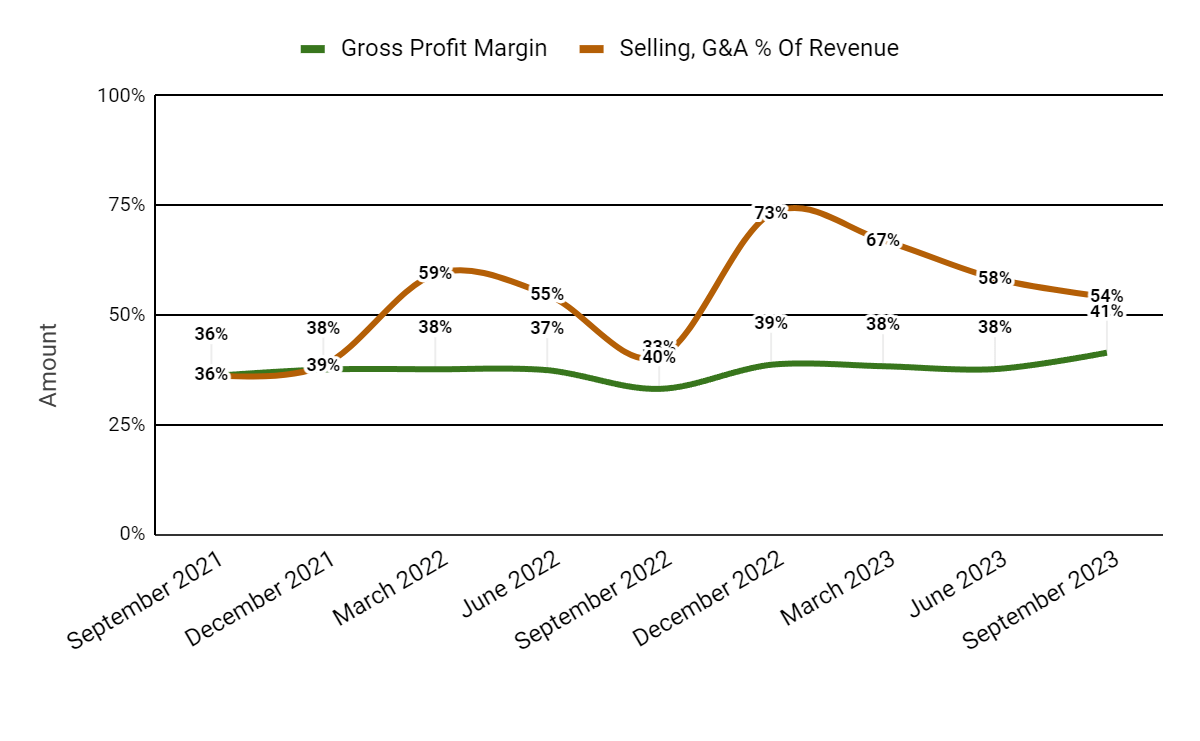

Gross profit margin by quarter (green line) has trended higher more recently; Selling and G&A expenses as a percentage of total revenue by quarter (amber line) have been dropping from a jump in late 2022

Seeking Alpha

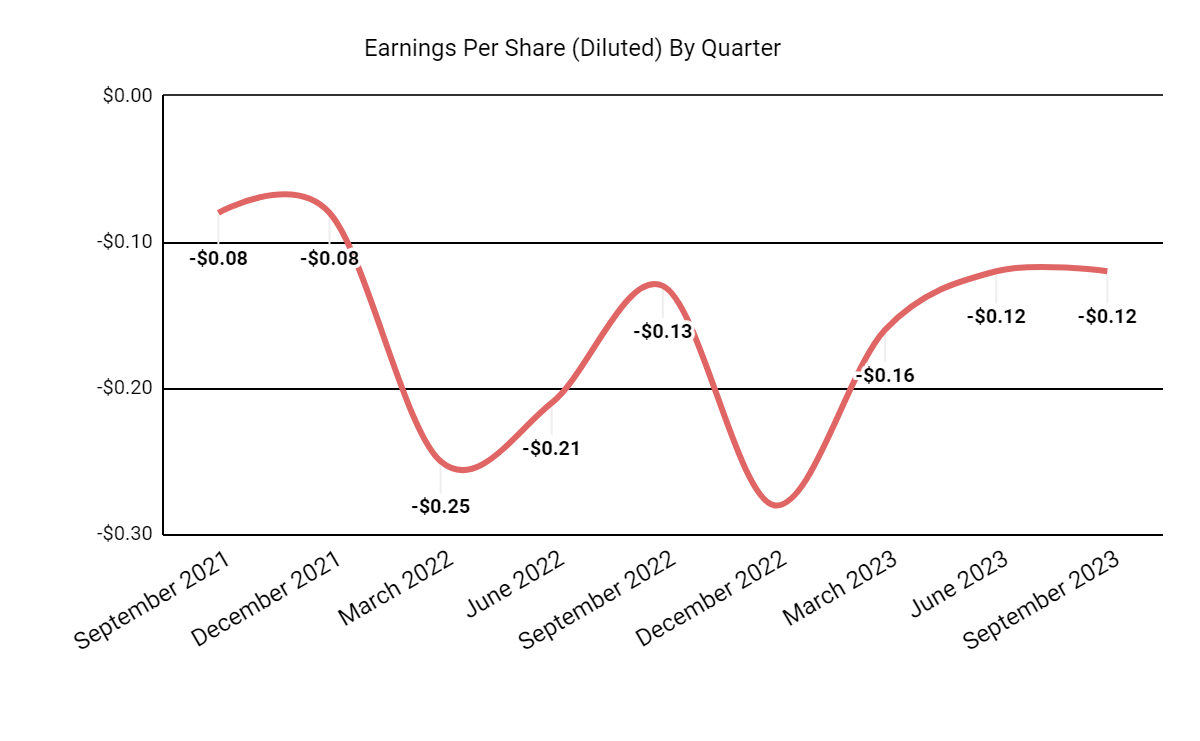

Earnings per share (Diluted) have fluctuated significantly and have remained substantially negative:

Seeking Alpha

(All data in the above charts is GAAP.)

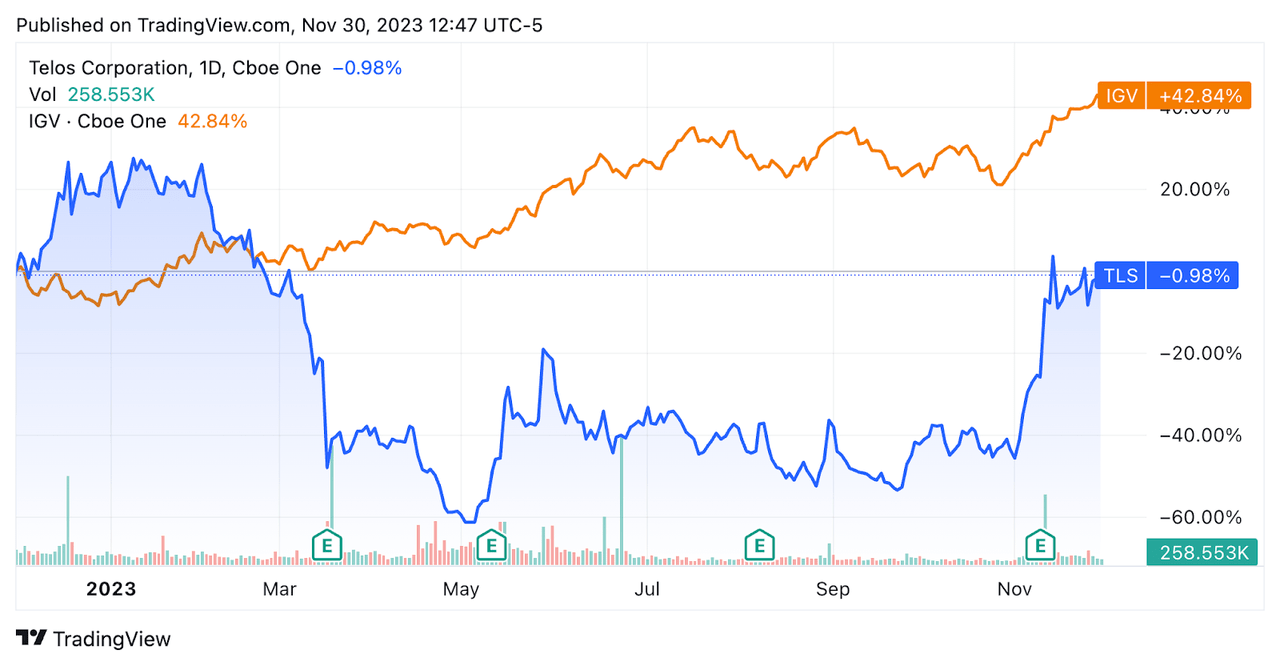

In the past 12 months, Telos Corporation’s stock price has fallen 0.98% vs. that of the iShares Expanded Technology-Software ETF’s (IGV) gain of 42.84%:

Seeking Alpha

For balance sheet results, the firm ended the quarter with $100.0 million in cash and equivalents and no debt.

Over the trailing twelve months, free cash used was ($7.5 million), during which capital expenditures were $0.5 million. The company paid $38.3 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For Telos

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (Trailing Twelve Months) |

Amount |

|

Enterprise Value / Sales |

1.2 |

|

Enterprise Value / EBITDA |

NM |

|

Price / Sales |

1.8 |

|

Revenue Growth Rate |

-35.1% |

|

Net Income Margin |

-27.5% |

|

EBITDA % |

-26.6% |

|

Market Capitalization |

$261,780,000 |

|

Enterprise Value |

$173,780,000 |

|

Operating Cash Flow |

-$6,980,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.68 |

|

Forward EPS Estimate |

-$0.27 |

|

Free Cash Flow Per Share |

-$0.34 |

|

SA Quant Score |

Hold – 3.36 |

(Source – Seeking Alpha.)

Telos Corporation’s most recent unadjusted Rule of 40 calculation was negative (61.9%) as of Q3 2023’s results, so the firm has performed poorly in this regard, per the table below:

|

Rule of 40 Performance (Unadjusted) |

Q2 2023 |

Q3 2023 |

|

Revenue Growth % |

-25.1% |

-35.1% |

|

Operating Margin |

-23.1% |

-26.8% |

|

Total |

-48.2% |

-61.9% |

(Source – Seeking Alpha.)

Commentary On Telos

In its last earnings call (Source – Seeking Alpha), covering Q3 2023’s results, management’s prepared remarks highlighted revenue and gross margin both being above its previous guidance range.

Management raised its full-year 2023 guidance for various metrics but also believes it has the potential to generate $200 million in revenue for 2024.

Reaching this goal is “highly dependent on two pending new business opportunities in Security Solutions and the ramp of our TSA PreCheck program.”

However, consensus estimates for 2024 revenue remain around $142 million, so it appears analysts don’t give much credence to that “potential.”

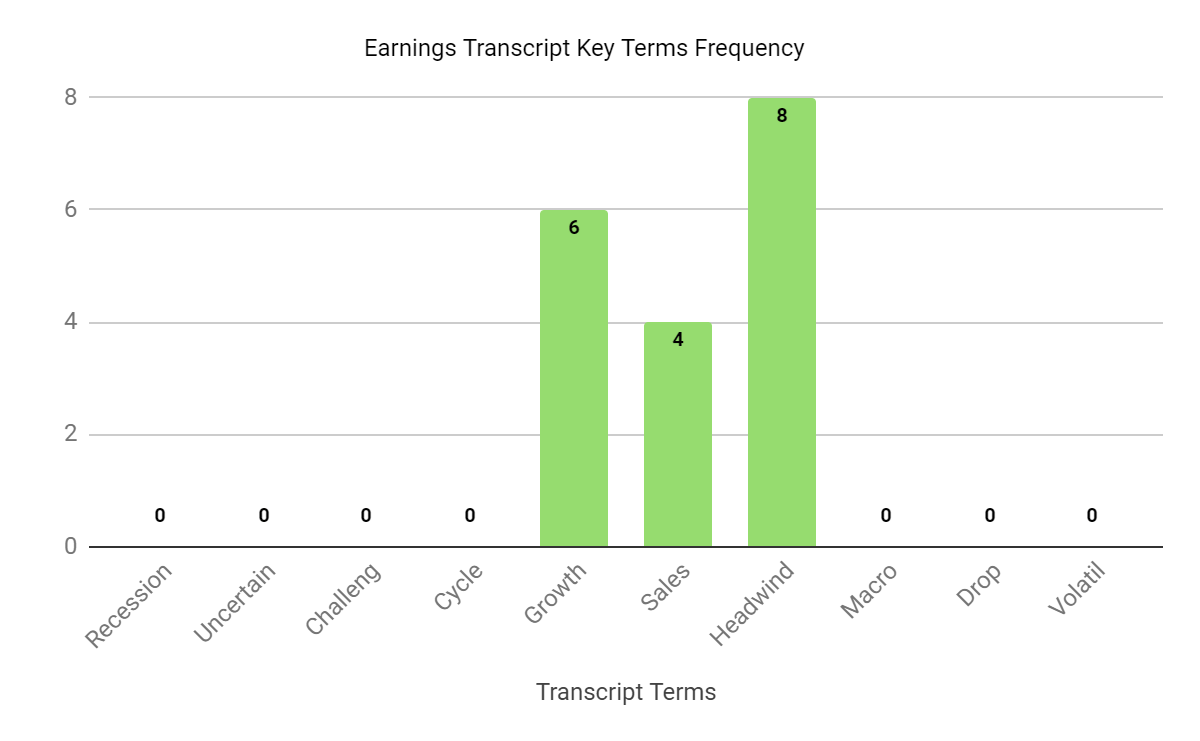

In the earnings call, I tracked the frequency of various keywords and terms spoken by analysts and management:

Seeking Alpha

The chart clearly indicates the revenue “headwinds” the company faces. Management hopes to make up the difference with its TSA PreCheck business growth, but I’m skeptical.

Analysts asked leadership about its TSA PreCheck program and outlook for 2024.

Management responded that the TSA PreCheck is bigger than pre-pandemic levels and that this segment drove the firm’s earnings beat in Q3.

The firm expects its TSA PreCheck sites to be fully rolled out by the end of 2024.

The leadership said that for new contracts to contribute $100 million in new revenue, start times would need to be no later than the end of Q1 or early Q2.

Total revenue for Q3 2023 fell 43.1% YoY, while gross profit margin increased by 8.3%.

Management didn’t disclose any customer or revenue retention rate metrics.

Selling and G&A expenses as a percentage of revenue increased by 13.7% year-over-year, a negative result, and operating losses increased by 10.2% to $9.7 million.

The company’s financial position is strong with plenty of liquidity and no debt, although with manageable use of free cash in the past four quarters.

TLS’ Rule of 40 performance has been quite poor and is getting worse.

Looking ahead, consensus revenue estimates for 2023 suggest a decline of (37.1%) versus 2022.

If achieved, this would represent an increase in revenue decline rate versus 2022’s decline rate of 10.52% versus 2021.

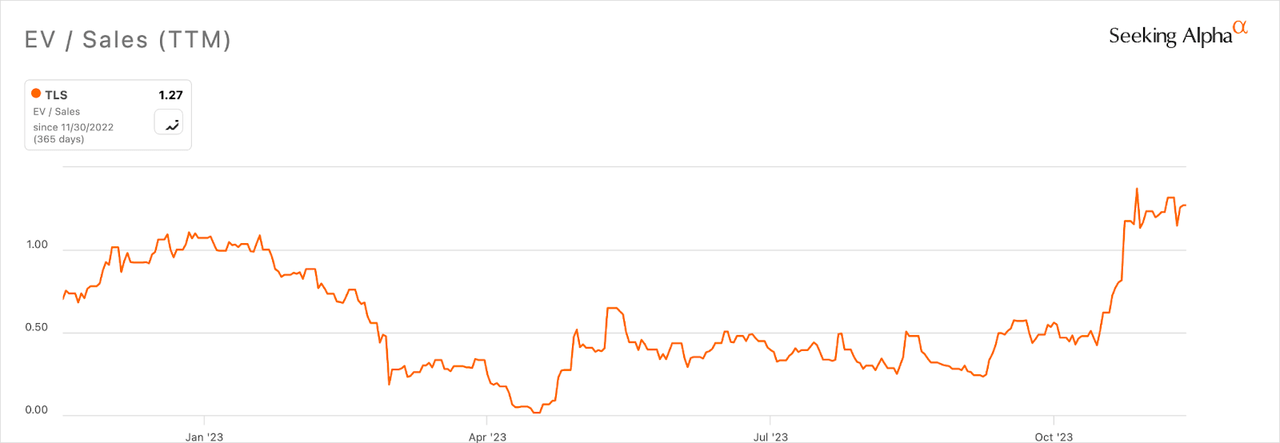

In the past twelve months, the firm’s EV/Sales valuation multiple has increased by a net of 81%, as the chart from Seeking Alpha shows below:

Seeking Alpha

A potential upside catalyst to the stock could include contract wins for its Security Solutions unit.

However, the stock likely will be subject to volatility as these potential wins could be “lumpy” in size and revenue recognition.

In any event, these wins wouldn’t show up in the firm’s financials until well into 2024, if at all.

Given the company’s continued sub-par performance results and revenue decline trajectory, my outlook for Telos Corporation in the near term is Bearish [Sell].

Read the full article here