The Semiconductor Talent Shortage

The semiconductor industry is expected to become a trillion-dollar industry by 2030. According to McKinsey analysis, the industry could grow 6%-8% a year up to 2030. The growth of the industry is driven by megatrends that include IoT smart devices, the growth of AI, and increasing demand for robotics and autonomous vehicles.

However, this growth also creates a significant challenge for the industry: the shortage of skilled talent. According to Deloitte, the industry will need more than 1 million additional workers by 2030, adding more than 100,000 per year. But finding and retaining qualified candidates is not easy, as there are not enough graduates and industry competes with other sectors for talent. To put this in perspective, there are less than 100,000 graduate students in electrical engineering and computer science in the United States every year.

This is where Synopsys (NASDAQ:SNPS) comes in to help the industry overcome this challenge. In this article, we will explore how Synopsys is boosting engineering productivity and speeding up chip design for semiconductor companies, and how it is expanding the EDA market opportunity beyond the current projections. We will also analyze Synopsys growth trajectory and valuation based on its increased market potential.

Synopsys Outgrowing the EDA Market

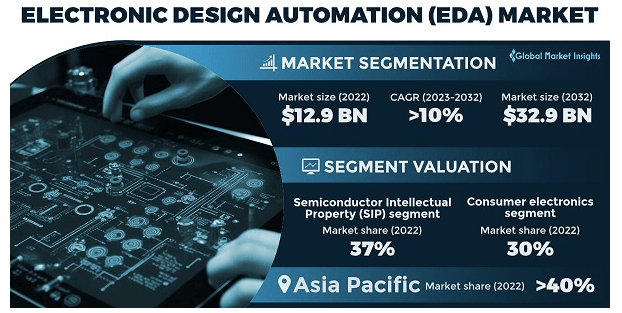

According to a report by Global Market Insights, The Electronic Design Automation (EDA) market size is expected to grow from $13 billion in 2022 to USD $33 billion by 2032, at a CAGR of 10% during the forecasted period.

EDA Market Size (Global Market Insights)

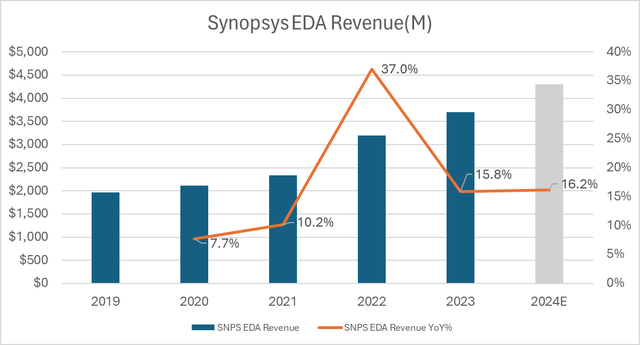

The EDA market is a specialized segment of the broader semiconductor market, with few rivals. Synopsys is the EDA industry leader with a 32% market share, followed by Cadence, which has 30% market share. The interesting point here is that Synopsys EDA has started to outgrow the EDA market since 2022 as you can see below.

Synopsys EDA Revenue (Author)

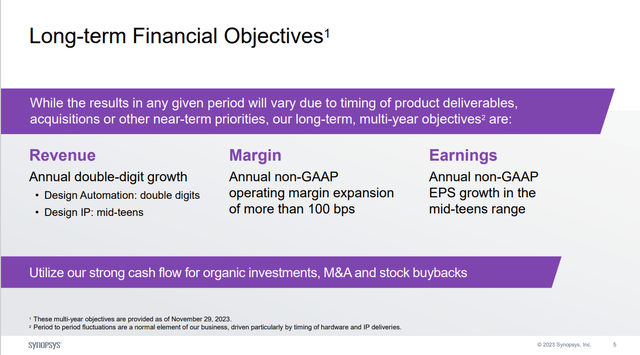

Synopsys is also guiding that their EDA segment will grow double digits on the long term (see below). Our view is that the current EDA market growth projections of 10% do not reflect the potential of Synopsys to expand the EDA market.

SNPS Long Term Goals (Synopsys Q4 Earnings Presentation)

Synopsys.ai: A Game-Changer for the EDA Industry

As the semiconductor industry faces a global talent shortage and a rise in chip design complexity and cost, Synopsys has introduced Synopsys.ai, the AI-powered EDA suite for chipmakers. What we are hearing from public sources is that Synopsys.AI product has gained lots of popularity and is in great demand. Customers are witnessing impressive results, such as 3x improvement in design productivity, 10x enhancement in verification process, and power reductions up to 15%. Its latest tool Synopsys.ai Copilot has been adopted by some of the world’s leading chip companies, such as AMD and Intel, who have reported significant improvements in their chip design outcomes.

By automating and optimizing many aspects of chip design, we think that Synopsys.ai is changing the game for the EDA industry. We also think that this product has enabled a new incremental TAM for Synopsys which is much bigger than what is being estimated today. Synopsys.ai is creating a new paradigm for the EDA market and positioning Synopsys as the leader in AI-driven chip design.

Our assumption is that Synopsys.ai product will drive increased demand for EDA tools by enabling new AI-powered capabilities and use cases. We estimate that it could expand the EDA market size up to $43 billion by 2032, from the current projection of $33 billion. This would imply a CAGR of 13% for the EDA market, compared to the current estimate of 10%. This would also imply a higher growth rate for Synopsys, as the EDA market leader.

Synopsys Financials and Revenue Trajectory

On November 29, 2023, Synopsys announced strong Q4 results, which exceeded analysts’ forecasts. The company reported revenue of $1.59 billion, a 25% increase from the same period last year and non-GAAP EPS of $3.17, up 66% year-over-year. Company also reported $8.6 billion non-cancellable backlog, which implies strength of its business. Synopsys guided Q1 FY 2024 revenue above consensus: to be between $1.63 to $1.66 billion and non-GAAP EPS to be between $3.40 to $3.45.

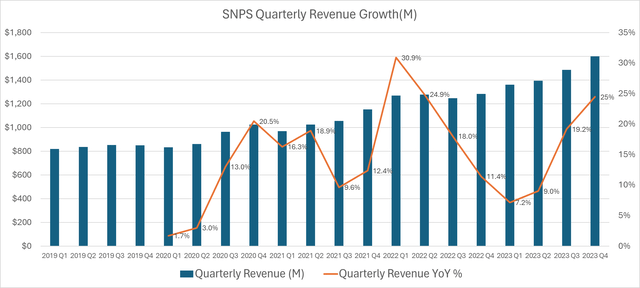

Synopsys has 3 business segments which are EDA, Design IP and Software Integrity. Synopsys.ai, is part of the EDA segment which generated revenue of $3.7 billion (16% YoY) and accounted for 63% of Synopsys’ total FY 2023 revenue (EDA is the biggest segment of Synopsys). If we look at the Synopsys revenue performance below, we can see a growth surge from FY2022 Q4 onwards. We attribute this surge to the launch of Synopsys.ai, and we anticipate that this growth trend will continue for the foreseeable future.

SNPS Quarterly Revenue (Author)

Synopsys Valuation

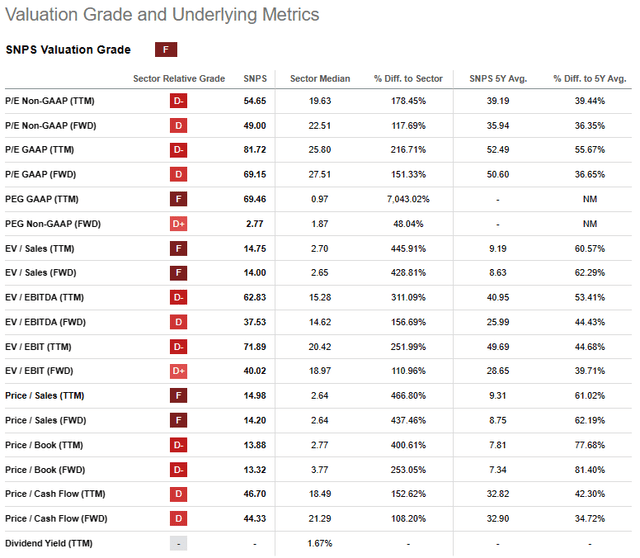

Synopsis is an expensive stock. Its market cap is $82.6 billion, and its sales and earnings multiples are quite high compared to its peers and industry averages. It has a P/E ratio of 81, and a P/S ratio of 15. Our view is that Synopsys’s high valuation reflects its strong growth prospects, market leadership, and innovation potential, especially with its recent launch of Synopsys.ai.

SNPS Valuation Metrics (Seeking Alpha)

Synopsys has a high valuation, but we believe that its revenue growth momentum will continue in the coming years.

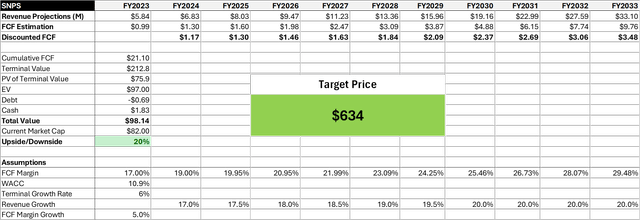

We performed a DCF analysis to estimate the fair value of Synopsys in case of such revenue acceleration. We use a 10.9% WACC to discount the future cash flows. We assume $6.83 billion as FY2024 revenue and 19% as the FY2024 FCF margin. We project a gradual revenue growth increase up to 20% by FY 2030. This gives us 19% CAGR which is higher than the EDA market growth as we believe that Synopsys will grow above the market rate and also gain market share. Moreover, we apply a 6% terminal growth rate after the 10-year period.

Our model also assumes a 5% annual increase in FCF margin, consistent with the current operating margin trajectory.

Note: Company revenue guidance for FY 2024 is $6.6 billion midpoint (13% YoY), which we think is very conservative considering the growth momentum and the $8.6 billion backlog they have. We are forecasting 17% growth for FY2024 in our model.

SNPS DCF Model (Synopsys)

According to our DCF calculations, the fair value of Synopsys business is $98 billion. This valuation implies a 20% upside potential for the stock, suggesting a target price of $634.

Risks

We see the following risks for Synopsys valuation:

- Volatility in the global economy and the semiconductor industry: Synopsys operates in a cyclical and volatile industry that is affected by various macroeconomic and geopolitical factors, such as economic recessions, trade disputes, supply chain disruptions, and regulatory changes. These factors may negatively affect the company’s business.

- IP violation claims and litigations: Synopsys operates in a highly competitive and innovative industry that involves complex and evolving IP rights. The company may face claims or lawsuits from its competitors, or third parties alleging that its products or services violate their patents, trademarks, or other IP rights. Any such claim or litigation could result in significant legal fees or damages.

Conclusion

A dominant position in the EDA market, a broad portfolio IP, a strong focus on AI-powered chip design, and an expanding TAM positions Synopsys as an EDA leader in the smart everything era.

Looking at Synopsys’ financial performance also shows a consistent growth trend. Our DCF valuation estimates that Synopsys has an intrinsic value of $634. Despite the recent surge in its stock price, we believe that it has more upside based on our valuation metrics.

We rate Synopsys as a Buy.

Read the full article here