Investment updates

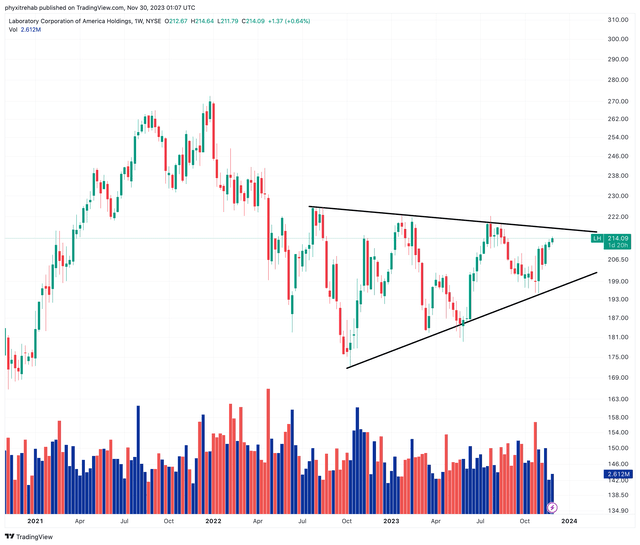

Since my September publication, there have been numerous updates in the investment debate for Laboratory Corporation of America Holdings (NYSE:LH). The company’s stock price has continued snaking into the ascending wedge formation shown in Figure 1. This translates to higher lows, lower highs-buyers at the support level; not enough size to lift the bid beyond previous resistance

After rigorous analysis of the latest investment updates, my recommendation on LH is to reiterate a hold across short to long term investment horizons (12mo-5 years). The investment debate is balanced, with sensible arguments on both sides:

- One, Q3 earnings (posted 26th October) were reasonably sound, beating consensus estimates at the top and bottom lines. Sales of $3Bn were up 6% YoY on earnings of $3.38 per share. Management now assumes FY’23 earnings of 13.75/share at the upper bound, on FCF of $950mm or $11.20/share, 81% conversion from net income. This compares to $800mm or $9.40/share in FCF in FY’22, 68% conversion.

- Two, the company sells at a discount vs peers of 15x forward earnings and 13.6x forward EBIT and is priced at 2.3x net assets. Both are in-line with the company’s 5-year averages, so no multiple expansion. Earnings trends are primed for this trend to continue.

- Three, earnings produced on investor equity have tightened drastically over the last 2 years, as a number of Covid-related tailwinds rescind.

- Four, investors are treated with satisfactory FCF per share in owning LH. It owns cash producing assets that are impervious to rates, market swings, and so forth, ensuring the investor is well positioned to receive these + dividends at the trailing rate of $2.6/share.

The critical factor is that my assumptions project these trends to continue. This report will cover all of the latest moving parts for investors to make the most informed reasoning possible. Net-net, I continue to rate LH a hold.

Figure 1.

Source: TradingView

Critical facts supporting investment thesis

Having rotated in and out of LH since 2021, at this point it is a question of price and value in choosing to own the company. What are you paying, and what do you own/receive for the price. For LH, multiples are arguably fair in relative terms, but not compared to earnings and capital in the business in my estimation.

The critical issues are best sorted in the following methodology:

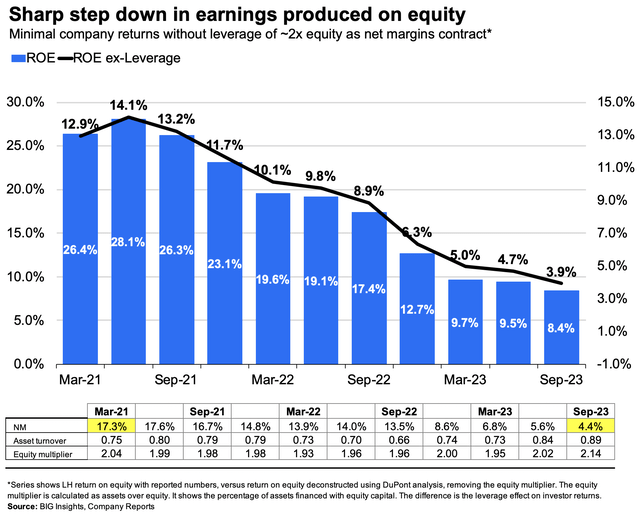

Table 1.

BIG Insights

Systematic analysis of the data suggests the investment debate is balanced for the following reasons:

(1). The company sells at 15x forward earnings, a 15% discount to peers but in-line with the 13x 5-year average.

- Consensus expects average 8.4% earnings growth from 2023-’25, with corresponding sales growth in the range of 2-4%. It eyes 31% downside in ’23.

- On a TTM basis, earnings have decreased each quarter since Q2 2022, down 60% YoY in Q3 (and ~$0.40/share YoY on a quarterly basis). In Q3, growth was negatively skewed as Covid-19 revenues are still being blown off the top. Core revenues were up 14% YoY, but operating margins were again weaker-8.3% of sales.

- Single-digit returns on equity also leave little room to recycle earnings into new investment opportunities. Mining the acquisition pipeline is the go-to strategy, a $380mm investment in Q3.

Therefore, paying $13 for every $1 of LH’s future net profit adjusted for 8.5% 3-year growth is not a valuable proposition in my eyes, not at this stage. Investment returns for the coming 12 months will be heavily influenced by multiples. Cheaper is better-but thoughtful analysis is needed to gauge what they mean. In context with growth, the prices seem justified.

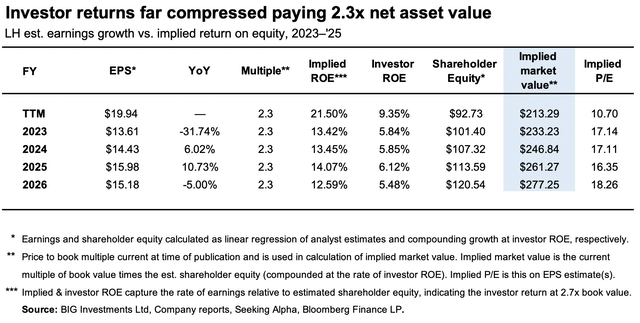

(2). Investors will pay 2.3x the book value of LH’s net assets for single-digit earnings on equity and 2x leveraged returns.

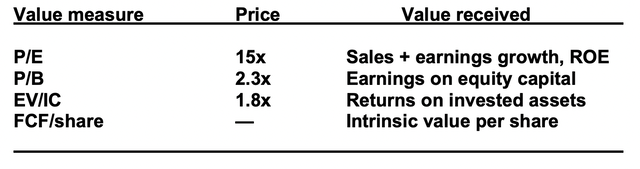

- Investors have employed $12.4Bn of capital (debt, equity) into the business as of Q3 ’23. LH has put 109% of this at risk, running ~$13.5Bn across its core assets to generate revenues + cash flows.

- Profits earned on investor capital have tightened substantially since 2021 highs of 26-28%. We now sit at 10-11% trailing returns on equity, still reasonable, but not value-accretive.

Figure 2.

BIG Insights

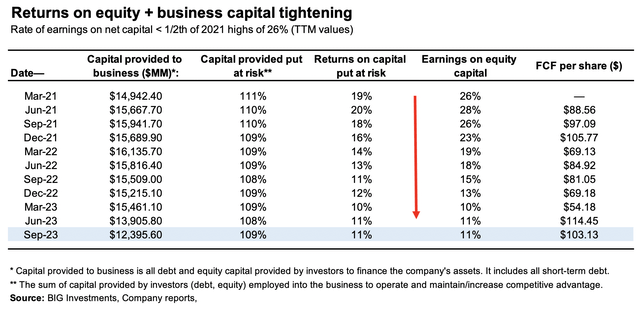

- The core reason for this is the company’s tightening margins. Post-tax margins are down to 9.7% from 20% in 2020, and net margins compressed to 4.4% from 17% (Figure 3). Otherwise, leverage and capital turnover are flat at 2x and 0.75-0.8x, respectively.

- Two observations, related to capital intensity and operating leverage, are pertinent from the tightening ROE and contracting margins. One, a capital efficient firm (asset turnover ≥1) will see most change in earnings with changes at the operating margin (vs. capital). LH is in this camp. Two, LH is a firm decelerating in growth and likely mean-reverting in my opinion. The trends in returns on investor equity are evidence of this.

Figure 3.

BIG Insights

- Finally, the composite of price to value is skewed to the downside looking forward. Linear regression of consensus earnings estimates to 2025 are seen in Figure 4. For LH to earn the est. $13.61/share on net assets of $101.40/share, would yield the investor 13.4% on his or her equity. This is reasonable. Paying 2.3x net asset value to receive these returns, however, is not.

- At the price of 2.3x net assets ($92.73/share) the investor acquires equity ownership in LH for $213-214/share, effectively paying as much for the firm’s net assets. The investor ROE is therefore 5.8% under current terms. (2.3×101.40 = 233; 13.61/233 = 5.8%).

- At the estimated growth rates out to ’26, the company could earn 12-14% on equity per annum. But investors will have to settle with a 5-6% return on capital if paying 2.3x equity value today. Starting valuations matter.

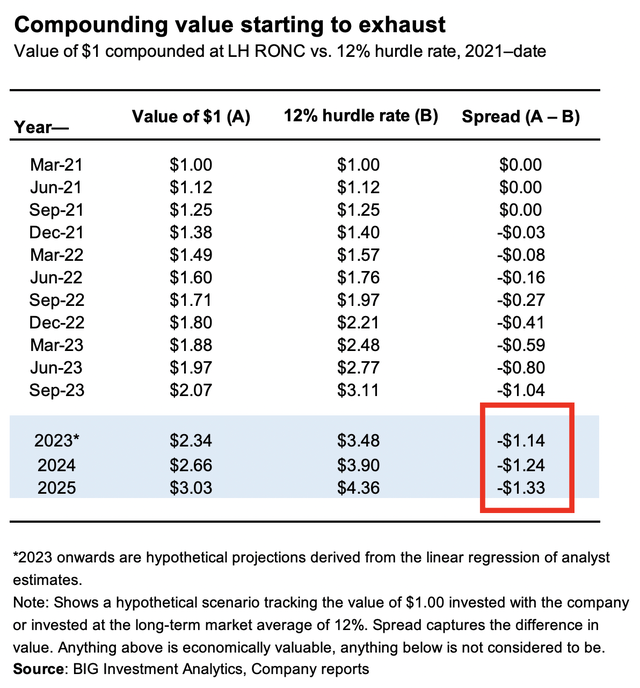

- Consequently, the value of $1 is more valuable in the investor’s hands than investing it with the company if paying 2.3x in my opinion. It has been to recent date, as seen in Figure 5. Tracking the value of $1.00 compounding at the company’s return on equity vs. the 12% hurdle rate, and paying the 2.3x multiple, would result in a negative spread of $1-$1.33 from FY’2023-2025 under these assumptions.

Figure 4.

BIG Insights

Figure 5.

BIG Insights

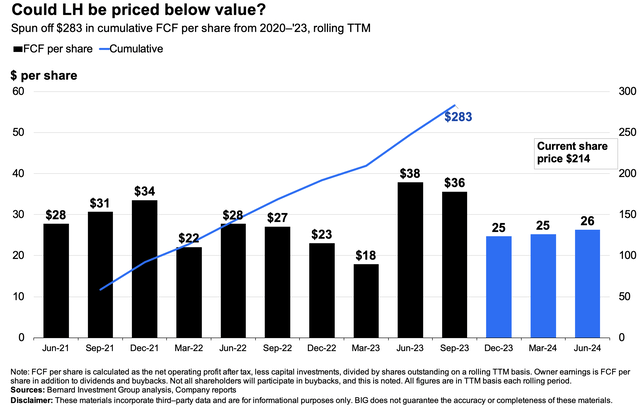

(3). Whatever price is paid, LH continues to conduct a sensible business that spins off healthy amounts of FCF per share (more so inc. dividends + buybacks).

One can’t overlook the durable cash flows spun off to LH’s shareholders each period as a talking point. For instance, the firm produced $36/share in the TTM to Q3 ’23 (17% yield as I write), up from $27/share last year. Whatever period, the company has managed >$18/share each period since 2021 (TTM values).

This balances the risk-reward calculus in the following ways:

- LH has produced a cumulative $283/share in FCF since Q1 2021 (rolling TTM values),

- The company is priced at $214/share as I write. Markets are also discounting mechanisms, that typically look 18 months-2 years out. It could be it has either 1) recognized this already and priced it in, or 2) it has left an unfilled value gap from $214 to $283 per share.

- My assumptions have LH to spin off $25-$26/share in TTM FCF per quarter to mid ’24 (12.1% yield at time of writing, and 35% total yield on share price of $214/share), around $75/share of investor value in that time.

Figure 6.

BIG Insights

Conclusions

After the extensive review of data, there are numerous talking points for discussion. In particular, the risk/reward calculus remains balanced in buying/selling LH in my opinion.

On the one hand, you have a company producing substantial cash flows ($36/share, roughly 17% yield) for shareholders, along with 1-1.5% in dividends. Indeed, this does make it a valuable company-$18Bn at the time of writing.

However, the prospects for growth and compounding returns on equity reduce its intrinsic value to the investor-more so for the one seeking capital appreciation over a 1-5-year horizon.

The factors putting the brakes on capital growth in my view are:

(1). Rescinding sales + earnings growth

(2). Declining rate of earnings on equity

(3). High valuations, at 2.3x book value, clamping investor returns on equity

On asset factors and earnings power, my rating on LH remains a hold. The next catalyst to watch out for is its FY’23 numbers. Keep a close eye out in the coming months, as these will be telling. This report will serve as a good baseline to compare too.

Read the full article here