CION Investment (NYSE:CION) has been a relatively under-the-radar middle-market business development company since going public in 2021. The externally managed BDC primarily invests in first lien senior secured loans with total investments at fair value of $1.73 billion across 109 portfolio companies as of the end of its fiscal 2023 third quarter. The dividend yield is admittedly compelling with CION last declaring a quarterly cash dividend of $0.34 per share, unchanged from its prior distribution for what’s currently a 12.7% annualized forward dividend yield. There was also a $0.05 per share supplemental announced back in August that’s set to be paid next year on 15 January. The fat double-digit dividend is attractive and the BDC has also traded at a persistent discount to net asset value per share. Is this a buy? Perhaps.

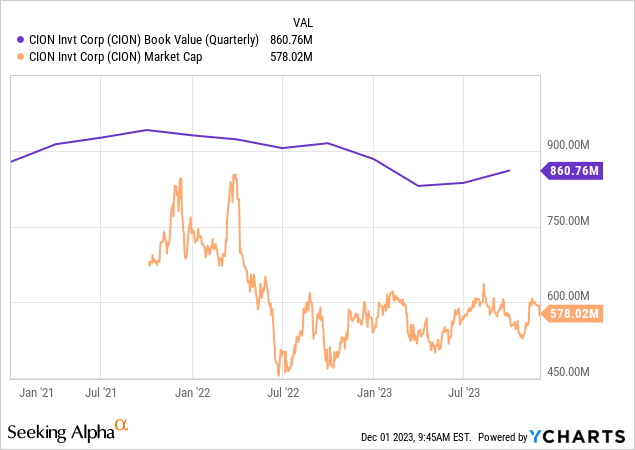

CION’s third quarter NAV of $860.8 million, around $15.80 per share, grew by 49 cents per share sequentially. The BDC is currently trading hands for $10.72 per share, a 32% discount to NAV to form one of the most substantial discounts in the space. Whether or not this is an opportunity to capture alpha is not quite certain. To be clear, whilst CION can be bought for what is essentially 68 cents on the dollar and comes with a 12.7% base dividend yield, the general direction of its NAV since 2021 has broadly been down through a period when the Fed fund’s rate was hiked back to back to deliver a boost to a total investment portfolio that was 81.2% floating rate at the end of the third quarter. The sticky discount has forced CION to embark on and extend until summer 2024 a $60 million share buyback program which had at least $37 million outstanding in September.

| Investments at Fair Value $000 | Percent of total | |

| Senior secured first lien debt | $1,481,498 | 85.7% |

| Senior secured second lien debt | $36,114 | 2.1% |

| Collateralized securities and structured products – equity | $1,224 | 0.1% |

| Unsecured debt | $14,631 | 0.8% |

| Equity | $194,476 | 11.3% |

| $1,727,943 | 100% |

PIK Income, Dividend Safety, And Investment Activity

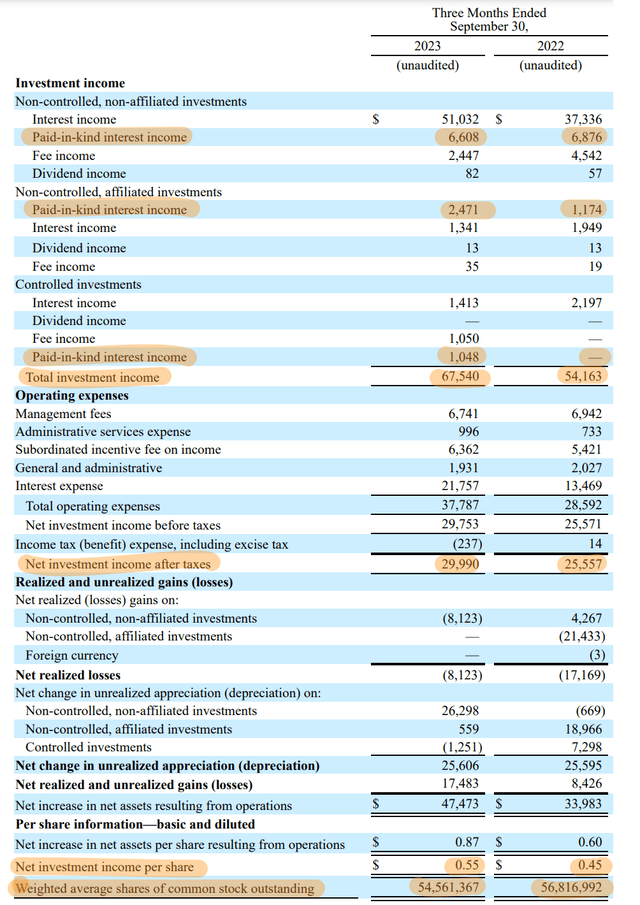

CION Investment Fiscal 2023 Third Quarter Form 10-Q

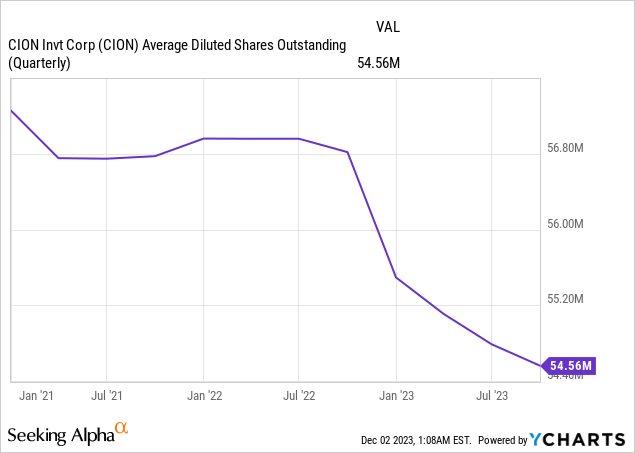

CION reported a total investment income of $67.5 million for its third quarter, up 25% from its year-ago period. This came on the back of a yield on debt and other income-producing investments that was up 66 basis points sequentially to 13.04%. Payment-in-kind income was $10.13 million, around 15% of total investment income, and up incrementally from 14.86% of total investment income in the year-ago period. Net investment income at $29.99 million, around $0.55 per share, was up from $0.43 per share in the year-ago period with CION delivering an NII boost on a per share basis with the 4% reduction of its weighted average shares of common stock outstanding to 54,561,367.

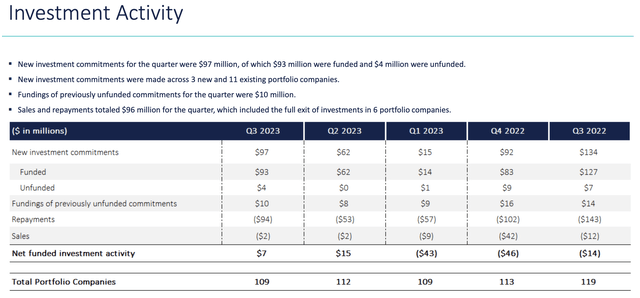

The current dividend is currently 161% covered by NII per share, a 61.8% payout ratio. Hence, the BDC is substantially underpaying on its dividend with a special year-end dividend confirmed by management during their third-quarter earnings call. Management also stated during the earnings call that they intend to maintain the dividend at its current level so no near-term hike. Investment activity during the third quarter also moderately ramped up from a year ago as positive net funded investment activity of $7 million was an uptick from net repayments of $14 million.

CION Investment Fiscal 2023 Third Quarter Presentation

Credit Quality, Expensive Debt, And 2024 Outlook

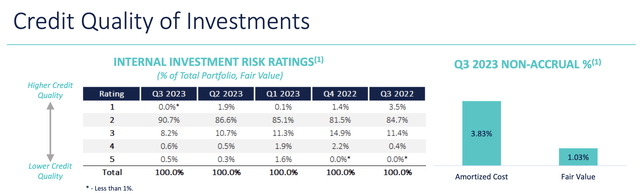

CION had 1.03% of its loans at fair value on non-accrual status at the end of the third quarter, down sequentially from 1.7% with the BDC’s underlying underwriting quality seeing gains during the third quarter with investments rated grade 1 and grade 2 at 90.7% up sequentially from 88.5%. However, non-accruals on an amortized cost basis are somewhat high and PIK income at 15% of total investment income is also high.

CION Investment Fiscal 2023 Third Quarter Presentation

CION has also been issuing somewhat expensive debt with a November offering of $100 million in senior unsecured notes due 2027 being priced at the 3-month secured overnight financing rate plus a credit spread of 4.75% per year. 3-month SOFR currently sits at 5.3%, meaning this issue is priced at roughly 10.05%. The CME’s 30-Day Fed Funds futures pricing data has ruled out the prospect of any further rate hikes with a 25 basis point now expected as early as March.

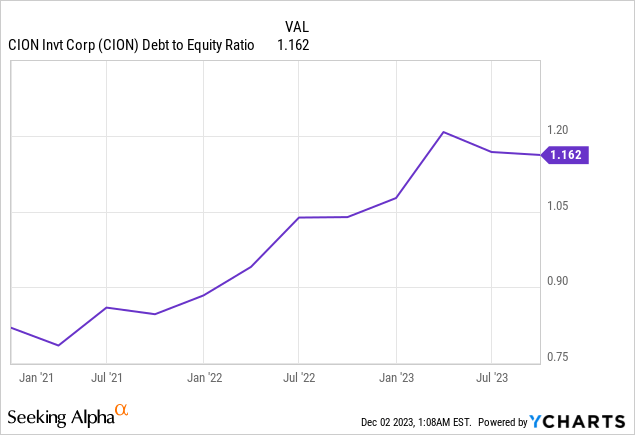

Total returns for BDCs are comprised of their dividend and the trajectory of their NAV. CION’s NAV has been on a recent upswing but the trajectory has been too negative for the ticker to be a clear buy. The BDC’s credit quality is healthy with its dividend coverage being quite substantial and a year-end special dividend distribution set to boost the income of its shareholders. Its debt to equity at 1.16x while rising remains at a still prudent level. I’m not a buyer here though but this is a hold.

Read the full article here