Mistras Group (NYSE:MG) offers asset protection solutions. MG posted Q3 FY23 results, which I will analyze in this report. I think MG is not a buy right now. Due to increasing debt, stagnant revenue growth, and because of the technical chart. It would be risky to bet on MG right now. Hence, I assign a hold rating on MG.

Financial Analysis

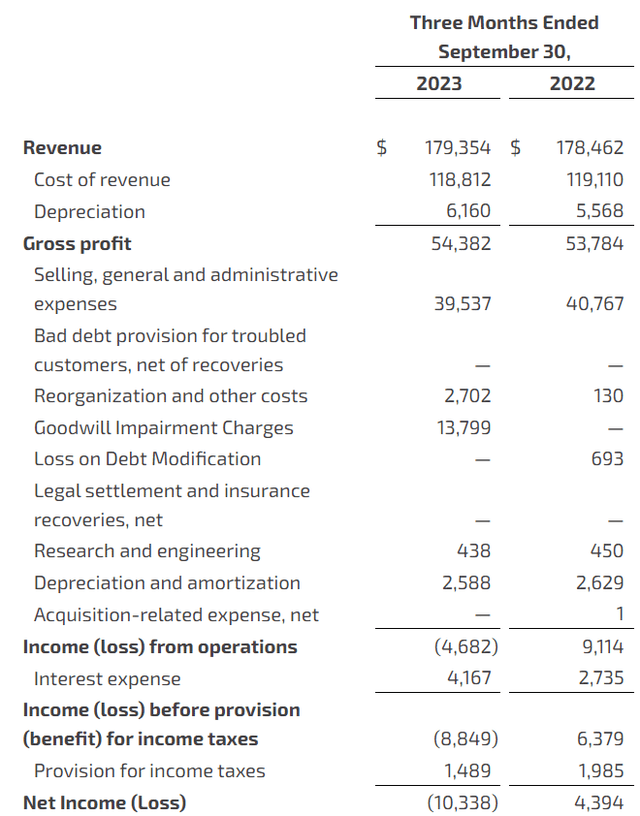

MG announced Q3 FY23 results. The revenue for Q3 FY23 was $179.3 million, a slight increase of 0.5% compared to Q3 FY22. The reason for the stagnant revenue growth was the underperformance in its services segment. The revenue from the services segment declined by 2.6% in Q3 FY23 compared to Q3 FY22. The major reason for the drop was a decline in power distribution due to project timing. The gross margin for Q3 FY23 was 30.3%, which was 30.1% in Q3 FY22. The rise was mainly due to low healthcare expenses and a favorable sales mix.

MG’s Investor Relations

The company had to incur a $13.8 million non-cash impairment charge. Due to this, it reported a net loss of $10.3 million compared to a net income of $4.4 million. Honestly, I don’t see anything noteworthy in the results. The revenue growth was stagnant, and the management has cut down its sales and EBITDA guidance for FY23, which might create a negative sentiment and affect its share price. Its sales guidance for FY23 is now around $700 million, previously $710 million, and the EBITDA guidance is now at $66 million from $69 million. However, there were two positives for them in this quarter. First, the continued aerospace growth is boosting its sales and is expected to continue to benefit them. Second, the positive initial effect of the project Phoenix. Its gross margin expanded, and the management attributed this to the Phoenix project; it is an initiative to reduce the company’s expenses and boost profitability through efficient pricing and reducing SG&A expenses. This project is new, and the management mentioned that it has seen some success, which is a positive sign because, with time, the margins of the company will continue to improve. However, stagnant revenue growth is an issue, and the guidance suggests softness will continue in the fourth quarter. The other issue that I see is the increase in the long-term debt. Its long-term debt increased 1% in September 2023 compared to December 2022 to $185.4 million. Although the increase is not significant considering its low profitability, the high debt becomes an issue.

Technical Analysis

Trading View

MG is trading at $6.6. In the last two years, the stock has corrected more than 40%, and right now, it is at a crucial level because it is near a trendline. This trendline has been a barrier for the stock since 2021. The price has failed to cross the trendline and has reversed every time it touches it. So if the stock fails to cross the trendline, which is at $7.3, it might reverse and fall up to $4. The $4 level has been strong support for the stock since 2020, so if the stock faces resistance from the trendline, the downside that I see is at $4. Now, talking about what if the stock breaks the trendline, which is at $7.3, then we might see a solid upside. So, for now, I would say one should wait, and if the stock breaks the trendline, then one can initiate a buying position, and if it fails to do so, it would be better to avoid it.

Should One Invest In MG?

MG has an EV / EBIT [FWD] ratio of 15.75x compared to the sector median of 15.31x. MG doesn’t seem overvalued, but there isn’t any opportunity that we can capitalize on. It still needs quite a lot of work to do. The high debt seems to be a problem. The company’s interest expense increased significantly in this quarter compared to the previous year. So, the increase in debt becomes an issue because its revenue growth has been stagnant, and softness is expected in the fourth quarter as well. Additionally, its share price is near an important level. So, considering these factors, I think MG is not a buy right now.

Risk

Many of their previous earnings have come from their customers in the oil and gas sector. In particular, for the years ending December 31, 2022, 2021, and 2020, they constituted roughly 56%, 54%, and 54% of their revenues, respectively. Even though they now serve a wider range of sectors besides the oil and gas sector, this sector still accounts for the majority of their earnings. The operators of plants, refineries, and pipelines depend on their services, which they have increased by adding mechanical and in-line inspection services to their portfolio. However, contracts for their services have been reduced in the past and may continue to be so due to economic downturns or low oil prices. Furthermore, low oil prices may discourage new construction and exploration, which would hurt their market potential. Their cash flows, earnings, and revenues might all decline if the price of oil dropped. The provision of inspection services to clients in the oil and gas sector may be delayed or postponed if the price of oil hits record highs, as happened in 2022.

Bottom Line

The continued growth in the aerospace market and the Phoenix project are positive for the company. However, I think it is not a buy right now because of the stagnant revenue growth and increasing debt. Additionally, its share price is at a crucial level where we can see a reversal from the current level. Hence, it would be risky to invest at the current level. Hence, I assign a hold rating on MG.

Read the full article here