East West Bancorp (NASDAQ:EWBC) is a bank that capitalizes nearly $10 billion and was incorporated in 1998 in Pasadena, California.

Compared to peers this bank seems to have a leg up, especially in terms of profitability and dividend growth, which is why I decided to devote an article to it. After collapsing at the beginning of the year caused by the banking crisis, EWBC has recently recovered lost ground.

Resilience and prospects

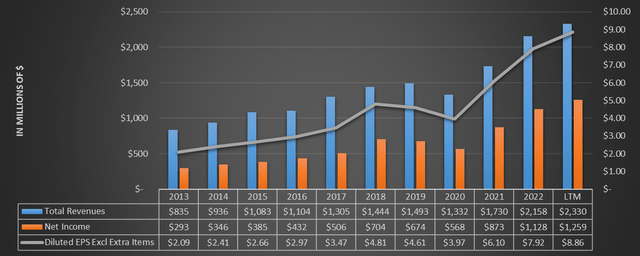

Before discussing EWBC’s prospects, I would like to begin with a review of what this bank has achieved over the past 10 years. In fact, there has been a marked improvement that deserves to be mentioned.

Chart based on Seeking Alpha data

With the exception of 2020, a difficult year for anyone, EWBC has always achieved growing revenues as well as net income. But there is more.

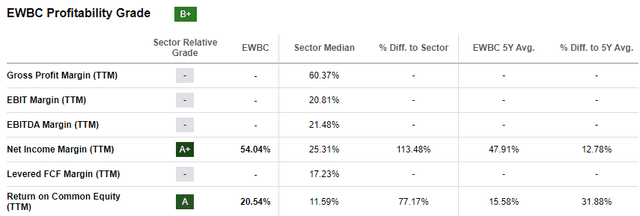

Seeking Alpha

Net income has grown faster than total revenues, and this has generated a significant improvement in net income margin: now 54.04% while the sector median is 25.31%. Moreover, its ROE is also high, 20.54% versus 11.59% for the sector median. It is not easy to find such a profitable bank, especially in today’s complex macroeconomic environment. But how did EWBC achieve such results? The answer lies in proper management of the loan portfolio.

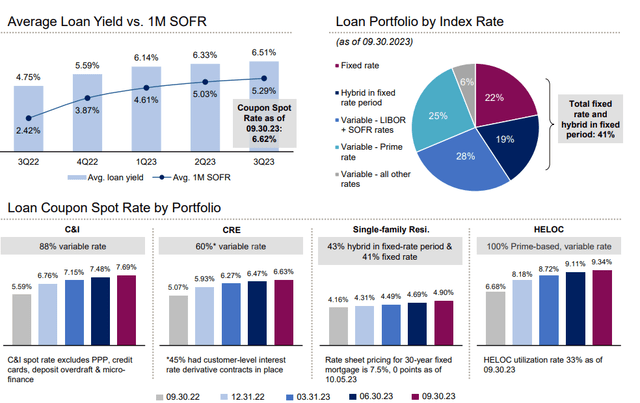

East West Bancorp, Inc. (EWBC) Q3 2023 Earnings Call

First of all, fixed rate loans account for only 22% of the loan portfolio. So, the moment the Fed started to raise the Fed Funds Rate, the yield on the loan portfolio increased as a result.

- HELOC and C&I have a variable rate in 100% and 88% of cases, respectively. For HELOC, the rate is almost in the double digits.

- CRE and Single-family residential have a variable rate in 60% and 43% of cases, respectively.

Overall, compared to the previous year, the average loan yield has increased from 4.75% to the current 6.51%.

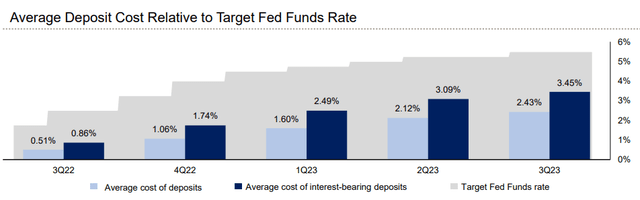

East West Bancorp, Inc. (EWBC) Q3 2023 Earnings Call

The increase in the average loan yield managed to offset the inevitable increase in the cost of deposits. The latter experienced an increase of 192 basis points over the previous year.

Many other banks are well above 2.43%, so all in all it is not such a bad result. Making it less bitter was the large presence of demand deposit accounts, still 29% of total deposits.

The second strength of the loan portfolio is that it is relatively low risk.

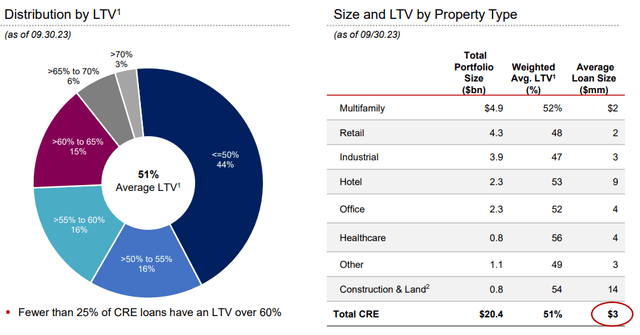

East West Bancorp, Inc. (EWBC) Q3 2023 Earnings Call

CRE loans are the ones most discussed by analysts, as they are typically not very resilient in a recession and therefore more prone to develop impaired loans. In the case of EWBC, CRE loans represent as much as 40% of the loan portfolio, but their LTV is quite low, only 51%. As many as 44% of them even have an LTV of less than 50%. Moreover, although the CRE portfolio size is $20.40 billion, the average loan size is only $3 million.

So even if it were to be a major decrease in the value of CREs, the low LTV provides the bank with a large enough margin of safety to cope with the problem.

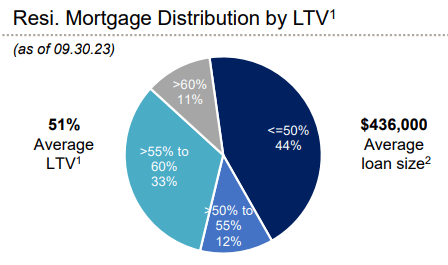

East West Bancorp, Inc. (EWBC) Q3 2023 Earnings Call

Similar reasoning applies to the residential mortgage portfolio, whose size is $14.60 billion, about 29% of total loans. The LTV here is also low, only 51%, while the average loan size is $436,000. Moreover, residential mortgages tend to be less volatile than CREs, which is why such a low LTV represents an even greater margin of safety in the event of a housing market crash.

Overall, the composition of the loan portfolio, skewed toward variable rate and with a low LTV, has proven to be the proper strategy for operating in the current macroeconomic environment.

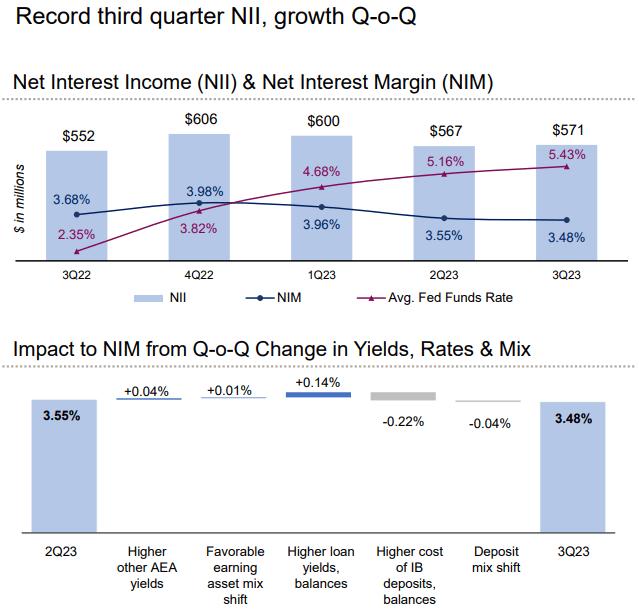

East West Bancorp, Inc. (EWBC) Q3 2023 Earnings Call

Q3 2023 denoted record net interest income, $571 million. The net interest margin deteriorated slightly, but at 3.48% it is still higher than the peers’ 3.26%.

Let us now take a look at growth.

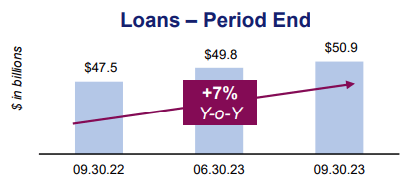

East West Bancorp, Inc. (EWBC) Q3 2023 Earnings Call

Over the past year, the loan portfolio increased by 7% and reached $50.90 billion. The fastest growing category was Single-family Residential, up 4% from the previous quarter and 18 % from last year. Apparently, high rates are not discouraging families too much from buying a new home to live in.

Seeking Alpha

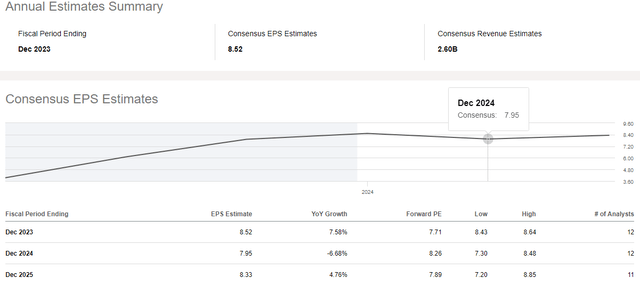

According to Street Estimates, EPS are expected to decline in 2024 and then recover in 2025. Presumably, the market is discounting a scenario in which demand for loans will fall but the cost of bank funding will not, and this could lead to further deterioration in NIM and consequently EPS. In 2025, interest rates should have normalized, and this will lead the cost of deposits to fall a lot.

Dividend and fair value

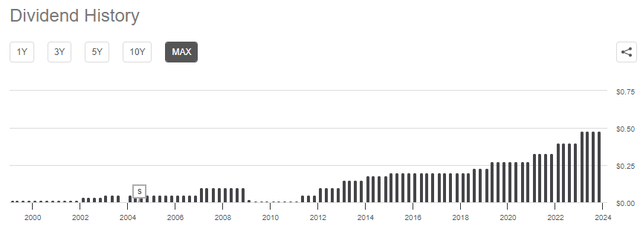

EWBC’s dividend history appears rather troubled, particularly until 2012: at that time the dividend was not always issued and rarely increased.

Seeking Alpha

With the coming of the great recession, EWBC suffered a major crisis where the issuance of the dividend was the least of the problems. Anyway, after several years it came out of it, and has since become a good dividend company. Obviously, the macroeconomic environment has favored it, but that does not take away from the fact that the dividend growth rate has been important, much more than the sector median.

Seeking Alpha

Most surprising is the speed of dividend growth over the past 3 and 5 years.

The current dividend yield is not very high, 2.92%, but a few months ago it was over 4%. In any case, the payout ratio is only 21.67%, compared to 35.95% for the sector median, which makes EWBC’s dividend widely sustainable. Potentially, the low payout ratio could be an important driver for future dividend growth: even if it were to increase by 10%, it would still remain largely sustainable.

Management probably also tends to keep it low because it does not only remunerate shareholders through dividend but also through buybacks. No treasury shares were purchased in the last quarter, but management has announced that purchases will start again from Q4. EWBC still has $254 million available for buyback.

Conclusion

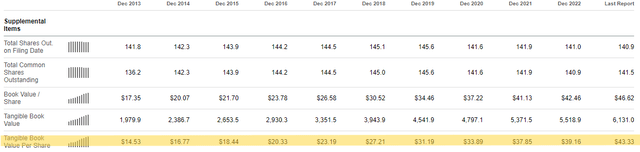

EWBC is a solid bank in more ways than one, in fact its EPS tends to increase over time as does its tangible book value per share.

Seeking Alpha

This is not a foregone conclusion, in fact many banks have seen a sharp decrease in their equity given the large unrealized losses on their AFS securities. In EWBC’s case these losses amounted to $875.40 million, but tangible book value per share increased nonetheless.

The loan portfolio has managed to offset the difficulties in bank funding and although NIM is declining, NII has never been higher for Q3. Street Estimates predict a decline in EPS in 2024, but I would not be so sure.

In the coming quarters we can expect both increasing dividend issuance and share buybacks; capital ratios will remain well above the minimum threshold.

East West Bancorp, Inc. (EWBC) Q3 2023 Earnings Call

There has been a steady improvement since last year, and today EWBC is more than well capitalized.

After all these considerations, my rating is a buy, partly because at the current price it does not seem too expensive. The current tangible book value per share is $43.44; multiplying this figure by the 10-year average price/tangible book value per share of 2.03x, the fair value amounts to $88.18 per share. So, we are talking about a potential upside of 34.25%.

Read the full article here