I’ve been pretty clear during 2023 that I prefer to own growth-oriented sectors of the market, as the bull market that began earlier this year has continued to rage. That means I’ve been less inclined to recommend exposure to stocks like dividend names, and that hasn’t changed. One example of a stock that I think is overvalued and not worth owning with a bull market raging is Clorox (NYSE:CLX).

The company is legendary in the income investing game and has countless brands that are first or second in their respective categories. I’m not suggesting Clorox isn’t a great company; I’m suggesting there are many better places to put your investment dollars. Let’s dig in.

Where’s the growth?

My primary issues with Clorox are its growth expectations, and valuation. Of course, the two things are related, but when I look at the way Clorox is trading against a very weak fundamental backdrop, I simply don’t understand anyone wanting to own it right now.

We know the pandemic – in an odd way – was amazing for Clorox. The entire world suddenly needed limitless cleaning supplies, and Clorox reaped massive benefits for it. Of course, that was transitory, and it unwound pretty quickly. The problem is that Clorox still hasn’t really seen earnings normalize off of the pandemic boom/bust cycle, and I actually think the problems are deeper than that.

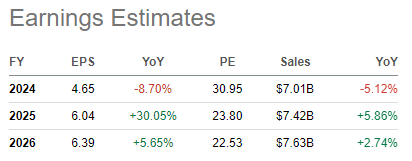

Seeking Alpha

Estimates for this year are nearly 9% lower for EPS, and sales are expected to be more than 5% lower. We’re further out from the pandemic, in my view, than warrants this kind of thing. Like I said, the lack of growth the company is dealing with is deeper than just a pandemic boom/bust cycle.

There are three ways any company can grow EPS: revenue growth, margin growth, and share repurchases. All three offer a way to move the needle on EPS, but for Clorox, I don’t see much in the way of meaningful growth in any of these.

We’ll get share repurchases out of the way, because they’re essentially nonexistent. The share count has barely moved over the past few years, so we’ll just put a 0% rate on that.

Sales expectations are weak, but the bigger issue is that expectations continue to worsen.

Seeking Alpha

We’re looking at -5.1% for this year, +5.9% next year, and less than 3% the following year. However, look at the revisions; all time frames and years are negative. Clorox has been chronically underperforming expectations for some time now, and these revisions suggest that under performance may not be done. If you’re buying the stock based on current estimates, just know that there’s a pretty good chance the company will miss.

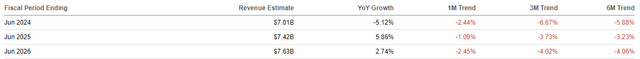

Finally, let’s look at margins, which I think is actually Clorox’s biggest issue. Below are trailing-twelve-month gross and operating margins, and the picture isn’t pretty.

TIKR

Gross margins were best during the height of the pandemic, as were operating margins. They plummeted into the end of 2021, however, and never recovered. Gross margins are about 600bps lower than peak, but operating margins are about 1,000bps lower. Clorox has pricing power with its more popular categories, but it simply isn’t translating into margins the way it used to.

Clorox knows this, and is attempting to recover margins through targeted actions.

Investor presentation

Cost saving efforts are underway, and the company continues to try and boost revenue and margins through higher pricing. Pricing actions are great but there’s an end point, as at some point, consumers will stop buying anything if it gets too expensive. Clorox needs volume to pick up, and I’m not sure I see a catalyst for that.

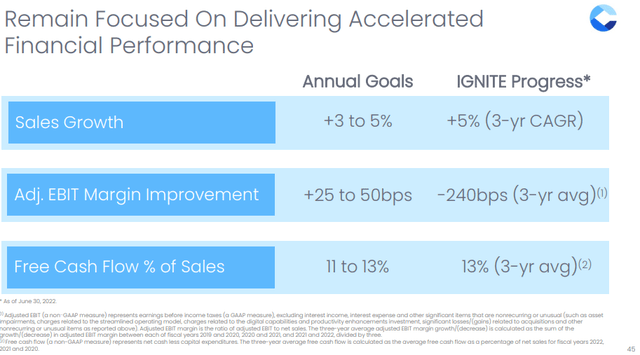

Looking forward, here’s what management is attempting to do.

Investor presentation

Sales growth of 3% to 5% will require some improvement in volumes because, like I said, at some point you cannot simply continue to indefinitely raise prices. I suspect weak volume is why expectations for revenue continue to creep lower, so unless/until we see that improve, I think these goals are at risk.

Margin improvement is expected to be fractional, with the top end of guidance at 50bps annually. Remember Clorox lost 1,000bps of margin in the past two years, so while 25bps to 50bps would be better than nothing, we’re nowhere close to pre-COVID levels. To my eye, that’s critical when considering whether to own this stock or not.

Let’s value this thing

With that in mind, the valuation makes even less sense to me. Valuations are driven by many things, but generally, they’re based on the value of revenue (otherwise known as profit margins) and growth potential. Companies with high margins and/or high rates of growth tend to get higher P/E multiples. Clorox has neither of these things.

Clorox’ growth potential is modest to say the least – based on what we looked at above – and we know margins are nowhere near where they used to be. With that being the case, you’d expect the valuation to be lower, because each dollar of revenue is producing a lot less in profits than it once did. That’s just not the case, however.

TIKR

Yes, 25X forward earnings is lower than the historical mean, but given operating margins have been cut in half, I’d argue we need a lower valuation to account for that. If you think 25X forward earnings for 3% to 5% growth is acceptable, you can certainly buy Clorox. Those two things are entirely incongruous to me, however, and I think the stock is way overvalued.

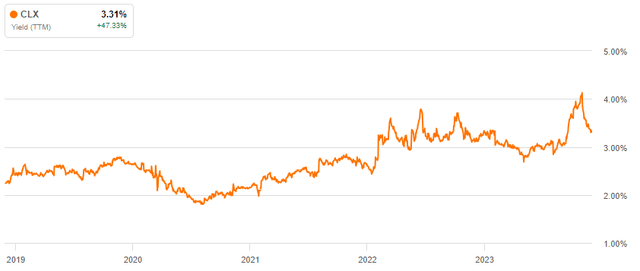

Another way to value the stock is via the yield, as we know it’s an income investor favorite.

Seeking Alpha

The yield is okay, but keep in mind you can buy Treasuries that have much better yields than this. If you can get a tax-advantaged, risk-free yield that’s better than Clorox’ yield, and not have to accept earnings risk, I’m again struggling to understand why anyone wants to own this stock.

If we wrap this up, I see Clorox as a company that hasn’t figured out how to rebuild its business after the pandemic-induced disruption, but investors continue to value the stock like they’ve already done just that. It’s too expensive, has very limited growth options, and it’s a sell.

Read the full article here