We previously covered CrowdStrike Holdings (NASDAQ:CRWD) in September 2023, discussing its massive long-term tailwinds given the transition towards centralized cloud-native applications and robust generative AI demand.

With a highly sticky consumer base and growing non-cancellable remaining performance obligation, we had rated the stock as a Buy then, attributed to the attractive risk/ reward ratio.

In this article, we shall discuss why we choose to prudently rate CRWD as a Hold here, with the stock already pulling forward most of its upside potential and the generative AI hype going into overdrive.

While we maintain our conviction surrounding its long-term prospects, we also believe that there may be moderate volatility in the near-term, with some traders likely to take their profits off the table at these inflated levels.

CRWD’s Inflated Levels Offer A Minimal Margin Of Safety

For now, CRWD has recorded an impressive FQ3’24 earnings call, with revenues of $786.01M (+7.4% QoQ/ +35.3% YoY) and accelerating adj EPS of $0.82 (+10.8% QoQ/ +105% YoY), implying its improved monetization rate.

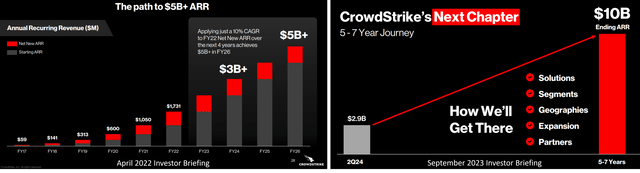

CRWD’s Raised ARR Guidance Through 2030

CRWD

Most importantly, the CRWD management has already offered a new aggressive guidance of $10B in Annual Recurring Revenue [ARR] over the next five to seven years, expanding at a CAGR of +22.91% at the midpoint, implying their confidence of delivering highly profitable growth through 2030.

Investors may want to note that its ARR growth has been accelerating, with $3.15B (+7.5% QoQ/ +34.6% YoY) already achieved by FQ3’24, compared to the previous projection by FY2025.

Combined with the fact that the cybersecurity company’s net new ARR has been increasing to $223.1M (+13.8% QoQ/ +12.6% YoY), we can understand why Mr. Market has grown extremely bullish on its prospects. This is attributed to the excellent new customer acquisition and expanded cross selling across existing customers thus far.

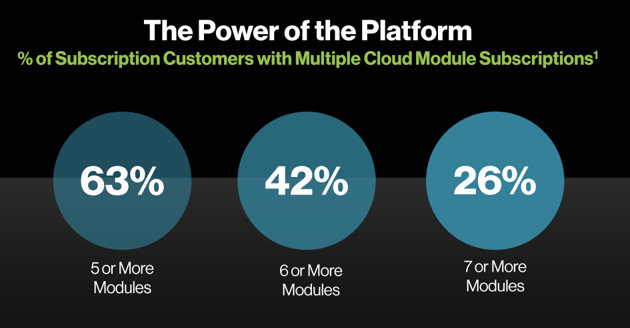

Expanded Module Adoption

CRWD

For example, CRWD is already reporting expanded module adoption of 5≥ modules at 63% (inline QoQ/ +3 YoY), 6≥ modules at 42% (+1 points QoQ/ +6 YoY), and 7≥ modules at 26% (+2 points QoQ/ +5 YoY) by the latest quarter.

This further underscores why the cybersecurity company is able to record growing adj subscription gross margins to 80% (inline QoQ/ +2 YoY), despite the supposedly elongated sales cycle and tightened corporate spending.

The same has been reflected in CRWD’s growing Remaining Performance Obligations of $3.7B (+2.7% QoQ/ +32.1% YoY), stretched over the next four years, suggesting that its existing customers will likely be very sticky thanks to the growing demand for its vertically integrated cybersecurity offerings.

The management has already highlighted a notable expansion in the AI-native Security TAM from $100B in 2024 to $225B by 2028 at a CAGR of +25.35%, compared from the previous CAGR of +10.64%.

This further demonstrates the growing market demand for cybersecurity at a time when cloud computing and generative AI are increasingly popular/ adopted by multiple global large to medium enterprises.

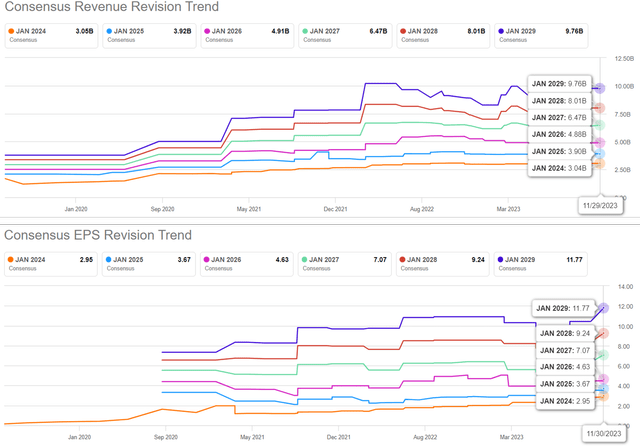

The Consensus Forward Estimates

Seeking Alpha

The combination of the highly promising factors above have directly contributed to the raised consensus forward estimates, with CRWD expected to generate an impressive top and bottom line growth at a CAGR of +29.9% and +44.3% through FY2026.

Notably, its profitability is expected to accelerate compared to the previous estimates of +36.8%.

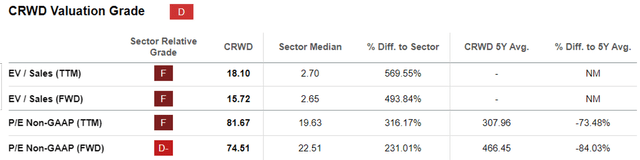

CRWD Valuations

Seeking Alpha

However, while we are highly encouraged by CRWD’s FQ3’24 results and raised long-term guidance, we are not certain if its current premium FWD EV/ Sales valuation of 15.72x and FWD P/E valuation of 74.51x make sense.

This is especially when compared to its 1Y mean of 10.19x/ 58.68x and the sector median of 2.65x/ 22.51x, respectively.

We are seeing a similar trend for CRWD’s generative AI peers, to a larger extent with Palantir (PLTR) at FWD P/E of 79.67x, and to a smaller extent with Nvidia (NVDA) at 38.88x and Microsoft (MSFT) at 34.14x.

Despite its growing lead compared to its cybersecurity peers, it remains to be seen if CRWD is able to sustain its premium valuations, against Okta (OKTA) at 61.56x and Palo Alto Networks (PANW) at 50.48x.

In addition, we believe that the CRWD stock is trading above its fair value of $173.69, based on its normalized P/E of 58.68x and the management’s FY2024 adj EPS guidance of $2.96 (+92.2% YoY).

There appears to be a minimal upside potential to our long-term price target of $271.68 as well, based on the consensus FY2026 adj EPS estimates of $4.63, with these inflated levels offering interested investors with a minimal margin of safety.

So, Is CRWD Stock A Buy, Sell, or Hold?

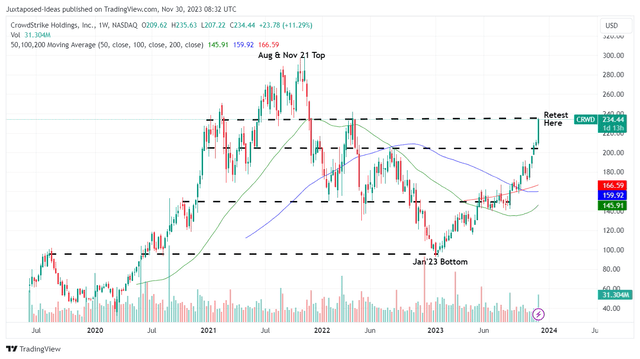

CRWD 5Y Stock Price

Trading View

For now, CRWD has already broken out of its 50/ 100/ 200 moving average in one fell swoop while rallying by +126.99% YTD, with the stock currently retesting its 2021/ 2022 resistance level of $235s.

However, we are of the opinion that the upward momentum is frighteningly over-optimistic, similar to the hyper-pandemic trend between March 2020 and February 2021.

While the Fed’s commentary has turned dovish, thanks to the cooling inflation reported in the October 2023 CPI, we believe that CRWD is overbought here, with the market sentiments similarly turning greedy.

As a result of the potentially painful correction, we prefer to prudently rate CRWD as a Hold here, since anyone adding here may overload their dollar cost averages with the stock already nearing its hyper-pandemic heights.

Lastly, we do not recommend anyone chase this rally as there is a high chance of traders taking some profits at these inflated levels, especially if the stock hits the hyper-pandemic peak ranges of $250 to $280. Only time may tell.

Read the full article here