Intro

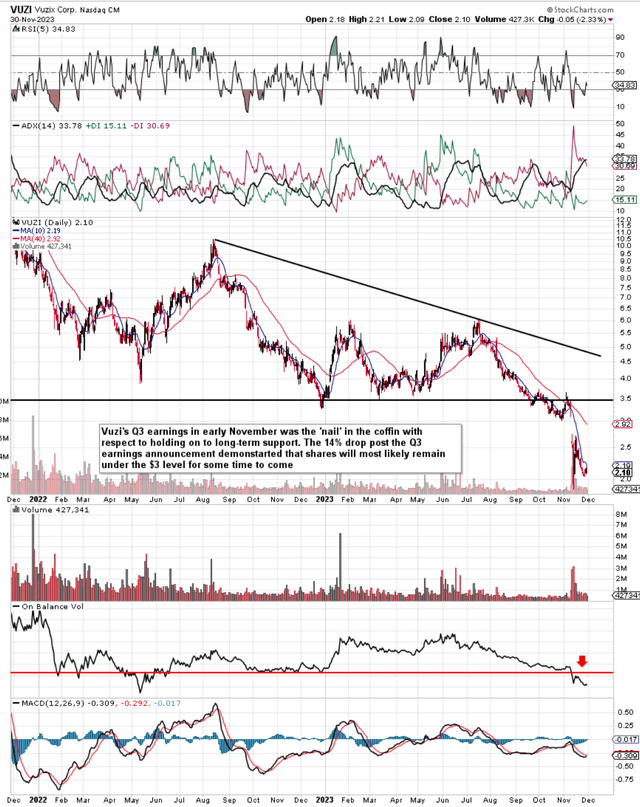

We wrote about Vuzix Corporation (NASDAQ:VUZI) in September of this year post the company’s second-quarter numbers which saw sales increase by 41.7 million (56% growth). Furthermore, Vuzix managed also to report a rare bottom-line beat in the second quarter but neither the above-average sales growth nor the -$0.14 GAAP EPS print in Q2 could stop the established pattern of lower lows in the stock. We warned investors about this in our September commentary just as shares were about to test underside support (hence the hold rating at the time). The volume trend (which usually precedes share-price action) was bearish at the time which meant that a breach of support was more probable than possible. As we see below, VUZI’s Q3 earnings report, specifically the 36%+ negative top-line growth rate for the quarter was the final confirmation that indeed underside support had failed in the stock.

The ugly $2.18 million top-line number for the quarter undoubtedly took investors by surprise considering Vuzix is deemed a growth stock by the market. Although earnings remain in negative territory, the smart glasses company still has grown its sales by approximately 20% on average per year over the past five years. Suffice it to say, that considering VUZI’s lofty valuation and evident growth problems, fundamentals for the company remain very much bearish at this moment in time.

Vuzi Bearish Technicals (Stockcharts.com)

Q3 Earnings Report – Not Based On Reality

On the latest earnings call, the long-term potential of Vuzix was once more focused on by management, outlining multiple areas where the company could see significant growth in upcoming years. The company’s present trailing annual sales come in at only $14 million but that didn’t stop management from touting lofty numbers such as the company’s $12 billion/year top-line potential in the bigger broad market (smart glasses, waveguides & displays) once augmented reality goes mainstream & $500 million/year top-line potential in the enterprise market. The problem with presenting these numbers is that it can fake investors out considering as mentioned, Vuzix is only turning over approximately $14 million in annual sales at present.

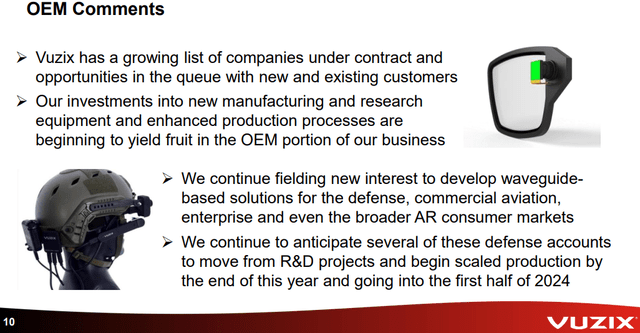

Despite the 36%+ negative top-line growth in Q3 (which management put down to customers delaying their purchases), management focused commentary on the likes of the new waveguide factory which is now up and running, the potential of Micro LED’s & Incognito & how the company’s sizable stake in Atomistic will put Vuzix at the cutting edge of Micro Led display technology. Moreover, management portrayed how Vuzix’s pipeline concerning its smart glasses is at its largest point ever & the assumption that AI-enabled glasses should be able to ride the strong AI tailwind that we are witnessing currently in the world. Management also touched on the OEM side of the business where present R&D projects are expected to transition to production as we learn below. All futuristic with no link to how present shareholders are expected to ride this current downturn out (which is reality).

Vuzix Q3 Investor Presentation (Company Website)

Ultimately The Financials Are What Rule

The problem with all of the potential growth catalysts above is that investors believe they are not feasible at present, hence the stock’s bearish trend. Headcount cuts look like they are on the way with management announcing a 20% cut in operating costs going forward. Therefore, the question becomes whether Vuzix can remain aggressive with its growth initiatives whilst at the same time cutting costs aggressively to preserve cash. It is supposed to be a growth company, remember? The hemorrhaging of the company’s cash balance remains palpable, so it is understandable that the company has to batten down the hatches somewhat at least over the near term.

Vuzix’s cash balance dropped by over $10 million in Q3 to come in at $38 million. Suffice it to say, that unless costs get cut quickly, the company will be out of cash within 12 months. The problem is that substantially more than the ‘20% of ‘operating costs target will have to be shaved for the balance sheet to stop draining cash. The reason being is that at the present run-rate, as mentioned, Vuzix’s cash balance is dropping by $10+ million at least per quarter whereas 20% of trailing 12-month operating costs do not even amount to $10 million over four quarters. Vuzix needs direction fast or that already high sales multiple of 9.53 will most likely go a lot higher when management has no option to dilute the float or take on debt to meet the shortfall.

Conclusion

Therefore, to sum up, given near-term difficulties, things may get worse here over the near-term before getting better. The stock’s technicals, negative sales growth in Q3, lack of profitability, and continuous burning of cash flow all point to selling pressure over the near term. The short-interest ratio remains ultra-elevated at over 19% demonstrating that short-sellers continue to see more downside here. We look forward to continued coverage.

Read the full article here