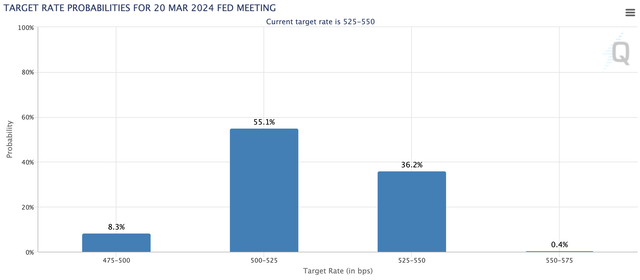

Venture capital-focused business development company TriplePoint Venture Growth (NYSE:TPVG) is likely set to eke out positive total returns for 2023 even after its common shares have fallen 17% over the last 1 year. The BDC’s most recent quarterly cash dividend distribution at $0.40 per share was unchanged sequentially for what currently works out to be a 15.2% annualized forward dividend yield. The BDC also had a spillover income of $1.03 per share at the end of its fiscal 2023 third quarter, enough to cover 2.6x quarters of its base dividend. Hence, the current yield is extremely secure but like other BDCs faces the end of the Fed rate hiking cycle. CME’s 30-Day Fed Funds futures pricing data is currently pricing in a 55% chance that the 20 March 2024 FOMC meeting will see the first 25 basis points cut to a Fed funds rate currently sitting at a 22-year high of 5.25% to 5.50%.

CME FedWatch Tool

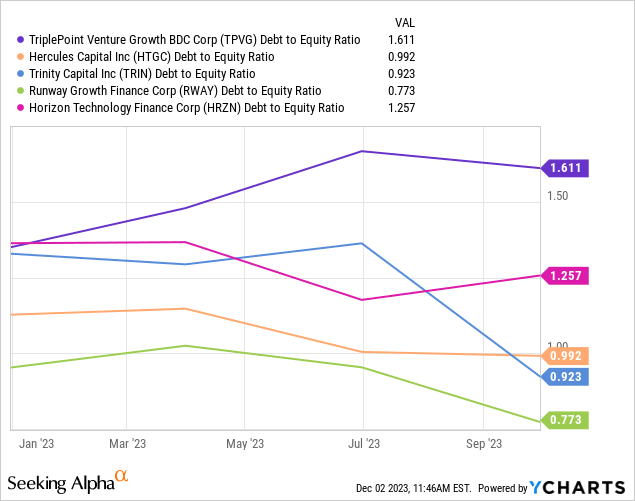

Whilst the pace and intensity of cuts will drive how material of a headwind the dovish pivot is for all BDCs, tickers operating with higher leverage and a high degree of credit on non-accrual status will see the risk posed by this heightened. TPVG reported a debt-to-equity ratio of 1.6x as of the end of its third quarter, higher than other venture debt-focused BDCs like Hercules Capital (HTGC) and Horizon Technology Finance (HRZN). TPVG holds the highest ratio of its peers.

Critically, the collapse of Silicon Valley Bank has opened up a significant opportunity for non-bank players in the venture debt market as the regional bank was the biggest player in the space. SVB provided 50% of all venture loans in the past 20 years. Its collapse has left a substantial gap for BDCs like TPVG to fill with short maturity and highly secured loans to startups who typically don’t want to give up equity. Coupons are typically higher than other BDCs due to the higher credit risk of startup borrowers. I last covered the BDC in the summer when bad loans were spiking to form a trend that’s yet to be reversed.

Investment Income And Net Asset Value

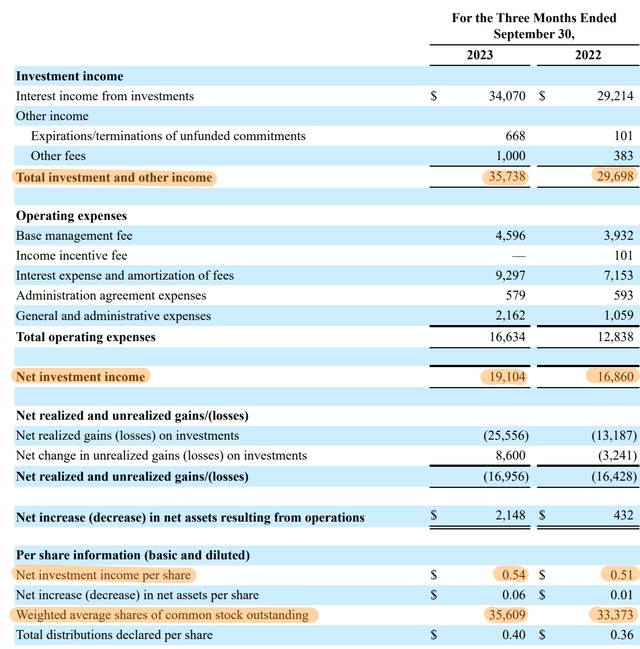

TriplePoint Venture Growth Fiscal 2023 Third Quarter Form 10-Q

TPVG reported a total investment income of $35.74 million for its third quarter, up 20.3% over its year-ago comp and a beat by $2.03 million on analyst consensus. Net investment income grew by 13% year-over-year with NII per share of $0.54, up 3 cents from its year-ago figure. Hence, TPVG is significantly outearning its base dividend distribution by around $0.14 per share, a 74% payout ratio. This beat consensus by around 4 cents and meant the continued buildup of spillover income. There will not be a hike to the base dividend though with management stressing during the third-quarter earnings call that see the current base distribution as solid and that they intend to defend NAV and reduce their high leverage ratio.

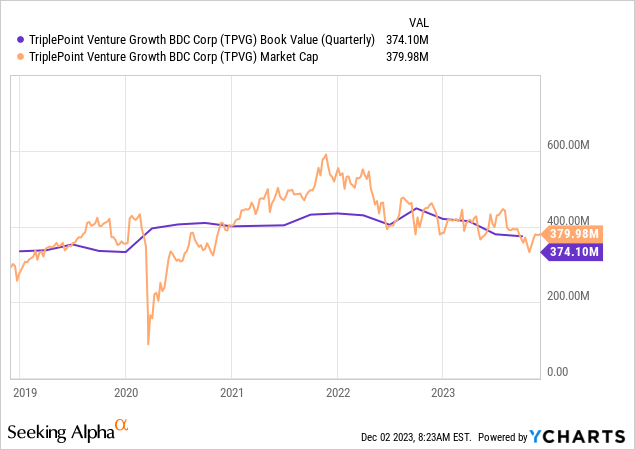

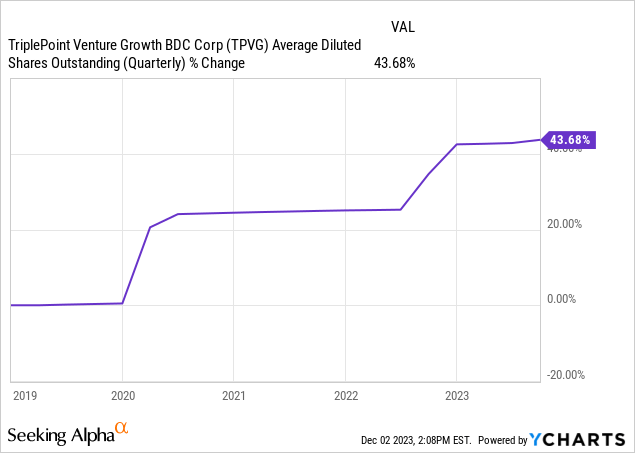

NAV came in at $374 million at the end of the third quarter, around $10.37 per share, down by around 33 cents sequentially. It was also down by a material $2.32 from $12.69 per share in the year-ago period. TPVG has seen its NAV per share decline for 7 consecutive quarters, peaking at $14.01 in the fourth quarter of its fiscal 2021. The decline looks less pronounced on a nominal basis but the BDC has expanded its share count by 45% over the last 5 years. The issuance of new equity by BDCs is not controversial if completed above NAV and TPVG has traded above NAV for most of the last 5 years. However, an expansion of shares that leads to a still high leverage ratio and an erosion of NAV per share is not great for shareholders.

Underwriting Quality And Payment-In-Kind

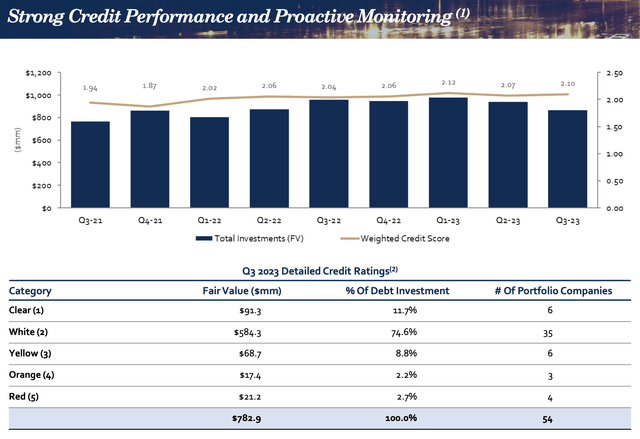

TriplePoint Venture Growth Fiscal 2023 Third Quarter Presentation

The BDC has faced headwinds from credit quality. Net losses on its investments came in at $25.56 million during the third quarter. There were also eight portfolio companies on non-accrual status with an aggregate cost and fair value of $94.8 million and $39.2 million respectively. As TPVG’s debt portfolio at fair value was $782.9 million at the end of the third quarter, non-accruals at fair value was 5%, up from 0.98% in the year-ago comp. To be clear, a year ago TPVG had one portfolio company on non-accrual status with a fair value of $8.4 million. This was against a $856.7 million debt portfolio at fair value. Portfolio companies rated yellow to red at 13.7% during the third quarter was a 370 basis points increase from a year ago and a 180 basis points increase sequentially. Payment-in-kind income at $3.27 million, 9.14% of total investment income, was also up from a year-ago figure of $1.66 million. This was around 5.59% of total investment income in the year-ago period. Hence, whilst the substantial dividend yield is safe and a year-end special looks likely, credit quality headwinds mean it is hard to recommend this as a buy.

Read the full article here