Investment Thesis

Builders FirstSource (NYSE:BLDR) reported earnings for a challenging period. However, the key takeaway is that 2023 is nearly behind us. Looking forward to mid-2024, comparisons with this year will be crucial for Builders’ prospects.

At 7x next year’s free cash flows, the business is very attractively priced. While acknowledging the investment thesis isn’t flawless, there are numerous compelling aspects that make this investment worthwhile considering.

Quick Recap

Back in September I said about BLDR,

My bullish assessment is that this stock is cheap. That the company is buying back significant shares each quarter. And that the outlook for 2024 is likely to be better than 2023, leaving the company well set up to deliver investors with compelling returns.

In light of BLDR’s Q3 2023 results, I stand by this assessment.

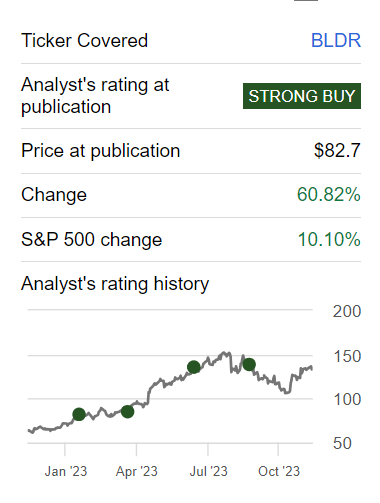

What’s more, as you can see below, I’ve been bullish on BLDR for the past year, and this stock has been a terrific winner.

Michael Wiggins De Oliveira BLDR

And as we look further ahead, I remain just as bullish on BLDR stock.

Improving Revenue Growth Rates

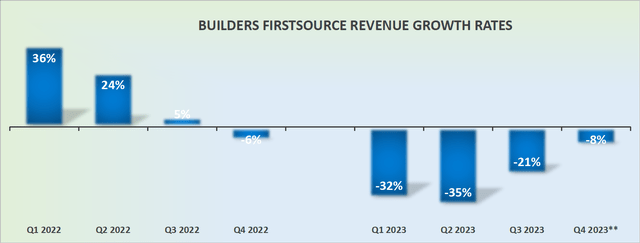

BLDR revenue growth rates

Previously I stated that ”BLDR has reported its trough quarterly revenues”. Accordingly, given management guidance for 2023, this implies that its revenue growth rates for Q4 will probably end close to negative 8% y/y.

This means that BLDR’s revenue growth rates are starting to meaningfully improve so that as it steps into 2024, its revenue growth rates will be in a much better shape.

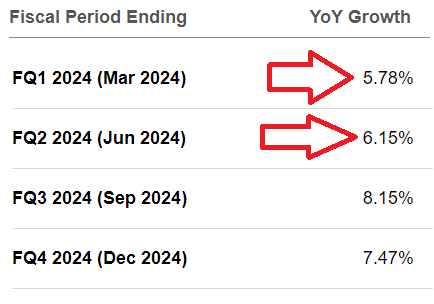

This line of reasoning is supported by analysts’ revenue consensus figures, see below.

SA Premium

Indeed, as you can see above, analysts believe that in 2024, BLDR will be able to deliver mid-single-digit growth rates. That’s a much better growth rate, than that reported in 2023. Particularly compared with the trailing 9 months of 2023.

And whilst that’s great insight, there’s even better news.

BLDR’s Very High Profitability

Despite the challenges, BLDR remains highly profitable. With aggressive share repurchases amounting to 11% of shares this year, the business is poised to show faster bottom-line growth than top-line growth, potentially exceeding 10% CAGR.

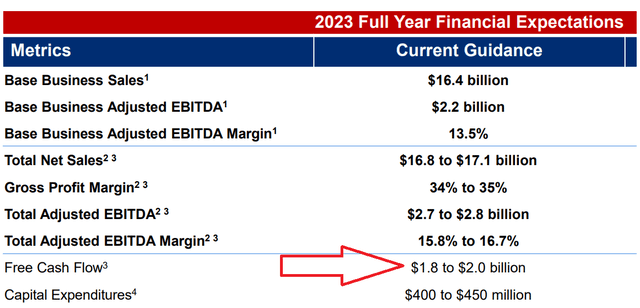

BLDR aims to achieve around $2 billion of free cash flow in 2023 (see figure below) and I project this free cash flow to grow to approximately $2.1 billion in 2024. This leaves BLDR priced at less than 7x next year’s free cash flows.

BLDR Q3 2023

As a reminder, the appeal of investing in BLDR is that the business has been aggressively repurchasing its shares. Case in point, on a year-to-date figure, BLDR repurchased 11% of its shares.

This means that in 2024, on the back of around 5% or 7% topline growth, the business will probably be growing its bottom line at a faster rate, which could easily surpass 10% CAGR.

Again, if we think about 2024, in all likelihood BLDR will report around $2.1 billion of free cash flow. This leaves BLDR priced at less than 7x next year’s free cash flows.

Yes, there’s abundant cyclicality in lumber prices. And yes, BLDR services the residential homebuilding industry, which is meaningfully exposed to the broader U.S. economy, including factors such as interest rates and housing demand, plus the cyclical nature of the building products industry, especially wood products.

Trading Economics; lumber prices 1-year

And yet lumber prices remain high, and importantly stable.

On top of all that, competition within the industry, coupled with potential shifts in homebuyer preferences towards smaller homes, challenges BLDR’s market share gains. And yet, consider this graphic that hammers home my argument:

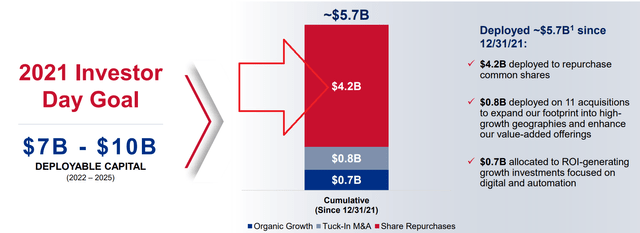

BLDR Q3 2023 presentation

In the past 2 years, BLDR has bought back $2 billion worth of stock. For a business that’s valued at $14 billion, this implies that in the past 2 years, BLDR has bought back 14% of its market cap.

To put it more concretely, BLDR is determined to continue reducing its total number of shares outstanding. Indeed, this is the best type of investment. One that doesn’t cause any negative surprises.

The Bottom Line

Builders FirstSource emerges as a compelling investment prospect, underscored by its conservative valuation of merely 7x 2024 free cash flow.

This appeal is further strengthened by the company’s ongoing commitment to share repurchases, resulting in a notable 14% reduction in outstanding shares over the past two years.

Such proactive measures not only reflect management’s unwavering confidence but also solidify the potential for substantial returns and consistent growth in the foreseeable future, rendering BLDR a very attractive investment for investors seeking long-term stability and no likely negative news.

Read the full article here