Investment Thesis

In continuation with our coverage on Primo Water (NYSE:PRMW), we had rated the stock Buy driven by its ongoing transformational shift towards a pure play water solutions company over the past couple of years, improving operational and financial profile along with relative undervaluation. Sentiment was weak heading into Q3 as a result of macro headwinds but quickly rebounded post its earnings driven by continued strong growth. The company recently reported another strong quarter and beat estimates and while the beat was not followed through on raising estimates, we believe conservatism is likely built with the appointment of new CEO. It further reinvigorates its focus to become a leading North American water solutions provider after divesting its majority of International business at an attractive valuation. We reiterate our Buy rating with a target price of $18 (at 9.3x EV/ Fwd EBITDA, in line with its historical average)

Another Strong Quarter

The company reported another strong quarter with Q3 revenues increasing by 6% YoY to $622 mn, largely in line with the consensus estimates pegged at $624 mn and was at exact midpoint of the company’s guidance. Revenues in North America grew by 5% YoY driven by outperformance within Water refill/ filtration (up 18% YoY) and Other Water (up 41% YoY) while Water Direct/ Exchange (up 7% YoY) and Dispenser sales (down 30% YoY) came in below estimates. The strong growth was driven by continued follow through on pricing actions (although modest compared to previous quarters) as well as resilient demand from residential and business users. Dispenser sell-through declined 7% YoY and steady on sequential basis while revenue per route increased by 7% YoY demonstrating continued benefits from route optimization and efficiencies. ROW sales remained a surprise up 10% YoY driven by strong growth in both Water Direct/ Exchange segment (up 10% YoY) along with Water Refill/ filtration segment (up 24% YoY). This was largely as a result of pricing actions along with favorable Fx benefits which had largely been a headwind over the past several quarters.

Gross margins improved by 250 bps YoY to 62.1% and flat sequentially driven by pricing initiatives along with operational efficiencies with no overlapping impact of from the exit of single bottle retail. SG&A expenses leveraged by 20 bps on the back of revenue growth outpacing fixed costs along with route efficiencies partially offset by increase in selling and operating costs. Adj. EBITDA margin came in at record 22.7%, up 270 bps YoY, beating consensus estimates. In all, it reported an EPS of $0.33, ahead of the consensus estimates pegged at $0.26.

Balance sheet position continues to improve with the company ending with a cash balance of $98 mn and total debt outstanding of $1.45 bn (no maturities until 2028) with a net leverage ratio easing to 2.9x from 3.4x at the end of 2022 and 3.3x last quarter. The company further expanded its share repurchase program from $50 mn to $75 mn which will provide further support to the stock.

Divestment of International Business

The company announced the divestment of majority portion of its international business to Culligan International for $575 mn, implying an EV/ TTM EBITDA of 11x. The company plans to use the proceeds to pay down its cash flow revolver balance and increase its share repurchases by $25 mn (to $75 mn in total) and accelerating its long-term goal of sustaining <2.5x net leverage ratio. The company was able to reap an attractive value at 11x EV/EBITDA compared to the 7.5x EV/EBITDA PRMW paid for the business in 2016. The transaction is also accretive to the earnings as it trades at <8x EV/ TTM EBITDA while the transaction multiple being significantly higher. PRMW also noted that it is pursuing strategic alternatives for the international business not included in the transaction i.e. Aimia Foods, UK, Portugal, and Israel businesses and expect to divest them by 2024 with marketing efforts having started recently. The remaining business is potentially generating an EBITDA of ~$30-$40 mn but may not fetch the exact multiple like it did for the other international business it already sold.

We believe the transaction is attractive for it will enable them to leverage and consolidate its position in the attractive North American market, potential for few additional tuck-in M&A, bolster its balance sheet optionality along with potential for shareholder activities such as share repurchases and dividends.

Guidance Slightly Disappointing

Despite the company delivering a strong EBITDA beat for the quarter, the company did not follow through on its guidance for Q4 and reiterated the guidance for the full year for revenues of $2,320-2,360 mn (up 4.7 – 6.5% YoY) and adjusted EBITDA of $460-480 mn while slightly increasing the FCF guidance from $150 mn to $160 mn. This implies a Q4 EBITDA of $108-$118 mn below the implied consensus expectation of $115 – $125 mn which was slightly disappointing. However, we believe conservatism is likely being built as a result of the impact of Israel is still unknown with the company roping in a new management CEO Robbert Rietbroek with significant leadership experience in CPG industry a week back.

We continue to believe that the company is likely be able to achieve mid single digit pricing growth going forward and MSD to HSD revenue growth in the Remaining Company while robust EBITDA margins continue to be a positive surprise and is likely to maintain a 21%+ margin entering 2024 after the exit of its International business.

Valuation

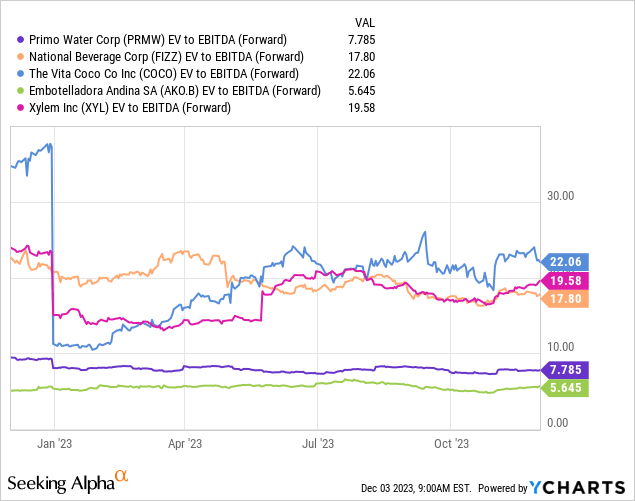

PRMW continues to trade at an EV/EBITDA of just 7.8x at a significant discount to its peers as well as at a discount to its historical average. We continue to value PRMW at 9.3x EV/ EBITDA and reiterate a target price of $18.

Risks to Rating

Risks to rating include

1) Continued Macro challenges and prolonged slowdown may lead to demand headwinds and the company may have to resort to pricing changes (which has been the key contributor for revenue growth past couple of quarters)

2) Adverse FX moves can be a drag on overall P&L (while Fx contributed positively to revenue growth in Q3, it declined by 4% in Q2 and 2% in Q1 due to FX)

3) Execution challenges may lead to stagnating or declining revenue per route which has also been a driver to revenue growth apart from pricing

Final Thoughts

We believe the company continues to take steps in the right direction continuing with its transformational journey over the past several years. The appointment of its CEO and the divestment of its International business removes a key overhang and we believe the company is poised to consolidate and expand its position within its focus area in North America. Reiterate Buy with target price of $18 (at 9.3x Fwd EBITDA)

Read the full article here