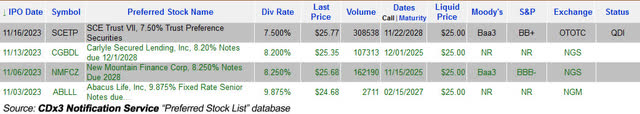

New offering summaries:

CDX3Investor.com (CDX3Investor.com)

Electric utility company Edison International (EIX), through its subsidiary Southern California Edison, priced an offering of 22 million shares of new cumulative trust preference securities, offering a fixed dividend rate of 7.5%. The new shares were rated Baa3, BB+, and BBB- by Moody’s, S&P, and Fitch respectively. The new shares began trading temporarily on the OTC under symbol (OTC:SCETP), and will eventually move to the New York Stock Exchange under symbol SCE-M.

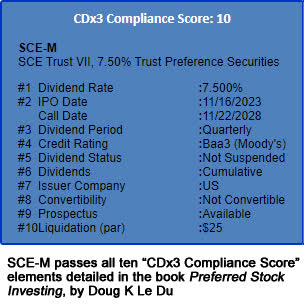

Of the four IPOs mentioned in today’s article, SCE-M represents the only one scoring 10 out of 10 on our CDx3 Compliance scale, entering it into the basket of CDx3-compliant securities matching our strategy. Long-time readers of our Seeking Alpha articles may already be familiar with our compliance scale and what it means to rank 10 out of 10, but for those readers who may be new to CDx3 compliance as a framework for selecting quality preferred stocks, the following elements must match or exceed our target: dividend rate, time until call date, cumulative unsuspended quarterly dividend, investment grade credit rating, US issuer, non-convertible, prospectus availability, and $25 par value. Here is how these criteria look for SCE-M:

CDX3Investor.com

Carlyle Secured Lending (CGBD), an externally managed Business Development Company [BDC] focused on making senior secured debt investments in middle market U.S. companies, priced an offering of $75 million worth of new exchange traded notes due 2028, offering a fixed coupon of 8.2%. The new notes received a credit rating of BBB from DBRS Morningstar, and trade on the Nasdaq under the symbol (CGBDL).

Abacus Life (ABL) priced an offering of $31 million worth of new exchange traded senior notes due 2028, offering a fixed coupon of 9.875%. The company indicated that proceeds would be used in part to repay $26.5 million of existing indebtedness. The new notes trade on the Nasdaq under the symbol (ABLLL).

And New Mountain Finance Corporation (NMFC), an externally managed Business Development Company, priced an offering of $115 million worth of new exchange traded notes due 2028, offering a fixed coupon of 8.25%. The new notes were rated Baa3 and BBB- by Moody’s and Fitch, respectively, and trade on the Nasdaq under the symbol (NMFCZ).

SEC filings for further information: SCE-M, CGBDL, ABLLL, NMFCZ.

Buying new shares for wholesale

Preferred stock IPOs often involve a temporary period during which OTC trading symbols are assigned until these securities move to their retail exchange, at which time they will receive their permanent symbols. (For example, the new Edison preferred discussed above, which is presently trading on the OTC as (SCETP) but will eventually move to the NYSE under permanent SCE-M).

But there is no need to wait. Individual investors, armed with a web browser and an online trading account, can often purchase newly introduced preferred stock shares at wholesale prices just like the big guys (see “Preferred Stock Buyers Change Tactics For Double-Digit Returns” for an explanation of how the OTC can be used to purchase shares for discounted prices).

Those who have been following this strategy of using the wholesale OTC exchange to buy newly introduced shares for less than $25 are more able to avoid a capital loss if prices drop (if they choose to sell).

Your broker will automatically update the trading symbols of any shares you purchase on the OTC, once they move to their permanent symbols. A special note regarding preferred stock trading symbols: Annoyingly, unlike common stock trading symbols, the format used by exchanges, brokers and other online quoting services for preferred stock symbols is not standardized.

For example, a given Series A preferred stock might have a symbol ending in “-A” at TDAmeritrade, Google Finance and several others but this same security may end in “PR.A” at E*Trade and “.PA” at Seeking Alpha.

Past preferred stock IPOs below par

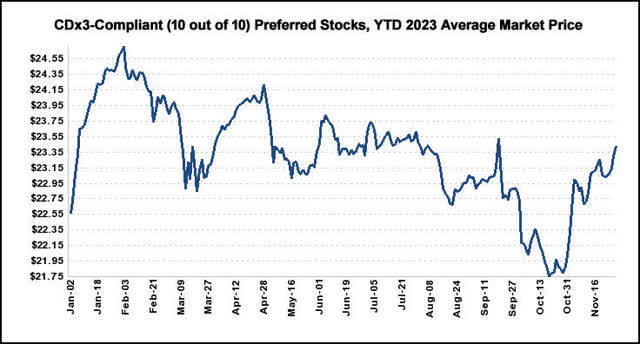

In addition to covering new preferred stock and ETD offerings, here at CDx3 we also track past offerings, with alerts when securities fall below their par values. For all of 2023, the basket of CDx3-compliant preferred stocks and ETDs (i.e. scoring 10 out of 10 on our compliance scale), has traded below par value of $25 as a group. The lowest price levels were seen in October, coinciding with the spike in US Treasury bond yields; the preferred stock basket has since made a strong rebound, to trade right around the average discount to par it has seen thus far in 2023.

CDX3Investor.com

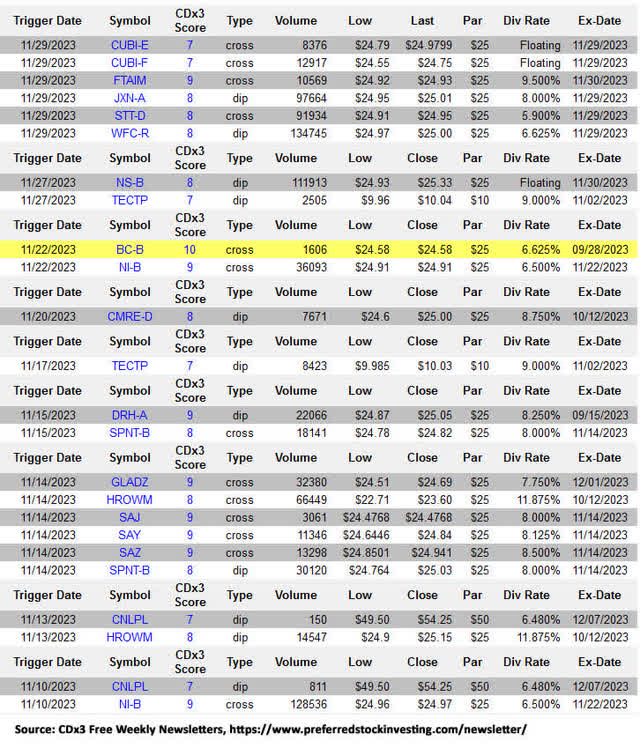

To close this article, we would like to share with you some of the most recent dips/crosses below par we have observed among individual securities (note that yellow highlighted entries indicate highly rated securities eligible for the “CDx3 Bargain Table”):

CDX3Investor.com

For those preferred stock (and ETD) investors interested not just in new IPOs but previously issued securities, following par crosses can provide useful insight into which securities have recently become available in the marketplace below their initial offering prices; for example, BC-B is a 10 out of 10 CDx3-compliant security (highlighted in yellow), which had crossed below par earlier in November. It traded as low as $22.56 before rebounding during the recent rally, and now trades above par again ($25.63 at the time of this writing).

Investor Takeaway

In our monthly Seeking Alpha articles, we here at CDx3 Notification Service typically summarize all the new preferred stock and exchange traded debt offerings observed over the course of the month; we also highlight past offerings that have begun to trade below par value. Our goal is to keep fixed-income investors up-to-date on the various investments available in the current marketplace, and we hope this month’s article has served this purpose. See you next time, and thanks for reading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here