Topline Summary and Update

BioLineRx (NASDAQ:BLRX) has recently gained approval for a blood cancer drug that can aid in stem cell transplantation. In my first assessment of this company, I noted that a drug approval is too big a deal to ignore, even if there are questions about the ongoing market size for a drug that has generic competition and that is in a setting that continues to be questioned in the literature. My take on this in Q4 2023 is that they still have a lot of potential to realize if they can execute, making this continue to be a buy for now.

Pipeline Updates

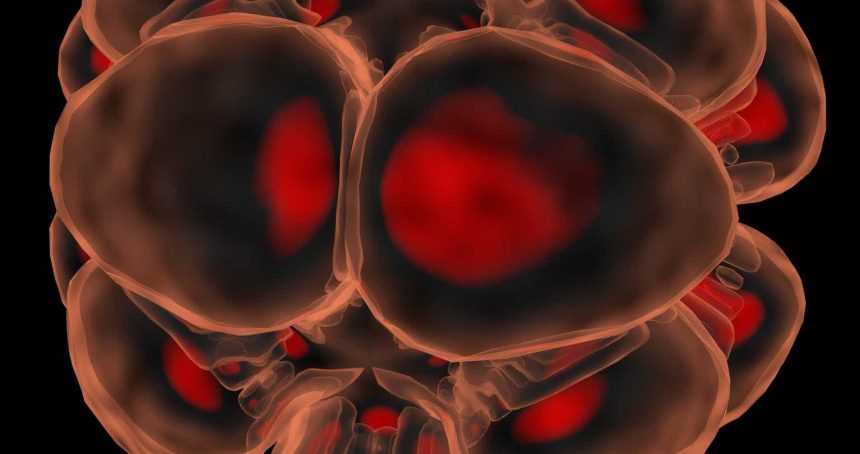

MotixafortideThe flagship for BLRX continues to be motixafortide, a CXCR4 inhibitor that can stimulate blood stem cell production and mobilization, a critical step in stem cell transplantation that remains a key part of the standard of care for certain blood cancers, including most notably multiple myeloma.

As a reminder, motixafortide is based on positive findings from the phase 3 GENESIS trial, which showed high rates of successful mobilization of blood stem cells when added to filgrastim compared with filgrastim alone.

It remains unknown whether motixafortide is superior to plerixafor, a CXCR4 inhibitor that has a generic version approved. An indirect comparison of the two agents presented last year suggested that motixafortide needed fewer rounds of treatment to achieve optimal stem cell mobilization, which could help blunt the cost/benefit comparison.

There are 2 updates that I want to highlight for motixafortide. The first is a poster presentation at the upcoming ASH meeting in San Diego. This poster will present findings from a single center that enrolled patients on the pivotal GENESIS trial. This study details the outcomes of patients prior to and after a protocol amendment to try and reduce the risk of infusion reactions. Long story short: the protocol appears to have worked, and the reactions observed have been improved substantially.

Also, there was an interesting report that came out of the AACR Special Conference in Pancreatic Cancer Research. Findings from the investigator-initiated CheMo4METPANC study showed encouraging response rates for a novel chemoimmunotherapy regimen supplemented with motixafortide. In 11 patients with metastatic pancreatic cancer, 55% achieved a partial response with gemcitabine plus nab-paclitaxel, cemiplimab, and motixafortide.

Based on these findings, this phase 2 trial has been amended to become a randomized study, which should help to give a clearer picture of the promise of this regimen.

Financial Overview

At the end of Q3 2023, BLRX held $28.8 million in total current assets, of which $7.7 million was cash and equivalents, and $18.2 million was short-term bank deposits. Their operating losses were $12.3 million, with other expenses bringing the net loss to $16 million, down slightly from the $18.5 million in Q2 2023.

This brings BLRX into a situation where they have only 1 or 2 quarters of cash on hand left as of their latest filing. It does not, however, take into account an agreement announced in October licensing motixafortide to Guangzhou Gloria Biosciences, a deal that brings in $15 million upfront, as well as a $14.6 million equity investment.

Strengths and Risks

The concerns I brought up in my last assessment remain, and in fact the hegemony of auto-SCT continues to be undermined as more and more studies come out, as I discussed in my previous article.

In short, various studies have undermined the hegemonic hold that auto-SCT has on the management of multiple myeloma. Not a decade ago, a newly diagnosed patient would get a first-line transplant as a standard of care, and this was supported for years. You would likely get one even after a relapse. Now, as more and more novel therapy regimens are demonstrating comparable efficacy findings, the use of autologous transplant is being eroded, giving patients other options.

Regardless, for my readers who take issue with this statement, auto-SCT is still a key treatment option, for which motixafortide offers some compelling benefit. I am eager to see what the commercial launch looks like under these conditions, but that’s still going to take some time. Transplant is not going away; I just don’t think we’re going to see quite the same potential market size as we would have in the era prior to effective combination regimens.

There also remains the question of just how much market share BLRX can capture from plerixafor. Like I said, we have no head-to-head studies, and there are cost issues associated with both drugs. A generic version of plerixafor could very well undermine the market penetration of motixafortide, and without a comparative trial, clinicians will be trying to make these decisions in a data-light zone.

The cash issue is also not solved for BLRX, although the licensing deal definitely buys them some more time. I don’t know that they’re a “prime” takeout candidate, and it’s not something I’d be willing to count on as part of an investment thesis. I’d rather see them implement and grow the motixafortide franchise themselves.

Another strength for BLRX is the maturation of the pancreas cancer data. These response rates look quite promising, and if they can confirm that >40% response rate, it would be a really large improvement over that seen with nab-paclitaxel/gemcitabine alone (which had a 23% response rate in the first-line setting). It’s a tall order to take down pancreatic cancer, but BLRX is showing early signs that they may fit into something promising. I can’t get too excited about it yet from an investing perspective, but it’s well worth watching.

Bottom-Line Summary

BLRX continues in a holding pattern as they’ve gotten some distance from their first approval. They’ve accomplished something very difficult here, and it’s going to be important to see how well they roll it out to get a sense of how much motixafortide can capture in an important market. I maintain that they are worth considering as a buy, since many of the risks have been removed. Furthermore, the risks I cited related to number of transplants and plerixafor competition are the kinds of issues ripe for a “surprise” beat. BLRX has a solid drug, one that may present a more convincing case than I’m seeing in this analysis.

If they enter the market with strong revenue, then the current valuation is a very strong bargain. The next few quarters have the potential to be massive catalysts for the company, if you respect the risks associated with diving in here.

Read the full article here