A Tough Industry

In his book Zero To One, Peter Thiel outlines two different ways that industries can develop–monopolies and, well, non-monopolies. Non-monopolistic industries are filled with products that are undifferentiated and widely used (think: screws, bolts, etc). Monopolistic companies have highly differentiated products that are very difficult to replace. Profits for non-monopolistic companies are often competed away: if you start making money selling bolts, someone else will eventually come in and start selling bolts for less, causing each of you to compete away your profits.

The food industry is decidedly a non-monopolistic enterprise. It is an exceedingly difficult space to succeed in, which makes the meteoric rise of Mama’s Creations (NASDAQ:MAMA) all the more interesting.

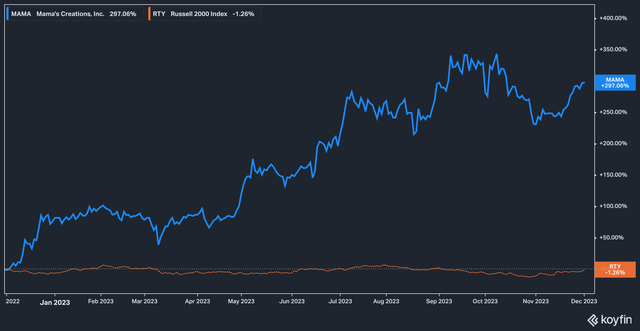

MAMA vs. RTY (Koyfin)

In the last year, Mama’s has surged almost 300% while the Russell 2000 (RTY) has lost 1% in the same period.

This surge has come on the back of a monster year for the company. In FY2022 (ending January 31st, 2022), the company posted $47 million in sales. In FY2023, the company booked $93 million in revenue. The big question on investor’s minds, then, is whether or not the growth can continue.

Let’s dive in!

The Product

Mama’s Creations is the parent company of Mama Mancini’s, which is the largest brand under which the company’s products are sold.

MamaMancinis.com

Mama Mancini’s specializes in meatballs, deli products, sausage, and other similar items.

There’s a line from the Showtime show Billions where Bobby Axelrod–the arch-villain hedge fund manager–advises a young analyst working on a food company to “when you can, always put a company in your mouth.” In other words, try the product.

Those unfamiliar (or unable) to try to product due to availability can be forgiven if their default position is skepticism–after all, how good can these meatballs be?

Well, according to customer reviews, pretty good. The company has an expanding partnership with Costco (COST), which is in and of itself a sign of high quality (Costco is well known for its rigorous product screening).

The partnership with Costco is expanding as well. CEO Adam Michael’s had this to say about the relationship on the latest earnings call:

Most recently, we expanded our partnership with Costco, penetrating the Los Angeles region, marking the fourth out of 8 regions nationally. This growth includes our first-ever non-meatball product, a 3-pound sausage and pepper sleeve set for December rotation alongside MamaMancini’s beef meatballs. 2023 has seen us expand our relationship with Costco both in terms of order volume, which already has made 2023 a record year with this customer in terms of order sizing, having recently received a record $1 million-plus order. This secures our triple play with Costco, having the largest orders in our history, with the most number of regions in the year and now having multiple items in a year. We look forward to working closely with Costco to explore other exciting products for their highly engaged customer base.

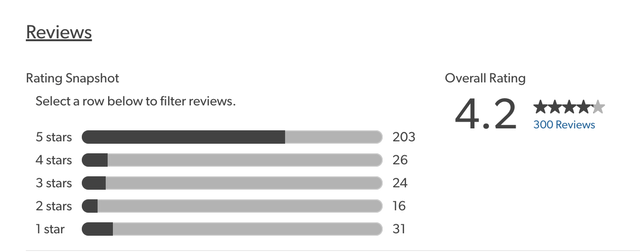

Reviews from other retailers are stellar. 93% of BJ’s Wholesale (BJ) customers who have tried the product say they would recommend it to a friend.

Customer Reviews Overview (BJ’s Wholesale)

The company has a similar review profile at Sam’s Club:

Customer Reviews Overview (Sam’s Club)

Valuation & Growth

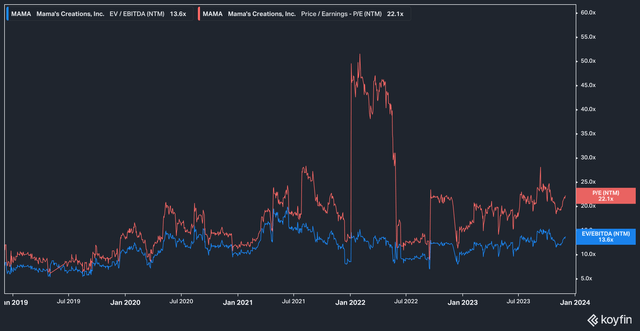

Mama’s Creations, then, is a very interesting non-tech growth story. The company is profitable, and scaling fast. With its meteoric year, it’s not surprising then that valuations have become a bit stretched.

Koyfin

Today the stock trades at 22x forward earnings estimates and 13.6x times EV/EBITDA–so, not exactly cheap. However, the company has considerable room for growth. Take a look at the company’s sales by geographic region from its latest quarterly filing:

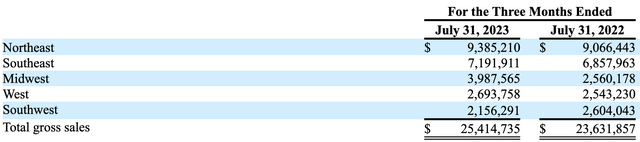

MAMA SEC Filings

As an East Coast-based company, it’s not surprising to see that the Northeast and Southeast would boast the company’s largest sales. The remarks from Adam Michael, however, suggest that the company is aggressively working to expand its footprint and generate similar sales profiles in the West, Southwest, and Midwest. On that front, the Midwest seems to be catching on to Mama Mancini’s–sales in the region grew by 56% year over year.

Wall Street analysts seem to agree that the runway for Mama’s Creations’ growth is quite large. Of the three analysts who cover the stock two rate it a buy, and one a strong buy.

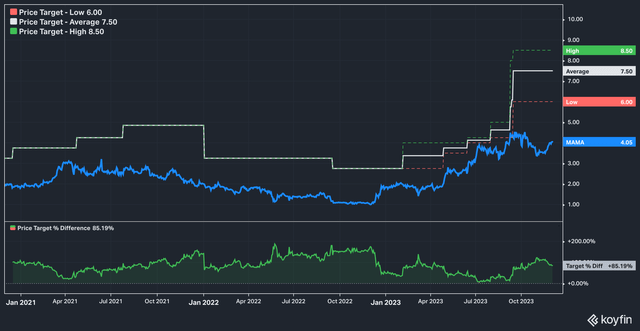

Analyst Target Price (Koyfin)

The analysts have also recently raised their target price. Today, the stock trades 85% below the analyst consensus target of $7.50 per share.

What Are The Risks?

At the end of the day, Mama’s is a micro-cap company, and investing in companies like this carries particular risks. In the past the company has issued preferred stock with odd dividend payouts. In July 2023, the company converted all outstanding Series B preferred shares into common stock, which is good news for investors.

Mama’s also has customer concentration risk. Consider the following from the latest quarterly filing:

For the six months ended July 31, 2023, the Company’s revenue was concentrated in three customers that accounted for approximately 22%, 13%, and 11% of gross revenue, respectively. For the six months ended July 31, 2022, the Company’s revenue was concentrated in three customers that accounted for approximately 24%, 13%, and 12% respectively, of gross revenue.

While we don’t know the identity of these customers, we can assume based on management comments that Costco is among them. No matter the identity, however, at the end of the day 46% of total sales can be attributed to only three customers. Even though this reliance has dropped 3% year over year, it is not ideal.

The Bottom Line

Mama’s Creations appears to be a rare bird–a non-tech growth (and profitable) growth story. Keeping in mind the risks associated with a micro-cap company like this, we think that the story for Mama’s is in the early innings and investors should pay close attention to this up-and-coming meatball maker.

Investors should keep an eye out — the company is set to report its Q3 earnings after the market close on December 13th. Top line expectations from Wall Street are $26.9 million and $2.22 million in operating income. We think the operating income will be the most important number to watch, as the $2.22 million expectation is a 48% change from the prior year and shows that the company is beginning to achieve operating leverage.

Read the full article here