Investment Thesis

DraftKings (NASDAQ:DKNG) is a digital sports entertainment and gaming company that provides users with online sports betting (Sportsbook), online casinos (iGaming), daily fantasy sports (DFS) product offerings, DraftKings Marketplace, retail sportsbooks, media, and other consumer product offerings. My bullish outlook is grounded in the view that DraftKings is a leader in the realm of mobile sports betting and gaming, boasting top-notch technology and customer service within the industry. DraftKings envisions an $80 billion total addressable market for mobile sports betting and iGaming in North America. I anticipate that DraftKings could command approximately 40% of this market in the long term as DraftKings gets legalized in more states and gains additional players.

Analysts anticipate that consensus revenues will reach $3.7 billion in 2023, reflecting a substantial 65.0% increase from the $2.24 billion reported in 2022. DraftKings has shown its capability in expanding revenue, propelled by the increasing legalization of sports betting across states and a surge in Monthly Unique Players (MUPs), at 2.3 million as of the end of September. The Street expects Adjusted EBITDA to be a $99.5 million loss in 2023, a significant improvement from a $722 million loss in 2022. I expect management to be more efficient with marketing spend over the next few years to reach positive Adjusted EBITDA in 2024, as the Street estimates Adjusted EBITDA will be $423 million.

Revenue Breakdown and Industry Background

The majority of 2022 revenue, constituting 98%, is attributed to the business-to-consumer (B2C) segment. This segment encompasses integrated Daily Fantasy Sports (DFS) with peer-to-peer play for competitive prize money, sports betting involving wagering on events at fixed odds, and iGaming offerings, particularly online casinos offering a comprehensive suite of games available in land-based establishments, primarily within the U.S.

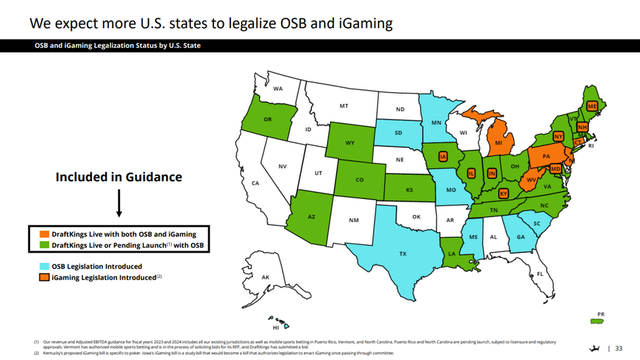

In contrast, the business-to-business (B2B) segment, accounting for 2%, comprises the entirety of SBTech, acquired in April 2020. This segment is dedicated to providing casino gaming software, B2B sports betting, and iGaming services to gaming operators, resellers, and government-run lotteries. Legalization of sports betting and online wagering has been in place for many years in several places outside the U.S. such as Ireland, the U.K., and other European countries and territories. In the U.S., a pivotal moment occurred in May 2018 when the Supreme Court overturned the Professional and Amateur Sports Protection Act (PASPA), a federal law that had restricted sports betting to Nevada since 1993. Shortly thereafter, in June 2018, New Jersey became the first state to enact sports betting legislation. As of September 30th, 38 jurisdictions in the U.S. including D.C. and Puerto Rico have legalized sports betting and DraftKings operates in 22 of them. Seven U.S. states have legalized iGaming.

Market Share and Competition

In August, DraftKings secured the top position in U.S. online gambling, as revealed in a recent study by the research entity Eilers & Krejcik Gaming. DraftKings captured 31% of the total gross gaming revenue, surpassing FanDuel’s 30%. Notably, FanDuel had maintained a dominant position in the American market for several years.

This percentage encompasses revenue generated from both sports betting and various other online casino games. In the specific realm of sports betting, FanDuel still maintains a lead with a 39.3% market share, compared to DraftKings’ 34.1%. (DraftKings most recent investor presentation stated their U.S. online sports betting market share is 37%). The shift in leadership for overall gaming revenue signifies a pivotal moment in the ongoing development of the U.S. gambling market and shows DraftKings’ momentum as a growth company in the market. Half of the U.S. population still does not have legal sports betting and DraftKings is only 11% of the population for iGaming, so there is still a huge growth opportunity ahead. Management called out Georgia, California, Texas and Florida on the earnings call as big prizes where they see potential if gambling is legalized and highlighted these states in their most recent investor presentation.

DraftKings

Penn Entertainment launched a recent partnership with ESPN for sports betting, and there was some concern on DraftKings’ latest earnings call about whether the company would increase its rate of promotions to account for increased competition. The company stated they don’t plan on doing so, and I don’t believe they’re overly concerned about ESPN. I think the brand recognition, product, and user experience on DraftKings will help them maintain and grow their market share.

Risks

Risks to my long-term investment thesis for DraftKings include the failure of gambling to pass in different U.S. states, any adverse changes in regulations or taxes, a notable decline in US consumer spending in the event of a recession, and increased competition from ESPN and Penn Entertainment.

Valuation and Closing Thoughts

Paying 3.9x 2024 expected consensus revenue isn’t a cheap valuation and DraftKings does look a little stretched right now. I bought DraftKings at an average of $29 and would be looking to buy more if it went back under $30. Long term I think the stock will get back north of the $60 it reached in 2021.

I foresee continued favorable trends as more states pass legislation to legalize sports betting and mobile gaming. DKNG is poised to sustain annual revenue growth of over 20% over the next two years in my opinion as more states legalize mobile gambling, simultaneously enhancing profit margins and leveraging fixed costs. Following a robust performance in Q3, coupled with a promising Q4 and optimistic 2024 guidance, I’m optimistic that the shares are well-positioned for long-term growth, even though they look fairly valued in the near term.

Read the full article here