Introduction

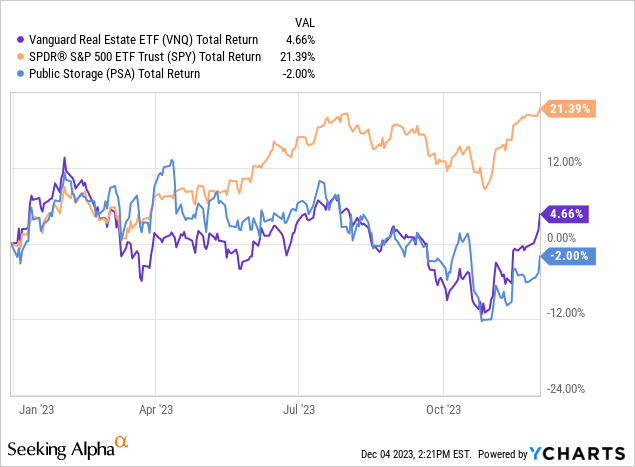

As we’re quickly closing in on the end of this year, I have spent some time working my way through my broker statements. One of the stocks I bought most aggressively this year is Public Storage (NYSE:PSA). I more than doubled my position this year, making it a top 10 position in my dividend growth portfolio.

Although this was a very challenging year for real estate stocks, the good news was that investors were able to buy some of the best income stocks money can buy at attractive prices.

I consider Public Storage to be one of these stocks.

As we’ll discuss in this article, the company has everything I’m looking for in a long-term investment.

- Even after rallying 15% from its 52-week lows, the stock still yields 4.5%, which is 30 basis points higher than the Vanguard Real Estate Index Fund ETF Shares (VNQ) offers.

- The company has a well-managed portfolio of self-storage assets.

- It has a stellar balance sheet. Its A-rating is one of the best ratings in the REIT space.

- Despite cyclical headwinds in the self-storage business, the company remains in great shape, as analysts expect the company to avoid adjusted funds from operations (“AFFO”) contraction this year.

- Given its growth opportunities, PSA is very attractively valued, potentially leading to strong, double-digit annual returns going forward.

So, let’s dive into the details!

Public Storage Thrives Amid Headwinds

PSA is a company that needs no introduction.

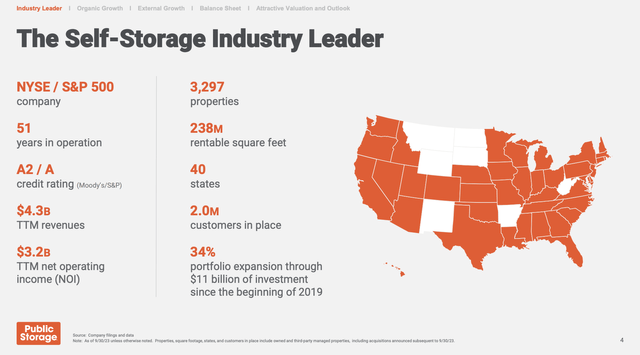

Founded more than 50 years ago, the company has turned into the second-largest self-storage operator in the United States, managing roughly 3,300 properties, including almost 240 million square feet of rentable storage space.

Public Storage

I believe that even most people who have visited the U.S. as tourists will be somewhat familiar with the company, as it’s really hard to miss its buildings when visiting the United States.

Currently, I hold two REITs in my portfolio. Both are self-storage REITs.

While I have other REITs on my watchlist, I’m fascinated by the self-storage industry and the ability to buy top-tier assets in bulk.

There are a number of long-term tailwinds for self-storage, including:

- Secular Growth: Self-storage REITs benefit from secular trends such as urbanization and downsizing (smaller homes), driving demand for storage space.

- Resilience in Economic Downturns: Self-storage tends to be more recession-resistant, as people may downsize their homes or businesses during economic challenges, increasing the need for storage. This is related to the first point of this list.

- Stable Income Streams: Rental payments from tenants contribute to stable and consistent income for investors, providing a reliable source of revenue. This applies to most REIT sectors.

- Low Operational Costs: Operating self-storage facilities generally involves lower maintenance and operational costs compared to other real estate investments, contributing to higher profit margins.

- Flexibility in Locations: Self-storage facilities can be established in various locations, offering flexibility and adaptability to market demands in both urban and suburban areas. This supports the demand for micro-warehousing solutions.

Unfortunately, it’s not as anti-cyclical as defensive segments like multi-family housing.

In its November self-storage report, Yardi Matrix notes headwinds (emphasis added):

Elevated residential mortgage rates have slowed home sales, reducing population mobility, a major driver of storage demand. As a result, storage operators continue to lower asking rates to drive new rental demand. Street rates fell month-over-month in October, and year-over-year growth remained negative at the start of the fourth quarter. Although construction activity is expected to slow, it has remained steady nationwide, creating another headwind for operators in the near term.

The good news is that it’s not all bad!

According to the same source:

[…] in-place rents continue to trend upwards, supported by existing customer demand, helping bolster rental income for operators. In addition, the labor market remains relatively strong and inflation is slowing, which will benefit the storage industry as it helps boost the financial confidence of new and existing customers to utilize storage units.

Public Storage is seeing similar developments, which makes sense, as the company is so large that major developments automatically impact its business.

While it is seeing a shift in demand, it sees solid demand from new renting customers, who have proven to be valuable, especially in terms of length of stay.

During its earnings call, the company praised its team, technologies, and analytics, which play a crucial role in determining the right mix of marketing, promotions, and rental rates.

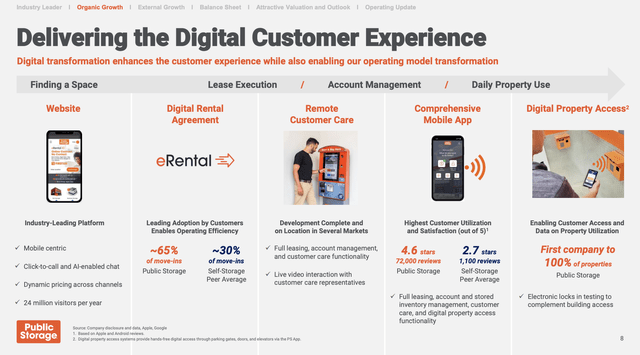

In fact, Public Storage’s digital customer experience is a major reason why it is able to offer quick, satisfying services for customers and streamline operations.

The company has an efficient website, digital rental agreements, a focus on remote customer care (this reduces wage costs), a successful mobile app, and digital property access.

Public Storage

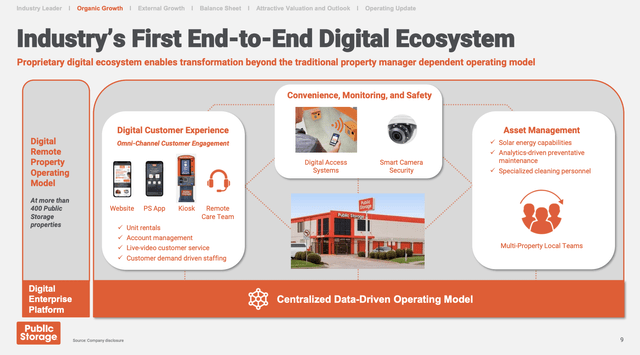

In fact, it makes the case that it has the industry’s first end-to-end digital ecosystem, allowing customers to do everything online/digitally.

Public Storage

Over 60% of customers use the online leasing platform, and more than 1.4 million customers use the PS app.

Going back to the operating environment, the company noted that the strong move-in volume and positive customer behavior contribute to better-than-expected occupancy trends.

The same-store occupancy gap has narrowed from 250 basis points at the beginning of the year to 60 basis points as of the third quarter.

This positive trajectory is attributed to a combination of strong move-in volume and favorable customer behavior.

Furthermore, the company’s strategic approach to marketing, promotions, and rental rates, guided by advanced analytics, has played a pivotal role in achieving better-than-expected occupancy outcomes.

At the end of 3Q23, the occupancy rate was 93.4%. That’s down from 94.5% in the prior-year quarter.

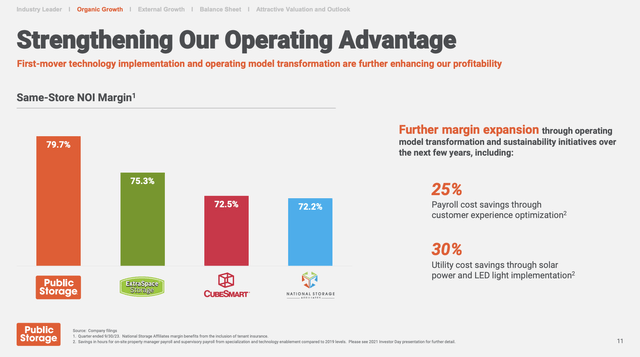

It also benefits from the highest same-storage net operating income (“NOI”) margins among its major peers. A big part of this is caused by its advanced digital capabilities.

Public Storage

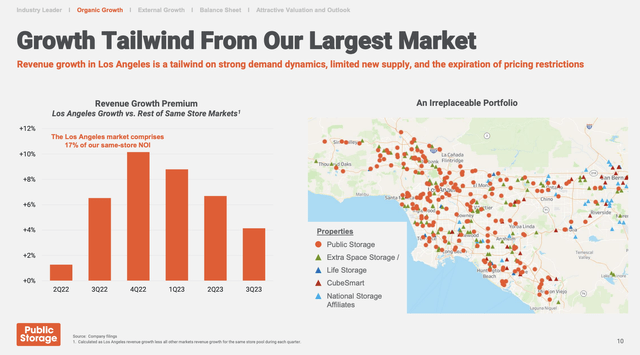

Speaking of net operating income, in the third quarter, the company’s largest market, Los Angeles, led the portfolio with a 6% growth in NOI for the 214 properties in the same-store pool.

This growth was driven by steady demand and the limited new supply of facilities.

Additionally, recently acquired and developed facilities demonstrated impressive performance, with a nearly 20% year-over-year increase in NOI.

Public Storage

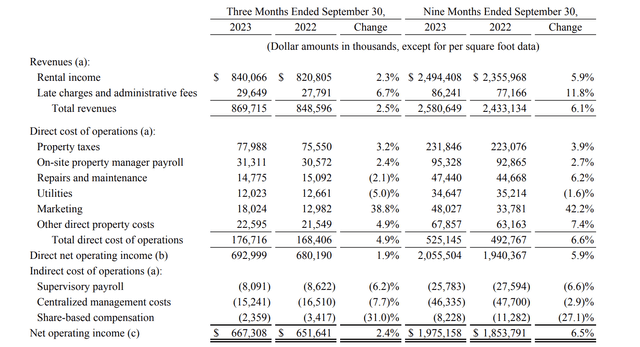

Zooming a bit out, company-wide same-store revenues experienced a 2.5% increase during the quarter.

Despite lower move-in rental rates compared to industry standards, the company saw strong move-in volume, attributed to effective marketing spending and promotions.

Public Storage

Meanwhile, the existing customer base performed well, with moderated move-out volumes. The year-over-year occupancy gap narrowed to 60 basis points as of the current date.

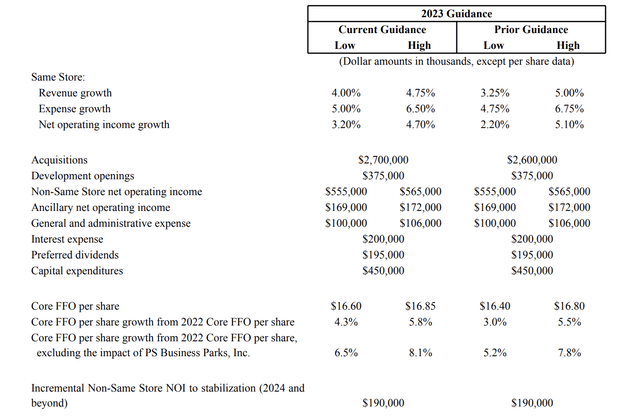

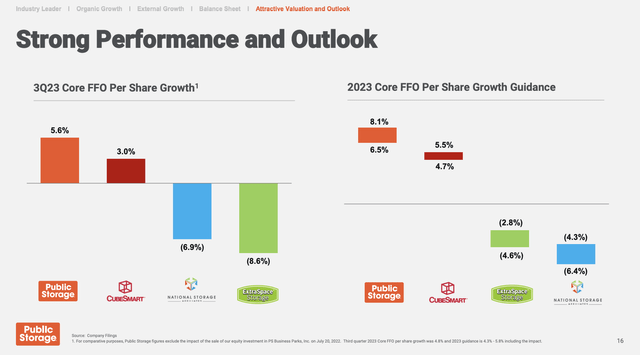

Looking forward, the company revised its core FFO range, increasing both the low and high ends.

The new range is $16.60 at the low end to $16.85 at the high end, indicating confidence in future performance and growth – despite economic headwinds.

Public Storage

Interestingly enough, the company has the strongest core FFO guidance among its major peers!

Public Storage

So, what does this mean for shareholders?

Shareholders Remain In A Great Place

Before we get to the dividend, it’s important to discuss the company’s financial health.

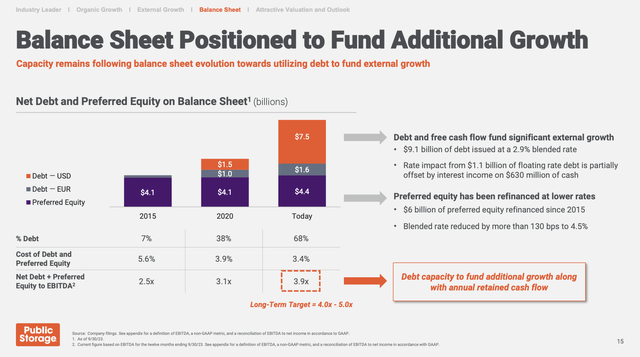

Especially in times of elevated rates, it is key to focus on companies with strong balance sheets.

As I already mentioned, Public Storage has an A-rated balance sheet. This makes it one of the safest REITs on the market – at least when it comes to its credit rating.

As of the third quarter, the company has a balance sheet that consists of 68% debt. The remaining 32% is preferred equity.

Including preferred equity, the company has a net leverage ratio of less than 4.0x EBITDA. The total cost of debt and preferred equity is 3.4%. That’s one of the lowest numbers I’ve seen this year.

In fact, of its total debt, more than $9 billion was issued at a 2.9% blended rate.

It also benefits from more than $600 million in cash, which generates income when rates rise. It has just $1.1 billion in floating-rate debt.

Public Storage

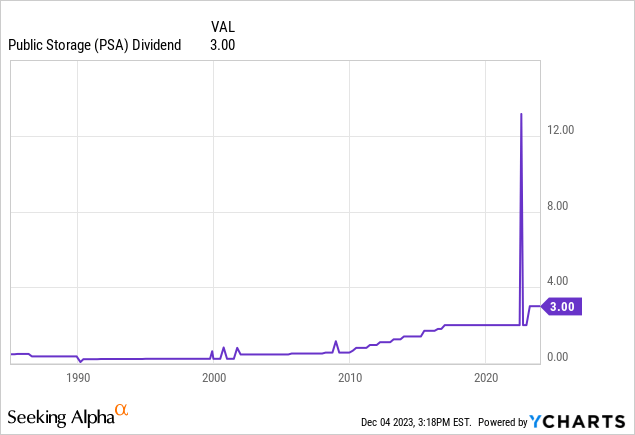

With that in mind, PSA currently pays $12 in annual dividends per share.

This translates to a 4.5% yield, protected by a 2023E AFFO payout ratio of 83%.

The five-year dividend CAGR is 6.6%.

However, please be aware that the company has hiked its dividend just once since 2016 (excluding a special dividend).

The company, which didn’t cut its dividend during the Great Financial Crisis, has spent most of its cash since 2016 on growth.

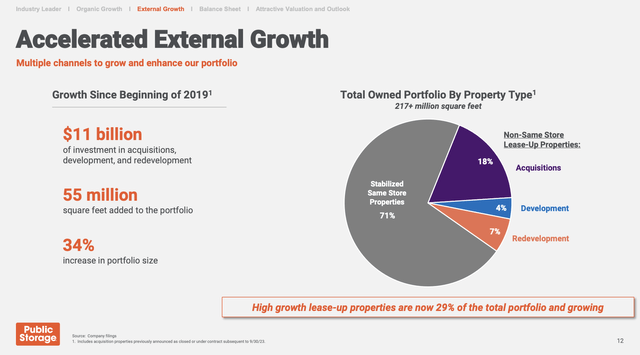

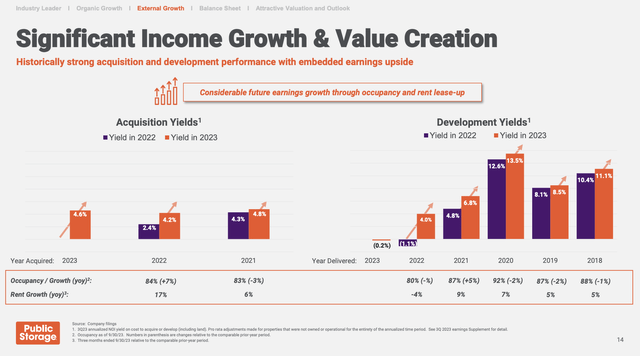

This way, it maintained a healthy balance sheet and expanded its footprint. Since 2019 alone, the company has expanded its portfolio by 34%, investing $11 billion in acquisitions, development, and re-development.

Public Storage

Now, this is paying off handsomely, as the company has high acquisition and development, which provide organic growth without the need to acquire new assets in this unfavorable environment.

Public Storage

This is one of the reasons why the stock is attractively valued.

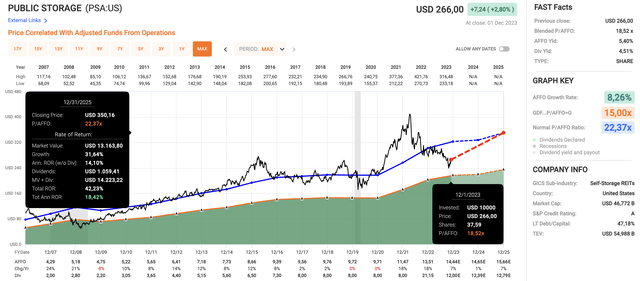

Using the data in the chart below:

- PSA is expected to grow AFFO by 7% this year, likely avoiding contraction despite headwinds.

- Next year, AFFO is expected to grow by 1%, followed by 7% in 2025.

- After dropping almost 30% from its highs, the stock is trading at a blended P/AFFO ratio of 18.5.

- Going back twenty years, the normalized P/AFFO ratio is 22.4x.

- A return to that multiple could result in >18% annual returns through 2025, including its dividend and expected AFFO growth rates.

FAST Graphs

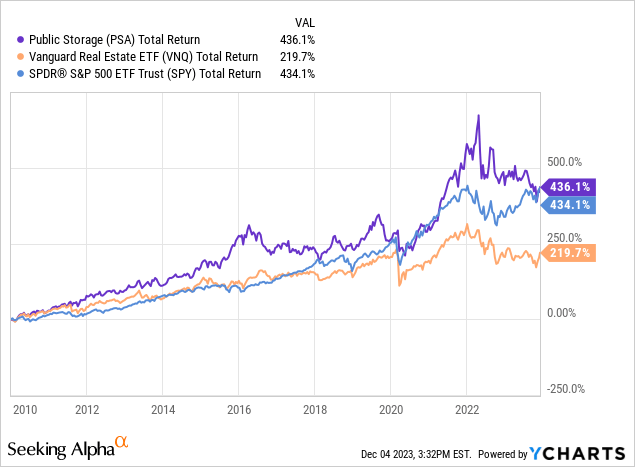

Since the Great Financial Crisis, PSA shares have returned roughly 14% per year.

While elevated rates could keep the stock from rallying further in the next few quarters, it is likely that the current valuation will come with elevated returns in the next few years.

In this case, even if the valuation remains closer to 20x AFFO, the stock could return more than 14% per year.

It’s a theoretical number, but it shows that the current risk/reward remains attractive.

That’s why I’m consistently adding to my PSA position on weakness.

On a long-term basis, I expect PSA to continue outperforming its peers and the market, generating juicy dividends along the way.

The biggest risk is further pressure on home prices, consumer sentiment, and elevated rates.

Takeaway

Amidst a challenging real estate landscape, Public Storage stands out as a resilient investment.

With a well-managed portfolio and an A-rated balance sheet, PSA offers a robust 4.5% yield, outperforming its peers. The company’s digital abilities and strategic marketing have contributed to better-than-expected occupancy trends, showcasing its adaptability.

Despite economic headwinds, PSA revised its core FFO range upwards, reflecting confidence in future growth.

Shareholders benefit from a solid financial foundation and a well-covered dividend with an attractive yield.

Furthermore, I believe PSA’s proactive approach positions it for long-term outperformance.

Read the full article here