The second half of 2023 has been difficult for shares of New York Community Bank (NYSE:NYCB) as they have fallen 30.24% from their highs. Shares are still up 14.81% YTD, but NYCB has given up a large portion of its gains. Just as quickly as things started looking upward as J.P. Morgan upgraded shares of NYCB to overweight from neutral on July 28, Wedbush analyst David Chiaverini downgraded NYCB to underperform from Neutral on November 14. Shares of NYCB retraced a bit after their Q3 earnings were announced and have bounced back in recent weeks. I have an investment thesis for 2024 that I believe will play out, and I am looking for income-producing opportunities that are trading at a discount to book value and are producing strong yields. The banking sector hasn’t had the blockbuster 2023 that big tech encountered as the SPDR S&P Regional Banking ETF (KRE) is down -18.64% YTD and the Financial Select Sector SPDR Fund ETF (XLF) has appreciated by just 5.39%. There are certainly risks on the horizon for the financial industry as nobody knows where rates will end up, and all eyes will be on Jerome Powell on Wednesday, December 13 at the upcoming Fed press conference. I think shares of NYCB have fallen back into value territory, and I want to buy more shares of this regional bank before the Fed pivot. There could be more pain ahead, but I think the risk-reward scenario sets up well if my investment thesis plays out.

Seeking Alpha

Following up on my previous article regarding NYCB

On July 31 I wrote an article about NYCB after they reported Q2 earnings. I discussed the JPMorgan upgrade, Q2 earnings, and why I felt there was still value to be unlocked. In the short term, I was incorrect, as shares of NYCB have fallen -28.01% since that article was released. After the dividends are factored in, shares of NYCB have declined -25.83% compared to the S&P 500 appreciating by 0.22% since July 31. I went from being very bullish around the $10 level to bullish when shares topped out in the summer, and now, after the recent decline, I am back to being very bullish on shares of NYCB. While there are risks on the horizon, I think 2024 will ultimately set up well for NYCB, and I am happy adding shares and reinvesting the income they produce as I wait for 2024 to unfold. I am following up on my previous article to discuss why I am upgrading my sentiment on shares of NYCB and to discuss the possible headwinds that NYCB could encounter along the way.

Seeking Alpha

While I am very bullish again on NYCB Stock

Just because I am more bullish on NYCB than I was in the summer doesn’t mean my investment thesis will play out the way I think it will, as there are substantial risks on the horizon. Right now, NYCB is fighting rates as they are a double-edged sword. The high-rate environment has allowed NYCB to generate large amounts of net interest income (NII) over the past several quarters. From Q1 of 2021 through Q4 of 2022, NYCB has generated between $318 million and $379 million in NII on a quarterly basis. Over the past three quarters, NYCB has generated $555 million, $900 million, and $882 million as their NII has grown significantly during the rising rate environment. The first headwind is that if the Fed does pivot in 2024 and ends up cutting aggressively just as they raised rates at an unprecedented pace, NYCB is at risk of generating significantly less NII on a quarterly basis.

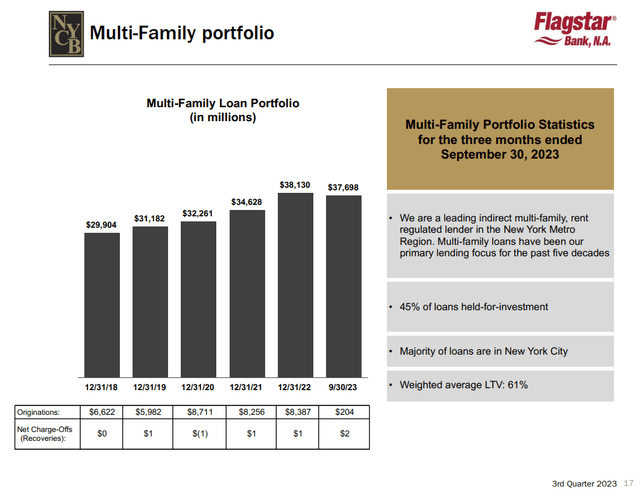

The second headwind is the exact opposite of rates staying higher for longer. While this is good from an NII perspective, it could become detrimental to NYCB’s loan book. NYCB is a leading lender in the multi-family loan segment of the New York Metro area, in addition to having a sizeable loan book in commercial real estate, including the office segment. In Q3, NYCB’s originations in the multi-family loan segment flatlined, and charge-offs increased. We’re also in a situation where the current rate environment doesn’t work well for the upcoming debt that needs to be refinanced in the real estate sector. Bloomberg reported that the commercial real estate market has roughly $1.5 trillion in loan maturities due from 2023 to 2025. This could turn from active loans to defaults or foreclosures where landlords would be forced to turn the keys over to banks as the assets were used as collateral against the loans. Morgan Stanley (MS) has speculated that commercial real estate values could fall as much as 40% in the process. Entities such as Unibail-Rodamco-Westfield and Brookfield Properties have already stopped payments on their $588 million loan on a 1.2-million-square-foot shopping center in downtown San Francisco’s Union Square and are preparing to give the keys back to their lender.

If rates stay higher for longer, the models utilized when real estate companies took out the loans become worthless, and we could see more entities stop payments and return the keys back to the banks. The banks would be left with assets that they have no expertise in managing and would likely need to sell them at deep discounts to get them off their books and recognize sizeable losses. NYCB has $3.4 billion of exposure to the office segment alone and roughly $10.5 billion in loans in the commercial real estate segment. While the market is pricing in interest rate cuts in 2024, the Fed could have other plans. The Fed has gone against the grain and taken rates higher than where many analysts thought they needed to go, and Jerome Powell has pounded the table on rates being higher for longer time and time again. If the Fed isn’t bluffing, then part of NYCB’s loan book could be headed for a rocky 2024. Wedbush’s base case was that NYCB could experience 10% losses on its rent-regulated MF portfolio, and this could correlate to a drop in tangible book value by roughly -20%.

NYCB

Why I am bullish on NYCB and plan on adding to my position before heading into 2024

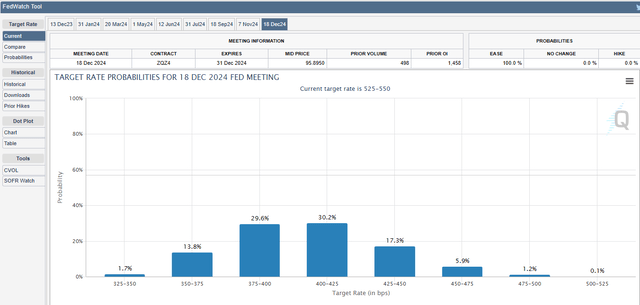

I was bullish on NYCB when its share price declined into the mid-single digits, and I am also bullish during the latest decline. I am looking to deploy additional capital into income-producing assets prior to a Fed pivot because I believe that when the Fed does start cutting rates, it won’t be at a slow pace. There is nearly $6 trillion in capital sitting idle in money market accounts due to where the risk-free rate of return ended up. When investors who are focused on income can get 5% on idle cash risk-free, there is less of a reason to take on equity risk in the capital markets. I am looking for equities that are trading below book value, that produce strong earnings, and pay a high-yielding dividend. NYCB checks off all the boxes for me. The CME Group is now projecting that there is more than a 40% chance rates have a 3-handle on them by the end of 2024, and there is virtually no chance that the Fed doesn’t pivot at some point.

I can’t predict the future, and I can’t predict what the Fed will do, but I want to deploy more capital toward income-producing investments before the Fed pivots. My reasoning is that investors who have been using risk-free assets as a proxy to generate income will need to redeploy capital into the market as the risk-free rate of return declines. In addition to the income side of the story, others will probably look to redeploy capital as there will be less of an incentive to stay in cash. I think that income investments that sat out of the tech bull market will catch a bid as they could see unusually stronger volumes in 2024 as investors look to recreate mid-single-digit yields from equities. I think underappreciated assets that represent value and pay a healthy dividend will be at the top of the list, and NYCB could be an interesting opportunity.

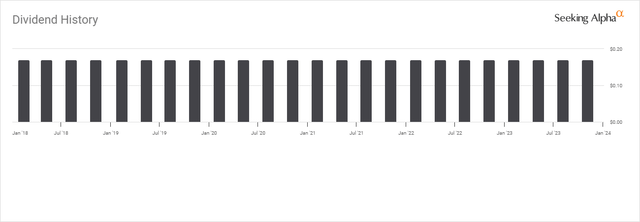

CME Group

Over the past five years, through a pandemic and a regional banking meltdown, NYCB has kept its dividend steady at $0.68 per share. Today, shares of NYCB yield 6.86% and have a payout ratio of 50.37% based on their forward EPS projection. I think investors are going to want a couple of extra points of yield to take on equity risk, and being able to lock in a 6.5%-7% yield that is roughly 50% of its EPS looks enticing. This creates a margin of safety over a long-term investment thesis as the ongoing quarterly dividends provide stable high-yield cash flow compared to an imminent declining risk-free rate of return.

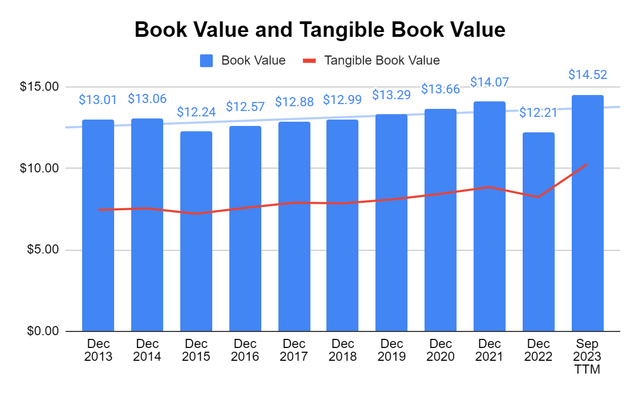

Seeking Alpha

NYCB looks undervalued, and I would speculate that a lot of it has to do with the potential headwinds I outlined earlier in the article. I am looking for banks that trade under book and tangible book value. Today, shares of NYCB trade at a -31.68% discount to book value and at a -3.22% discount on its tangible book value. While I am not in the same camp as Wedbush, I do agree that there is a possibility of some assets getting rerated, or if defaults outside of NYCB’s models occur, that book and tangible book value could decline due to charge-offs. Trading at a -31.68% discount to book is a large margin of safety, in my opinion, and gives the valuation some room. In a scenario where the bearish case occurs, there is some breathing room, and if the Fed cuts rates and real estate comes back into favor, then this gap could close pretty quickly.

Steven Fiorillo, Seeking Alpha

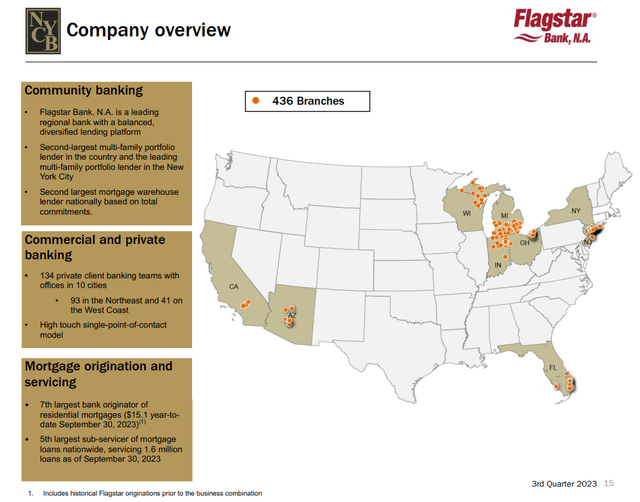

The other positive aspect that I feel has gone under the radar is Flagstar’s underlying business. NYCB is now the seventh largest bank originator of residential mortgages in addition to having a large commercial loan book and being the second largest multi-family lender in the country. If rates go down, then NYCB’s NII could be impacted in the short term, but transactional activity in the real estate market should drastically increase. The mortgage market has been held hostage to rates on the residential side because there is less of a reason to get rid of a fixed mortgage that is between 2.7%-4% to take on a new mortgage in the 6-8% range. As rates come down, we will probably see significant increases in mortgage applications and originations, and NYCB will benefit from the volume of new originations that could offset interest losses from declining rates.

NYCB

Conclusion

The past several months have been difficult for NYCB as they encountered a downgrade from Wedbush, and value eroded from its share price. Nobody knows what the Fed will do, and there are headwinds on the horizon if rates stay higher for longer. My investment thesis revolves around the Fed pivoting in the first half of 2024 and a real estate crisis being adverted. I think that we will see a lot of capital flow into the market as the risk-free rate of return declines, and I want to buy assets that are undervalued and generate strong yields. I think investors will look to pick undervalued assets in segments of the market that haven’t recovered yet, and the financial sector could be at the top of the list. NYCB is one of the largest regional banks, trades at a -31.86% discount to book, and pays a dividend yield of 6.86%. The dividend is well covered, and shares of NYCB look as if they may have found a bottom. While several things need to go right for NYCB, I think my investment thesis has a better chance of playing out than the bear case, and shares of NYCB could be an opportunity for appreciation and generating income in 2024.

Read the full article here