The iShares Cybersecurity and Tech ETF (NYSEARCA:IHAK) invests across a basket of companies innovating in the field of cybersecurity and related technologies. This is an important market segment that continues to generate high growth, benefiting from the climbing demand for online protection in an increasingly digital economy.

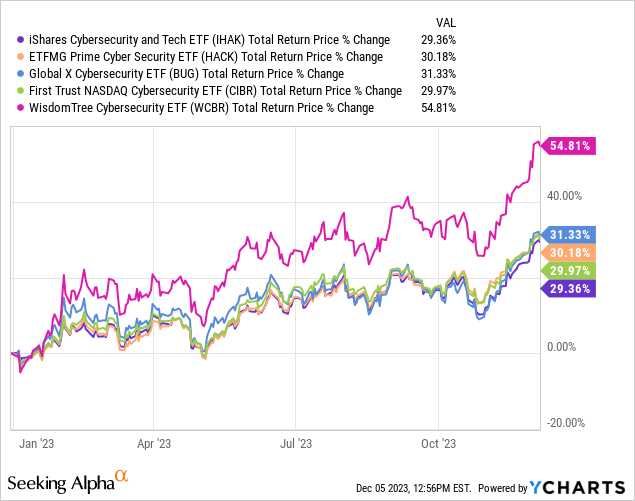

The fund has been a solid winner over the past year, with a 29% return amid the broader market rally. At the same time, we note that IHAK has slightly underperformed a peer group of “cybersecurity ETFs” which we connect to subtle differences in strategy and a less concentrated portfolio.

IHAK isn’t perfect, but we view the fund as a good option to gain exposure to this market theme. The diversified profile across global cybersecurity leaders is well-positioned to trade higher going forward with a path to potentially outperform its peer group over the long run.

What is the IHAK ETF?

IHAK technically tracks the “NYSE FactSet Global Cyber Security Index”, a ruled-based benchmark designed to track the performance of hardware, software, and services companies engaged in “protecting enterprise or personal networks, applications and data from unauthorized attacks and damages.”

By this measure, cybersecurity is more of a “theme” than a particular industry recognizing that the companies involved extend beyond the technology sector to also cover communications and even industrial names.

According to the methodology, eligible companies must generate 50% or more revenue from cybersecurity activities with a minimum market value of $300 million. Notably, the holding weight is based on their float-adjusted capitalization with a 4% cap on individual stocks, rebalanced semi-annually.

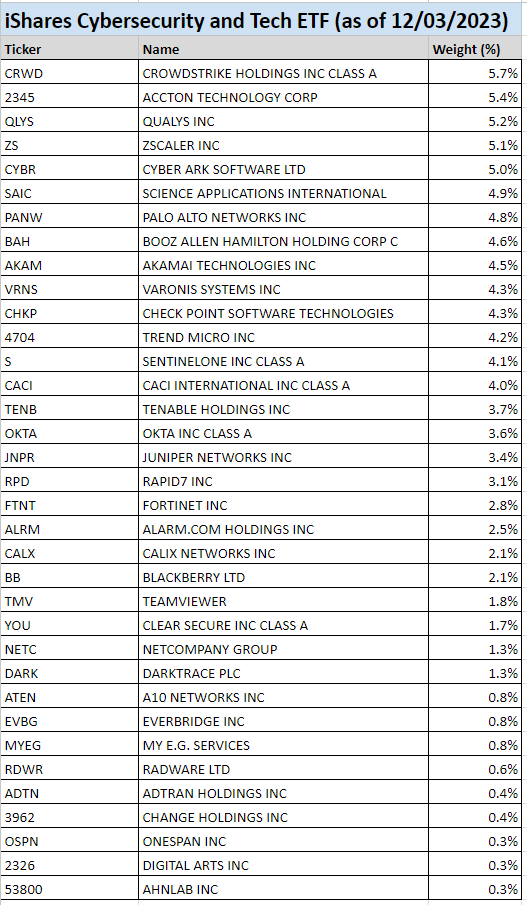

The current portfolio includes 35 stocks with the largest position in CrowdStrike Holdings (CRWD) with a 5.7% weighting, followed by Taiwan-based “Accton Technology Corp” as a manufacturer of networking hardware and data center solutions with a 5.4% weighting in the fund.

Going down the list, it is a whos-who of industry leaders covering names like Qualys (QLYS), Zscaler (ZS), CyberArk Software (CYBR), SentinelOne (S), and Fortinet (FTNT) among others. Keep in mind that the stocks are global, with approximately 30% of companies incorporated outside the United States.

source: iShares (table by author)

IHAK Performance

We already mentioned that IHAK has lagged a couple of other cybersecurity ETFs in 2023. We’re including the ETFMG Prime Cyber Security ETF (HACK), Global X Cybersecurity ETF (BUG), First Trust NASDAQ Cybersecurity ETF (CIBR), and the WisdomTree Cybersecurity ETF (WCBR) in this group.

The segment has become rather crowded with several fund sponsors offering their twist on them. IHAK with around $700 million in AUM is technically the second largest fund next to HACK which has amassed $1.6 billion in AUM. Others are even smaller like WCBR with just $39 million in assets

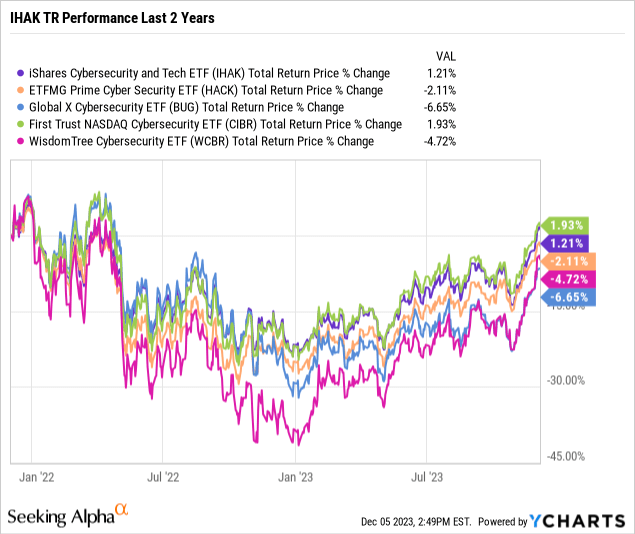

With data going back two years where all of these names were live, IHAK has returned a cumulative 1.2%, which is at a positive spread compared to the negative return in HACK, BUG, and WCBR over the period, but slightly below CIBR with a 1.9% gain.

This period covers the extreme market volatility amid the shifting macro environment, particularly in 2022 where cybersecurity stocks faced large declines. In this case, the max drawdown of IHAK around 30% fared better compared to larger declines in BUG and WCBR which lost nearly half their value.

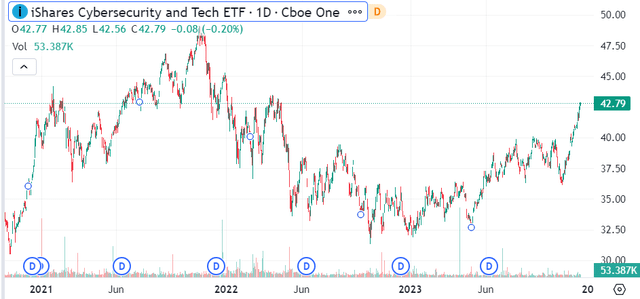

Fast forward, the story in 2023 was the recovery largely based on reset valuations where the underlying cybersecurity names, in general, were able to reclaim growth from a more reasonable base of valuation. So while IHAK is not quite back to its all-time high reached in mid-2021, what we’re seeing is renewed bullish momentum.

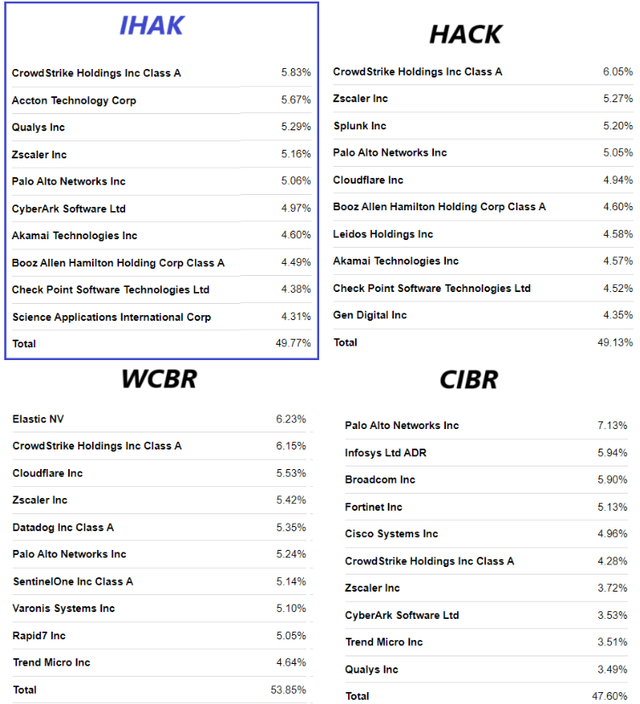

There’s no secret here to explain the relative performance of each fund. Going through the top holdings, there is an overlap with many of the same familiar names covered. The key differences are the relative weighting in each holding.

In this case, IHAK stands out with its more “global” profile including stocks that are not actively traded in the U.S. like Accton Technology. WCBR has outperformed this year, likely based on its concentration in Elastic N.V. (ESTC) which is up more than 120% in 2023 and is the largest position in the fund.

Overall, it’s hard to say one ETF is “better” than another, and we’d expect all cybersecurity ETFs to capture the same high-level market trends. Still, what we like about IHAK is its apparent balance by including the international stocks not listed on a U.S. exchange which makes it otherwise unique to this group. That aspect has appeared to help limit the volatility during 2022 which means the strategy should work well across different market cycles in the future.

Seeking Alpha

What’s Next for IHAK

There’s a lot to like about cybersecurity stocks with a sense that the leading companies are benefiting from several secular growth tailwinds. The idea here is that increasingly complex networks and online infrastructure are facing a growing number of threats against privacy and sensitive information.

Companies are willing to invest in the necessary tools to stay protected and the latest data suggests the market is growing about 12% per year. The leaders in cybersecurity still have room to consolidate their position and capture what remains a significant addressable market.

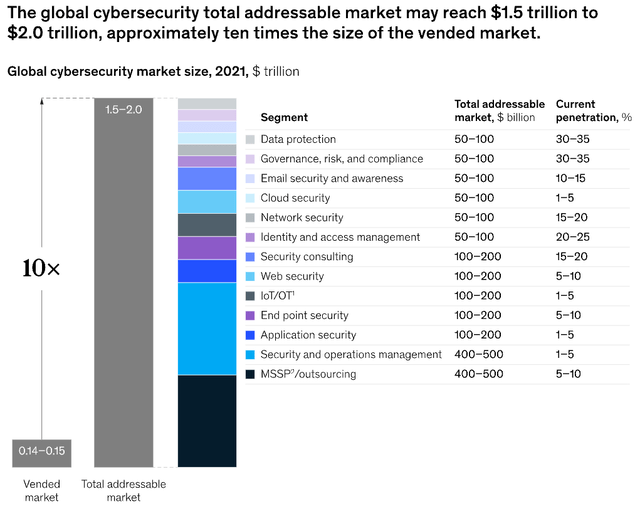

According to research from the consulting firm McKinsey & Co., the potential that the global cybersecurity market represents a $1.5 to $2.0 trillion market, nearly 10x the level from 2021. The estimate considers that certain segments like data protection, cloud security, and network security remain under-penetrated. Naturally, the companies within IHAK are well-positioned to benefit.

source: McKinsey

Final Thoughts

In the context of current market developments, we believe 2024 looks bullish for the group. An environment of low inflation, with room for interest rates to stabilize, should be positive for global growth by kickstarting a new credit cycle.

Companies looking to invest will require cybersecurity solutions as a backdrop for strong earnings in the underlying stocks of the IHAK portfolio. From the IHAK price chart, we see shares running toward an all-time high near $50.00 by next year as part of the bull case.

In terms of risks, the main setback that would undermine a continuation of the rally would be a more concerning deterioration of the global macro conditions. A scenario where inflation somehow re-accelerates, pushing interest rates even higher, would likely introduce a new round of financial market volatility and undermine the earnings outlook for cybersecurity names.

Seeking Alpha

Read the full article here