Summary

Readers may find my previous coverage via this link. My previous rating was a buy, as I thought that Paycom (NYSE:PAYC) fundamentals were strong and valuation back then was undervalued. I am revising my rating from a buy to a hold as I am uncertain about the near-term growth outlook. The growing adoption of BETI has made it extremely tough to model how PAYC is going to perform (growing BETI adoption cannibalises growth, but by how much? And when will it end.

Financials / Comments

3Q23 was a very bad quarter for PAYC. The business reported total revenue of $406.3 million, missing its own guidance of $411 million. Given the track record for PAYC to beat its own guidance, this miss has resulted in a major shift in sentiment. Furthermore, if we adjust for float interest income, core revenue only grew 18%, a 400bps deceleration from 2Q23. The weak performance resulted in management downgrading its FY23 revenue estimates to $1.68 billion (from $1.716 billion) and FY24 growth to be between 10 and 12%. The FY24 revision basically killed the stock as consensus had a growth expectation of ~21% pre-results, which was a full 10 points difference.

I am throwing in the towel for PAYC as BETI, which I was bullish on previously, turns out to be a headwind that will hurt PAYC’s near-term growth. My bullishness on BETI was that it makes payroll runs more accurate, which is a strong value proposition that will drive a high adoption rate as it helps businesses save money. This turns out to be a weakness that cannibalises PAYC growth. Because of fewer charges for errors and extra payroll runs, customers are not using as much service revenue with the BETI solution. 3Q23 was a confirmation that growth BETI has significantly impacted growth, as seen from the deceleration in recurring revenue excluding float interest over the past few quarters (dropping from >20% to 18% in 3Q23). Now that management is guiding FY24 revenue growth of 10-12%, it is literally telling investors that the situation with BETI is not going to turnaround anytime soon.

The fact that new bookings were the reason why this headwind was not primarily reflected in the P&L is also concerning. That was possible in the past because there was still plenty of room for PAYC to increase adoption. However, now that the majority (~2/3) of PAYC’s customer base is already using BETI, up from 50% in 1Q23, the opportunity set is a lot less. Note that this is not something that management can switch off or remove from the market easily, given that the majority of the customer base has already adopted it. As such, I believe PAYC has trapped itself in a vicious cycle that will reflect very badly on headline growth.

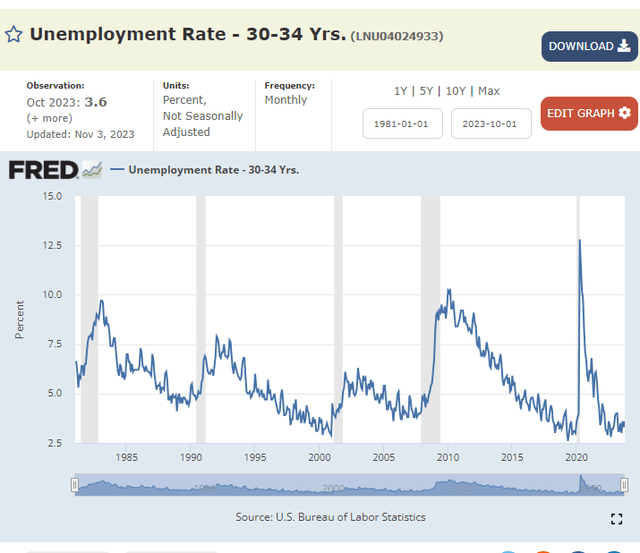

In addition to the BETI issue, PAYC also faces a tough macro environment, which puts further pressure on the stock. Fundamentally, PAYC growth is tied to the number of employees (headcount) using its solution. The number of employees is impacted by the number of businesses and the number of employees per business. Both of which are greatly impacted by how the macroenvironment is. In bad times, like today, businesses cut headcounts to save costs, and new business growth slows as financing gets tougher. All of these translate to massive headwinds for PAYC. If we look at US historical unemployment rates, the US is at a very healthy level. While this seems good for PAYC, my concern now is that this means there is a lot of room for unemployment to increase, which is a significant risk to near-term performance.

FRED

The positive thing is that the BETI is, in fact, gaining a lot of traction, especially considering that it was only launched in 3Q21. The impact on PAYC business seems to be a near-term issue, as the impact of cannibalization should taper over time as service revenue becomes a smaller piece of the revenue pie. The bull case is that BETI is the game changer that will dramatically alter the way businesses do their payroll, as they can now do it themselves with little to no errors.

That said, I think the long-term bull case is not being focused on by the market at the moment. PAYC has historically traded a steep premium to peers like Paycor HCM, Automatic Data Processing, Ceridian, Paylocity, and Bill because of its strong growth and history of beat-and-raise vs. guidance (100% beat rate since FY14). Now that growth is going to be weak and the market has lost confidence in management guidance, I believe a lot of investors are going to stay on the sidelines until there is clearer visibility into how these headwinds will unwind.

Given the uncertain outlook, I am not confident in making an accurate estimate of how PAYC is going to perform in the near term (which is why there are no model updates this time around).

Conclusion

I revised my recommendation for PAYC stock from a buy to a hold due to uncertainties surrounding its near-term growth outlook. BETI’s high adoption, initially seen as a value proposition, now poses a growth headwind. The tough macroeconomic environment adds further pressure, impacting PAYC’s growth, which is tied closely to the number of businesses and employee headcounts. Given this uncertain scenario, I suggest a hold position until clearer visibility emerges regarding PAYC’s strategy to navigate these headwinds.

Read the full article here