This is my first look at Rocket Pharmaceuticals (NASDAQ:RCKT). I have to say somehow it has escaped my attention over the years, despite its impressive attributes which I will discuss. These include:

- an accepted BLA filing with a 3/31/2023 PDUFA date;

- several pivotal trials in progress or advanced planning;

- reasonable liquidity.

I will discuss each of these and explain my thinking behind my hold rating.

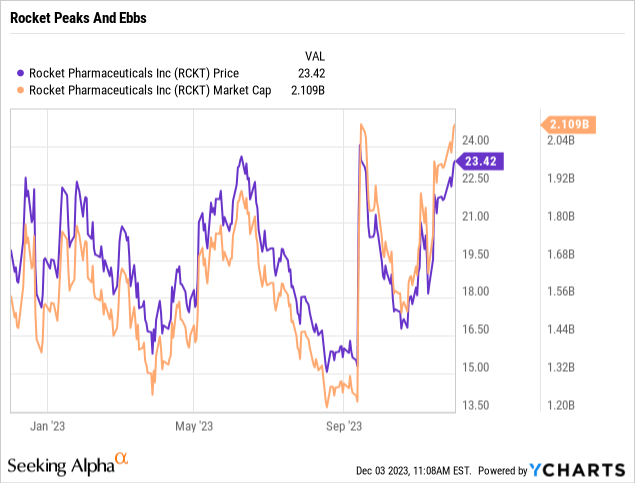

Rocket has a scary jagged stock trajectory for 2023.

Like the weather in certain parts of the country, Rocket’s stock has been subject to vicious changes. No sooner does it seem to be hot, when a terrible cold spell descends. The chart below shows the situation:

On 12/15/2022 Rocket peaked at $23.48 only to drop to a low of $16.85 a week later on a heavy volume of ~4.6 million shares. Soon it was climbing again; on 01/17/2023 back at $22.74. It traded up and down for a while falling back to $15.79 on 03/28/2023.

Despite ample activity, there are no entries on Seeking Alpha’s Rocket news feed that adequately explain this erratic trading. Rocket’s shares trudged back up reaching an interday high of $24.53 on 06/09/2023. Exhausted it tumbled all the way down to $14.89 on 08/21/2023. It rocketed back over $20 on a huge volume of ~23.7 million shares, peaking at $24.65 the next day on 09/14/2023. It fell back tumbling <$17.00 In mid-October.

As I wrote on 12/05/2023 it is trading >$25.00 a high for the year. Checking its news feed was inadequate to explain its discrete periodic changes in direction; its current trade creating a cap >$2 billion is easily justified as I explain below.

Upcoming PDUFA presents a significant catalyst.

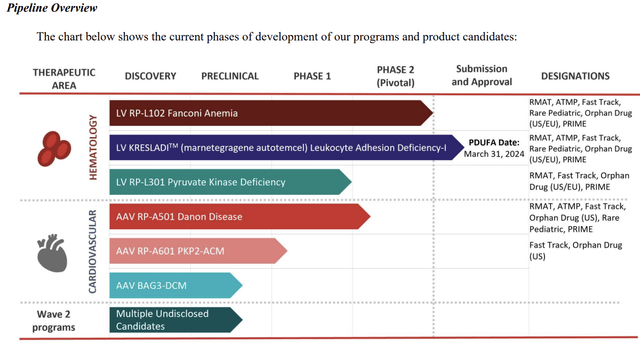

Rocket’s latest 10-Q for Q3, 2023 includes the pipeline graphic below:

seekingalpha.com

KRESLADI (RP-L201; marnetegragene autotemcel), a lentiviral vector-based investigational gene therapy for severe Leukocyte Adhesion Deficiency-1 (LAD-1) is Rocket’s lead therapeutic candidate. RP-L201 was cleared by the FDA for an IND in 11/2018.

It has since advanced to the point that its BLA was accepted by the FDA with an 03/31/2024 PDUFA date. It is eligible for a priority review voucher [PRV] if it is approved by the FDA and meets the FDA’s requirements. Such a PRV would have an indeterminate value, possibly north of $100 million. Under its in-licensing agreement, it is responsible to pay REGENXBIO [RGNX] 20% of any proceeds received from a PRV sale.

LAD-1 is a particularly awful, luckily quite rare, pediatric disease caused by a gene mutation. The mutation results in a type of blood vessel leakage that damages natural processes for combatting infection.

Children with severe LAD-I are often affected immediately after birth. During infancy, they suffer from life-threatening bacterial infections. These infections result in frequent hospitalizations for recurrent infections including pneumonia, gingival ulcers, necrotic skin ulcers, and septicemia.

Absent a successful bone marrow transplant, mortality in patients with severe LAD-I is 60-75% prior to the age of 2; survival beyond the age of 5 is exceedingly rare.

On p. 28 of its referenced 10-Q, Rocket explains how it uses modified non-pathogenic viruses for the delivery of its gene therapy. It characterizes them as particularly well suited for this role because they are adept at penetrating cells and delivering genetic material inside a cell.

It explains its LAD-1 therapy’s approach as follows:

…the viral (pathogenic) genes are removed and are replaced with a functional form of the missing or mutant gene [the transgene]] that is the cause of the patient’s genetic disease. … The process of inserting the transgene is called “transduction.” Once a virus is modified by replacement of the viral genes with a transgene, the modified virus is called a “viral vector.” The viral vector delivers the transgene into the targeted tissue or organ (such as the cells inside a patient’s bone marrow).

In addition to KRESLADI, Rocket has three other pivotal trials pending or near.

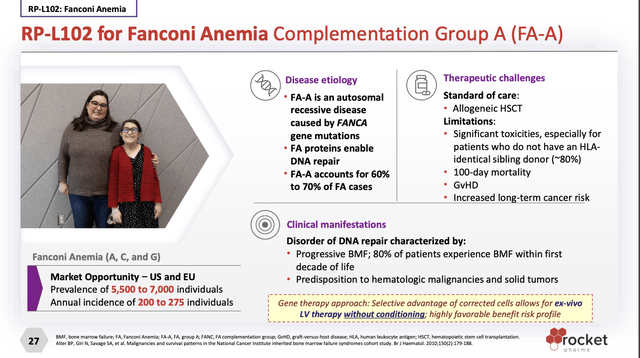

RP-L102

Rocket’s RP-L102 targets Fanconi Anemia Complementation Group A (FA-A). Its undated website presentation (the “Presentation”) slide 27 describes FA-A as follows:

seekingalpha.com

In its latest 10-Q it characterizes FA-A as a genetic defect in the bone marrow that reduces the production of blood cells or promotes the production of faulty blood cells. Its five FA-A trials listed at clinical trials .gov have treated 14 patients.

Per its referenced 10-Q, 12 of these were treated in its registration enabling phase 2 trial. Supportive data from these trials has been reported at various medical conferences. Rocket anticipates product filings for RP-L102 in the first half of 2024 in the U.S. and Europe. It is finalizing its CMC package with the FDA.

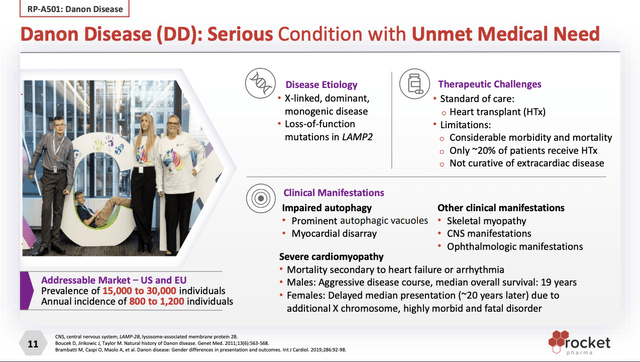

RP-A501

Rocket’s RP-A501 (AAV9.LAMP2B) targets Danon’s Disease (DD). Presentation slide 11 describes DD as follows:

seekingalpha.com

Like PAD-1, DD is a dread disease that is often fatal with a difficult and expensive standard of care.

There are only four studies listed on ClinicalTrials.gov addressing DD. Rocket is participating in all of them. Two, NCT05548855 and NCT03766386 are natural history studies two are traditional clinical trials. These latter two include:

- NCT03882437 – an 03/2019 phase 1 – following Rocket’s 12/2022 end of phase 1 meeting and other meetings with the FDA addressing challenges associated with executing a randomized controlled trial in DD, Rocket anticipates going forward with a pivotal trial design at a dose of 6.7e13 GC/kg, utilizing a single arm open-label evaluation and a robust natural history comparator, and

- NCT06092034 – a 10/2023 single arm Phase 2 clinical trial to characterize the safety and efficacy of RP-A501 in male patients with an estimated primary completion date of 09/2025, and co-primary endpoint including myocardial tissue expression of LAMP2 protein and decrease in left ventricular mass index (LVMI). [Time Frame: 12 Months post-infusion].

Rocket views this phase 2 trial as a pivotal trial supportive of a regulatory submission. Whether and when are known unknowns for investors. I would be loathe to hazard a prognosis on the actual timing of a submission.

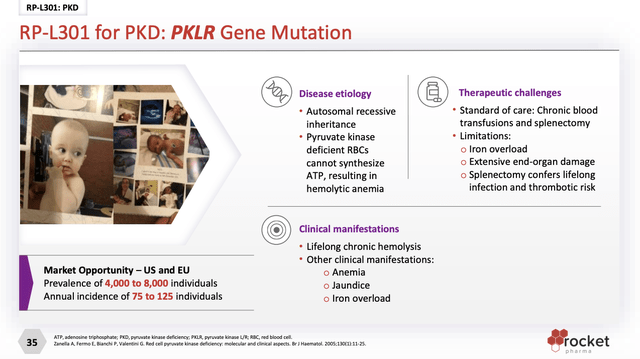

RP-L301

Rocket’s RP-L301 targets Pyruvate Kinase Deficiency (PKD). Presentation slide 27 describes PKD as follows:

seekingalpha.com

Insofar as Rocket has but a single phase 1 study for RP-L301 (NCT04105166), it is a stretch to characterize it as a pivotal asset.

Rocket’s liquidity is geared to take it into H1 2025.

Rocket’s Q3, 2023 earnings press release reports that it had cash, cash equivalents, and investments of approximately $437.2 million as of 9/30/2023. It guided this as giving it a cash runway into 2025. It had Q3, 2023 operating expenses of ~$65.4 million; these consisted of ~$46.8 million R&D and ~$18.5 G&A. It has a clean balance sheet.

Rocket’s strong cash position was bolstered by net proceeds of ~$188 million from a 9/13/2023 stock offering at a price of $16 per share. Purchasers at this price got a bargain compared to its price >$25.00 as I wrote on 12/05/2025.

Conclusion

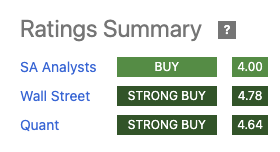

Rocket is currently trading at a high for the year. As shown by its Seeking Alpha ratings summary panel below it has broad support:

seekingalpha.com

At the outset of this review, I noted that I would explain why Rocket’s >$2 billion market cap was justified. It has powerful upcoming catalysts based on a gene therapy that could be transformative.

Without gainsaying the positives that support the Rocket bulls, I am holding back at this point. The following are factors in my hold rating:

- Rocket’s near-term trading history;

- Rocket’s current elevated price;

- Uncertainties inherent in securing FDA approval;

- Rocket’s lack of any approved products or product income.

Read the full article here