Investment thesis

Our current investment thesis is:

- Carrefour has a global presence and a large market share in core markets. It has faced increased competition from Aldi and Lidl yet continues to gain market share.

- The key opportunities we see in the market are increasing private label sales and continued expansion, both of which Carrefour is focusing on.

- Profitability is adequate and remains sticky despite the inflationary pressures. On a relative basis, Carrefour underperforms, but this looks priced in.

Company description

Carrefour SA (OTCPK:CRRFY) is a multinational retail company that operates stores in different countries. They have a variety of store formats including hypermarkets, supermarkets, convenience stores, and cash and carry stores. Carrefour also has e-commerce sites and service stations.

Additionally, the company is engaged in various other activities such as banking, insurance, property development, franchise operations, travel agency services, and shopping mall rentals.

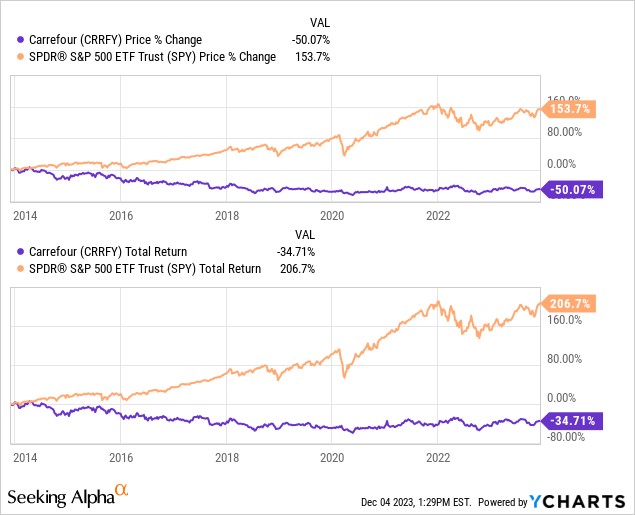

Share price

Carrefour’s share price has trended down in the last decade, reflecting a period of increased competition and tight margins, heightening the difficulty of trading conditions.

Financial analysis

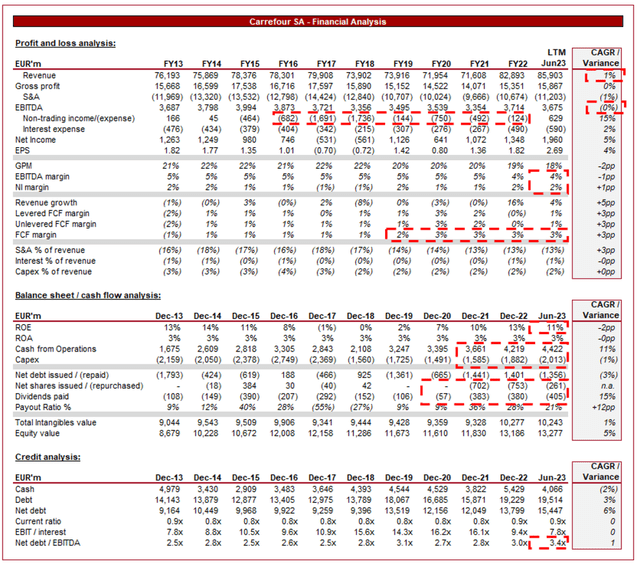

Carrefour financials (Capital IQ)

Presented above is Carrefour’s financial performance for the last decade.

Revenue & Commercial Factors

Carrefour’s revenue has grown at a CAGR of 1% across the last 10 years, with 6 periods of negative growth and a single year exceeding the target long-term inflation rate (3%).

Given the maturity of the grocery industry, it is difficult to exceed the rate of inflation, however, this is clearly an underperformance. The company has sought expansion in order to outperform, such as banking, but this has failed to materially impact the top line.

Carrefour operates a traditional groceries model, with a large national footprint across its core markets, operating a range of store sizes based on location and demand. Generally, superstores are outside of city centres, in easily accessed locations surrounded by residential homes. Conversely, smaller local stores will be strategically placed close to central locations and offices with high footfall.

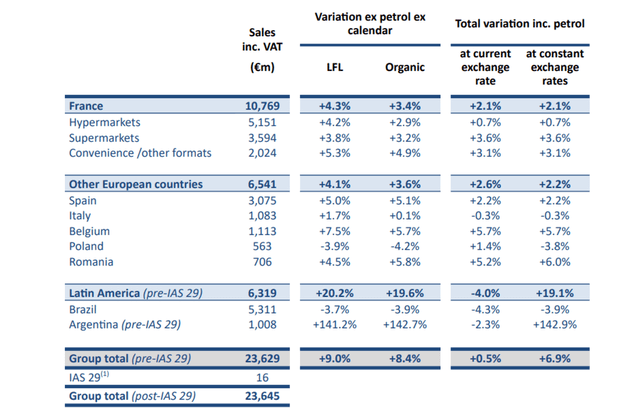

Carrefour generates the vast majority of its revenue from France, its core market, followed by 7 other important countries. This gives the company some degree of differentiation but clearly leaves the business susceptible to changing conditions in Europe.

Q3-23 (Carrefour)

Grocery industry

The grocery industry has experienced heightened competition in the last decade, in large part due to the expansion of Aldi and Lidl into markets such as the UK and France. These brands offer affordable alternatives to the traditional supermarkets, cutting costs in areas cost-conscious consumers care less about, as a means of keeping prices low. Following the GFC and an extended period of Austerity/reduced government spending, these businesses performed extremely well and rapidly gained market share. It is estimated that the two have just under 10% market share in France currently, which is c.50% of Carrefour (21.2% market share). Thus far, Carrefour continues to gain market share (c.20bps between FY21-FY22), suggesting the 2 are impacting the others in the French market more.

We are also seeing increased demand for e-commerce services in the grocery industry, as consumers seek the benefits of convenience and flexibility afforded through these services. This has forced Carrefour to invest in its e-commerce capabilities and develop a supply chain to service this market effectively. This has given rise to the omnichannel retailing approach, which requires a seamless experience between the online/in-store offerings. We consider this a negative development in the industry. Firstly, it requires increased investment to service the offering on an ongoing basis. Secondly, consumers shopping in-store are more likely to purchase items they did not initially intend to purely because they saw something. Online purchases are far more logic-driven (Buying what is needed based on a list).

Due to the difficult trading conditions, we have seen investment in technology and automation as a means of enhancing operational efficiency and improving the overall customer experience. Marks & Spencer (OTCQX:MAKSF), for example, acquired Gist, which is a contract logistics provider to its groceries segment.

Carrefour is exploring new market opportunities to drive growth. This includes expanding its presence in emerging markets with favorable demographic and economic conditions. The strong presence in Brazil and Argentina illustrates Carrefour’s capabilities in operating outside of Europe. We believe expansion through M&A or a partnership is the most realistic route, as it will provide the necessary expertise and market position from which to utilize its deep expertise. Carrefour recently announced the acquisition of Louis Delhaize’s Romanian operations, which includes 10 hypermarkets and 9 urban stores.

Margins

Carrefour operates with tight margins. Its GPM, EBITDA-M, and NIM have remained flat across the historical period, with some slippage in the most recent period (discussed later).

The weak margins are a reflection of the market, with high competition and an unwillingness by consumers to pay a premium for basic food products.

The importance here is that margins are sticky and cash flows are not volatile, creating consistent returns for shareholders.

Economic & External Consideration

Current economic conditions represent a risk and opportunity for Carrefour.

Inflationary pressures impact both consumers and businesses, with high input costs and prices continually rising in response to this. The impact has been a squeeze on consumers, as well as some businesses that have been unable to wholly pass on cost increases.

Carrefour has materially suffered from an increase in food costs, illustrated by the decline in its GPM by 120 bps. The difficulty here is that winning back margins is not easy in such a competitive market.

From a demand perspective, inelasticity has allowed Carrefour to continue growth, with a 16% increase in revenue during FY22 and a continuation of this in the YTD period (+10.5%). The concern is that many consumers will choose cheaper alternatives, such as Aldi and Lidl, at an increasing rate.

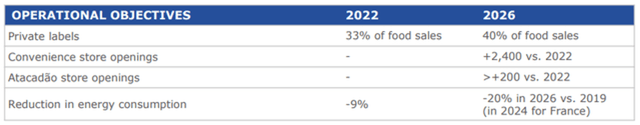

The key opportunity we see is improving the sale of private label products, which earn the business improved margins. The current inflationary pressures are forcing fast-moving consumer goods (FMCGs) businesses to increase their prices substantially in order to keep shareholders happy. This represents an opportunity to increase the price delta, encouraging the value proposition with private labels.

Carrefour’s primary operational objective is to increase the proportion of private label sales to 40% by 2026, which should have the impact of improving margins.

Operational objectives (Carrefour)

Balance sheet

Carrefour’s leverage has gradually increased over the historical period, as the company maintains its capital allocation strategy and must fund the shortfall. Our view is that a 4x ND/EBITDA multiple is a healthy maximum, which gives the business sufficient runway to fund M&A through growth if required, without facing liquidity concerns.

With deleveraging in recent years, we see distributions increasing in the coming 3-5 years, given the strong and consistent FCF conversion.

Outlook

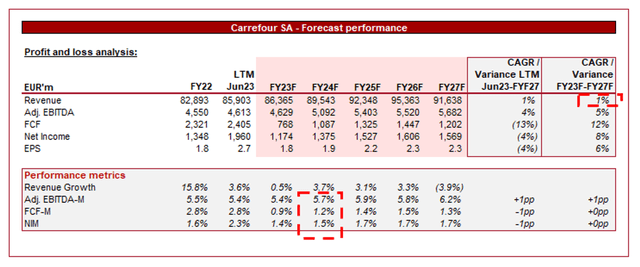

Outlook (Capital IQ)

Presented above is Wall Street’s consensus view on the coming 5 years.

Revenue growth is forecast to remain mild, with a 1% growth rate into FY27F. Further, margin improvement to pre-FY22 levels is not expected until several years in the future, reflecting the difficulty of recovering its position.

Peer analysis

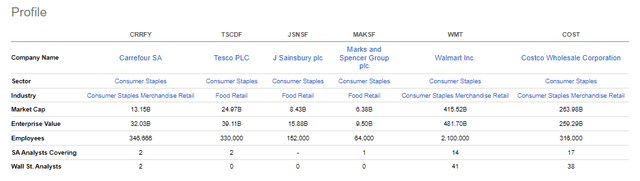

To assess Carrefour’s relative performance, we have compared it to the following peers.

Peers (Seeking Alpha)

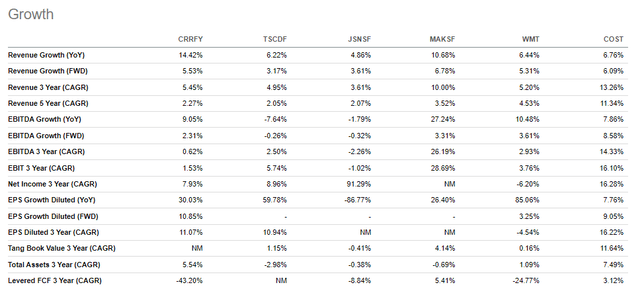

From a growth perspective, Carrefour has slightly underperformed in the last 3-5 years on a revenue basis, although its forward outlook is more respectable. This is likely an illustration of economic conditions in France relative to the US/UK. Importantly, the gap widened on a profitability basis, implying Carrefour’s margins have suffered greater slippage over a 3Y period.

Growth (Seeking Alpha)

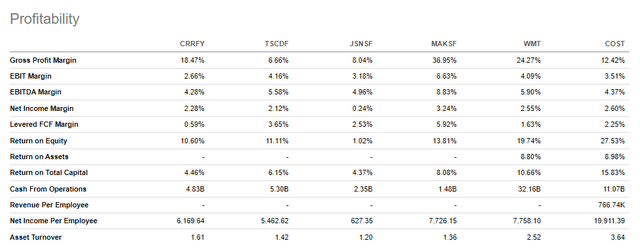

Carrefour’s EBITDA margin is the lowest of the cohort, although performs better on a NIM basis. This level is comparable to its European peers, reflecting the increased competition and greater pressure from consumers when attempting to lift prices.

Profitability (Seeking Alpha)

Relative to the other businesses, Carrefour is positioned slightly below the average in our view. Its growth and profitability in conjunction are strong, and margin resilience is a key strength. However, on an absolute basis, the weaker FCF and EBITDA-M are disappointing.

Valuation

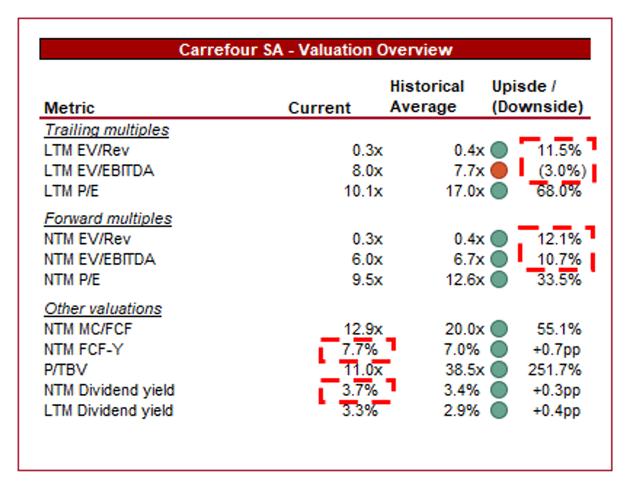

Valuation (Capital IQ)

Carrefour is currently trading at 8x NTM EBITDA and 6x LTM EBITDA. This is a discount to the company’s historical average. This is likely

We believe this discount looks reasonable in our view, given the slippage in margins and the current economic conditions. This said, we do see value from private label tailwinds, margin appreciation over time, and continued benefits from scale globally.

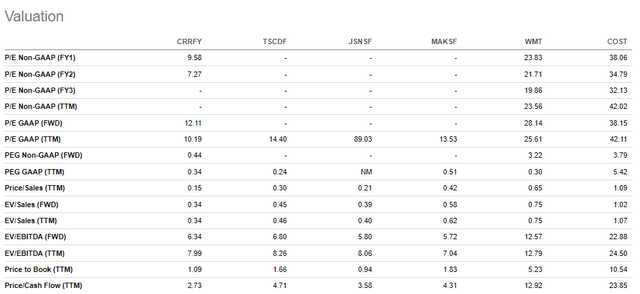

In order to cross-check this valuation assessment, we would expect to see Carrefour trading at a small discount to its peers. Carrefour is currently trading slightly above Tesco, and above J. Sainsbury and M&S. Although this does not suggest the stock is overvalued, we do not see a significant upside for shareholders.

Valuation (Seeking Alpha)

Final thoughts

Carrefour is a strong performing grocery business with a global operation and a large market share in its core markets. The industry has been disrupted by economic conditions, namely inflation, but has shown itself to be resilient.

Growth is poor but a 2-3% long-term trajectory is sufficient to generate value long-term given its consistency. Following a share price rally, we do not consider the stock attractively priced.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here