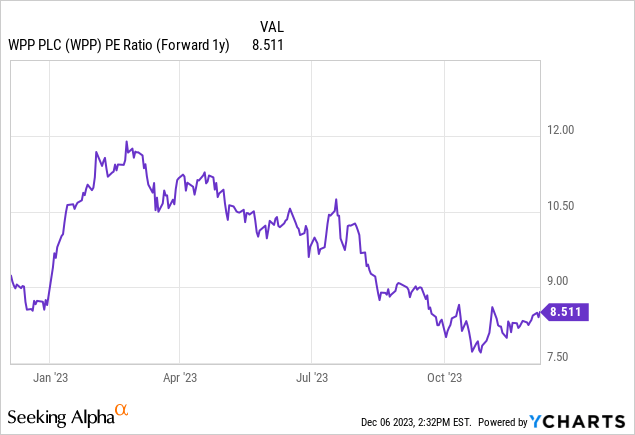

Global advertising leader WPP plc’s (NYSE:WPP) underwhelming Q3 trading update confirmed fears that the company is facing slower growth compared to the likes of its key European peer Publicis Groupe (OTCQX:PUBGY). While the company’s headline results and leverage to a slower near-term global growth outlook remain hurdles to owning the stock, there were some silver linings beneath the surface, particularly on the resilience of the non-tech & digital services side of the business. And as the company continues to unlock new cost efficiencies over the mid-term (mainly streamlining at VML and GroupM), there is a clear path to margin improvement from here. Plus, at 8-9x forward earnings (a relative discount to its peers), WPP stock already prices in a fair bit of pessimism at current levels and could re-rate as tech spending eventually recovers alongside lower rates next year.

Picking Through the Q3 Letdown

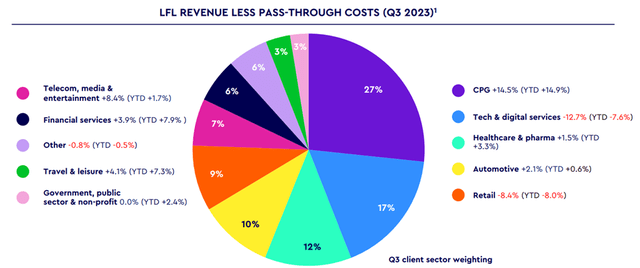

Looking back, WPP’s Q3 trading update offered far more negatives than positives. On the one hand, the company did report organic growth of -0.6% – significantly short of consensus estimates heading into the print. This shortfall was largely down to weakness from tech (a vertical to which WPP over-indexes), which saw a 12.7% organic decline (implying a QoQ and YoY deterioration) amid steep cuts in ad spend following a major hit to valuations and funding costs following the Fed’s rate hikes. WPP’s media division, GroupM, was another driver of the miss, slowing to 1.6% vs a steady mid to high-single-digit % growth algorithm previously. Creative agencies were also down, albeit at a slower -1.1% organic decline amid continued client churn in the US. More worryingly, this marks yet another quarter post-COVID that WPP has been outpaced by Publicis, highlighting the importance of the latter’s more diversified revenue stream.

WPP plc

However, a closer look reveals some silver linings. Outside of the tech weakness, WPP’s Q3 organic growth would actually have been positive. While it’s also worth noting that there was broader deceleration across segments and geographies this time around, this needs to be viewed against a challenging operating backdrop, particularly for WPP’s two major exposures – US tech and China. Also positive was the company’s sequential acceleration of new deal wins – a robust pipeline bodes well for near-term growth as it filters through to the P&L in the coming months.

Bar Moves Lower Following Post-Q3 Guidance Downgrade

Coming off another quarter of top-line weakness, it was no surprise that WPP management revised its full-year organic growth guidance lower to a 0.5-1% range (down from 1.5%-3.0% prior). As for margins, the 2023 guide now stands at 14.8%-15.0%, only about 10bps down from the prior ~15% target at the midpoint due to the company’s lower operating leverage (i.e., more variable than fixed costs). Debt levels are also expected to be manageable, though the lower EBITDA generation means average net debt/EBITDA will run “slightly above” the prior 1.5-1.75x target range. In contrast, key peer Publicis raised its forward guidance after delivering mid-single-digit % growth in Q3.

While this updated guide won’t inspire confidence in investors, management commentary on the post-Q3 call indicates there remains ample reason for optimism. In particular, WPP’s ongoing transformation program, which mainly revolves around merging VMLY&R and Wunderman Thompson into one creative agency (VML) and then unlocking synergies, for instance, streamlined back offices. Also in the pipeline is the further simplification of GroupM (think integrated platforms to enhance go-to-market strategies and shared back-office services for cost efficiencies), extending the initial phase in 2020. To be clear, this won’t be a straightforward process, and there will be some execution risk and one-off restructuring costs (albeit spread out over two years or so) to be incurred. But the broader rationale of leveraging scale benefits is sound, in my view, and should unlock cost savings and potentially even revenue prospects. Management (rightly) isn’t underwriting the latter just yet; instead, it has targeted net cost savings of “at least GBP100m,” which entails some margin uplift through 2024/2025.

WPP plc

Murky Outlook but Priced Accordingly

WPP stock has been a serial underperformer this year, and rightly so, given the weakness of its quarterly earnings. Looking through the near-term challenges, though, the company still has some mid-term levers going for it, including its strategic digital advertising investments and an ongoing P&L optimization program. Fundamentally, this remains a company with strong brand equity globally. That positions it well to capitalize on a growth recovery as elevated rates eventually come down next year. A lot of these positives likely aren’t in the price, given WPP’s currently discounted earnings valuation (relative to historical levels and to peers). With the guidance bar also lowered post-Q3, the stock offers a compelling entry point for patient investors with longer time horizons.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here