Introduction

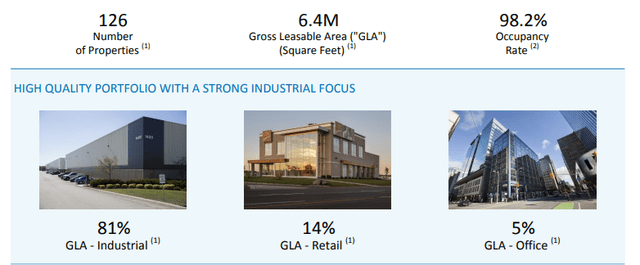

Pro Real Estate Investment Trust (TSX:PRV.UN:CA) is a Canadian REIT focusing on industrial assets which account for 81% of its portfolio. As you can see below, the REIT also has some exposure to the office segment but with this segment representing just 5% of the GLA, that asset class is pretty negligible in the greater scheme of things.

Pro REIT Investor Relations

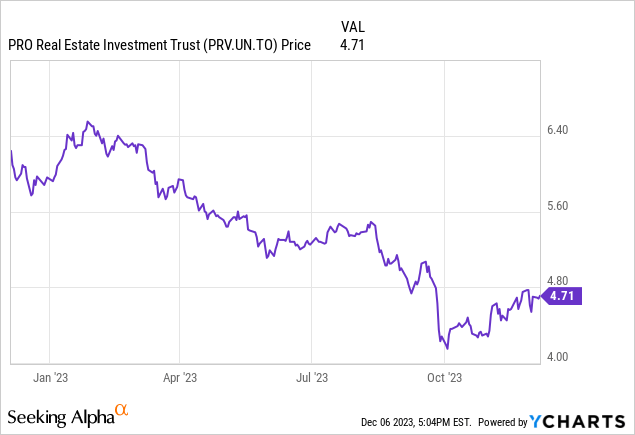

Although the industrial real estate asset class still is in high demand, the REIT has to deal with a stagnating NOI (on a same property basis) and this obviously creates some uncertainty on the market. In this article, I’ll have a closer look at the financial performance and I will explain why I prefer to be a creditor instead of a shareholder.

Following up on the REIT’s financial performance

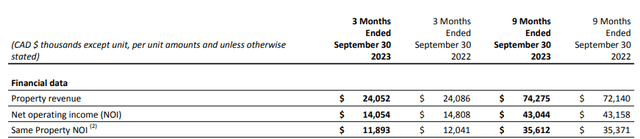

The summary of the financial results of Pro REIT shown below shows a worrisome evolution: the property revenue remained stable in the third quarter of this year compared to the same quarter last year and both the NOI as well as the same property NOI came in lower than a year ago.

Pro REIT Investor Relations

That sounds very surprising considering the demand for industrial assets remains strong and the inflation-related rent hikes should have had a positive impact on the REIT’s NOI. As this is an important element of my investment thesis, I would like to tackle this issue first. While the lower property revenue is pretty normal (the REIT only owned 126 properties at the end of September compared to 132 properties at the end of Q3 2022), the same property NOI result has a relatively straightforward explanation. From the Q3 conference call:

This Québec property is fully leased as of October 1, 2023, on a 10-year lease, with terms and average spread of 55 percent over the previous tenant rents. We will see the full benefits of this attractive renewal reflected in our fourth quarter results; more specifically, positively impacting AFFO, payout ratio, net operating income and same property NOI.

Excluding the impact of the temporary vacancy, the same property NOI would have increased by 1.7%. Still not a great result, but that at least is a more satisfying evolution.

The 55% spread is excellent but not necessarily an anomaly. From the same conference call:

we have successfully renewed 88 percent of GLA maturing in 2023 at 43.9 percent average spread, and for GLA maturing in 2024, approximately 18 percent have been renewed at approximately 30 percent average spread.

This means we should expect the FFO and AFFO result to show a meaningful increase in Q4 2023 and I expect to see a continuous improvement in 2024. Looking at the AFFO performance, we see the REIT generated C$7M in AFFO during the third quarter of the year, which represented C$0.116 per share.

Pro REIT Investor Relations

The AFFO per share in the first nine months of the year was C$0.36 and I now aim for a full-year AFFO of C$0.48-0.485 per share before moving up towards C$0.50 per share in 2024 (assuming the interest rates on the financial markets won’t increase from the current levels).

That will also provide a more comfortable payout ratio as the current payout ratio is approximately 97% of the Q3 AFFO. The payout ratio was approximately 93.5% based on the 9M 2023 AFFO result.

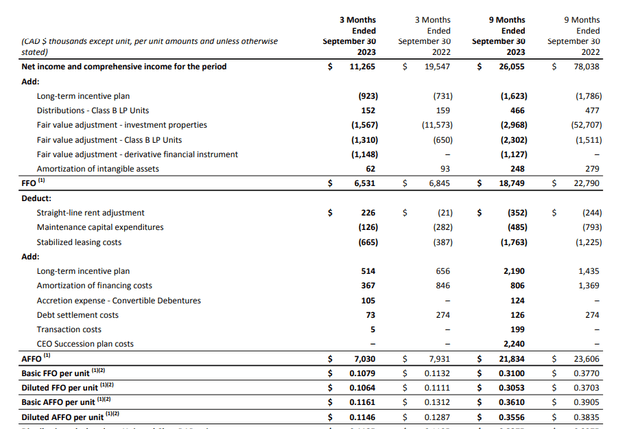

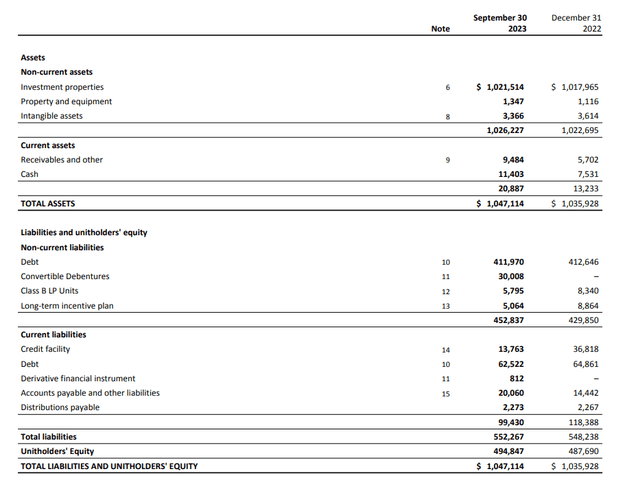

At the end of the third quarter, Pro REIT had approximately C$507M in net debt (excluding the value of the Class B LP Units) and based on the total book value of the properties of C$1.02B, the LTV ratio (defined as net financial debt versus the book value) was just under 50%.

Pro REIT Investor Relations

While that’s not low, it is a manageable position. And the AFFO of approximately C$30M per year would reduce the LTV ratio by almost 300 bp per year should the REIT suspend its dividend. Just to be clear, I don’t anticipate any dividend suspension, but it is a theoretical possibility to retain the AFFO to shore up the balance sheet should there be a need to do so.

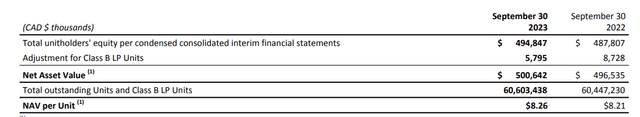

This also means there’s just over C$500M in equity which ranks junior to the debentures (which I will discuss next). The NAV/share (using a capitalization rate of 6.1%) is C$8.26 per share, which means the stock is trading at a discount of in excess of 40% to its NAV.

Pro REIT Investor Relations

We also know a 25 bp increase in the capitalization rate would reduce the fair value by just over C$40M. Subsequently, an increase of the capitalization rate to 7% would reduce the equity by approximately C$140M which would further reduce the NAV to just under C$6/share while the LTV ratio would increase to just under 58%. High, but still manageable.

I am adding to my position in the debentures

In May, the REIT announced the closing of a C$35M convertible debenture offering (the underwriters did not exercise the greenshoe option) with an 8% coupon. The debentures may be converted into common units of Pro REIT at a fixed conversion price of C$7 per share which was a premium of approximately 30% to the share price at the time the debentures were issued. That’s not outrageous but for the purpose of this article, I will assume the debentures will mature on an ‘out of the money’ basis and no capital gains will be generated. As the stock is currently trading around C$4.70, the share price would have to increase by approximately 50% before the conversion feature becomes an asset.

I originally bought the debentures at a small discount to par, but due to the increasing interest rates on the financial markets and the lack of interest in REITs, the debentures are currently trading at just 91.24 cents on the Canadian Dollar, which means the yield to maturity until June 2028 now exceeds 10%.

TMXMoney.com

And I think that offers a pretty good risk/reward ratio for a debt security given the acceptable LTV ratio and the in excess of C$500M in equity which ranks junior to the debentures.

Investment thesis

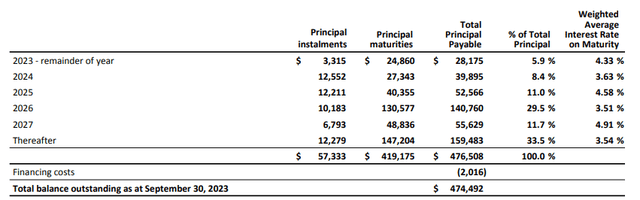

Pro REIT has had to deal with some issues but I expect the Q4 results to show a considerable improvement. Not only because the newly leased Quebec property will start to contribute but also because we should start to see some stabilization in the interest expenses. During the third quarter, the REIT sold office and retail assets for total proceeds of C$11.3M and subsequent to the end of the quarter, it signed agreements to sell an additional C$10.9M of retail assets. This will have a positive impact on the debt ratio and the gross and net debt levels and that will help to keep the interest expenses under control as the REIT only has to refinance C$40M of mortgages in 2024 and C$53M in 2025 with a weighted average interest rate of 4.21%. Based on recent financings, the REIT would see its cost of debt increase by approximately 150 bp from that 4.21% level.

Pro REIT Investor Relations

This would add approximately C$1M to the interest expenses. The main test for the REIT will be in 2026 when almost C$141M in mortgage payments will have to be refinanced. But from the perspective of a creditor, I am more than happy to increase my position in the debentures given the double-digit yield to maturity. I also like the common stock but in my portfolio, I am prioritizing buying the debentures over the common equity.

Read the full article here