Vail Resorts (NYSE:MTN) has been a poor performer over the past twelve months, losing about 13% of its value. This has added to long-term underperformance with shares 4% lower than five years ago. Higher rates have weighed on real-estate valuations, and the company has struggled to grow into its once-lofty valuation, given the slow-growth nature of the ski business. However, I view shares as sufficiently de-risked after their underperformance to buy following Q1 results.

Seeking Alpha

In the company’s first fiscal quarter, Vail lost $4.60, missing estimates by $0.04, as revenue fell by 7.5% to $259 million. This net loss of $176 million widened from last year’s $137 million loss. The primary driver of this decline was that Australia was down $14 million from last year. Employee costs were $7 million higher, and summer US activities were down $4 million. Australia remained locked down for longer than the US, so last year was their equivalent of “revenge travel,” with activity more normalized this year.

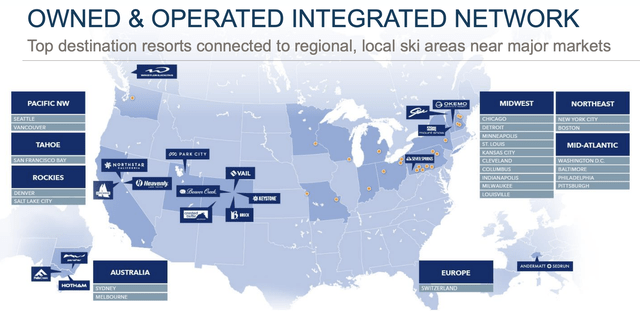

Now, seasonally, Vail typically reports a loss in its first quarter. The company of course is primarily a ski company. It operates 41 mountains, predominately in the United States. These are at peak activity from November through March. There are some summer activities, though Q1 occurs after the peak of summer business and before ski season, leaving Australia (which has its winter when the US has its summer) as the only operation “in-season.”

Vail Resorts

For Vail, its Q2 and Q3 are what matter the most to shareholders. In terms of Q1 results though, I would highlight that mountain and lodging revenue fell by $28 million (13%) while retail and dining rose by $2.5 million (4%). The weakness in mountain and lodging was due to a 22% decline in lift and ski school with hotel and golf revenue actually rising 7%. Lodging RevPAR (daily revenue per room) rose 2% to $82.95. We are still seeing people go to its hotels and spend at restaurants; Australian ski activity just returned to a more normal level.

More important than Q1 results in my view is what the company guided to for the year. It reiterated guidance of $316-394 million in net income on $912-$968 million in EBITDA. Resort EBITDA was $835 million last year, so results should be up at least 10%. Underpinning this reiteration, we learned that pass sales for the 2023-2024 ski season are up by 4% in units and 11% in revenue, thanks to a 7% pricing gain. That shows the company has strong pricing power, amidst fear the US consumer could be slowing down. This 11% growth in pass revenue is consistent with 10% EBITDA growth, assuming daily activity is consistent.

The company has already received nonrefundable commitments from 2.4 million visitors, providing a $900 million revenue base, which should account for about 73% of activity. This gives management solid visibility on future revenue, from which it provides guidance. By expanding operations to 41 mountains, Vail has been able to sell the “Epic Pass,” allowing skiers to use essentially of their resorts, developing revenue synergies from its large network, helping to support this level of pre-sale activity.

This strategy is why I am excited about its M&A activity. On November 30, Vail announced the purchase of its second European ski resort, Crans-Montana in Switzerland. Based on current exchange rates, this transaction carries a $135 million value, including the assumption of debt. The entity will need about $35 million in one-time capital spending over the next five years, at which point it should generate $15 million in EBITDA, giving the transaction an effective multiple of 11.3x. For comparison, Vail trades at 11x its 2024 EBITDA, including net debt.

M&A is usually done at a premium valuation, but this premium is quite small, relative to its own valuation. By adding a second European mountain, I am hopeful Vail will be able to increase cross-Continental Epic Pass sales for consumers in both Europe and the United States, looking to take a ski vacation. Moreover, this could prove to be the beginning of a strategy to build an intra-European network of resorts, similar to its vast US presence. At less than $200 million, this is a modest bet that provides significant optionality for the company.

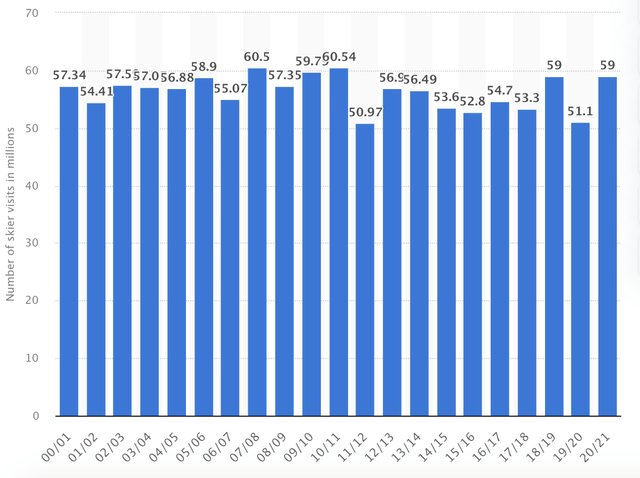

Ultimately, the only way to grow is through M&A. New mountains do not form overnight, and there have been no large mountain resorts built since the 1980s in the US. This limited supply is a positive as it reduces potential competition. The challenge has been that the ski industry has been very slow growing. From 2000-2021, there was essentially no growth with about 55-60 million ski visits per year, as you can see below.

Statista

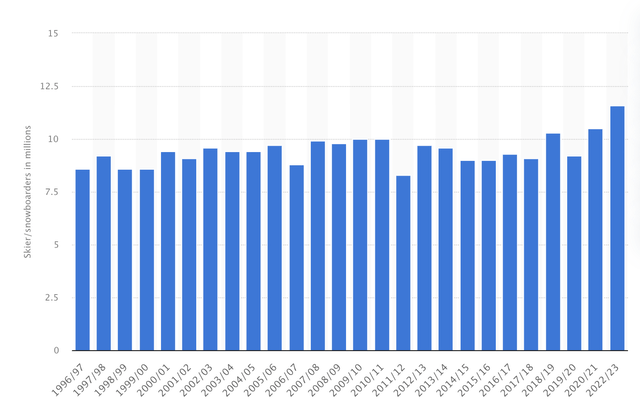

However, last year saw 65 million ski visits, a new record, and pass sales are running higher this year. For years, the mountains were fighting for the same visits; now, visits are rising, as COVID led Americans to seek more outdoor activities. Indeed, this growth has come from new people entering the sport, a more sustainable path for growth than relying on the same skiers to ski more, though hybrid work arrangements may make it easier for people to do a weekend trip, working part of a Friday from the mountain, for instance.

Statista

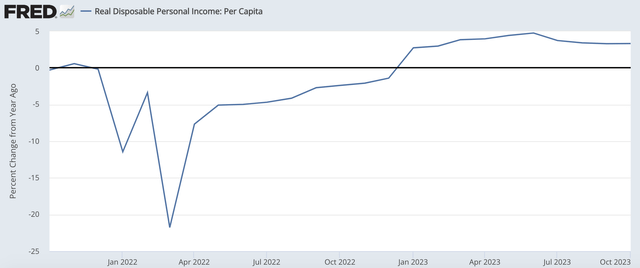

To those worried about a downturn in discretionary spending, I would first note that Vail’s strong pre-sale activity locks in a material base of revenue for the year ahead. Moreover, we are actually seeing real disposable income growth, thanks to a resilient labor market and slowing inflation, after declines last year. This should support ongoing spending by US consumers over at least the winter ski season. With the Fed potentially set to cut rates next year, a soft landing looks increasingly likely, a positive for Vail.

St. Louis Federal Reserve

Now, I do not expect skiing to suddenly be a high-growth business but with limited quality mountains, even this marginal increase has clearly resulted in increased pricing power for Vail. Further, its stock no longer requires that much growth. Alongside results, Vail has announced that aside from Crans-Montana, there is $214-219 million of cap-ex planned. Given about $41 million in quarterly run-rate interest costs and its EBITDA guidance, Vail has $560 million of underlying cash flow.

That gives shares a 6.7% free cash flow yield. Even with just 3% annual growth (ie 1% skier growth and 2% inflation and no operating leverage), that creates a ~10% long-term return potential. Importantly, the company has a strong balance sheet with $729 million of cash on hand. Debt has been flat at $2.8 billion over the past year with net debt to EBITDA of just 2.6x.

Even with a cash outlay for Crans-Montana, Vail has significant capital to return to shareholders. It also offers a 3.9% dividend yield. Over the past five years, it has grown its dividend by 8% per year, excluding the COVID-related suspension. This dividend costs about $310 million per year, leaving ample excess free cash flow for share repurchases.

Vail did $50 million of repurchases in the quarter, and the share count is lower by 5.5% from last year. I would expect a ~4% share count reduction over the next year, given its cash balances and free cash flow.

Given its industry, Vail will not be a high growth stock, but the company is exhibiting solid pricing power, thereby driving material EBITDA growth and free cash flow. It has an unmatched set of assets, and international expansion could create material cross-selling opportunities. At a 6.7% free cash flow yield with a strong balance sheet, shares are now discounting very little growth. I think that is exactly the time to get into the stock of a well-run, premier franchise in an industry with limited potential for supply growth. With even 3-5% growth, and potential upside from Europe, shares offer the potential for low double-digit returns, and work well for income-growth oriented investors.

Read the full article here