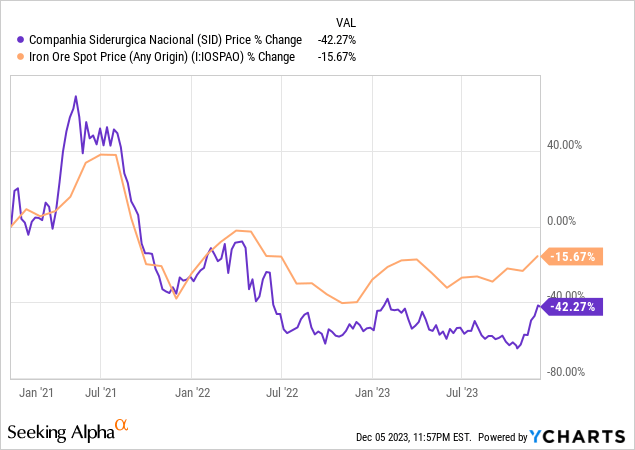

Brazilian steelmaker and mining company Companhia Siderúrgica Nacional (NYSE:SID), also known as CSN, has faced significant challenges in its performance over the past three years due to weaker global economic growth. This impact has been particularly evident in the recent downturn of iron ore and steel prices, as detailed in my prior article on the company.

The Brazilian and Chinese markets are grappling with limited demand in the steel segment, with the reopening process falling short of initial expectations. This subdued demand affects CSN’s revenues and puts pressure on costs, given the reduced ability to distribute expenses across higher production volumes.

Initially, I adopted a neutral stance on CSN, anticipating iron prices converging toward $110/t, which could face further strain with potential future cost discounts, especially for steel.

However, there was a notable rally in iron ore prices in the second half of 2023. This shift can be attributed to a positive turnaround in the Chinese construction sector, which, after signaling a 30% decline in new construction, is now indicating a more favorable short-term outlook for the steel sector. This positive development is expected to benefit CSN’s overall performance.

When considering investments in companies closely tied to the commodities cycle, such as CSN, resilience becomes crucial amid price instability. CSN has effectively demonstrated resilience in its margins throughout its recent history, outperforming its domestic peers, particularly in the steel industry.

Despite the risks tied to the economic cycle and weakened steel demand in Brazil, the Q3 results fell short of being impressive. However, I am optimistic that, at least in the short to medium term, CSN’s situation is set to improve.

With these considerations, I am upgrading my neutral stance to a cautiously optimistic view of Companhia Siderurgica Nacional.

Economic Cycle and Demand for Steel

The economic cycle and the steel demand play a pivotal role in influencing the results of companies like CSN, mainly due to the impact of iron ore prices.

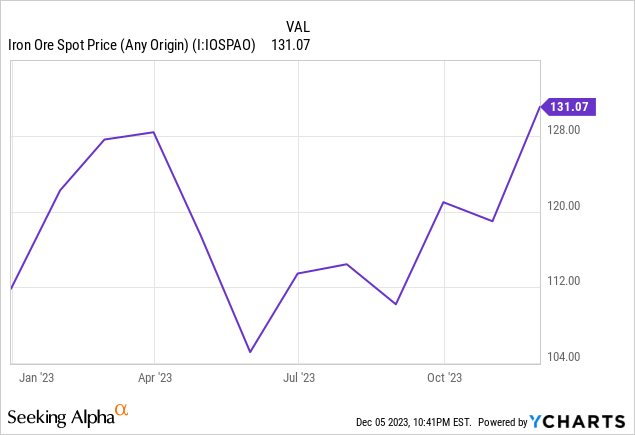

Recently, there has been a consistent upward trend in iron ore prices, surging from approximately US$105 per ton in September to around US$130 at the beginning of December. This surge is attributed to China, the largest consumer of this commodity, announcing plans to stimulate its construction sector.

However, the Chinese government is now taking steps to control the price of commodities to prevent inflation. Regulatory entities have pledged increased supervision of trades involving unmanufactured iron ore to curb speculation. Moreover, they have urged companies engaged in commodity trading to refrain from exaggerating price increases or accumulating excessive stocks.

This situation is not unprecedented, as Chinese authorities have historically sought to control raw material price inflation during periods of significant price increases. These headlines should not surprise investors, as attempts to manage price volatility have been a recurring theme in China.

Despite potential speculative elements, I believe that the fundamentals of the iron ore market will see improvement, particularly in the fourth quarter, driven by increased Chinese steel production.

Examining the backdrop, the Chinese construction sector, which previously signaled a 30% decline in new construction, is now poised for a turnaround. The government plans to inject a $137 billion stimulus, focusing on renovating urban roads and infrastructure. Concurrently, benchmark rates are being reduced to incentivize the real estate sector.

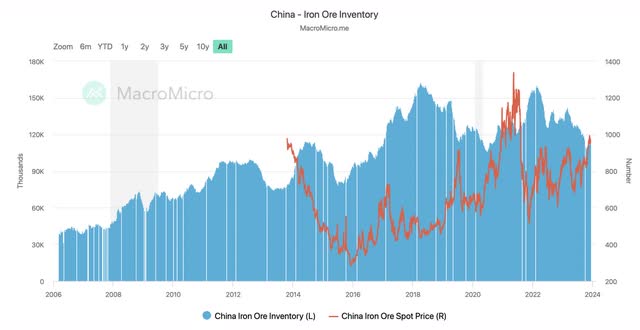

From a fundamental standpoint, China maintains high steel production levels with relatively low inventories. Ore stocks are notably below the average for the next five years, having experienced a decline since the middle of the year. This suggests a positive outlook for the iron ore market in the foreseeable future.

China – Iron Ore Inventory (MacroMicro.me)

In light of these developments, there is a possibility that the recent rally in iron ore prices will continue, potentially reaching $150 per ton in the first quarter of the coming year. This anticipated surge is driven by the likelihood of mills being compelled to enter the market due to persistently low inventories.

The restocking efforts and the seasonally weaker iron ore production expected from Brazil and Australia are anticipated to contribute to a tighter market in the first quarter. Following this, a gradual price decline is projected, with an outlook of reaching $100 per ton by the fourth quarter of 2024. Analysts from the Bank of America foresee an average price of $125 per ton for 2024.

Steel consumption in Brazil is displaying indications of weakness. Despite remaining stable year-to-date, flat steel consumption witnessed a 2% decline in October, while long steel experienced a 4% decrease. The Brazilian National Steel Institute (IABR) anticipates a 2.6% decrease in apparent steel consumption for 2023 compared to the figures recorded in 2022.

CSN’s Latest Financial and Operational Results

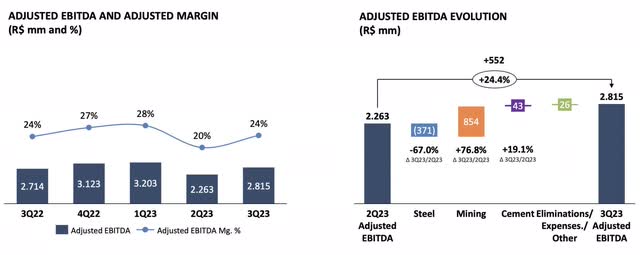

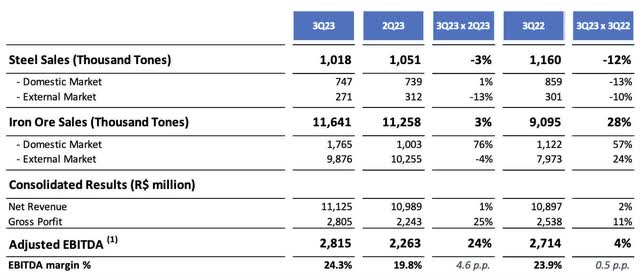

In its latest financial results, CSN reported a net profit of R$90.794 million for the third quarter, representing a 61.8% decrease compared to the R$237.632 million reported in the same period last year. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) increased by 4% year-on-year to reach R$2.815 billion, with a margin of 24.3%, up by 0.5 percentage points.

CSN’s IR

Net revenue experienced a 2% year-on-year growth, reaching R$11.125 billion. Gross profit saw an 11% increase to R$2.805 billion, resulting in a gross margin of 25.2%, compared to 23% in the previous year.

According to the company, this improved profitability was attributed to strong operational performance and the positive impact of the exchange rate increase on foreign market sales.

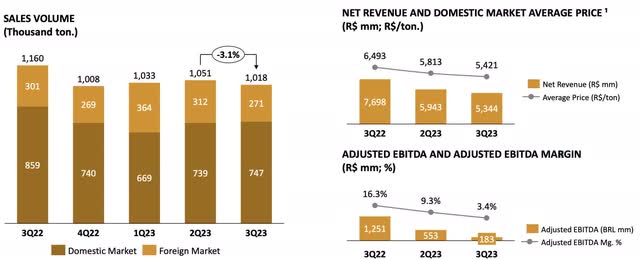

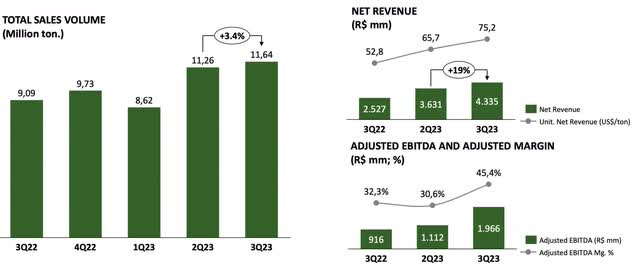

Despite a 12% decrease in steel sales per ton, with a 13% drop in the domestic market and a 10% drop in the foreign market, ore sales rose by 28%, increasing by 57% in the domestic market and 24% abroad. On the production side, there was a notable improvement in the mix in favor of own production, enhancing operational profitability. CSN achieved a new historical record in production and sales, with a volume of 11.6 million tons sold in 3Q23.

CSN’s IR

Regarding steel prices, CSN noted a decline in domestic and foreign markets due to an increased share of imported material, offsetting the fall in production costs. The adjusted EBITDA for the steel industry reached R$183 million in 3Q23, with an adjusted margin of 3.4%.

CSN’s IR

The mining segment achieved a solid adjusted EBITDA of R$1.96 billion in 3Q23, setting an adjusted EBITDA margin of 45.4%.

CSN’s IR

Cost of Goods Sold (COGS) totaled R$8.320 billion, down 4.9% from the previous quarter, reflecting the normalization of production at the steel mill. Selling, General, and Administrative Expenses reached R$1.175 billion in 3Q23, marking an 8.6% increase compared to 2Q23, driven by higher freight expenses due to increased mining volume.

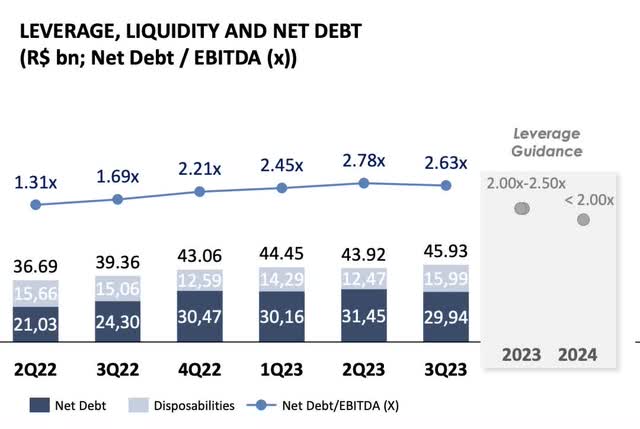

The financial result for 3Q23 was negative at R$1.223 billion, up 285% year-on-year but stable in the quarterly comparison. Adjusted net debt increased 23% year-on-year to R$29.939 billion, while cash and cash equivalents rose 6% to R$15.991 billion. Leverage, measured by the ratio between net debt and adjusted EBITDA, stood at 2.63 times.

CSN’s IR

Despite the increase in adjusted net debt, the company anticipates improved results in the coming quarters, especially in the steel segment, leading to a reduction in leverage and alignment with the company’s guidelines.

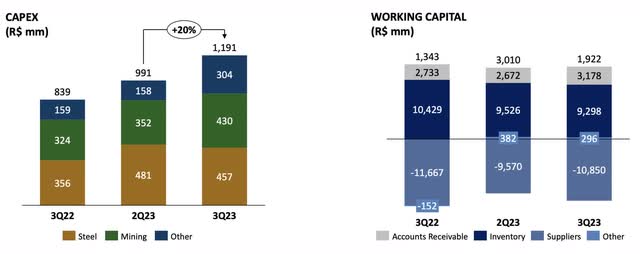

CSN invested R$1.191 billion in 3Q23, a 20.2% increase compared to 2Q23, focusing on repairs to coke batteries at UPV and general maintenance at steelmaking operations. Noteworthy investments in the mining segment include maintaining operational capacity and progressing on expansion projects, mainly related to P15, recovery of tailings from dams, and expansion of the Itaguaí port, along with current investments in cement operations.

CSN’s IR

Guidance Adjustments

CSN has made adjustments to several of its guidance.

These changes include revising the forecast for iron ore production plus purchases from third parties from 39,000 kton and 41,000 kton to a new range of 42,000 Mton and 42,500 Mton by the end of 2023.

Additionally, there is a modification in the C1 cash costs in mining, shifting from a range between US$19/ton and US$21/ton to a new projection of US$22/ton for 2023.

In terms of leverage, measured by the Net Debt/Adjusted EBITDA indicator, the initial projection, ranging between 1.75x and 1.95x, has been adjusted to a new range between 2.00x and 2.50x at the close of the 2023 annual balance sheet. The company aims to bring the leverage below 2.0x by the close of the 2024 yearly balance sheet.

Furthermore, CSN communicated the removal of the steel sales volume projection of 4,670 Mton in 2023 and the withdrawal of the projection to achieve an EBITDA per ton in steelmaking of US$165/ton in 2023.

The Most Defensive Brazilian-Steel Pick

The primary concern is survival in a cyclical sector dependent on commodity prices. In challenging times, a company should refrain from selling assets or accumulating bad debt, particularly given the unpredictable nature of commodity price fluctuations.

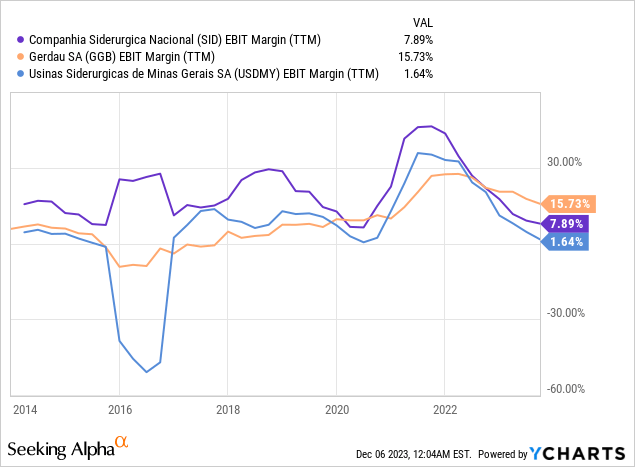

When comparing Brazil’s three leading metals companies, it is evident that CSN has consistently maintained an EBIT margin of at least 11% over the last decade. In contrast, Gerdau (GGB), despite currently boasting the highest margin, has experienced negative margins in the recent past, a trend similarly observed in Usinas (OTCPK:USNZY), as depicted in the graph below.

This demonstrates that during weak iron ore and steel demand periods, CSN generally exhibits a better ability to withstand these challenges, showcasing a more defensive profile than its counterparts.

It’s important to highlight that CSN’s market resembles Usinas, both having substantial exposure to China. In contrast, Gerdau operates in the West and is less exposed to iron ore.

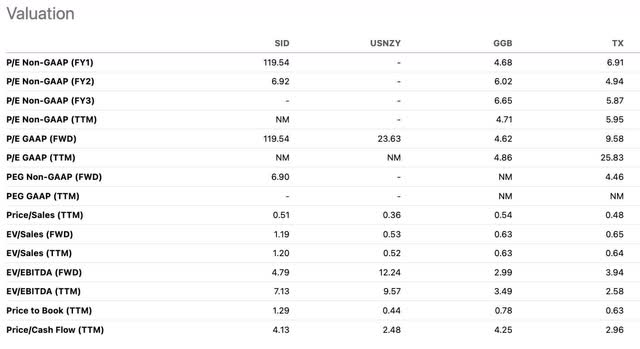

CSN’s current valuation is 4.7x its 2024E EV/EBITDA, while Usinas stands at 12.2x and Gerdau at 3.4x. Additionally, CSN has a mining business contributing 39% of its revenues and 70% of its total EBITDA, along with logistics and cement – segments the other two domestic metallurgy companies lack. This diversification further ensures stable results, significantly when one of the segments underperforms.

Seeking Alpha

Conclusion

Anticipating a more positive trend in iron ore for 2024, particularly in the first half of the year, along with the expected seasonally weaker iron ore production from Brazil and Australia, conditions seem favorable for a tighter market in the first quarter. Despite indications of weakness in steel consumption in Brazil, which could act as a slight retractor in the short to medium term, I see potential for a rally for CSN.

While CSN’s Q3 results are not ideal, they were somewhat better than expected, given the still delicate scenario of steel demand. With the company readjusting its guidance, the prospect of improved results in the upcoming quarters, especially in the steel segment, is expected to contribute to a further reduction in leverage, aligning with CSN’s guidelines.

Observing that CSN is trading at a discount compared to its primary domestic peer and considering its potential for better performance in the steel segment, I am cautiously adopting a bullish stance on CSN.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here