I have been bullish on Uber Technologies, Inc. (NYSE:UBER) for as long as I can remember. If you have been following the ride-hailing giant closely, you would know that Uber stock has consistently found resistance around the $50 level. Last August, when UBER was trading at $43, I claimed that Uber stock was well-positioned to break this barrier this time around and head higher, supported by improving business fundamentals. With tech stocks continuing to attract investors, Uber stock did just that.

Seeking Alpha

Since my last article, two important events have occurred.

- Third-quarter earnings announcement.

- Announcement by S&P Dow Jones confirming Uber’s inclusion in the S&P 500 Index.

Fellow Seeking Alpha analysts Daan Rijnberk, Tech Stock Pros, and Piotr Kasprzyk have already dived deep into Q3 earnings, so I am not planning to take you through the recent earnings report in this analysis. Instead, I will focus on whether Uber’s inclusion in the S&P 500 materially changes my bullish thesis for the company.

Beware Of The Index Inclusion Effect

Uber stock popped more than 4% when news broke that the company will be a part of the S&P 500 starting on December 18.

When a new stock is added to a widely tracked index such as the S&P 500, index funds that track this benchmark will buy the shares of the newly added company to ensure they are accurately tracking the index. This is the main driver of short-term gains following the announcement of an index inclusion.

Other reasons for short-term optimism include improved analyst coverage and an expected improvement in investor sentiment stemming from the inclusion in a prestigious index.

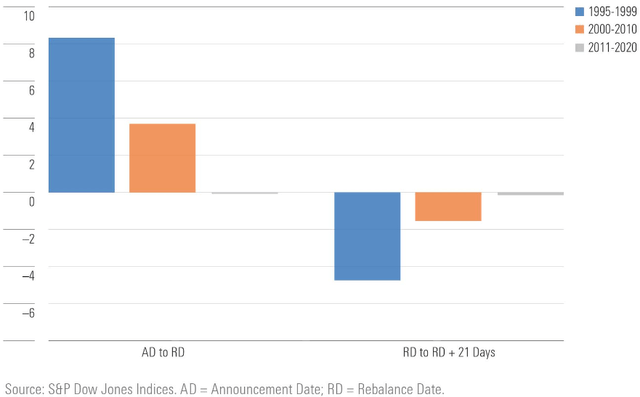

Empirical evidence suggests the presence of an index inclusion effect where stocks tend to rise between the announcement date (of index inclusion) and the rebalance date (when the stock is added to the index) and then shed most of these gains in the first 21 days following the rebalance date. This phenomenon, commonly referred to as the index inclusion effect, often prompts investors to be wary of companies that are freshly added to widely followed indexes.

In recent years, though, the index inclusion effect has waned. Morningstar did a very informative study on the performance of new additions to major stock indexes. For ease of comparison, they used three time frames to explain the presence and the eventual non-existence of the index inclusion effect.

- 1995-1999

- 2000-2010

- 2011-2020

From this comprehensive study, Morningstar found that the index effect has been very strong between 1995 and 1999 only to lose strength between 2000 and 2010. More interestingly, the index effect was negligible between 2011 and 2020.

Exhibit 1: The diminishing index effect

Morningstar

Although it is difficult to pinpoint the exact reason behind the diminishing index inclusion effect, Morningstar claims that many new S&P 500 additions graduate from other S&P benchmarks such as S&P 400 and S&P 600, which forces funds tracking these indexes to sell the shares of companies that are being removed, creating selling pressure.

The below excerpt from Morningstar elaborates on this.

Consider that many new S&P 500 additions graduate from smaller S&P benchmarks like the S&P MidCap 400 or S&P SmallCap 600 indexes. When S&P 500 trackers buy stocks that graduate from their smaller brethren, funds that track those indexes must sell them simultaneously, helping offset the upward pricing pressure. Far more wealth is attached to the S&P 500 than its mid- and small-cap counterparts, but mid- and small-cap index funds have grown at a faster rate over the past two decades. The amount of money indexed to the S&P MidCap 400 and S&P SmallCap 600 indexes increased about 12-fold and 35-fold, respectively, over the 20 years through 2021.

There is a caveat.

Companies that have joined the S&P 500 as outsiders – without previously being part of any other S&P Dow Jones index – have still shown a strong presence of the index inclusion effect in the last decade. A classic example is how Tesla, Inc. (TSLA) stock gained more than 70% between the index inclusion announcement date and the rebalancing date in 2020.

Uber is not part of the S&P 400, meaning that the company will join the S&P 500 as an outsider – similar to Tesla. Based on empirical evidence, there is a high probability for Uber stock to book more gains through December 18 and shed some of these gains following the inclusion in the index.

Index Inclusion Effect Or Not, I Remain Bullish

I am a long-term-oriented investor. I would love to see Uber stock go up in one straight line, but it’s naive to expect that to happen. I know there will be both ups and downs, and I have decided to turn a blind eye to the increased volatility resulting from Uber’s inclusion in the S&P 500.

As an investor, I focus on two things.

- Identifying great businesses that are poised to grow in the long term.

- Investing in such businesses at reasonable prices.

Uber, in my opinion, easily meets the first criterion.

- Gross bookings, total trips, and monthly active platform customers registered stellar growth in Q3, which highlights that Uber is still in the first innings of its growth story.

- Adjusted EBITDA margins hit a high of over 3% in Q3 while adjusted EBITDA surpassed $1 billion for the first time. This is a sign that Uber is successfully converting topline growth into the bottom line.

- Against all odds, the delivery segment is continuing to grow. This, in my opinion, reflects a new normal where younger generations are increasingly prioritizing convenience.

- Despite carrying $9 billion in debt, Uber is better than ever from a financial strength perspective with the company now turning cash-flow positive.

- Last but not least, Uber is showing unmistakable signs of competitive advantages that stem from its industry-leading scale. Such advantages will go a long way in helping the company earn economic profits.

Uber operates in two fast-growing markets; delivery and ridesharing. The company is showing signs of competitive advantages. This is a recipe for long-term earnings growth.

The next piece of the puzzle is to solve whether Uber is attractively valued. The company certainly was cheaply valued when I published my previous article, but on the back of a 40% increase in its stock price since then, investors may have to be cautious here.

Uber’s earnings yield is just shy of 2% today and the P/S multiple has expanded close to 3.5. I still don’t think Uber is ridiculously valued given that this is a company that is expected to grow in double-digits each year through 2026 while registering efficiency gains that will boost its profitability. That being said, I am not comfortable adding to my position at these prices either as I am not enticed by the current earnings yield of Uber compared to other options that I have found in the small-cap space.

Takeaway

The S&P 500 inclusion of Uber is a sign that the company has grown too big to ignore while breaking through to profitability. As a long-term-oriented investor, I welcome this development. Based on the stellar market run in recent months, I believe Uber is no longer cheap enough for me to add to my position but I have no plans of booking my gains as I believe Uber will likely deliver multibagger returns in the long run, which depends on the execution of its growth plans.

Read the full article here