Introduction

The financial sector is at a crossroads. On the one hand, the interest rate is high, which makes it possible to charge more for loans and increase the NIM (net interest margin). On the other hand, demand for loans declines when they’re as expensive as they are. Investors expect the interest rate in the U.S. to decline in the coming 12 months as we see the treasury yields backing off from 5%.

An interesting company in the sector is Ally Financial (NYSE:ALLY), specializing in consumer finance. I analyzed the company a year ago and found it to be a HOLD due to the uncertainty regarding growth in a challenging business environment. As we see the strength of the American consumer and the possibility of reducing rates, I believe it is time to revisit the company.

Seeking Alpha’s company overview shows that:

Ally Financial, a digital financial services company, provides various digital financial products and services to consumer, commercial, and corporate customers, primarily in the United States and Canada. It operates through Automotive Finance Operations, Insurance Operations, Mortgage Finance Operations, and Corporate Finance Operations segments. The company also offers commercial banking products and services. In addition, it provides securities brokerage and investment advisory services.

Fundamentals

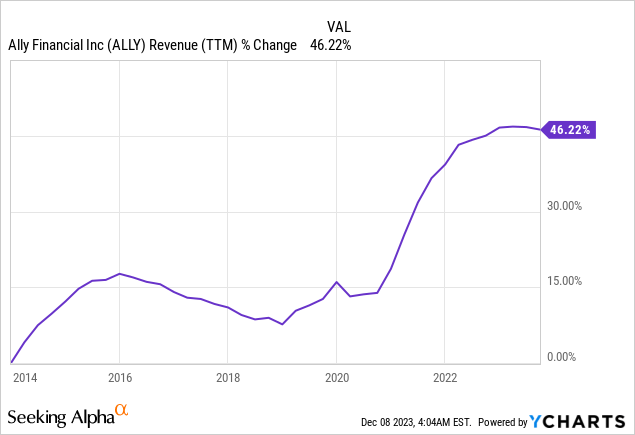

Ally Financial’s revenues have increased by 46% over the last decade. They grew organically as the company originated more loans and managed to expand its NIM. The company also grows, using M&A to boost its value proposition and scale. It did so in 2021 when it acquired Fair Square Financial, a credit card company, for $750 million and rebranded it as Ally Credit Card. In the future, as seen on Seeking Alpha, the analyst consensus expects Ally Financial to keep growing sales at an annual rate of ~4% in the medium term.

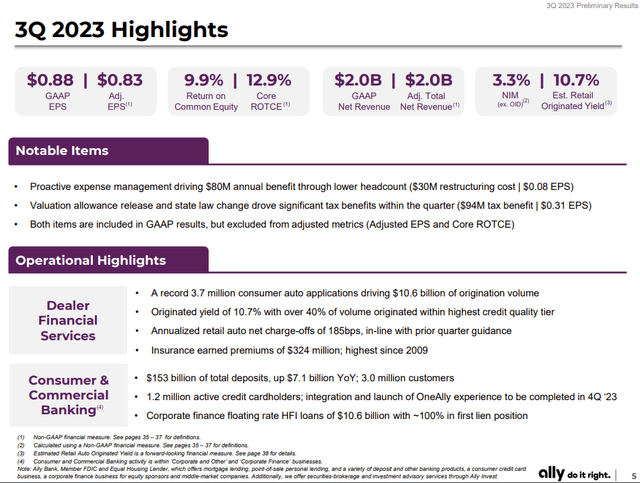

The EPS (earnings per share) has grown much faster during the decade. The 348% increase while the sales grew only 46% can be associated with the company’s ability to cut costs to improve the margins and aggressive buybacks. The company keeps aiming to lower costs in its business plan (slide 6). In the future, as seen on Seeking Alpha, the analyst consensus expects Ally Financial to keep growing EPS by 30% in 2024 and 2025, following a harsh EPS decline in 2023.

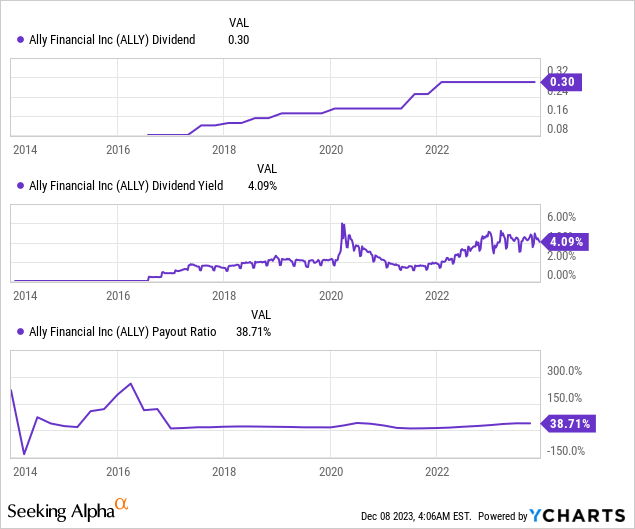

The dividend is a relatively new prospect here. The company started paying it only six years ago and increased it annually until this year. The 2023 dividend will be in line with the 2022 payment. The company has had more challenging times with the Federal Reserve regarding approving its dividend increases. However, the 4.1% yield still looks adequately covered, as even following a steep decline in EPS in 2023, the payout ratio stands at 39%. When the business environment becomes more stable, the dividend will likely increase.

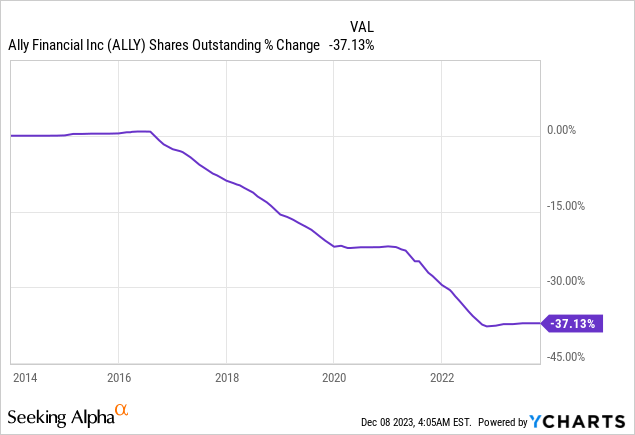

In addition to dividends, Ally Financial, like other financial institutions, returns capital to shareholders via buybacks. Share repurchase plans support EPS growth as they reduce the number of shares. Over the last decade, the company has initiated dividends and buybacks. The buybacks reduced the number of shares by 37% over that decade. Buybacks are highly effective when the valuation is attractive, and once the business environment improves, Ally Financial is likely to keep executing buybacks aggressively.

Valuation

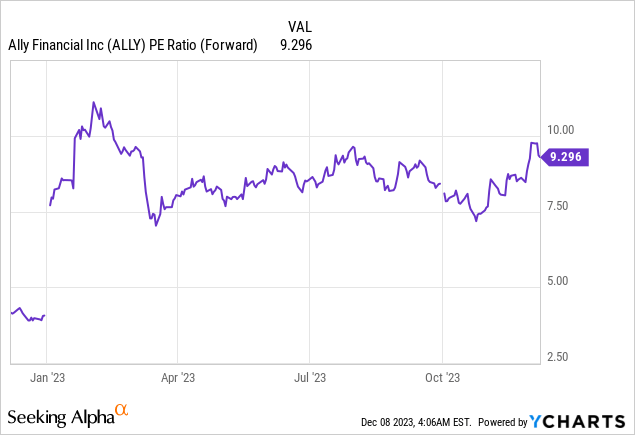

The P/E (price to earnings) ratio, when using the 2023 EPS forecast (following an almost 50% decrease in EPS), stands at 9.3. This is a low valuation if the company manages to grow as fast as the analysts predict it will. The current valuation aligns with the valuation we have seen over the last twelve months, but it is only attractive if it manages to execute well. Therefore, there is an execution risk. Successful execution will make it a good entry point.

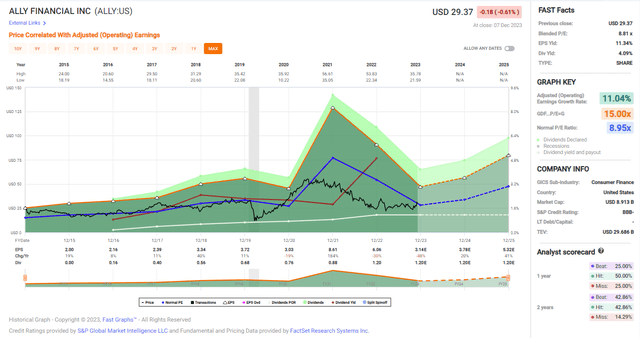

The graph below from Fast Graphs shows that the company’s valuation is attractive. The average P/E ratio of Ally Financial since it started trading a decade ago is 9, and the current P/E ratio is 9.3. The average growth rate is 11%, and the expected growth rate in the medium term is 30%. Therefore, the share price is attractive if the management can execute, and it is only fair if it grows as it did in the past. I tend to go for a mid-scenario. Thus, I believe that the share price is slightly attractive.

Fast Graphs

Opportunities

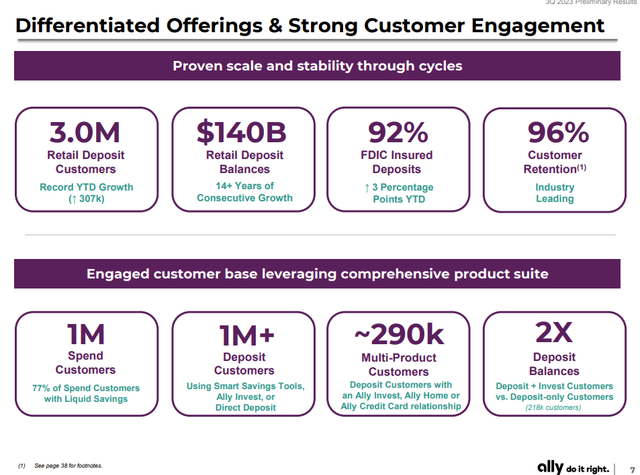

The first growth opportunity is digital banking expansion. Ally Bank has experienced significant growth in its digital banking services, with total deposits reaching $153 billion, a year-over-year increase of $7.1 billion. The addition of 95,000 customers in the third quarter and 307,000 on a year-to-date basis demonstrate a growing customer base. Launching a One Ally experience in the coming months is expected to further enhance the digital banking offering, presenting an opportunity for increased engagement and customer acquisition.

“Total deposits of $153 billion are up $7.1 billion year-over-year. We added 95,000 customers in the quarter, which results in 307,000 on a year-to-date basis-an Ally record.“

(Jeffrey J. Brown – CEO, Q3 2023 Transcript Call)

Ally Financial

Auto financing growth is another crucial growth prospect. Ally Financial’s auto finance segment has achieved a record application volume of $3.7 million, resulting in $10.6 billion of originations with attractive risk-adjusted returns. The company has capitalized on solid returns within the highest credit quality tier, comprising 40% of the volume. With a cumulative pricing beta of 95% in retail auto, Ally is well-positioned for yield expansion, indicating a growth opportunity in the auto financing sector.

“Within auto finance, we have generated record application volume of $3.7 million, which resulted in $10.6 billion of originations and attractive risk-adjusted returns.“

(Jeffrey J. Brown – CEO, Q3 2023 Transcript Call)

The last growth opportunity is the value proposition, as existing clients buy more products. The bank now serves 3 million retail deposit customers, holding $140 billion in balances. The engaged customer base is reflected in the growth of checking accounts, innovative savings tools, and multi-product customers, providing a foundation for continued growth within the consumer bank. As Ally realizes new products, its clients are likely to join due to high engagement from the loans.

“We’ve steadily grown our checking, or what we call our spending product, to more than 1 million customers. Across that population, 77% also have a liquid savings account.“

(Jeffrey J. Brown – CEO, Q3 2023 Transcript Call)

Ally Financial

Risks

Interest rates are a significant challenge. The near-term challenges of a rapidly rising interest rate environment pose a risk to Ally Financial’s financial performance. While the company has been disciplined in managing pricing on both sides of the balance sheet and has implemented active hedging programs, the pressure from higher interest rates is acknowledged as the demand for loans and the NIM may decline. The company anticipates near-term revenue pressure due to these challenges, emphasizing the need for strategic measures to offset the impact.

“From an interest rate perspective, we’ve talked about the near-term challenges of a rapidly rising rate environment for multiple quarters.“

(Jeffrey J. Brown – CEO, Q3 2023 Transcript Call)

Credit risk management is another risk, especially when the company has disagreements with the Federal Reserve regarding risks. Actively managing credit risk remains a top priority for Ally Financial. The company has refined its buybacks to eliminate underperforming segments and added significant pricing, particularly in riskier segments. While unemployment remains historically low, persistent inflation poses a challenge for consumers. The company expects retail auto net charge-offs of 1.8% for the entire year and acknowledges the need for continued vigilance in credit risk management.

“Actively managing credit risk remains a top priority. We’ve refined our buybacks to eliminate underperforming segments and added significant price, particularly in riskier segments to compensate for potential volatility.“

(Jeffrey J. Brown – CEO, Q3 2023 Transcript Call)

Regulatory changes may also pose a risk in the short to medium term. Regulatory proposals released in recent months threaten Ally Financial, requiring the company to prepare for increased capital and liquidity across the industry. While the company acknowledges the importance of regulatory compliance, it emphasizes the need for regulators to study these proposals’ implications thoroughly. Ally Financial is originating high-interest loans, which require discipline in allocating capital across its various businesses to optimize risk-adjusted returns.

“On the regulatory front, we continue to evaluate the proposals released in recent months and are preparing for increased capital and liquidity across the industry. However, we believe that regulators should fully study the implications of these proposals.“

(Jeffrey J. Brown – CEO, Q3 2023 Transcript Call)

Conclusions

To conclude, Ally Financial is a leading, growing financial company. It offers attractive fundamentals with revenue growth and exponential EPS growth. Its ambitions in digital banking, auto financing, and shareholder-friendly practices make it attractive. However, the company faces the headwinds of rising interest rates, regulatory uncertainties, and credit risk management challenges.

With a current P/E ratio of 9.3, Ally’s investment landscape holds promise, yet execution risks loom. Investors must navigate carefully, monitoring the company’s ability to overcome challenges and leverage growth opportunities. Due to the challenges ahead, I believe there is a need for caution. Therefore, I think the share is a HOLD for most investors. Those who prefer higher risk and rewards may buy company shares. Others should wait for a margin of safety with a P/E ratio of 8 or a return to growth.

Read the full article here