By Brian Nelson, CFA

Stock prices and returns are in part a function of the cash-based sources of intrinsic value: net cash on the balance sheet and future expectations of free cash flow. All else equal, a company with more net cash on the books is worth more than a company with a significant amount of net debt. Similarly, the stronger and more predictable a company’s future expected free cash flow stream, the higher the valuation multiple it should be assigned by the market. As free cash flow expectations rise, so should the stock price, all else equal. If free cash flow expectations fall, the stock price should fall, too, all else equal.

In this article, we would like to update readers on our new fair value estimate of Salesforce (NYSE:CRM), explain key changes within our valuation model, as well as walk through its most recent quarterly results. Back in November 2022, we wrote in this article that we thought investors should be cautious on Salesforce’s shares. Our $163 per share fair value estimate at the time was only modestly higher than where shares of Salesforce were currently trading, and we’re finding that our fair value estimate has largely tracked its share price through this update. Let’s now get into the details.

Latest Earnings Report

Salesforce issued strong fiscal third-quarter results on November 29 and provided an outlook for its fiscal fourth quarter that came in better than what consensus had been expecting. The firm’s performance was quite welcome in this uncertain economy as the bellwether showcased that spending on cloud-based CRM software continues to be robust. Revenue advanced 11% from last year’s quarter, while non-GAAP diluted earnings per share was a solid $2.11. Salesforce’s outlook was rosier than what the Street had been expecting. The Dow Jones Industrial Average component is targeting non-GAAP earnings per share in the range of $2.25-$2.26 per share for the fiscal fourth quarter, better than the consensus forecast of $2.18. Salesforce’s strong quarterly report only increases our confidence in Salesforce’s longer-term outlook.

Here is what CEO Marc Benioff had to say about the quarter in the press release:

We had another strong quarter of executing on our profitable growth plan we set in motion last year, delivering $8.7 billion in revenue and again raising our operating margin guidance for this fiscal year. We’re now the third largest enterprise software company by revenue, the number one AI CRM and the number one enterprise apps company. Most importantly, we’re bringing CRM, data, AI and trust together in a single, integrated platform, leading our customers into a new era of incredible productivity and growth.”

We think the growth runway at Salesforce continues to be a long one. Its total addressable market is targeted at $290 billion by calendar 2026 and is growing at a nice 13% compound annual growth rate. The company’s land-and-expand strategy generates incremental revenue across its existing customer base, while geographic expansion and multi-cloud adoption is helping performance. The company is targeting as much as $50 billion in revenue by fiscal 2026, up from expected fiscal 2024 revenue of $34.75-$34.8 billion, and as it scales its business, the firm’s operating margin should continue to expand. Salesforce ended the quarter with ~$11.9 billion in total cash and marketable securities and ~$9.4 billion in short- and long-term debt–good for a nice net cash position. For the first nine months of its fiscal year, free cash flow totaled $6.2 billion, up from $3.7 billion in the same period last year.

Updated Valuation Statistics

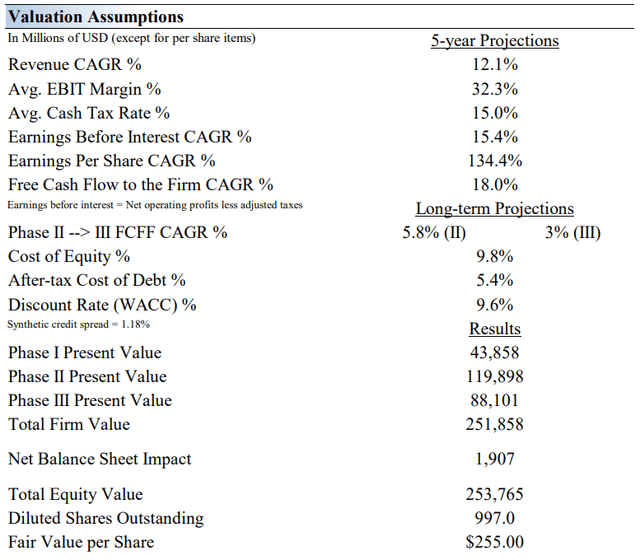

Our summary valuation assumptions for Salesforce. (Valuentum)

Since our last update, we’ve finetuned our revenue growth forecasts and they remain in the low double-digit range. Now, we expect a 12.1% compound annual revenue growth rate over the next five years versus 14.4% previously. We, however, significantly raised our operating margin [EBIT] assumptions, and we’re now forecasting the company achieves a non-GAAP 32.3% average operating margin over the next five years, significantly higher than our prior assumption, accounting for a large part of the delta in the fair value estimate revision. We think Salesforce is scaling its business well, and recent commentary from CEO Marc Benioff indicates that the firm continues to experience solid operating leverage, something innate to its scalable business model. Salesforce has outperformed our expectations since our last update, and our current fair value estimate now stands at $255 per share (was $163 per share).

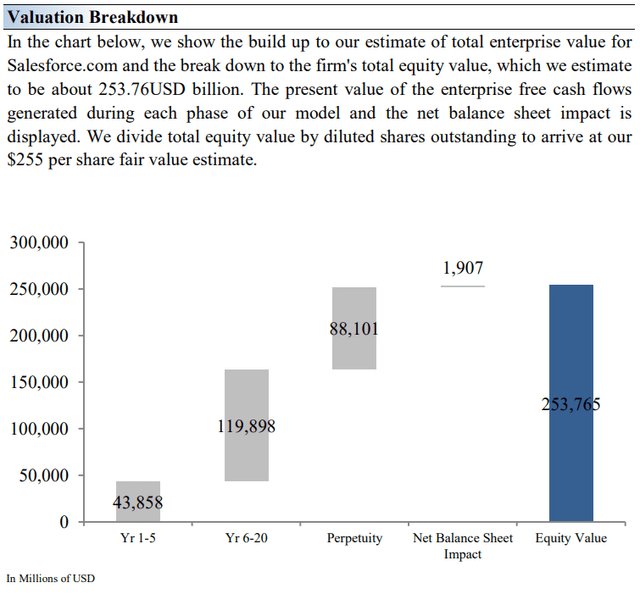

Valuation Breakdown of Salesforce (Valuentum)

Margin of Safety

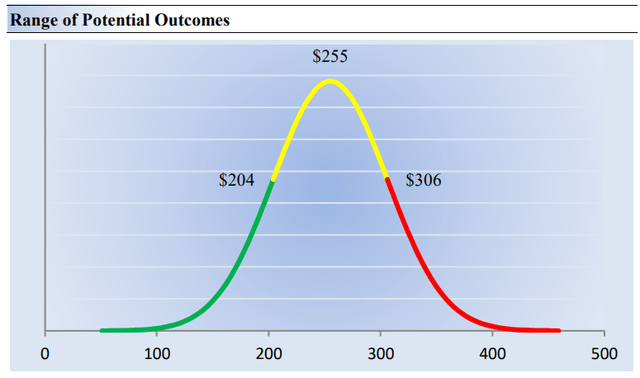

Integral to a discounted cash flow [DCF] process is the application of a margin of safety, as the fair value estimate is sensitive to many assumptions, not the least of which are mid-cycle revenue and mid-cycle operating margin assumptions. We like to use a fair value estimate range in our process, addressing the pitfall that is precision when dealing with the DCF valuation model tool. Said another way, if one has a stock that one thinks is worth $100 per share, it may be more appropriate to say that the stock is worth, let’s say, somewhere between $80 and $100. In this context, we think Salesforce’s fair value range is $204-$306, a wide range that takes into consideration not only potential variation in future revenue growth but also its mid-cycle operating margin, both to the upside and to the downside. Our fair value estimate of $255 should only be viewed as the most probable fair value in the distribution below.

The fair value estimate range for Salesforce. (Valuentum)

Concluding Thoughts

In this article, we wanted to reiterate how we think Salesforce has a huge addressable market opportunity, as it scales its business to higher adjusted operating margins. It is now clear that we were way to cautious in our prior November 2022 article, and today, we view Salesforce’s shares as about fairly valued, given the material fair value increase since our last update on Seeking Alpha. For more aggressive investors, the high end of our fair value estimate range, north of $300 per share, may be a good target for shares, while more conservative value investors may only seek shares at more attractive levels, below the low end of the fair value estimate range. The problem, of course, with great companies such as Salesforce is that they often don’t even reach bargain-basement prices that often.

Read the full article here