This week’s FOMC meeting will likely highlight the big differences between where the Fed sees interest rates in 2024 and where the market sees rates. The November job report this past week highlights that the labor market remains healthy despite a slowdown in hiring and an unemployment rate that is trending higher.

But where rates head from here will largely depend on the economy, and it is clear from Powell’s last speaking event before the FOMC blackout period that the Fed will let the data tell them where rates go next.

Headline inflation has fallen, but core CPI has remained stubborn, and while it has come down, it has been a very slow progression. This means it will be difficult for the Fed at this stage in the game to forecast too many rate cuts in 2024.

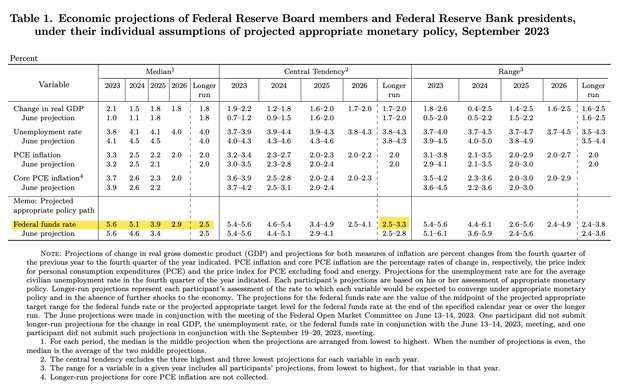

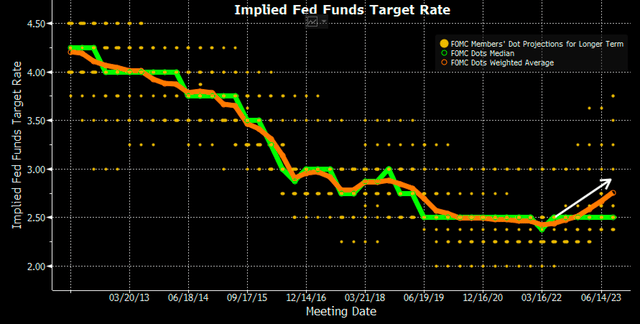

Currently, the market sees rates at the end of 2024 around 4.35%, while the Fed was projecting an overnight rate of 5.1% at the end of 2024 based on its September Summary of Economic Projections. In other words, the market sees about 75 bps more rate cuts in 2024 than what the Fed is projecting.

Trading View

November CPI

This week’s inflation data will help to shape how fast inflation is coming down and whether the path is sustainable. Since June, inflation has been stuck in this 3% to 4% range, which isn’t surprising, as inflation has become more sticky and stubborn.

At least for November, analysts see CPI flat on a month-over-month basis, which aligns with the October reading while rising by 3.1% y/y, down from 3.2% in October. Core CPI is expected to remain elevated and climb by 0.3% in November, up from 0.2% in October, while rising by 4.0% y/y in line with October.

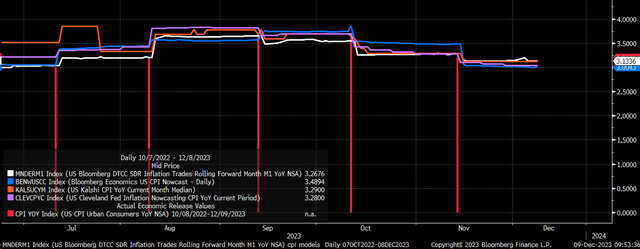

Inflation swaps are projecting the CPI to rise by 3.13%, and Kalshi is projecting a y/y increase of 3.12%. Meanwhile, Bloomberg Economics and the Cleveland Fed are projecting an increase of about 3.0%. The October CPI report came in below all of the estimates.

Bloomberg

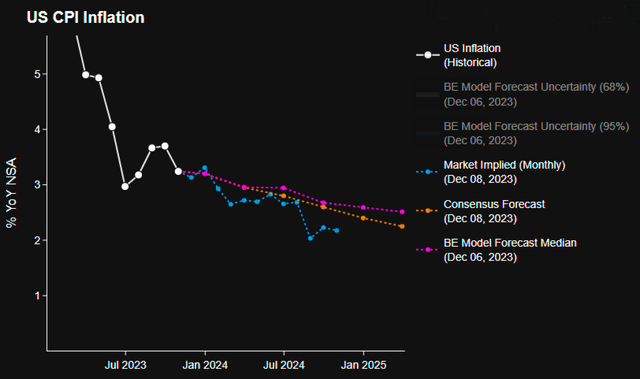

If CPI comes in as expected, then the current path of projections suggests that headline CPI will fall to around 2.5 to 2.7% by the end of 2024. This means that progress on inflation will be slower in 2024 than the progress that was seen in 2023.

Bloomberg Economics

Higher Rates

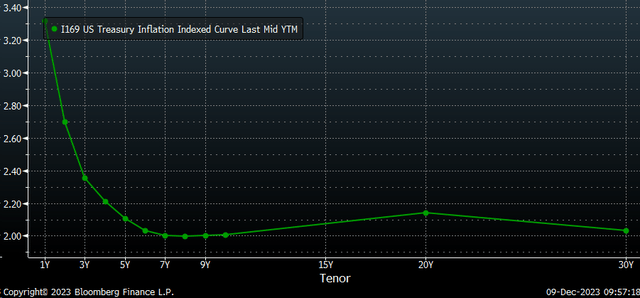

But what is important is what the bond market is currently pricing where it sees real rates, and right now, the market is pricing real rates above 2% for the foreseeable future based on the real yield curve. Assuming that both PCE and CPI inflation rates come down to around 2.5% on a headline in 2024 as the Fed projects, and the current 2-year real yield is at 2.7%, it seems to suggest that the Fed Funds rate for 2024 should be around 5.2%, which means that the FOMC SEP for 2024, should be unchanged at 5.1%.

Bloomberg

Additionally, if PCE comes down to the Fed’s projected 2.2% in 2025, and real rates are to stay above 2%, then it would suggest that the Fed is likely to increase its 2025 Fed Funds rate target to 4.2% or higher from its current projection of 3.9%. The market is forecasting a Fed Funds rate of 3.7% in 2025.

FOMC

The other metric is the longer-run rate, which currently stands at 2.5%. There has been great debate in recent months about the long-run neutral rate of the economy, and the Fed central tendency for that rate expanded in the September FOMC meeting to a range of 2.5% to 3.3% from 2.5% to 2.8% in June. It seems likely, given the strong GDP in the third quarter and the stronger-than-expected November jobs report coupled with a string of health job reports, we may see the weighted average move higher. Overall, this moved the weighted average in September to 2.75% from 2.66% in June.

Bloomberg

It makes sense for the Fed to cut the rate some in 2024 and 2025 as the inflation rate drops to keep policy from becoming more restrictive as inflation falls. It isn’t likely that we will see rates fall as much as the bond market has priced in.

A Steeper Yield Curve

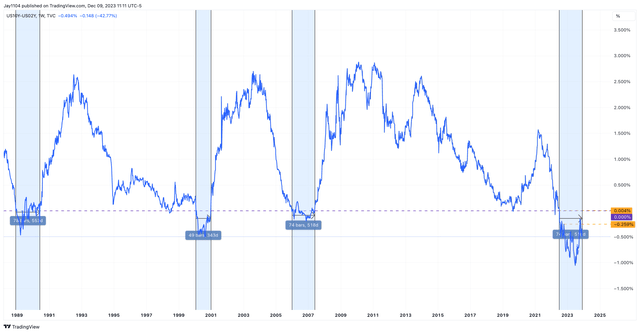

This will likely result in rates across the nominal yield curve moving higher from current levels and the yield curve steepening process to continue. Going back to 1989, this yield curve inversion has already been among the longest at 518 days, tied for the inversion in 2008 and well beyond the inversion of 2000; the only longer inversion was the one in 1989.

Trading View

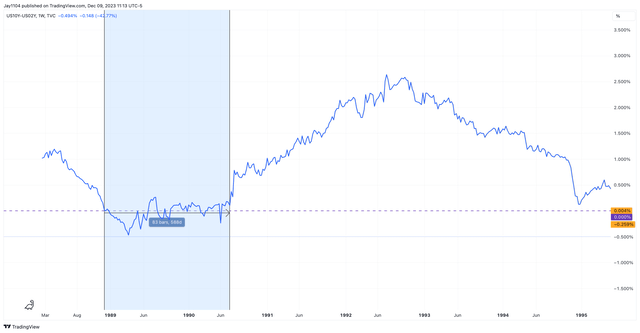

The main difference between the current inversion and the one in 1989 is that inversion in 1989 waivered between positive and negative for many weeks and wasn’t inverted for the entire length of time.

Trading View

The 2022/23 inversion has been significantly deeper and longer. Meanwhile, its current inversion of around -45 bps is more on par with the depths seen in prior inversions preceding recessions. If it becomes clear to the market that the Fed won’t be cutting rates as aggressively as it has priced in, along with a higher long-run neutral rate, it should lead to rates on the back of the curve climbing. Moving towards the front of the curve, due to the term premium for longer-date bonds, it begins to climb again.

Bloomberg

Translations

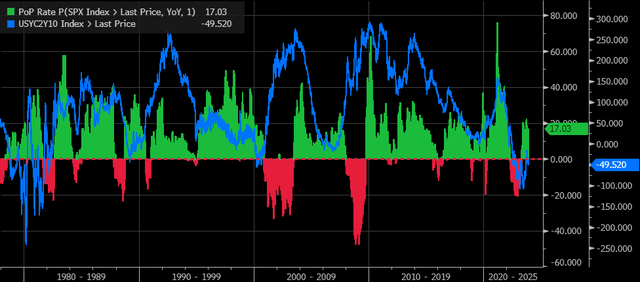

How the equity market and the media translate the FOMC meeting over the very short term is uncertain because, generally, a volatility crush occurs during the Fed press conference as the VIX drops, leading to rallies between 2:30 and 2:45 PM ET, distorting what is going on in rates and currency. While the very short-term is not the concern, it is likely to be the case that as the yield curve rises over the next several months, and the risk of a slowing economy from real rates being more than 2% positive starts to impact the economy, it seems more likely than not that stocks will suffer as they generally do when the yield curve steepens.

Bloomberg

Stocks typically drop sharply as the yield curve crosses back above the zero bound after a long-inversion, which remains the longer-term risk at this point because as the back of the curve continues to normalize for the higher rate world, the front of the curve will eventually begin to reset for Fed rate cuts as risk for a potential recession rises as the full effects of the Fed tightening cycle really begin to be felt, whether the Fed is forecasting it at this point or not.

Read the full article here