Albemarle Corporation (NYSE:ALB) exhibited a notable performance in Q3 2023, marked by an increase in net sales due to the growth in the energy storage sector. However, the company has faced challenges in maintaining its profitability, with a decline in net income and adjusted EBITDA, primarily due to the fluctuating prices in the lithium market and rising costs of raw materials. Despite these challenges, Albemarle’s strategic expansions, including new facilities in Chile and China and critical partnerships, underscore its potential for long-term growth. This piece examines Albemarle’s financial health by exploring Q3 earnings and detailed technical analysis to forecast its upcoming path and spot potential investment opportunities. The recent downturn in the stock price, followed by a consolidation, suggests the likelihood of a market bottom.

Albemarle’s Growth and Challenges

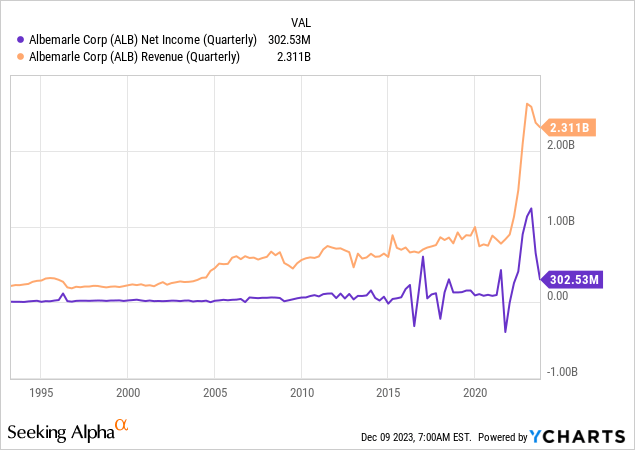

Albemarle achieved a 10% increase in net sales compared to Q3 2022, reaching $2.311 billion, primarily driven by robust growth in its energy storage business. This growth reflects the increasing demand in sectors reliant on advanced energy storage solutions. Despite the rise in sales, Albemarle faced some challenges in profitability. The company’s net income was $302.5 million, a significant decrease from the previous year, as shown in the chart below. This decline is attributed to the volatile nature of lithium market pricing and an increase in the costs of spodumene. However, it’s important to note that Albemarle’s adjusted EBITDA stood at $453.3 million, although it decreased from the previous year.

The energy storage segment, a crucial growth area for Albemarle, witnessed a 20% increase in net sales, reaching $1.7 billion. This surge was driven by a 40% volume increase due to expansions and new production facilities of the La Negra III/IV in Chile and a plant in Qinzhou, China. However, the segment faced challenges due to the rising costs of spodumene, impacting the adjusted EBITDA, which saw a significant decrease.

Albemarle’s cash flow and capital management have been areas of strength. The company generated $1.4 billion in cash from operations in the first nine months of 2023, an increase from the previous year, supported by higher adjusted EBITDA and dividends from equity investments. However, this was partially offset by increased working capital needs due to rising lithium prices. The company’s capital expenditures were also up, reflecting its investments in capacity expansion to support future growth.

Regarding financial health, Albemarle maintained a solid balance sheet with estimated liquidity of around $3.1 billion as of September 30, 2023. This includes cash and equivalents, available credit lines, and a relatively low debt-to-EBITDA ratio, indicating the company’s strong financial position and commitment to maintaining an investment-grade credit rating.

Overall, Albemarle’s performance in Q3 2023 presents a nuanced picture of growth amidst market and cost challenges. The company’s significant sales increase, particularly in the energy storage segment, demonstrates a strong market position and response to rising demand. However, volatile lithium pricing and increased raw material costs have pressured profitability, even as the company maintains a solid financial footing with robust cash flow and a healthy balance sheet. This delicate balance highlights Albemarle’s resilience and strategic adaptability in a dynamic industry landscape.

Technical Picture of Albemarle

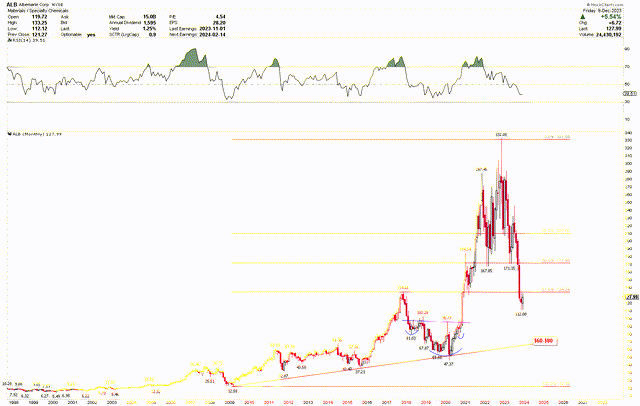

The monthly chart for Albemarle presents the technical aspects of the stock’s performance, indicating that the price has recently undergone a strong correction, bringing it to attractive levels for buyers. However, the chart also shows that the stock has breached the 61.8% Fibonacci retracement level at $134.29, suggesting a price consolidation phase. A closer look at the chart reveals that the most significant surge in the stock’s price commenced from the 2009 low of $12.58, reaching a peak in 2017 at $134.66. The second major rally began from the 2020 low of $47.37 and went to a record high of $332.08 in 2022.

This significant bottom in 2009 was primarily due to the global financial crisis that severely impacted various chemical industries. The situation led to reduced industrial activity, lower demand for specialty chemicals, and heightened economic uncertainty, negatively affecting Albemarle’s financial performance and investor confidence. However, the stock began a steady rally from this low point, reaching new highs by 2017. This upward trajectory was primarily driven by the company’s strategic focus on lithium, a critical component in batteries for electric vehicles and renewable energy storage systems. As global interest in EVs and renewable energy surged during this period, driven by environmental concerns and technological advancements, Albemarle capitalized on this growing market by expanding its lithium production capabilities. This strategic pivot positioned the company as a critical supplier in a rapidly expanding industry, significantly enhancing its financial performance and attractiveness to investors, reflected in its rising stock price.

ALB Monthly Chart (stockcharts.com)

The second strong price dip was observed in 2020 due to the global economic disruptions caused by the COVID-19 pandemic. This public health crisis led to widespread lockdowns, a slowdown in manufacturing activities, and a temporary decline in the automotive sector, directly impacting the demand for lithium in electric vehicle batteries. However, the stock rebounded and reached record highs in 2022, driven by a robust recovery in the electric vehicle market and a growing global emphasis on clean energy technologies. The formation of a solid bottom in 2020 coincided with an inverted head and shoulders pattern, where the head was identified at $47.37.

As countries and corporations intensified the focus on reducing carbon emissions, the demand for electric vehicles surged, subsequently increasing the demand for lithium. Albemarle benefited significantly from this trend. Additionally, the company’s strategic expansions and partnerships in the lithium market and favorable government policies towards electrification and renewable energy further fueled investor confidence, leading to a remarkable rise in its stock price, which hit record highs at $332.08 in 2022. The significant market volatility led to a pronounced correction in Albemarle’s stock, culminating in a low of $112 in November 2023, where the price began consolidating.

Notably, the substantial lows experienced in 2009 and 2020 have established a robust long-term trend line, depicted in red on the above monthly chart. This trend line suggests a solid support zone between $60 and $80, offering a potential bottom for long-term investors. The appearance of an inverted head and shoulders pattern in 2020, coupled with robust support along this trendline, indicates a bullish, solid price outlook for Albemarle.

Key Action for Investors

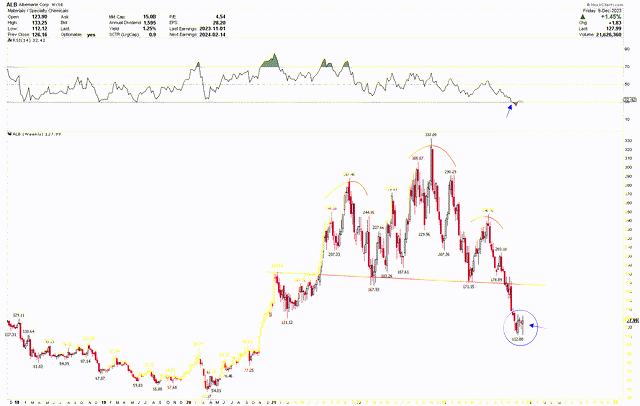

The weekly chart below presents a head and shoulders pattern, featuring the head at $332.08 and the shoulders at $287.45 and $246.90. This pattern typically suggested a bearish trend, which led to a rapid decline in price, reaching the November 2023 low of $112. However, the stabilization of the price at this level, highlighted by a bullish hammer candlestick pattern last week amid highly oversold conditions, suggests a potent recovery from these levels, aiming for a target of $170. The robust rebound in price from this level also indicates that the bearish trend, which began following the breakdown of the head and shoulders pattern, has been completed, and the price can start rallying from this point.

ALB Weekly Chart (stockcharts.com)

Given this solid support and the expected short-term price recovery, investors may consider buying Albemarle at the current price, with a strategy to increase their holdings if the price falls into the $60-$80 range.

Market Risk

Despite showing impressive growth in net sales, Albemarle Corporation faces significant fundamental risks primarily due to the volatility in the lithium market and rising raw material costs. The company’s net income decline due to fluctuating lithium prices and increased costs of spodumene indicates susceptibility to market dynamics that could impact future profitability. Although there is robust growth in the energy storage segment, the increasing costs of spodumene pose a challenge, potentially affecting the segment’s profitability.

From a technical perspective, Albemarle’s stock has experienced a correction, breaching the 61.8% Fibonacci retracement level. This movement suggests potential consolidation, reflecting investor uncertainty and market volatility. The historical analysis shows that the stock has been sensitive to macroeconomic events, such as the global financial crisis and the COVID-19 pandemic. Moreover, the weekly chart’s bearish head and shoulders pattern and the subsequent price decline highlight the stock’s volatility and the risk of further downturns toward the $60-$80 region. While there’s potential long-term support in the $60-$80 range, a monthly close below $60 will negate the bullish outlook and emerge negative price patterns.

Bottom Line

In conclusion, Albemarle’s Q3 2023 performance demonstrates a company adeptly handling a complex and dynamic business environment. Despite challenges like declining net income and volatile lithium market prices, Albemarle’s 10% increase in net sales signifies strong growth potential, especially in the energy storage sector. The company’s strategic investments and solid financial standing indicate resilience against market pressures. However, investors should be cautious, considering the stock’s recent bearish trends and sensitivity to market volatility.

From a technical standpoint, the stock’s weekly chart reveals a consolidation pattern, hinting at a robust rebound potential towards the $170 mark. Substantial long-term support is identified in the $60-$80 range. If the stock price surpasses the $172 threshold, it could signal a solid bottom formation, indicating potential for further upward movement. Consequently, investors may consider the current price levels as a suitable entry point for buying Albemarle stock, with the strategy to increase their holdings should the price fall into the $60-$80 range.

Read the full article here