The Fed is widely expected to hold rates steady at 5.5% this week. That being said, the combination of updated projections, messaging in the official decision statement, and Chairman Powell’s tone at the press conference all have important implications for markets heading into 2024.

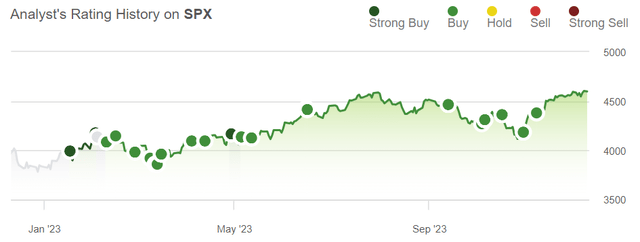

We’re still waiting for the November CPI due out on Tuesday ahead of the Wednesday event, but the backdrop here is for a sort of capstone on what has been a historic year where inflation fell sharply while the U.S. economy remained resilient. This is the “soft-landing” scenario playing out and a big reason the S&P 500 (SP500) is up more than 20% in 2023.

There is now a growing consensus that the Fed has room to cut in 2024, not because conditions are crashing and need the support, but because the CPI trending lower with anchored forward expectations can justify it. This week’s FOMC will be an opportunity for Powell to acknowledge this narrative consistent with the favorable data in recent months.

We expect the Fed will put those 2024 rate cuts on the table – but there’s also a good chance the pace and timing get dialed back compared to current market estimates. While this apparent hawkish twist might be perceived as a surprise or disappointment by some, we’re looking at the bigger picture in why stocks may rally anyway. We’ve been bullish and ultimately see stocks climbing through the year-end.

Seeking Alpha

The Fed Is Warming Up To Rate Cuts In 2024

A lot has changed in recent months, particularly going back to the Fed Meeting in September, when the economic projections package was last updated. The narrative at the time was some concern that inflation was re-accelerating and the potential need for further rate hikes in the cycle.

The major shift in the period since was propelled by a “goldilocks” October CPI report last month which surprised estimates to the downside and helped rebuild confidence that disinflation is ongoing. The selloff in oil prices, currently down -25% from its September high, has been one part of the story, but there are also encouraging trends in areas like goods and services along with stabilizing wage growth in the labor market.

Chicago Fed President Austan Goolsbee, a voting FOMC member and known as taking a more dovish stance, commented on these trends during a recent interview. Paraphrasing his words, inflation is coming down exactly how the Fed wanted it to. He believes inflation has more downside going forward with nothing to suggest the progress will stall at the current level.

The good news is that this line of thinking is likely shared by other Fed members who are warming up to ending the hiking cycle and taking the next step into cuts going forward. Simply put, if the CPI is trending under 3% over the next several months, a Fed Funds rate at 5.5% becomes unnecessary and even restrictive in terms of the real rate. The Fed cutting alongside lower inflation works to at least keep the “neutral rate” constant.

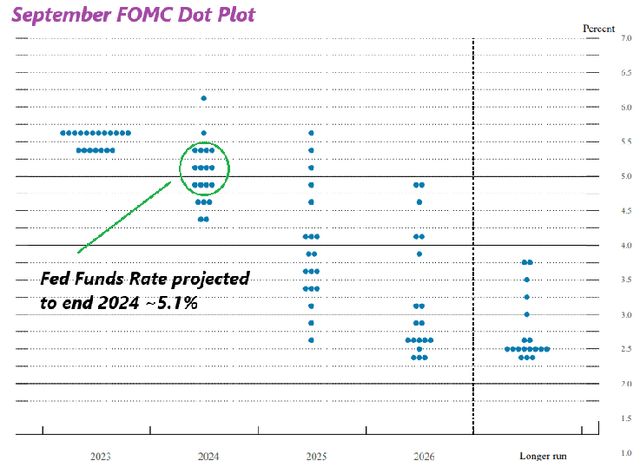

All Eyes On the Updated Fed Dot Plot

So we know that the new Dot Plot released at the December Fed Meeting will show some significant adjustments to the path the group expects interest rates will take. In September, the official estimate for the Fed Funds rate is that it would end 2024 year around 5.1%, representing one or two ~25bps cuts from the current level.

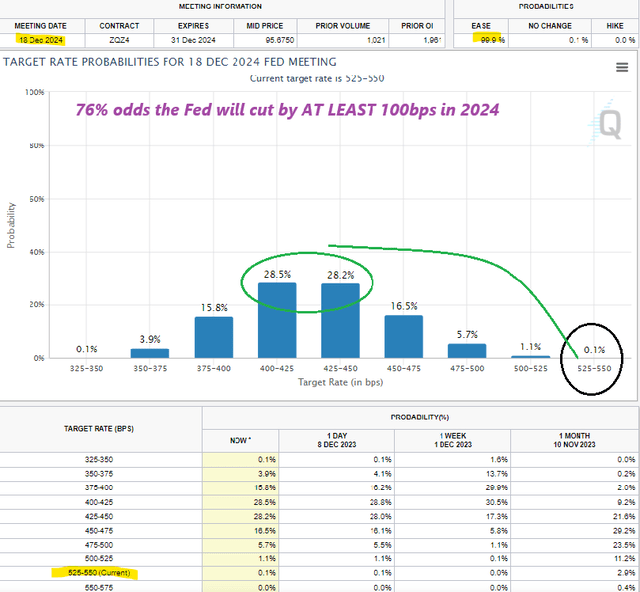

source: St. Louis Fed

Fast forward, the market has diverged sharply from there with the consensus now expecting the Fed Funds rate to end 2024 at 4.5% or lower, implying at least 100 bps of cuts or four or five 25bps over the next 12 months. According to the CME FedWatch Tool which extrapolates the market-implied probabilities based on interest rate futures pricing, there is a 57% chance the Fed Funds rate ends in 2024 between 4.5% and 4.25%.

So what we have at this upcoming Fed meeting is this showdown between an apparently aggressive pace of rate cuts through 2024 expected by “the market”, while the Fed thus far has been coy to even acknowledge that possibility.

source: CME FedWatch Tool

Size of 2024 Rate Cuts Should Not Matter

The insight we offer is that we’re not too concerned about where the updated Dot Plot ends up. What we think will happen is that the Fed will show a 2024 Fed Funds rate estimate at 4.6%, which was the figure from the June 2023 FOMC, implying three or four 25bps cuts.

As we see it, there are enough “hawkish-leaning” FOMC participants including Chairman Powell who will attempt to posture towards the uncertainty of how inflation will evolve through their interest rate projection. This follows the playbook the Fed has stuck to all year by erring on the side of caution and mostly downplaying favorable data. We’d say that direction stems from their effort to rebuild credibility on inflation going back to the policy mistakes in 2020 and 2021 on dealing with the initial wave of inflation.

The point we’re making here is that none of this should be a “problem” when it comes to the market, especially stocks. Just because the market is expecting 5 rate cuts in 2024, but the Fed ends up saying just 3 or 4 cuts, is not a reason for stocks to “crash” on Wednesday. Similarly, the timing of the initial rate cut whether it happens in March or June, in itself does not derail the bull market for stocks.

It’s fair to expect some volatility around the event with bonds making larger moves, but the real story will be some confirmation the possibility of the looming policy pivot is real. What’s more important is that inflation continues to trend lower and the economy remains resilient.

The Risk of An Extremely Dovish Fed

As it relates to this Fed meeting, the other argument we make is that extremely dovish messaging would be more concerning. While we view this as unlikely, if the Fed comes out on Wednesday, swinging for the fences and projecting +6 rate cuts in 2024, that would imply to us that the group sees some evidence of deteriorating underlying economic conditions- not good.

By this measure, a balanced approach in terms of the interest rate trajectory by a Fed that remains data-dependent stays consistent with the soft-landing baseline that is crucial for corporate earnings as the main driver of stock prices.

We want to see the Fed start cutting rates to ensure financial conditions do not become excessively tight, and not because they need to save the economy. The string of inflation-moving data over the next several months will dictate when the Fed will start cutting.

So to touch on what could go wrong at this FOMC, market bears need some evidence of a “hard landing”. Indications by the Fed this week that the group is becoming concerned about softening economic conditions or expects consumer spending to rapidly weaken into 2024 could mark the start of a deeper sustained selloff in the market. Comments by Powell raising questions about the stability of the financial system would also push the market lower.

Final Thoughts

With the December FOMC, anyone expecting the Fed to come in line with the market and match their interest rate forecasts is likely going to be disappointed, but this should not be seen as a surprise or shock to the market.

At this stage in the cycle, the market is more concerned about the Fed’s read on the economy and less about their inflation or interest rates forecast. Following some initial volatility around the event, we believe stocks will have a runway to rally based on the growing consensus that the Fed pivot is here.

The Fed has been hawkish all year, and there is every reason to believe they will continue to lean in the direction to keep all options open. Paring back expectations at the margin is standard fare and we don’t see it stopping stocks from continuing their upward momentum.

Read the full article here