A Quick Take On Hornbeck Offshore Services

Hornbeck Offshore Services, LLC (HOS) has filed to raise $100 million in an IPO of its common stock, according to an SEC S-1 registration statement.

The firm provides marine transportation services to clients in offshore oilfields and in other markets.

Hornbeck Offshore Services, LLC has produced strong top line revenue growth and is profitable.

I’ll provide an update when we learn more IPO details from management.

Hornbeck Overview

Covington, Louisiana-based Hornbeck Offshore Services, Inc. was founded to acquire, lease and operate a fleet of offshore supply vessels to transport people and supplies to offshore drilling rigs and other offshore, non-oilfield customers.

Management is headed by founder, president, Chairman and CEO Todd M. Hornbeck, who has been with the firm since its inception in 1997 and was previously Marketing Director – Gulf of Mexico for Tidewater and has served on the board of several marine industry associations.

The company’s coverage includes the following regions:

-

United States

-

Latin America.

As of September 30, 2023, Hornbeck has booked fair market value investment of $209 million from investors, including Ares Management affiliates, Whitebox affiliates, Highbridge affiliates and Merced affiliates.

Hornbeck Customer Acquisition

The firm markets its transportation services, 60 offshore supply vessels and 15 multi-purpose supply vessels, to offshore platforms and other non-oilfield systems (e.g., wind farms) via its direct sales, marketing and business development efforts.

The company’s multi-purpose supply vessels have the ability to be configured as “flotels,” housing up to 245 workers.

General and Administrative expenses as a percentage of total revenue have declined as revenues have increased, as the figures below indicate:

|

General and Administrative |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Nine Mos. Ended Sept. 30, 2023 |

11.1% |

|

2022 |

13.1% |

|

2021 |

15.9% |

(Source – SEC.)

The General and Administrative efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of General and Administrative expense, fell to 2.5x in the most recent reporting period, as shown in the table below:

|

General and Administrative |

Efficiency Rate |

|

Period |

Multiple |

|

Nine Mos. Ended Sept. 30, 2023 |

2.5 |

|

2022 |

3.3 |

(Source – SEC.)

Hornbeck’s Market & Competition

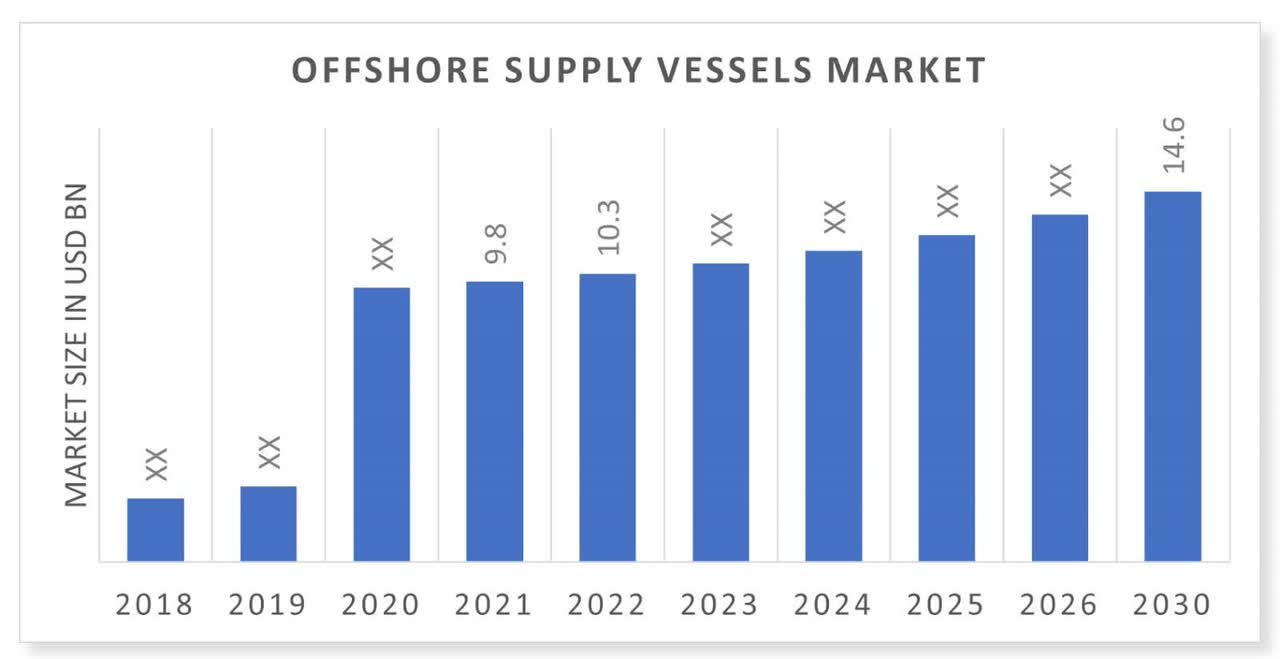

According to a 2022 market research report by Market Research Future, the global offshore supply vessels market (as a proxy for the growth of the related services industry) was an estimated $9.8 billion in 2021 and is forecasted to reach $14.6 billion in 2030.

This represents a forecast CAGR (Compound Annual Growth Rate) of 5.11% from 2022 to 2030.

The main drivers for this expected growth are an increase in demand for offshore vessel services from oil and gas platforms and from offshore wind farms.

The industry is also making technological improvements to its vessels, enabling service providers to enhance their service offerings to customers.

Also, the chart below shows the expected trajectory of the market through 2030:

Market Research Future

Major competitive or other industry participants include the following:

-

Tidewater

-

Edison Chouest Offshore

-

Harvey Gulf International Marine

-

Seacor Marine

-

Siem Offshore

-

Oceaneering International (OII)

-

Others.

Hornbeck Offshore Services, Inc. Financial Performance

The company’s recent financial results can be summarized as follows:

-

Growing top line revenue

-

Increasing operating profit

-

Higher cash flow from operations.

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Nine Mos. Ended Sept. 30, 2023 |

$438,588,000 |

37.8% |

|

2022 |

$451,226,000 |

76.1% |

|

2021 |

$256,300,000 |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Nine Mos. Ended Sept. 30, 2023 |

$115,504,000 |

26.3% |

|

2022 |

$165,059,000 |

36.6% |

|

2021 |

$53,773,000 |

21.0% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Nine Mos. Ended Sept. 30, 2023 |

$46,951,000 |

10.7% |

|

2022 |

$80,762,000 |

17.9% |

|

2021 |

$2,987,000 |

1.2% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Nine Mos. Ended Sept. 30, 2023 |

$114,714,000 |

|

|

2022 |

$112,967,000 |

|

|

2021 |

$49,611,000 |

|

|

(Glossary Of Terms.) |

(Source – SEC.)

As of September 30, 2023, Hornbeck had $146.3 million in cash and $590.0 million in total liabilities.

Free cash flow during the twelve months ending September 30, 2023, was $154.1 million.

Hornbeck Offshore Services, Inc. IPO Details

Hornbeck intends to raise $100 million in gross proceeds from an IPO of its common stock, although the final figure may differ.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Management says it will use the net proceeds from the IPO for general corporate purposes.

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, the firm has initiated legal proceedings against the Secretaria de Marina [SEMAR] Merchant marine regulator for its termination of the firm’s ability to use its Mexican-flagged vessels in Mexican coast-wise trade. The SEMAR action has been stayed while the firm pursues its claim against SEMAR.

The listed bookrunners of the IPO are J.P. Morgan, Barclays and a number of other investment banks.

Commentary About Hornbeck’s IPO

HOS is seeking U.S. public capital market funding for its general working capital needs and growth initiatives.

The firm’s financials have generated increasing topline revenue, higher operating profit and growing cash flow from operations.

Free cash flow for the twelve months ending September 30, 2023, was $154.1 million.

General and Administrative expenses as a percentage of total revenue have dropped as revenue has increased; its General and Administrative efficiency multiple has fallen to 2.5x in the most recent reporting period.

The firm currently plans to pay no dividends and retain any future earnings for reinvestment into the firm’s growth and working capital requirements.

HOS’ recent capital spending history indicates it has spent lightly on capital expenditures as a percentage of its operating cash flow.

The market opportunity for providing offshore transportation services is substantial and is expected to grow at a moderate rate of growth through 2030.

Risks to the company’s outlook as a public company include regulatory risks and market risks, as most of the firm’s revenue is a function of the amount of drilling activity offshore in the Gulf of Mexico.

Also, because the firm is subject to the Jones Act, at least 75% of the outstanding shares of each class of its stock must be owned and controlled by U.S. citizens.

When we learn more details about the Hornbeck Offshore Services IPO from management, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Read the full article here