Background

Welcome back to the second edition of Bank Buzz, where we cover the community bank sector, with a specific focus on mutual conversions, our favorite niche within a niche.

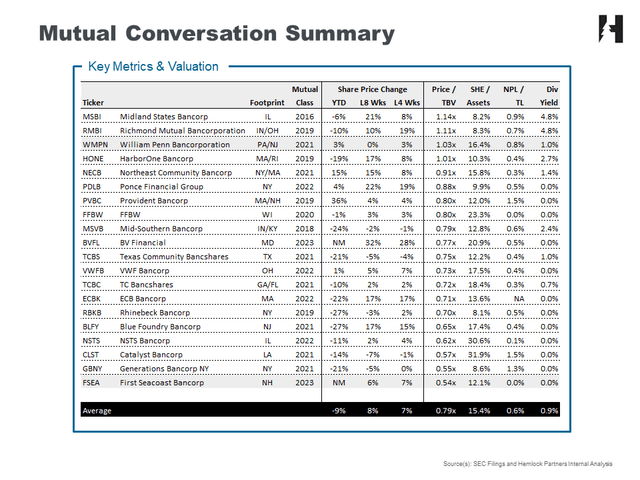

SEC Filings & Internal Analysis

Our strategy is to invest in banks trading below tangible book value (TBV) with overcapitalized balance sheets, solid asset quality, and shareholder-friendly management teams.

This combination typically leads to two catalysts, first accretive share repurchases and ultimately a sale to a larger institution.

Initiate a Share Repurchase Program

Our preferred converted banks hold excess equity and trade below TBV. Management can elect to use the balance sheet to drive loan growth and/or distribute a dividend. But, for shareholders, the best use for surplus equity is share repurchases.

And that’s what we are searching for, institutions with the means and the wisdom to buyback shares at pennies on the dollar.

However, there is a catch.

In this space, stock buybacks normally may not begin until the first anniversary of the conversion. So, we can attempt to predict before the press release who may launch a share repurchase program.

Here’s an example.

First Seacoast Bancorp (FSEA) is the holding company for First Seacoast Bank. Founded in 1890, the bank is headquartered in Dover, New Hampshire, and maintains four additional branch offices.

With approximately $550 million in assets, FSEA maintains an overcapitalized balance sheet (equity to assets of 12%) and attractive credit metrics. At $6.82 per share, the stock trades at only 54% of TBV.

Clearly, at these levels, a buyback plan would be accretive, but remains on hold for at least three more weeks. January 19 will mark the one-year anniversary of FSEA’s mutual to stock transition.

Although we cannot be sure a buyback will be announced, we, like many other shareholders, expect management to be prudent with our capital.

For FSEA, the near-term catalyst is the initiation of an aggressive share repurchase program.

Sell the Business

The second potential catalyst is a sale to another bank. As we illustrated previously, bank consolidation in the U.S. is a multi-decade trend that is expected to continue for the foreseeable future.

Even more important, within the mutual conversation niche, the odds improve. Roughly 70% of converted banks have been sold, usually at a nice premium to TBV.

Historically, the average thrift is acquired at 120%-140% of TBV. Investing below TBV and then waiting for a sale can lead to attractive returns.

As a reminder, demutualized banks must wait three years after the conversion date to sell the business. So, again, like our buyback monitoring, we can attempt to predict the most likely takeover candidates.

Here’s an example.

William Penn Bancorporation (WMPN), the holding company for William Penn Bank, serves the Delaware Valley via branches in Bucks County and Philadelphia, Pennsylvania, as well as Burlington and Camden Counties in New Jersey.

Management is excellent at capital allocation, using its overcapitalized balance sheet to pay a small dividend and execute a robust stock repurchase program.

Since March 2022, the company has repurchased over 30% of shares outstanding via six repurchase programs. Most importantly, the average purchase price per share of the first five programs is $11.50, below the 3Q reported TBV (~$12).

In about three months, March 2024, WMPN will be eligible to be acquired. For an acquirer, the bank offers a high-quality portfolio and an attractive footprint in the surrounding markets of Philadelphia.

Historically, the average thrift is acquired at 130% of TBV. To be conservative, we typically model an exit multiple of 120%.

Using this range and the TBV estimate of $12, we estimate an acquisition price of $14 to $16 per share or a roughly 25% return (prior to dividends) using the midpoint.

Wrap Up

Investing in banks below TBV, a proxy for liquidation value, with robust balance sheets and shareholder-friendly management teams has historically been a recipe for attractive returns.

It’s a niche worth exploring for patient small-cap investors.

In the next few months, the leadership teams at both FSEA and WMPN will have the ability to drive substantial shareholder value.

For FSEA, trading at 54% of TBV, the near-term catalyst is the initiation of an aggressive share repurchase program.

WMPN, which converted nearly three years ago, has levered a series of buyback programs to bolster the valuation. Now trading at TBV, a sale in 2024 would generate an incremental ~25% return and wrap up a well-managed mutual conversion lifecycle.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here