Stock Snapshot

For my very first coverage of a big pharma stock on Seeking Alpha, I’m picking a relatively under-covered one that has been around for a long time and has penetrated the pharma scene globally for a while now.

Some quick facts about Baxter International (NYSE:BAX) are that its roots go back to 1931 starting out as a producer of prepared IV solutions, was the company behind a commonly used surgical anesthetic called Sevoflurane, and more recently in 2019 launched a mobile app called myKidneyPlan to promote patient-centered education for kidney disease.

Its most recent earnings release was on November 2nd, and some of that data will be used in today’s note.

Scoring Matrix

This article uses a 9-point scoring matrix that holistically considers multiple angles of the stock, with an emphasis on cashflow potential for investors and fundamental trends from the key accounting statements publicly available such as the balance sheet and income statements, as well as a future-looking outlook on this stock.

Today’s Rating

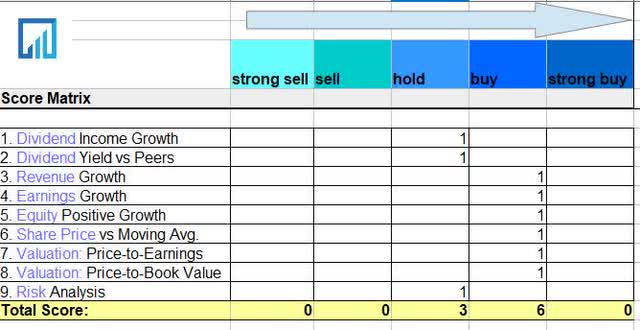

Baxter – score matrix (author analysis)

Based on the score total in the score matrix above, this stock is getting a rating of buy.

Compare to the consensus rating on Seeking Alpha today, I am siding with the consensus from SA analysts and Wall Street who are both bullish.

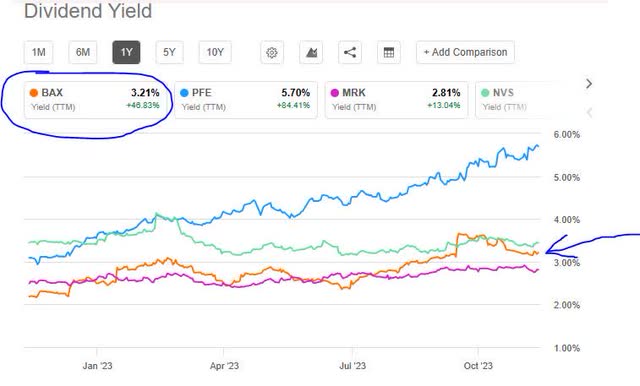

Baxter – rating consensus (Seeking Alpha)

Dividend Income Growth

This section uses dividend growth data to explores the 10 year dividend income growth for a hypothetical investor owning 100 shares, to determine whether this stock is a great dividend income opportunity.

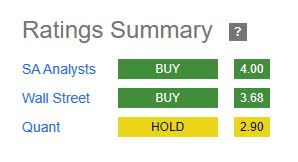

Baxter – dividend growth (Seeking Alpha)

As an exercise, I am looking at the above dividend growth chart as a dividend-oriented investor who bought a hypothetical 100 shares in 2013. With an annual dividend of $1.04/share that year, I would have seen $104 in dividend income that year. Fast forward to 2022 and the annual dividend is slightly higher at $1.15/share, for a dividend income of $115. That is a growth of just around 11% in 10 years.

If that growth rate were to continue (which is not certain), and we extrapolate to 2032, we can expect an annual dividend of $1.28/share at that time ($128 dividend income), or a 23% growth since 2013.

For this reason, in this category I would call it more of a hold than a buy, as it has proven 10 year dividend growth but 11% over a decade is not anything exceptional.

Dividend Yield vs Peers

This section uses dividend yield data to compare the trailing dividend yield vs 3 similar peers in the same sector, to determine if this stock presents the most competitive dividend yield on capital invested.

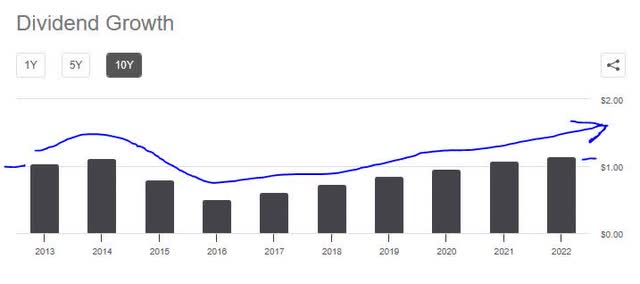

Baxter – dividend yield vs peers (Seeking Alpha)

In the above chart study, I compared my focus stock Baxter with three large pharma peers that also trade on the NYSE, to see who has the best trailing dividend yield. Of these four peers, big pharma giant Pfizer (PFE) is showing a yield of 5.70% and wins in this peer group, while Merck (MRK) is at the bottom of the pile and Baxter is third place at 3.21% yield (same as its forward yield).

I will call it a hold in this category, since it has a decent +3% yield but if I was a new buyer I would like to snag the +5% yield from Pfizer stock in this case to maximize return on capital invested. Consider that Pfizer is trading at a lower share price than Baxter and has a higher dividend payout at $0.41/share.

Revenue Growth

This section explores this company’s revenue growth trends over the last year, using data from the income statement.

Looking at top-line revenue data, we can see that in the quarter ending September the firm saw $3.7B in total revenue, vs $3.6B in Sept 2022, a 2.7% YoY growth. In addition, in looking at the year’s trend, the top-line numbers in all of the last 3 quarters were lower than in Dec 2022.

Here were some of the revenue drivers in the last quarter according to their earnings comments:

driven by new product launches in Pharmaceuticals, solid demand for Medical Products & Therapies products, and continued improvement in product availability in Healthcare Systems & Technologies. Sales performance in Kidney Care came in better than the company’s expectations..

Another notable mention was growth in the acute therapies segment by 12%. Here is what their comments said on that category:

Sales growth across all regions and reflects a more stabilized environment for this business following significant heightened demand during the pandemic.

Looking forward, because of their highly diversified portfolio which includes products that may be successful while others are not, I can base my positive sentiment on the company’s own FY23 outlook which expects a very small but positive sales growth this year:

Baxter – FY23 guidance (company quarterly results)

For this reason, in this category I will call the stock a buy rather than a strong buy, on the basis of past and expected positive top-line growth but not anything really exceptional.

In addition, consider the piling up of multiple headwinds expected for pharma in 2024, according to a late-November article in Forbes:

The pharmaceutical landscape is more volatile than ever before, as regulatory requirements increase the cost and time required to develop new products, payers globally clamp down on new products, physician clout diminishes, and public distrust of the industry and government scrutiny reaches new highs.

Earnings Growth

This section explores this company’s earnings (net income) growth trends over the last year, using data from the income statement.

From the data available, we can see that $2.5B in earnings was achieved in the recent quarter vs a net loss of ($2.93B) in Sept 2022, a +$5.4B YoY improvement, or over +180%.

The positive earnings trend also can be seen in each of the last 4 quarters who were all better than Sept 2022. In addition, this last quarter was better than any of the last 8 ones.

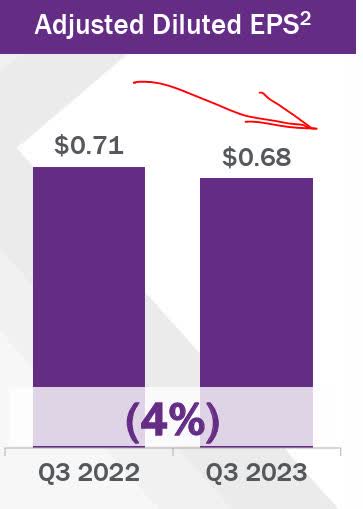

However, it should also be noted that the adjusted diluted earnings-per-share saw a 4% YoY decline:

Baxter – adjusted EPS (company results)

On the interest side, the company saw interest expense jump to $128MM this September, vs $104MM in Sept 2022, a 23% increase.

As a percent of sales, adjusted research and development (R&D) expense was 4.3% in September vs 4.1%, going up +20bps.

In this category I will call this stock a buy rather than a strong buy, on the basis of positive earnings growth trends, offset by the slight drop in earnings per share.

I expect earnings to be sustainable for the rest of the year due the prior outlook I already talked about, with the company projected a positive EPS for FY23.

Equity Positive Growth

This section explores this company’s equity (book value) growth trends over the last year, using data from the balance sheet.

The data tells us that total equity grew nicely to $8.16B in September, vs $5.57B in Sept 2022, a 46% YoY growth. In addition, in looking at the longer trend, all of the last 4 quarters saw an equity improvement vs Sept 2022.

A positive item to note that impacts book value is the decline in long-term debt to $14.06B vs $16.15B in Sept 2022, a 13% YoY decline in debt.

One item that will drive down the debt is cash from a recent divestiture they company did. According to their Q3 presentation:

Baxter is deploying substantially all of the estimated net after-tax cash proceeds of approximately $3.7 billion to pay down debt in accordance with the company’s stated capital allocation priorities.

In addition to the $350M of term loan paid down through Q3, $1.7B of incremental debt paydown expected to occur during Q4 2023.

So, in this category I will call this stock a buy, on the basis of declining debt and rising equity/book value, which I think is sustainable going forward as the company has already committed to debt paydown.

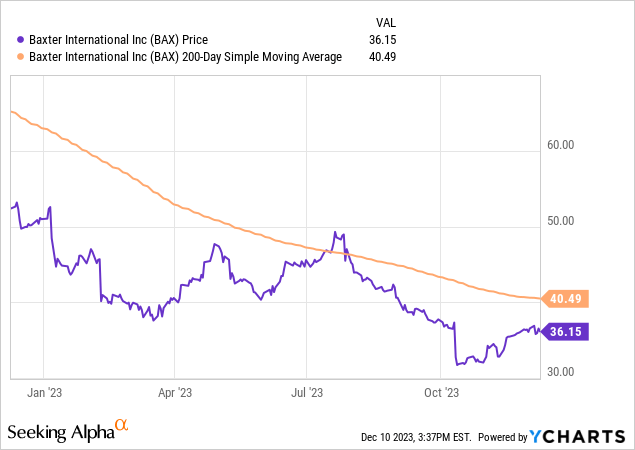

Share Price vs Moving Average

This section explores the current share price compared to the 200-day simple moving average, to decide if it currently presents a buy, hold, or sell opportunity.

As of Friday’s market close, the share price of $36.15 is around 10.7% below the 200-day simple moving average (orange line). In addition, it has been trading below that moving average ever since this summer.

I will call this a buy in this category on the basis of the share price trending well below average while revenue and earnings growth, as well as equity growth, have increased. In addition, it is an opportunity to grab a +3% dividend yield right now.

Valuation: Price-to-Earnings

This section uses valuation data to explore the forward P/E ratio and whether it presents an undervalued opportunity.

What this data point tells us is a forward P/E valuation of 24.80, around 9% below the sector average.

I think what is driving this nearly 25x multiple is not so much a spike in the share price (since it remains below the 200-day average) but rather that the earnings have been relatively low up until Q3 results when they improved.

Because the P/E multiple has dropped below the sector average, and earnings are on the improving trend while the share price is still in bearish territory, I would call this multiple justified and give it a buy in this category.

Valuation: Price-to-Book Value

This section uses valuation data to explore the forward P/B ratio and whether it presents an undervalued opportunity.

This data point tells us that the forward P/B ratio of 2.15 is +13% below the sector average.

Tying this back to the equity data and share price chart, I think the driver of this valuation multiple is the bearish share price trend combined with rising equity/book value which has been climbing.

For this reason, I will call it justified at just over 2x book value and consider it a buy opportunity, on the basis of the multiple falling below average as well as the share price while book value has been improving.

Risk Analysis

This section identifies a key risk to consider about this company and what its probability and impact could be to the business.

A key risk I identified is a story in Business Insider this week on Dec. 7th that could impact this company as well as its big pharma peers.

According to the story,

The Biden administration is putting pharmaceutical companies on notice, warning them that if the price of certain drugs is too high, the government might cancel their patent protection and allow rivals to make their own versions.

Further, a recent story in Bloomberg pointed to other regulatory headaches for big pharma as the current Federal Trade Commission seeks to increase litigation against mergers in the industry.

According to the article:

The proposed changes to pre-merger notification rules reject the established Hart-Scott-Rodino Act standards and would generate more than $2 billion in new costs for businesses.

So, both situations could set up a significant downside risk for a big pharma stock like Baxter, in my opinion.

However, this pertains only to US regulations, and keep in mind that Baxter isa global big pharma company with business reach in a few dozen countries worldwide.

In this category, I would call it a hold since I do think the US regulatory environment going forward will have a business impact but some of that will be offset by its global business portfolio outside the US regulatory scope.

Quick Summary

To summarize, I am bullish on this stock in today’s note as it is trading well below its moving average while also showing growth in revenue, earnings, and book value. At the same time, it is a modest +3% dividend yield opportunity to snatch up, and gain some exposure in our portfolio to the pharma industry.

The regulatory risk approaching in the US, as well as lackluster dividend growth in the last 10 years, were a few offsetting factors that were discussed.

Read the full article here