Co-authored by Treading Softly

It seems that we cannot turn around these days without running into another cinematic universe. Marvel made it popular with their superhero movies being exceptionally popular and highly successful, weaving multiple movies into one universe of thought.

DC Comics has been less successful. They’ve consistently tried to make a set universe and, time and time again, have had to collapse that universe in on itself – it seems that there is more “multiverse of madness” going on over at DC than Marvel has ever had. Lately, Disney has joined the “fun” with their latest movie, Wish, trying to mix and match a bunch of their different movies and themes together into one cohesive whole instead of hinting at it as they did within Frozen.

When it comes to investing, there’s another world of madness that investors seem to struggle to understand the nuances and varieties of. To many, it just seems like a section of the market that is meant for pure craziness. What is this mad area? It would be the mortgage real estate investment trust section of the REIT sector. Many can’t wrap their heads around commercial or residential, agency or non-agency, mortgage servicing rights or owning the loans directly, leverage, book value, and shorting Treasury notes – so many different parts are at play, and so many times investors simply blanket the entire sector as uninvestable, but these massive characterizations rarely bear out the true story. As a professional income investor for decades, I have found that doing the extra leg work can provide gems of truth and outstanding income flows. Mortgage REITs can be a source to produce spectacular cash flows for your portfolio.

Let’s take a look at one portion of this sector once again to understand and see how we can get massive levels of income from it.

Let’s dive in!

MREIT Madness!

AGNC Investment Corp. (NASDAQ:AGNC), yielding 16%, is a mortgage REIT that primarily invests in “agency MBS”. These are mortgage-backed securities that hold mortgages that are guaranteed by the agencies: Fannie Mae and Freddie Mac. If a borrower defaults, the agency will buy the mortgages back at par. As a result, agency MBS is generally recognized as an asset that has no credit risk. The pricing of agency MBS tends to correlate strongly with the pricing of U.S. Treasuries, and institutional buyers like banks will frequently consider agency MBS an alternative to U.S. Treasuries.

Being free from credit risk does not mean risk-free. Nor does it mean that the price doesn’t change. Indeed, the price of U.S. Treasuries is dramatically lower today than they were in 2016, and so are the prices of agency MBS. I hear from many investors who use this as a reason not to buy AGNC. “Look at the price!” they cry, “MBS are headed for zero!”, which is about as ridiculous as declaring that U.S. Treasuries are headed for zero. Prices are lower, and to me, that is a reason to buy.

Let’s do a side-by-side comparison of AGNC in Q1 2016, and AGNC as of Q3 2023.

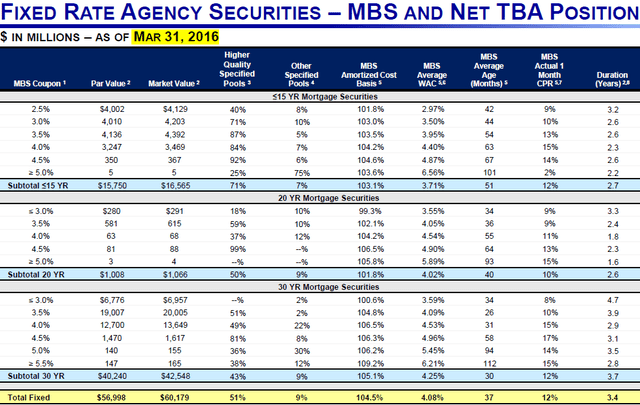

Here is AGNC’s portfolio in Q1 2016: Source

AGNC Q1 2016 Supplement

Note that on the bottom line, AGNC owned $56.998 billion in par value, with a weighted average coupon of 4.08%. Yet that was valued at $60.179 billion. Since no mortgage is ever going to pay more than par value, that is $3.181 billion being reported in book value that had absolutely zero percent chance of ever becoming cash. About $9.51/common share.

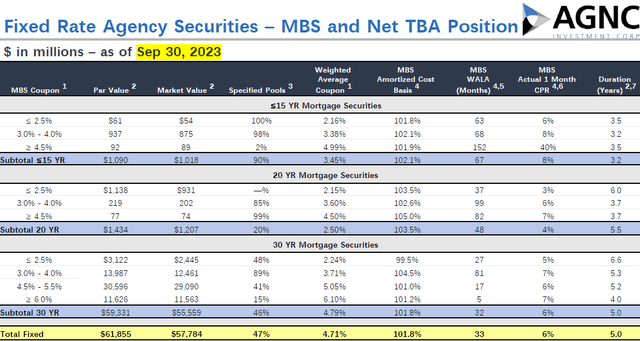

Here is the same slide from Q3 2023: Source

AGNC Q3 2023 Supplement

Today, AGNC owns $61.855 billion in par value, paying an average coupon of 4.71%, which is being carried at $57.784 billion for the purposes of calculating book value. That is a $4.071 billion or $6.54/share difference between market value and par value.

Which would you rather buy, a portfolio that is priced at $22.09, with assets that were guaranteed to decline $9.51 when they repay, or a portfolio that is priced at $8.08 and holds assets that have a $6.54 built-in increase when assets repay at par?

There are people who will point out that the former was a poor deal, and claim that is evidence that the latter is a bad deal.

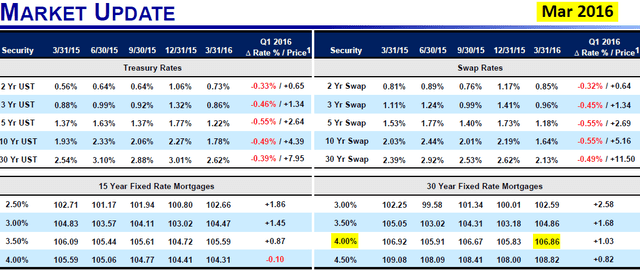

Now let’s look at the pricing of MBS in 2016 vs. today. The 4% coupon, which was close to AGNC’s average in 2016, was priced at $106.86. Par is always $100, so it was trading at a 6.86% premium to par.

AGNC Q1 2016 Supplement

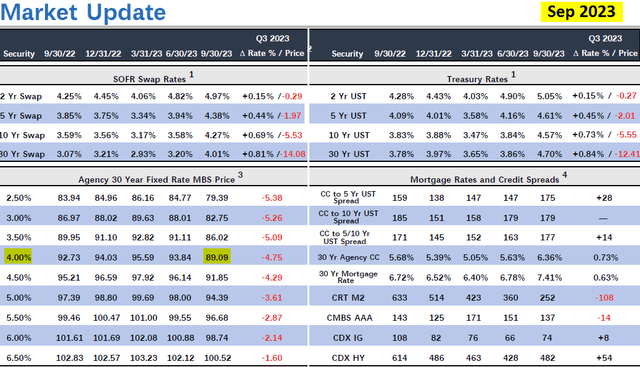

If we look at today’s pricing chart, things are very different:

AGNC Q3 2023 Supplement

The 4% coupon is currently trading at $89.09. From a 6%+ premium to a 10%+ discount to par.

Why did AGNC’s book value decline from $22.09 to $8.08? There is your answer. The price of MBS has fallen about 17%, and AGNC is a leveraged investment in agency MBS.

Another item to note is that, in 2016, the “production coupon”, which is the coupon for new MBS being created, was 3%, below the coupon for most of their portfolio. This means that as 4% MBS was repaid, AGNC realized a loss as an asset valued at $106.86 paid $100 in cash, plus that $100 in principal was then reinvested into an asset with a 3% coupon. So instead of having a $106.86 asset paying $4/year in interest, AGNC would have a $100 asset paying $3 a year.

Today, if a 4% coupon MBS prepays, AGNC has something valued at $89.09 that would become $100 in cash and be reinvested in a 6.5% coupon for $100. So instead of having an asset valued at $89.09, paying $4/year, AGNC would have an asset valued at $100, paying $6.50/year without any external capital.

Which portfolio would you rather own?

Now, let’s talk about cash flow. In Q1 2016, AGNC had a portfolio with a book value of $22.09, and it produced $0.52/share in net spread and dollar roll income in the most recent quarter, and $2.17 in the trailing 12 months. In Q3 2023, AGNC had a portfolio with a book value of $8.08, which produced $0.65 in net spread and dollar roll income in the most recent quarter, and $2.76 the trailing 12 months.

Would you rather pay $20+ dollars for a portfolio generating $2.17/share in earnings or under $10 for a portfolio generating $2.76/share?

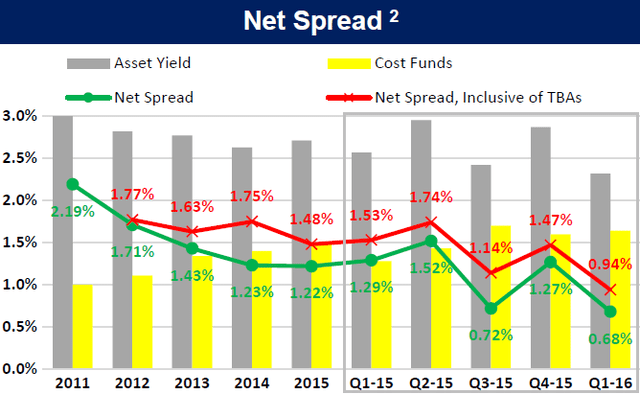

AGNC Q1 2016 Supplement

In 2016, AGNC was facing a situation where their asset yield was declining. See my above discussion about how MBS being paid off could only be reinvested in MBS at a much lower coupon or, as AGNC opted to do, buyback shares; from Q1 2015 to Q1 2016, AGNC bought back 18.4 million shares. Even as asset values declined, the cost of funds gradually drifted up. As a result, the net spread decreased from 2.19% in 2011 to 0.68% in 2016.

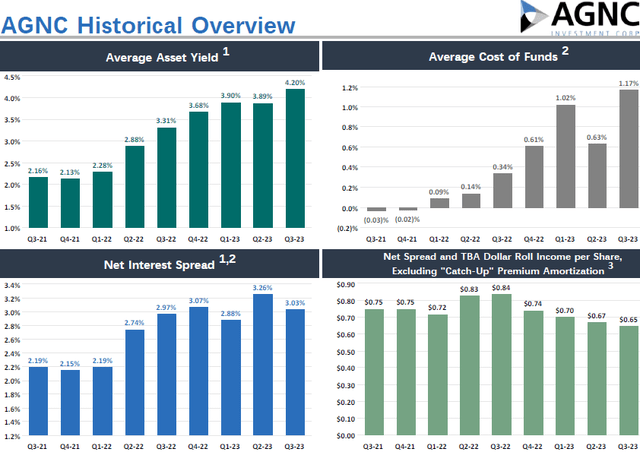

Today, AGNC’s average asset yield is trending up, and their cost of funds are as well, but not as fast. As a result, the net interest spreads are at the 3% level, which we haven’t seen since 2009:

AGNC Q3 2023 Supplement

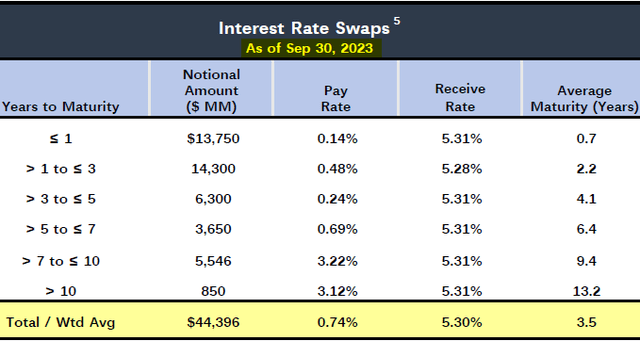

AGNC’s cost of funds will likely continue to rise, but the asset yield has lots of room to keep rising toward the 6.5% current coupon. Meanwhile, the rise in interest rates is being slowed down by their interest rate swaps:

AGNC Q3 2023 Supplement

$13.7 billion will mature in the next year, which represents 30% of AGNC’s swaps. The other 70% provides an ample runway for AGNC to rotate its portfolio into higher coupons.

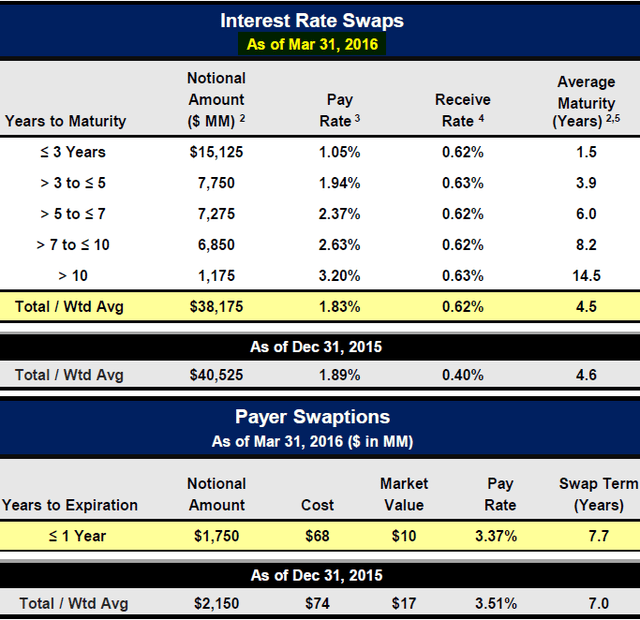

What did the hedge book look like in 2016? AGNC was paying above-market interest rates to protect itself from interest rate hikes that we now know came slowly and weren’t in the money until 2018:

AGNC Q1 2016 Supplement

The economy is not static. When you invest in a company like a mortgage REIT, BDC, CEF, or other “RIC” (regulated investment corporation), they are taking your capital and implementing a certain investment strategy. The results are then passed along to you as dividends. Anyone who has managed their own portfolio knows that from year to year, their results can vary greatly. I wasn’t a buyer of AGNC in 2016, but I am an enthusiastic buyer today.

When you compare the two portfolios side by side, and the respective price you will pay to gain the performance from those portfolios, it is obvious to me that one is materially better and has a significantly better outlook than the other.

I’ll admit that I was a buyer of AGNC in mid/late 2019, which, in 20/20 hindsight, was a bit early. I’ve been collecting my income and using a portion of it to reinvest and buy more shares. Can AGNC’s portfolio decline in price even more? It’s possible. Then again, with most expecting the Fed to be done hiking, maybe the bottom is in. Fortunately, you don’t need to peg the exact bottom to do very well in the market.

AGNC is the same company it was in 2016, but it is far from the same investment. So when the Chicken Littles break out their charts and cry OMG THE PRICE IS FALLING, I don’t panic. I look at the portfolio, and I like what I see; I love the outlook for potential capital gains, and especially for the income.

Conclusion

AGNC is a frequently misunderstood investment that provides massive levels of income today and has done so for decades. I do not rely on charts alone or future outlooks alone when investing; I take a holistic approach.

I am collecting cash income that rings in at double-digit yields annually. I am able to reinvest my excess income into AGNC or other outstanding opportunities presented to me by the market.

When it comes to retirement, you can enjoy a recurring strong monthly income. Something you need to meet the expenses of life head-on. I don’t want your retirement to be clouded by a confusing mess of trying to time the market or picking which hobbies to pursue. Instead, embrace the market’s confusion and misunderstanding so you can enjoy a retirement that puzzles so many others. Leave them asking: “How can they afford to do that?” or “How can I have a retirement like that?”

The answer? Our Income Method can help you and them achieve it.

That’s the beauty of my Income Method. That’s the beauty of income investing.

Read the full article here