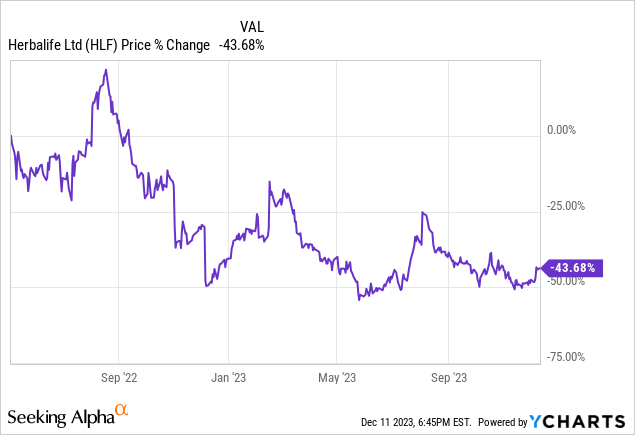

Herbalife Ltd. (NYSE:HLF) is an interesting business especially between the accusations, the Ackman-iCahn rift, regulatory fines, management changes, etc. For myself, my calls on Herbalife have been based more on the company’s underlying business performance, products, investment strategy, and valuation. Between 2017 and 2018, I was bearish, with the company’s enterprise value trending between $6 billion to $9 billion. Then shifted neutral at a $6 billion valuation and turned bullish around $5 billion by early 2022. Historically, the business has generated about $400+ million in free cash flow and the business was steadily growing sales during the COVID environment. However, I quickly sold in the following weeks in May 2022 after management cut their sales and EPS guidance. Although I was disappointed in taking a rapid 10% loss between April and May 2022, abandoning my bullish position turned out to be the right one, as shares subsequently plunged another 44%.

Perhaps the most interesting event for Herbalife was hiring Michael Johnson for the CEO position to lead the company on Dec. 27, 2022. Mr. Johnson has been arguably the most important driving force for the company, who “quadrupled sales and expanded its operations around the world from 58 to 95 markets.“

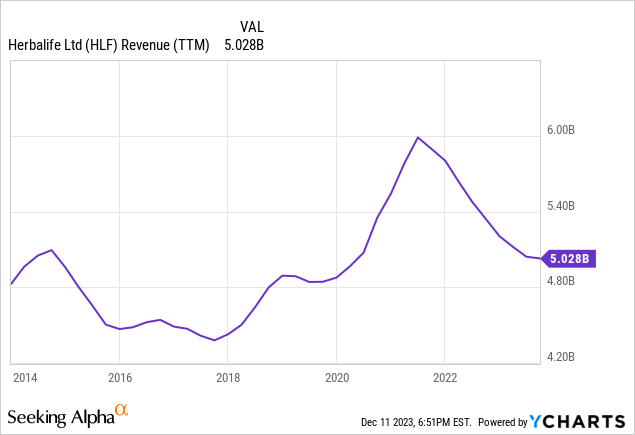

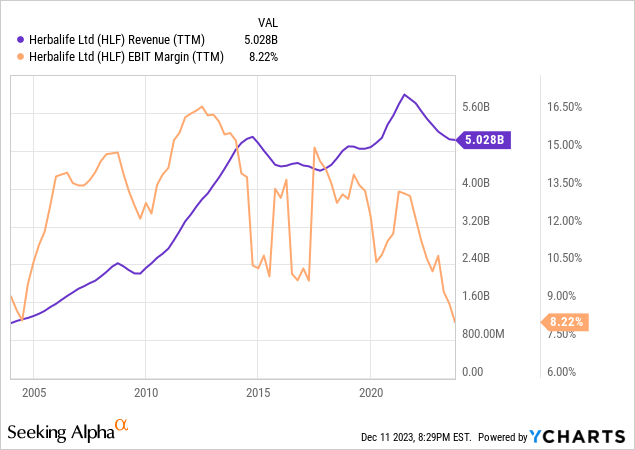

The question is whether he can move the company in the right direction again, as sales have slumped from their high watermark of $6 billion down to $5 billion today. Sales are not terrible relative to historical levels, thereabout pre-pandemic levels, but the trend indicates waning momentum.

For the three months and nine months ended September 30, 2023, volume points were down 11% and 5.6% worldwide, respectively. Overall quite anemic, albeit improving on a quarter-over-quarter basis. Based on the Q3 2023 earnings presentation, reported sales only declined by 1.1% thanks to a significant aggregate price increase of 6.3%. However, Herbalife’s gross margin and operating deleveraging (i.e. fixed costs as a percentage of the total cost structure) are seriously pressuring margins. For example, in prior downturns of 2008-2009 and 2015-2018, EBIT margins continually vacillated in the double digits, but have just fallen to 8.2% in 2023.

Management outlined in the Q3 2023 earnings call that raw material and manufacturing overhead costs were the primary issues: “Adjusted EBITDA margin benefited by approximately 190 basis points from the pricing increases we have implemented over the past year. However, higher raw material costs and manufacturing overhead costs continue to impact our results, which drove an approximate 290 basis point margin headwind versus Q3 of ’22.“

Sales have done relatively well up until 2023, but now Herbalife is increasing prices as volumes are falling, principally to offset inflationary cost pressures. I think for the nutritional product space where there’s tons of competition and customers are price sensitive, ongoing price increases into declining volumes is a risky strategy. However, management also mentioned that Q4 will return to net sales growth, in part driven by new product rollouts. This, combined with stabilization in their active sales leaders from 459K to 467K, has helped buoy sales volumes.

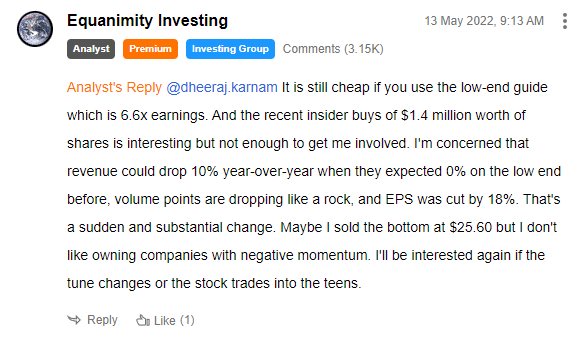

Turning to valuation. In my previous article, I mentioned I would only be interested in the stock if “the tune changes or the stock trades into the teens.”

Herbalife Article Comment (Author)

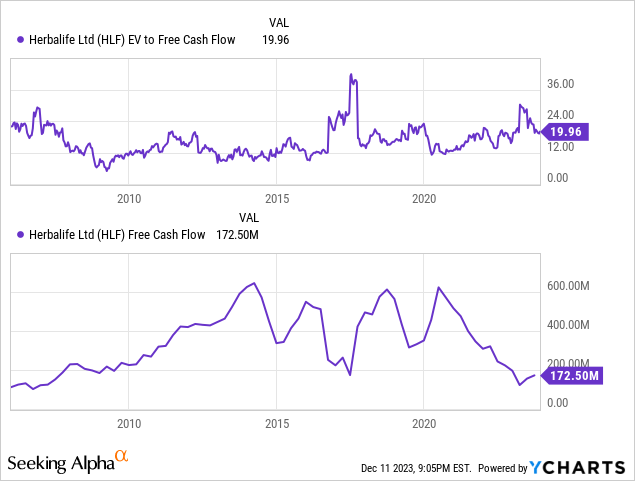

What’s interesting is that Herbalife’s enterprise value is now at its “cheapest” level since 2010. However, this time its operating income has collapsed and the total net debt outstanding is about $2 billion. So inherently, there’s more risk within the capital structure, which I personally would require a wider discount. Clearly at the current annualized FCF of $173 million, or an EV/FCF of 20x, the stock is not very compelling.

Either the stars need to align so FCF can revert back to its historical $400 million level, or the stock needs to decline further before I’d consider accumulating shares. We can argue that the business has more stability with Michael Johnson at the helm, yet I don’t like anchoring the validity of an investment thesis on one individual. For those reasons, I’m not interested in owning shares of Herbalife today. Thanks for reading and please comment below.

Read the full article here