The last time I wrote about Orchid Island Capital (NYSE:ORC) was in July and it was titled Orchid Island Capital: Looks Like A Yield Trap. Since then the stock has been down another 20% and the stock still looks like a bad investment despite getting cheaper.

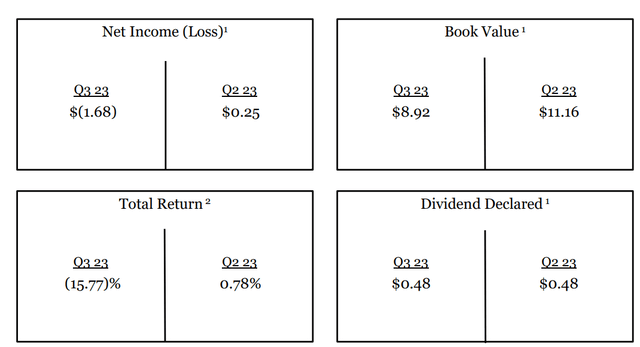

Last quarter the company announced pretty poor results that missed even the low end of estimates. It reported a pretty sizeable loss of $1.68 per share and its book value per share dropped drastically from $11.16 to $8.92. The company’s total return margin was negative -16%. Interestingly enough, it still didn’t cut dividends despite suffering a large loss and a big drop in its book value.

Q3 Results (Orchid Island Capital)

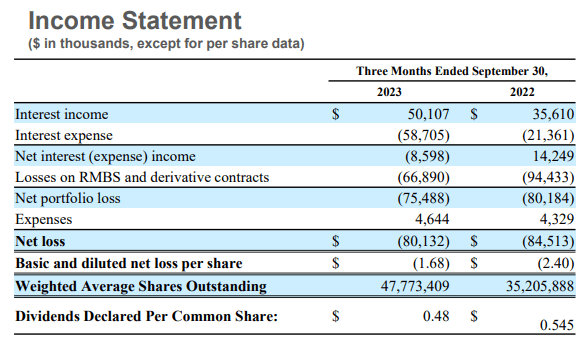

To make things worse, the company’s leverage ratio increased from 8.1 to 8.5 and its liquidity level dropped from 41.6% to 35.1%, showing signs that it may be doubling down on its bets. Even though most of the company’s losses came from RMBS and derivative contracts (such as SWAPs) due to interest rates changing ($67 million out of a total net loss of $80 million to be exact), the company still lost money on interest spreads. It made a total of $50 million on interest income while losing $59 million on interest expense so it was paying more on its borrowings than it was receiving from its holdings. In other words, the company’s main business was losing money.

Income Statement (Orchid Island Capital)

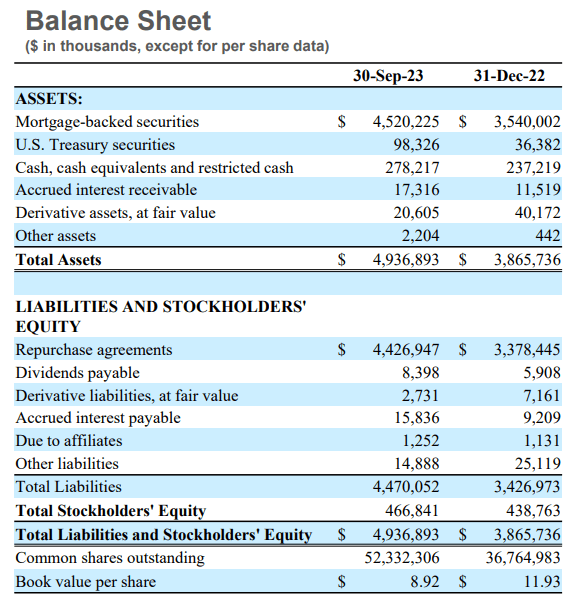

Earlier this year (in March) the company entered into an agreement of equity distribution which allowed it to sell up to $250 million worth of shares of the ORC stock to raise cash at a future date. As of last quarter, the company already used up $130 million of this vehicle and collected about $128 after commissions and fees. There were several effects of this on the company’s balance sheet. First, it added about $1 billion to its balance sheet both in assets and liabilities. How? Because, as I mentioned above, the company has a leverage ratio of 8.5 so it can sell $130 million worth of stock to add about $1 billion to its assets but this would also add an almost equal amount to its liabilities because it’s borrowing most of the money. Interestingly enough, the company’s book value per share dropped from $11.93 to $8.92 because its share count jumped significantly and this created further dilution for investors which is almost never good. So the company boosted its leverage and took on more risk at the expense of its investors.

Balance Sheet (Orchid Island Capital)

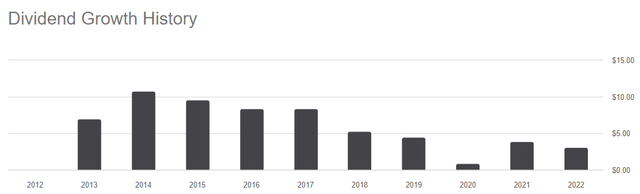

Sooner or later they will have to cut the dividends again and this is not something investors of this company are unfamiliar with. Between 2014 and 2022, ORC cut its dividends from $10.80 per share (annualized) to $3.12 per share (annualized) which represents a drop of 71%. This is not even accounting for inflation. We are just looking at nominal terms here. The funny thing is that the current dividend is not very sustainable either so it will have to be cut further and further.

Dividend History (Seeking Alpha)

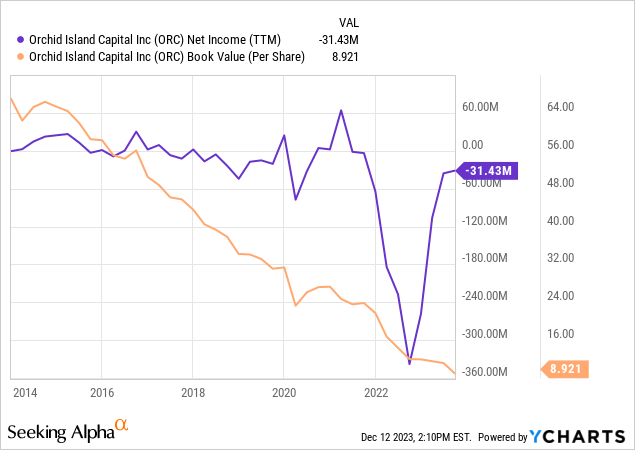

Many people say that it was the sharp unprecedented speed of rate hikes that ruined this company’s earnings in the last year or so. I will admit that rate hikes made things a lot worse for the company and it would probably benefit if rates were to drop significantly from here but that alone doesn’t explain the whole story. For example, during the period between 2014 and 2021, the company’s book value per share dropped from $64 to $24 even though we mostly enjoyed a low-rate environment. Back then people were blaming the low rates for its poor performance and saying that this company would actually benefit from higher rates (since it earns money from interest payments) but this turned out not to be true. Things just went from bad to worse when interest rates rapidly rose.

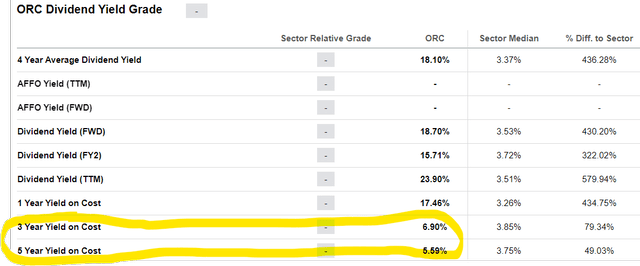

The company’s current dividend yield of 18% looks very impressive but look at the company’s 3-year yield on cost and 5-year yield on cost. If you bought the stock 3 years ago, your yield on cost would be only 6.9% and if you bought 5 years ago your yield on cost would have been 5.59% even though it had a yield of 15-20% at the time. Since the company’s book value and dividend payments are on a constant decline, your yield on cost will also keep declining from year to year. You could possibly slow down some of this decline by reinvesting your dividends but even that won’t do much in terms of recovering all your losses. Here is the funny thing. If you bought ORC 10 years ago, your yield on cost would be only 2% even though its original yield was more than 10% back then.

Dividend Yield (Seeking Alpha)

Many times I see people investing in high-yield traps saying that they don’t care about things like share price, NAV, book value, total return…etc., as long as they keep collecting those dividend checks because they are only in it for the income generation but sooner or later they learn their lesson hard way because sooner or later distributions also follow the NAV, book value or share price and get a cut if not multiple cuts.

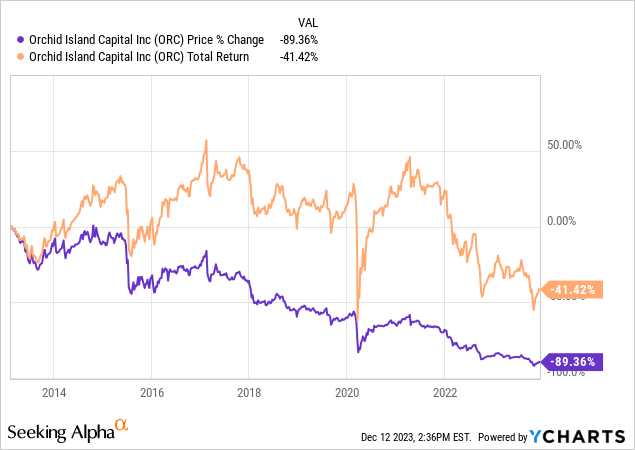

As much as ORC goes, it generated a share price return of -89% and a total return of -41% in the last decade. During this time we enjoyed low interest rates, rising interest rates, and the Fed doing QE as well as QT, so we saw different scenarios play out and this stock lost in most of those environments except for a brief period from March 2020 to 2021 where it outperformed for a bit but it didn’t last long. That’s why it’s difficult to blame this stock’s underperformance on the environment. It looks like the company’s business simply isn’t working out for wealth generation.

If we had an environment like March 2020 where the Fed suddenly cut rates to 0% and launched another massive quantitative easing, this stock could start outperforming again but it would only last for a brief period of time. Also, what are the chances that the Fed will actually do that? Sure, the Fed could cut rates in the next 2-3 years but they are not going to cut it from 5.5% to 0% unless something is going terribly wrong. Unless you are expecting another pandemic-driven global shutdown, I wouldn’t bet on it.

There are much better investment opportunities out there with much better returns. There is no reason to buy a stock just because it currently yields 18% when you will lose more than that in your principal. Remember, if something appears too good to be true, it probably is.

Read the full article here