Renowned billionaire investor Peter Lynch has offered a contrarian perspective on where he thinks the best places to invest money are, despite the strong performance of mega-cap companies in the stock market this year. In this article, we examine Lynch’s reasoning and compare the iShares Russell 2000 ETF (NYSEARCA:IWM) with Vanguard Small-Cap Index Fund ETF Shares (NYSEARCA:VB) to determine which fund may be a better option for those following Lynch’s lead in finding value in today’s market.

Peter Lynch’s Favorite Place To Invest Right Now

In a recent interview, Mr. Lynch pointed out that “We’ve been in an incredible bear market for two years,” excluding the leading mega-cap stocks such as Apple (AAPL), Tesla (TSLA), and Nvidia (NVDA). While the S&P 500 (SPY, VOO) and Nasdaq (QQQ) are flying high (and overvalued based on a number of metrics), these returns have been driven almost exclusively by a handful of tech giants. Meanwhile, the rest of the market has largely underperformed, with many stocks still trading below their 2018 highs.

Mr. Lynch believes that this presents a great opportunity for investors to find value in the overlooked and undervalued smaller-cap stocks. When asked explicitly if he was bullish on small-cap stocks such as the Russell 2000, he replied “Absolutely.”

The Bullish Case for Small Caps

We believe that Mr. Lynch’s bullishness on small-cap stocks is mostly warranted, as a combination of macroeconomic factors and market dynamics suggest that they could outperform their larger counterparts, particularly in 2024.

First and foremost, the U.S. economy has exhibited better-than-expected growth in 2023. Although a forecasted cooldown is expected in the fourth quarter and we would not be surprised if the economy slips into recession next year, the resilient consumer sector has been keeping the economy on solid footing, with retail sales and personal spending holding steady. Additionally, the labor market has remained relatively stable, despite recently slowing down some. Meanwhile, inflation has been declining steadily and appears poised to continue doing so, clearing the way for the Federal Reserve to cut interest rates soon. This is significant, because small-cap stocks have historically outperformed larger ones in periods of economic growth and slowing inflation, which aligns well with current economic trends, though this could change somewhat if the economy slips into recession.

Another reason to be bullish on small-cap stocks is due to their relatively low valuations compared to historical averages. The small-cap S&P 600 represented by SPDR® Portfolio S&P 600 Small Cap ETF (SPSM), for instance, is trading at a forward price-earnings ratio that is significantly lower than its long-term average, making these stocks more attractive than many large and mega-cap stocks which are trading at premiums to their historical averages.

IWM ETF Vs. VB ETF

Two great candidates for investing in a potential bull market for small-cap stocks are IWM and VB. Here is a side-by-side comparison of them:

Total Return Track Record

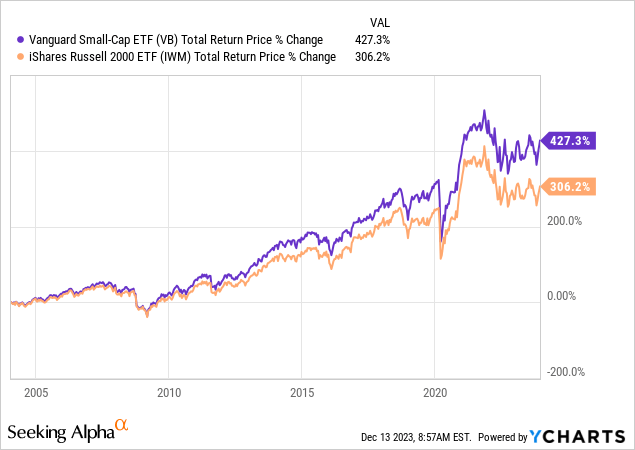

As the chart below illustrates, VB has significantly outperformed IWM over the long term:

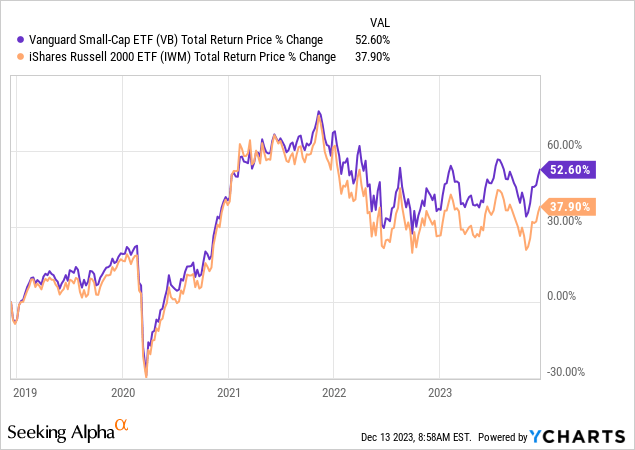

Moreover, VB has outperformed IWM over the past 1, 3, 5, and 10 years. Here is the five-year performance track record comparison:

Expense Ratio

It is also important to note that VB has a lower expense ratio than IWM. While VB only charges a meager 0.05% fee, IWM charges 0.19%, almost four times as much. Expense ratios play a crucial role when comparing Exchange-Traded Funds (“ETFs”), since they have a direct impact on the investor’s net return. An expense ratio represents the annual cost of owning an ETF, expressed as a percentage of the fund’s average assets. Therefore, a higher expense ratio means more money is deducted from the fund’s assets, which could potentially reduce the overall return for investors. As a result, a lower expense ratio is generally preferred, as it allows more of the fund’s earnings to be passed on to the investor. This is particularly important over the long term because even small differences in expense ratios can compound and result in significant variations in investment outcomes.

Sector Breakdown

IWM’s sector breakdown is as follows:

- Technology: 15.86%

- Industrials: 15.41%

- Financials: 15.14%

- Health Care: 14.71%

- Consumer Cyclical: 10.49%

- Real Estate: 7.48%

- Energy: 6.88%

- Basic Material: 4.81%

- Consumer Defensive: 4.20%

- Utilities: 2.09%

- Communication: 2.13%

- Cash & Equivalents: 0.19%.

VB’s sector breakdown is as follows:

- Industrials (19.86%)

- Technology (15.56%)

- Consumer Cyclical (13.10%)

- Financials (12.99%)

- Health Care (10.63%)

- Real Estate (7.93%)

- Energy (6.21%)

- Consumer Defensive (4.32%)

- Basic Material (4.21%)

- Utilities (2.83%)

- Communication (2.36%)

- Cash & Equivalents: 1.75%.

IWM and VB have a few notable differences as well as many similarities in sector allocation. IWM has a balanced distribution among its top four sectors, while VB shows a heavier emphasis on Industrials and Consumer Cyclical stocks and a lighter allocation to Health Care and Financials stocks. Both funds have comparable allocations in Real Estate, Energy, Basic Material, Consumer Defensive, Utilities, and Communication stocks.

Top 10 Holdings:

IWM’s top 10 holdings are as follows:

- Super Micro Computer Inc (SMCI) (0.54%)

- Simpson Manufacturing Co Inc (SSD) (0.33%)

- Light & Wonder Inc Ordinary Share (LNW) (0.33%)

- Rambus Inc (RMBS) (0.30%)

- BellRing Brands Inc Class A (BRBR) (0.30%)

- ImmunoGen Inc (IMGN) (0.30%)

- Qualys Inc (QLYS) (0.29%)

- Comfort Systems USA Inc (FIX) (0.29%)

- UFP Industries Inc (UFPI) (0.29%)

- Onto Innovation Inc (ONTO) (0.29%).

VB’s top 10 holdings are as follows:

- Targa Resources Corp (TRGP) (0.43%)

- PTC Inc (PTC) (0.39%)

- Atmos Energy Corp (ATO) (0.37%)

- Bunge Global SA (BG) (0.36%)

- Booz Allen Hamilton Holding Corp Class A (BAH) (0.35%)

- Deckers Outdoor Corp (DECK) (0.34%)

- Jabil Inc (JBL) (0.33%)

- Reliance Steel & Aluminum Co (RS) (0.33%)

- Axon Enterprise Inc (AXON) (0.32%)

- IDEX Corp (IEX) (0.31%).

It is also interesting to note that none of their top 10 holdings overlap. Moreover, both funds are exceptionally well-diversified, with VB only having 3.63% of its total portfolio allocated to its top 10 holdings and its portfolio containing a whopping 1,434 holdings overall.

IWM, meanwhile, has only 3.27% of its total portfolio allocated to its top 10 holdings and its portfolio contains an astonishing 1,980 total holdings overall.

Investor Takeaway

While mega-cap stocks such as Magnificent Seven members like Microsoft (MSFT), Amazon (AMZN), and Meta Platforms (META) have been leading the major market indexes to new highs this year, Peter Lynch thinks that investing in smaller-cap stocks is the way to go.

When determining which fund is best to invest in, it is important to consider factors such as total return track record, expense ratio, and sector breakdown. VB has a better long-term performance record and lower expense ratio, while IWM has a more balanced sector allocation. Ultimately, investors should do their own research and pick the fund that aligns best with their investment goals and risk tolerance, but we would overall prefer VB given that their portfolio setups are quite similar and VB has a significantly lower expense ratio.

That being said, given that there is still a fairly strong risk of recession next year, we are weighting our portfolio towards more defensively positioned small-cap stocks, which we think will perform even better than VB and IWM in such an environment.

Read the full article here