Mama’s Creations (NASDAQ:MAMA) is the largest public company selling prepared fresh foods to grocery stores for their deli sections. This industry is projected to grow at a CAGR of 10% for the rest of the 2020s, and Mama’s Creations is also primed to take market share from less efficient mom-and-pop operations as well as grocery store delis, who are smaller and less efficient. Together, these two trends could help MAMA keep growing at over 20% per year, as they have for the last decade, driving significant share price appreciation. The management is heavily invested in the company’s shares and seems highly capable of executing this strategy.

The catalyst is that Mama’s Creations only hired a marketing team this year, and they are just getting started. The stock is trading at industry average multiples, and consensus estimates are still only pricing in ~10% growth. The market is adopting a ‘wait-and-see’ attitude towards their marketing efforts, which is unreasonable given the company’s excellent products and successful track record of winning new business. This means that, if and when the marketing starts to work, and at least some of their channels start to grow much faster as a result, the stock price should increase dramatically. I have already bought shares and plan to build a bigger position over the coming months. I’m rating the stock a STRONG BUY with a two-year price target of $8.08, an implied annualized return of 41%.

The Business

The Industry

For decades, Americans have been cooking less and eating out more. Today, they want quick, healthy, affordable food. At the same time, consumers need to economize. To decrease grocery bills, they are shopping at cheaper stores, getting club store memberships, and buying private label products. With higher inflation, interest rates, and possible recession next year, these trends should continue.

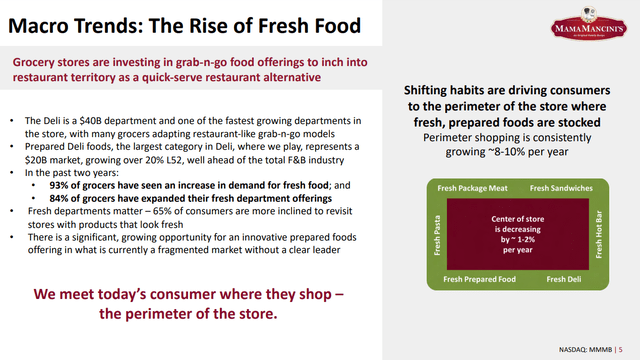

investor presentation

(source: investor pres.)

Prepared foods benefit from these trends. This is an industry with a total addressable market (TAM) of around $25 billion. Market research firms such as Grandview, Stringent Datalytics, NextMSC, and Allied estimate that prepared food sales will grow at around 9.5% per year until 2030. Prepared meals are faster than cooking, cheaper than restaurants, and can be healthy. Younger shoppers are even more likely to favor them. Grocery stores also like prepared food, for which they earn a higher margin. And since they have been plagued by labor shortages, it is hard for them to prepare a variety of foods. It’s more cost-effective to simply buy from a company like MAMA. Management is targeting these trends. On the FY24 Q2 call, they quoted reports saying that:

- >80% “have eaten at least one type of grocery prepared meal in the past three months”

- 94% “purchased items from the in-store deli”

- 71% “agreed that prepared meals have gotten healthier.”

- 68% “believed that it is worth paying for higher quality prepared meals.”

- “two thirds [of grocers] said that they will increase their assortment of prepared foods over the next 12 months”

I have been able to corroborate most of these trends, if not the exact figures, in my own external market research. While the pace and scale estimates vary, it is clear that prepared fresh foods are becoming an increasingly large, profitable, and important category for grocery stores.

Company Strategy

MAMA has a differentiated model to capitalize on these trends

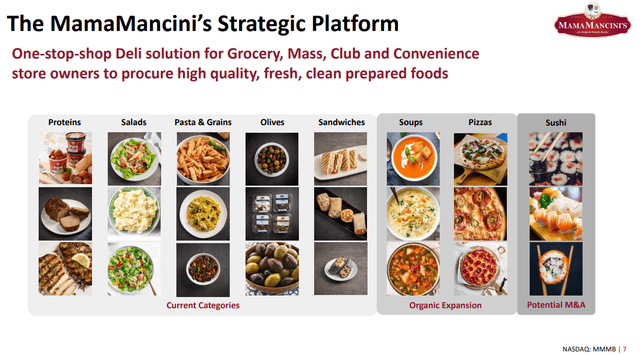

Mama’s Creations is trying to fill this niche and become the leading supplier of prepared foods for grocery stores: a one-stop deli solutions company. According to MAMA’s CEO, they have no serious competitors. Most deli companies are small, old, and privately held. MAMA has a differentiated business model within this space.

MAMA has already made significant progress towards this goal. Its products are sold in over 8,000 grocery stores (of about 60,000 total in the U.S.), including every BJ’s, Sam’s Club, half of the Costco regions as well as Whole Food’s, Publix, ShopRite, and Aldi (but not Walmart, Target, or Kroger). MAMA has already reached a significant scale, and there is room for growth.

Mama’s Creations has about 25 core product offerings. Recent acquisitions have given them an entrée into middle eastern food, salads, and paninis, but the flagship product is their meatballs, which are sold in the Whole Foods deli and Publix meatball subs. 93% of BJ’s customers would recommend them to a friend, and they have high reviews at Sam’s Club and Costco. They’ve won awards at QVC for the last five years; this year their products were ranked number one in the “I Could Eat This Everyday” category.

investor presentation

The reason for this, it seems, is their product freshness and quality control. Americans like Italian food, and the Mancini family is legit: they immigrated from Italy with family recipes. Dan Mancini’s Facebook and Instagram show him cooking traditional Italian food from scratch.

“Grandma Quality” is how the company describes this. The meatballs have eight ingredients: beef, breadcrumbs, pecorino romano, parsley, eggs, onions, salt, and pepper. The chicken strips are cooked on real grills and have actual grill marks. And every month, the CEO meets with founder Dan Mancini and the two executive chefs for a “grandma quality” meeting where they test the food (talk at LD Micro conference). They now have an internal Quality Assurance lab.

As part of the research for this article I ordered 8 10-oz meatball-in-a-cup packets on MAMA’s ecommerce platform. At almost $8/cup including shipping, they were a bit expensive. But they arrived in two days, well-packaged and still totally frozen, with clear and detailed cooking instructions. The sauce really tasted like tomatoes, and the meatballs had a good texture and a rich flavor from the cheese. The whole package is 310 calories and has 23 grams of protein. It’s a bit high in cholesterol, fat, and sodium, as you would expect from a packaged food product that’s mostly beef. But all things considered, I thought they were reasonably priced, very tasty, and healthy enough to be something I would eat regularly.

Costs & Margins

Margins have improved due to organizational improvements, but for now I think MAMA lacks the pricing power needed to increase them much further

The downside of this simplicity is that MAMA’s products are not proprietary, which means they have limited pricing power. Half of their business is branded, and half is private label. Their margins are about equal, which suggests that MAMA lacks pricing power. This year, MAMA has kept price increases below inflation (Q2 call). Going forward, I don’t yet see a durable reason that they would be able to raise prices faster than inflation. And since the company is so small, I doubt they have much brand power (except at QVC). Even worse, their revenue mostly comes from a few powerful grocery store chains who probably have negotiating power.

For these reasons, MAMA must control costs. They own both of their manufacturing facilities (in NY and NJ), which enables them to control quality, be flexible, and reduce costs. This year, MAMA has also implemented many new internal controls, such as:

- pushing harder to leverage their scale and request lower prices from suppliers

- consolidating six cold storage facilities into two and negotiating better pallet rates at them

- implementing real-time material cost tracking system to optimize purchasing

- transitioning all divisions to an integrated enterprise resource planning (ERP) system

- competitively searching for the cheapest freight rates

(source: earnings calls)

The result has been an amazing improvement in profitability. Net margins have gone from -0.5% in 2022 to a ten-year high of 6.3% over the last twelve months. The data below is median values for companies in the packaged food industry which I identified using a Morningstar screen. Clearly, MAMA has good margins and impressive profitability, even compared to its larger competitors. It has sustained this without substantial leverage (interest coverage is >10x).

|

metric |

small |

small and profitable |

mid-sized |

Index* |

MAMA |

|

Market Cap (mil) |

$14 |

$147 |

$6,202 |

$150 |

|

|

# of companies |

110 |

31 |

80 |

||

|

ROIC |

-22.2% |

8.4% |

8.6% |

18.2% |

23.9% |

|

ROE |

-20.1% |

9.6% |

12.2% |

28.4% |

50.0% |

|

ROA |

-41.5% |

4.6% |

5.8% |

10.5% |

16.5% |

|

Net Margin |

-21.4% |

5.0% |

7.0% |

5.6% |

6.2% |

|

Current Ratio |

1.4 |

2.1 |

1.7 |

1.4 |

|

|

Debt/Equity |

0.6 |

0.3 |

0.5 |

0.8 |

1.0 |

(data and index from Morningstar, calculated on 12/2/2023)

Specific changes driving these improvements include:

- formalizing hiring and HR policies

- commissioning an employee handbook in both English and Spanish

- holding a first ever town hall meetings

- increasing product shelf life from five to 21 days (I plan to ask about this)

- starting weekly meetings with top 50 employees to coordinate management

- setting a strategy centered on cost, controls, and culture – the ‘three c’s’

- tying 50% of bonuses to team goals

- starting to do employee satisfaction surveys

(source: earnings calls and interviews)

These changes are not all margin accretive. Some of them, especially additional hiring and marketing, result in significant costs for the company. But overall, they are part of a professionalization of the company’s internal processes which I think will reward long-term shareholders. And I think recent margins are sustainable. As a result of cost cutting this year, gross margins increased 7.1% and net margin increased 3.9% YOY. In addition to the developments noted above, more improvements should keep them high, like:

- Bringing material processing in-house (e.g. cutting their own chicken)

- Further automating manufacturing

- Increasing manufacturing facility utilization (the CEO said at the recent LD Microcap conference that the East Rutherford facility today only runs one shift, so they can add a second and double capacity:)

Recently, the COO retired, and the two heads of these facilities were promoted to higher job titles. But they will stay on as managers of the two manufacturing facilities. With production becoming even more efficient, management forecasts normal gross margins in the high 20s (about the current level), with the potential for an increase into the low 30s. I think this is realistic. MAMA’s net margins peaked at 10% in 2021 and are currently around 7%. As the table above shows, this is common in the industry. Given MAMA’s products and management, I could see net margins rising slightly into the high single digits, as forecast by at least one analyst.

Management

Management seems highly competent, motivated, and invested

These changes have been spearheaded by Adam Michaels, who took over as CEO a little over one year ago. Michaels has an MBA from Columbia Business School and worked for the last 25 years in consulting (at Booz Allen Hamilton) and in the food business (at Mondelez). He has been bringing that level of big-company operational expertise to MAMA, touting the idea that “what gets measured gets improved.” So far, I believe that Michaels has shown himself to be a very capable CEO.

The second factor I look for, in addition to managerial excellence, is insider ownership. Michaels himself bought $2.5 million in stock when he started and collects a salary of only $130,000. Overall, management owns 25% of shares. While this number could be higher given how small the company is, I think it is enough to tie their interests to those of long-term shareholders. Dan Mancini, a member of the family which founded the company, is still actively involved in customer meetings and day-to-day operations, but as far as I can tell no longer has a financial stake in the business. Given that his family name is on the brand, I think he has a strong incentive to ensure product quality.

Valuation

This is a tiny, high-growth company, uncertainty is high, and institutional investment is low, so I think the stock is undervalued even relative to consensus expectations. MAMA has beaten analyst estimates all year, but the magnitude of the price changes has come down significantly. This past quarter, they beat earnings estimates by 25% ($0.05 vs. $0.04) and revenue estimates by 6%, and the stock was basically flat. Therefore, I think market expectations are above analyst consensus, but not by much.

The consensus among analysts is that the stock could double in 2024. MAMA is mostly ignored on Wall Street, but analysts are bullish. Of the three Wall Street analysts, the most experienced and successful is Howard Halpern. He has covered MAMA since at least 2018, and is still bullish , offering a price target of $8.50 in his September report, above the average of $7.50. Halpern’s tone is similar to recent analysis on SeekingAlpha. In August, Steven Cress listed it as one of the “top 10 stocks under $10,” citing high quant scores, especially for growth and momentum. In July, one analyst’s DCF analysis produced an intrinsic valuation of $10.60. In November, a more conservative DCF analysis implying margin contraction in 2024-2025 and 10% annualized revenue growth yielded a valuation of $7.90. These analysts project revenue growth of 9.3% in 2024 and 13.4% in 2025 and slight margin expansion to gross margins around 30% and net margins around 8-9%.

I think these estimates are reasonable, but that there is significant potential for additional upside.

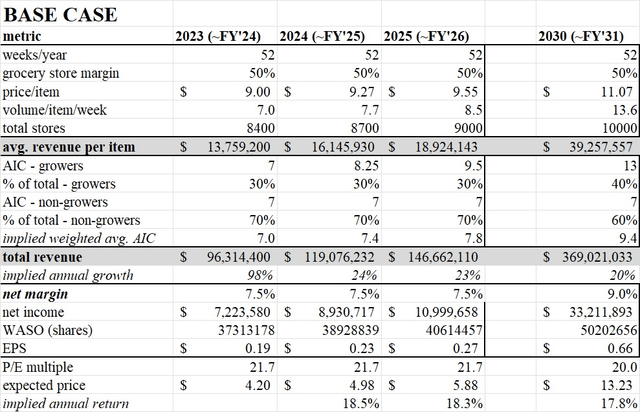

Base Case

My base case is more conservative than analyst estimates. I assume no significant further margin expansion, and no further multiple expansion. I have explained what I think about margins above: MAMA lacks the competitive advantages to push prices higher and cannot decrease costs significantly without damaging their business. So, I conservatively model net margins staying flat at their current rate of 7.5%.

And I think given standard growth expectations, multiples are basically fair. In the table below I compare MAMA’s valuation to those of a basket of other packaged food companies. If we take my numbers, we get a P/E and P/CF premium of about 50%. If we go with Morningstar, the premium is only 10%. I think these are more meaningful reference points than P/S or P/B, given how much more efficient MAMA than their competitors. These multiples are about average for MAMA in recent years.

|

metric |

small |

small and profitable |

mid-sized |

Index* |

MAMA |

|

Market Cap (MIL) |

$14 |

$147 |

$6,202 |

$150 |

|

|

# of companies |

110 |

31 |

80 |

||

|

Rev Growth – 5yr |

6.7% |

6.0% |

6.5% |

27.6% |

|

|

P/S |

0.6 |

0.5 |

1.1 |

2.4 |

1.5 |

|

P/E |

15.6 |

17.2 |

21.2 |

21.7 |

|

|

P/B |

1.1 |

1.1 |

3.8 |

8.9 |

|

|

P/CF |

6.9 |

6.0 |

10.0 |

15.2 |

16.4 |

(data from Morningstar as of 12/2/2023)

Basically, no value is being placed on MAMA’s higher growth rate. This suggests that, like the price targets surveyed above, most people don’t think MAMA can actually grow faster than their industry. For my base case I thus assume that the P/E multiple stays at the current level, around 22.

My Assumptions

- Their prices will rise at the rate of inflation, which I estimate at 3% over the next 5 years.

- Their volumes, all else being equal, will rise at the project industry CAGR of 10%.

- Their share dilution will continue at the pace from the last 10 years: 4.3% per year.

- Their margins vis-à-vis grocery stores will remain flat.

- P/E ratio probably will not expand or contract dramatically.

Model Explanation

- To more effectively model growth, I break down revenue into prices*volume*number of stores.

- I break out volume on a weekly basis to make it easier to understand.

- “AIC” refers to “average items carried” – the number of items per store.

- I split customers into “growers” and “non-growers” because MAMA won’t be able to convince all of its customers to carry additional items.

author

Whereas I think that multiples and margins will stay flat, in my base case I do project that management has some luck at their marketing efforts, driving modest increases in store counts, volume, and average items carried. These increases basically reflect the continuation of recent trends. In this scenario, my price target is much lower than the analyst consensus. In my scenario, growth comes at a slightly higher cost than people expect. Even in this case, MAMA could be a good investment, because it is well-run and operating in a growing industry.

My Growth Forecast

MAMA plans to grow in three ways: increasing the number average items carried (AIC) per store, the number of stores they sell in, and the volume of each product sold. I have found no evidence that they have significantly increased the number of locations over the last five years, and I have no insight into what might drive volume increases, so my thesis focuses on AIC. As of right now, management’s focus seems to be on increasing AIC. Since their strategy will drive results, I focus on AIC in my forecast as well.

About 20 core product offerings drive MAMA’s revenue. Out of those, they only sell about seven to their average customer. This is up from under 6 one year ago, for an increase of about 20% (management does not provide exact figures). And this is without very much marketing. Going forward, management is deliberately working to increase this figure. There are reasons that customers would want additional products. Good customer reviews should help. Second, MAMA already has relationships with these customers, which gives them the chance to cross-sell. And third, for grocery stores, having one supplier is convenient: it means fewer calls, invoices, and deliveries. For one unnamed customer, they were able to increase AIC from 1 to 10 over the last year. Finally, MAMA has finally started marketing. Last year, they:

- Acquired Chef Inspirational Foods, giving them a wider range of products

- Launched meatballs-in-a-cup and 4 new sleeve products (June)

- Hired a Chief Marketing Officer, Lauren Sella, a Wharton MBA with industry experience, and worked with Michaels at Mondelez (June)

- Rebranded “Mama Mancini’s” into “Mama’s Creations” (August)

- Hired a director of convenience store sales (October)

- Launched direct-to-consumer e-commerce website (November)

- Hired a head of trade promotion

- Overall: grew the sales team grew from one to five people

2024 will be the year for MAMA to try out this cross-selling strategy. My bull case (below) focuses on the likelihood that this strategy works, and that AIC increases significantly.

It should be noted also, though, that MAMA has numerous other avenues for future growth, like

- Pizza: which the Mancini family traditionally made – the largest category of frozen food

- Sushi: a fast-growing market that is a target for acquisition

- more stores: MAMA is currently in only around 12% of US grocery stores

- Midwest and West: where MAMA penetration is still relatively lower and much of the growth has come from in recent quarters

- Costco: currently in only four of eight U.S. regions, but sales volume is growing

- Convenience: recently launched meatballs in a cup are popular with younger, busier snackers, selling well at QVC, could sell to convenience stores

Each of these is a very significant growth opportunity for MAMA. Consider convenience stores. In China, per capita consumption of ready-to-eat meals is 68% of the U.S., even though GDP per capita is only 17%. The U.K. and Japan have per capita consumption 260% and 60% higher than the U.S. In Japan, packaged food is ubiquitous, good, and affordable. With free chopsticks, microwaves, and seating, convenience stores (konbini)are basically ultra-low-cost restaurants. In the U.S., chains like Wawa and Sheetz have started doing this too, but in my experience, their service is slow, and the food is mostly unhealthy. And their approach is to have kitchens on-site and cook fresh food. Obviously, this leads to a fresher product, but it also means that they are much slower and lack many economies of scale. I personally think that MAMA’s products would be a significant upgrade from the usual offerings at a store like 711, and that many customers will be willing to pay slightly more for better food. Obviously, this hypothesis hasn’t been proven yet. But the market opportunity is large, and MAMA has just started to target it.

food in a Japanese konbini (medium)

(source: medium)

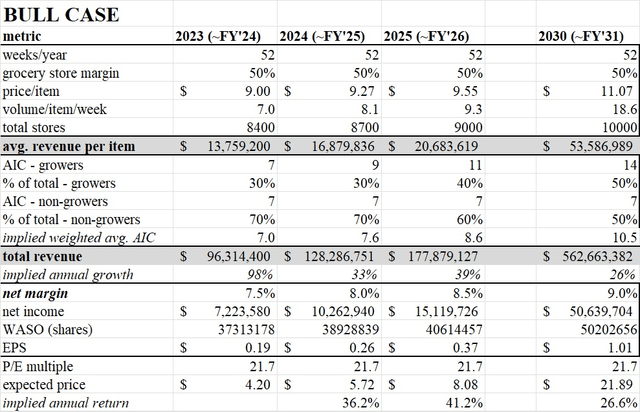

Bull Case

Based on these numerous growth possibilities, my bull case assumes that MAMA will be able to drive higher volumes on more items over the coming years. I model volumes increasing by 15% CAGR, faster than the 10% industry average, driven by their excellent customer satisfaction ratings. And I model AIC increasing over 20% per year, which I think is reasonable given recent results and the growth of the marketing department from 1 to 5 people, and the numerous additional growth opportunities. Even in this scenario, my model seems conservative. But what it reveals is that the market is not pricing in the long-term growth potential of this company. Adam Michaels wants to build MAMA into a billion-dollar company and increase AIC to over 20. Even if MAMA gets partway there, investors could still earn a phenomenal return of around 25-30% p.a. over the next five years.

author

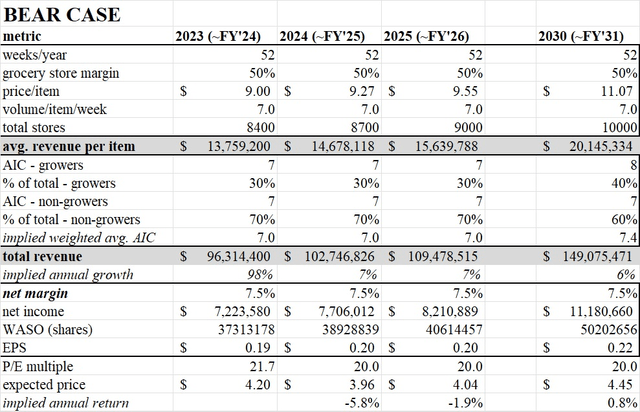

Bear Case and Risks

Assuming that nothing goes seriously wrong with the business, MAMA would marginally increase their prices and locations, and average items carried would remain low despite management efforts. In this case, I project the share price to remain basically flat. Industry tailwinds and strong company momentum could get derailed. Since the current valuation is reasonable, I don’t see excessive downside in a general bear case. If something more specific were to go wrong, then there could be much more significant downside. I don’t think it’s possible to quantitatively model what would happen in these scenarios, but any of them would be very bad and would be a strong sell signal.

author

First, if there is a major recall of their products due to food safety concerns, I think the stock could drop significantly as MAMA lost brand power, customers, and sales.

Second, I worry about the company’s growth strategy failing. Will existing customers want to carry additional products? Will consumers buy them? Will new customers like Walmart or Target want them? Competition is fierce, and MAMA’s success is not assured. If AIC increases stall out despite additional marketing, that would be another sign to sell.

Third, the CEO might leave, jeopardizing the strategic plan. He is clearly a very large presence in the company and has been responsible for many of the changes in the last year. If he were to be involved in any sort of personal or professional scandal, or just decided to leave, the fortunes of the company would become much more uncertain.

Fourth, it is possible that the recent consumer trend of buying more prepared food is reversed. Maybe the economy will become even stronger, and people will turn to eating out more. Or maybe frozen food will just get a lot better. There is lots of competition in this industry, and consumer tastes fluctuate. MAMA’s success is by no means assured.

Finally, an additional risk for buyers is that the COO just retired and announced his intention to sell 5.6 million shares, or about 15% of the current float. His sales might artificially lower the share price. It seems that this may already be happening, as shares remain mostly flat despite good results and a general market rally.

Bottom Line

The market is adopting a “wait-and-see” approach to management’s recent sales efforts. While this is reasonable, given the highly competitive nature of the packaged food industry and the fact that MAMA is a micro-cap company, my analysis of the industry’s prospects, the company’s products, and management’s execution ability has led me to think that MAMA is likely to grow much faster than the overall industry. Since the market has not yet priced in this growth potential, investors could see a handsome return if they buy in now and go along for the ride.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Read the full article here