Investment action

I recommended a buy rating for Luminar Technologies (NASDAQ:LAZR) when I wrote about it the last time, as the company was on track towards meeting its milestone. The path to profitability was reiterated by management, boosting my confidence in the business. Based on my current outlook and analysis of LAZR, I recommend a buy rating. I believe management execution remains on point and they are on the right track to achieving their FY30 targets. Despite recent share price actions, I remain buy rated as there are no fundamental dents to my buy rating. I believe the weakness in the share price is simply due to investors avoiding the stock as they avoid uncertainties associated with it.

Review

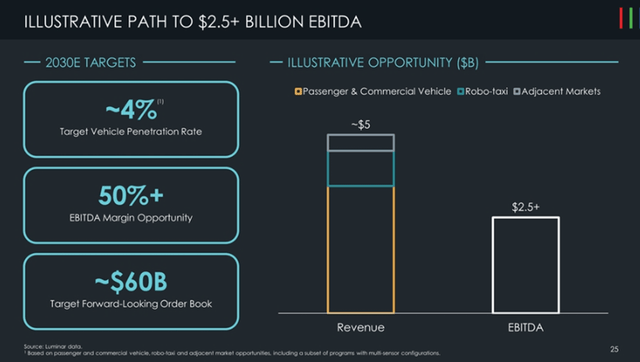

For 3Q23, LAZR reported a better gross margin and exited the quarter with ~$321 million in cash and marketable securities. While this was down from $366 million last quarter, management re-emphasized that the existing capital will be sufficient until it turns profitable in FY25 (I give my thoughts on this below). What is notable is that LAZR continues to meet several major milestones, which gives me confidence that the business can achieve its long-term guidance of $5 billion in revenue and >$2.5 billion in EBITDA in FY30.

First, the management has kept up its spotless execution at the Mexico facility, which was rewarded with a passing grade in Volvo’s Run at Rate production audit. This is a major step toward confirming the necessary production capacity and quality standards for the forthcoming Volvo EX90 launch. With this achievement, I believe management is definitely on track to achieve its non-GAAP gross margin improvement in 4Q23, as the business is going to benefit from economies of scale (large-scale production). This paints a very positive picture for FY24 and beyond, as gross margins should continue to expand as revenue grows. On this point about revenue growth, I thought it was great that management was so sure it could increase its forward-looking order book by $1 billion this year, bringing the total to $4.4 billion. More importantly, they noted that LAZR is on pace to achieve or surpass this target. Remember that in order for LAZR to factor into the order book, only booked series production awards for specific vehicle lines with signed agreements are considered. As such, I’d say LAZR is on track to grow its business by a similar magnitude in the coming years as it delivers.

Second, LAZR continues to improve its technology. In particular, by the end of the year, it plans to have its next-gen Iris+ lidar sensor ready for the C-phase. So far, it and TPK have begun the series production tooling process for Iris+. In addition, LAZR was able to integrate its software with data collection vehicles made by Mercedes, as well as with systems and middleware currently under development by Zenseact and Volvo. The common characteristics of these updates are that they involve third parties that have or potentially have commercial relationships with LAZR. The fact that LAZR is able to go into the phase of production and integration indicates that the product works well (if not, why would the customers use it?). While I am not able to check and test the products myself, I believe the actions by industry players (Volvo and TPK) are suggestive of the product quality, in my view.

Cash position to get better from here

This is an important thing to note, as I believe a lot of investors are worried about the LAZR cash position. On a headline basis, LAZR burned around $225 million on a year-to-date basis (YTD EBITDA ex-SBC). Using that as a benchmark, this implies that LAZR only has a little over one year of cash left. Hence, concerns have merit. However, I believe the quarterly cash burn rate will improve dramatically as LAZR benefits from scale (more volumes from upcoming launches), which will drive economies of scale, and as launch costs continue to ease in 4Q23. In addition, LAZR should also see a working capital benefit as the one-time $21 million increase in 3Q23 was used to prepare for the high-volume series production. This should not appear to be of the same magnitude moving forward. Based on management estimates, the 4Q23 cash burn rate will be reduced by 50% from 1H23 levels, driven by the increased volume and steep improvement in gross margin. I believe this achievement demonstrates management’s strong execution so far.

Yeah, I understand why some shareholders would ask that question, given the recent stock price performance, but when you actually look at our most recent results for Q3 we cut our non-GAAP gross loss almost in half, which puts us on trajectory to get it to positive by the end of the year as those launch-related costs continue to wind down as we successfully industrialized the Iris. 3Q23 call

Valuation

With major milestones on track for 2023, I believe LAZR remains well-positioned to meet its FY30 long-term targets. As LAZR launches new programs and introduces next-gen products with improved cost-to-performance solutions, I think we could see accelerated adoption. Management is already guiding for revenue growth of >100% over the next few years. The last 12 months revenue was $75.2 million. This implies that LAZR needs to grow at 100% for around 6 years in order to reach its FY30 target of $5 billion in revenue.

So that order book starts translating into revenue. And that transition is enabled us to expect triple-digit revenue growth every year for the next handful of years and continuing to exponentially accelerate. Feb investor day

Author’s work

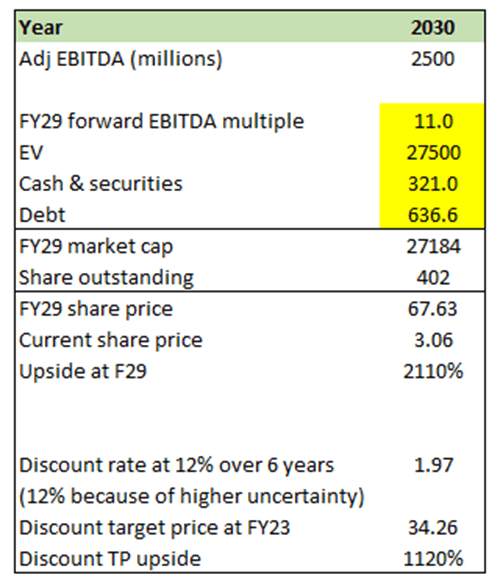

Putting things into perspective in a model, the upside continues to be potentially huge if LAZR hits this target, which I think is on the way to do so. How my model works is that I am applying a forward EBITDA multiple in F29 to LAZR FY30 targeted adj EBITDA of $2.5 billion, in order to derive LAZR’s enterprise value. Using that calculated enterprise value, I derived its FY29 market cap and my FY29 target price. Assuming my assumptions are right, and investors hold the shares until FY29, the total upside could be as high as ~2.6x. From a present value perspective, I discounted my target price by 12% discount rate over 6 years (FY29 to FY23), arriving at a target price of $34.

I believe the near-term reaction to the share price is due to investors being conservative and not wanting to take the uncertain risk associated with the business. So far, execution has been fine, and there is a clear path to revenue and margin acceleration in my view. Until such time as LAZR shows fundamental flaws in execution, I remain buy-rated.

LAZR

Risk and final thoughts

Bad execution is the biggest risk to my buy rating, as everything falls on management continuing to execute nicely. Any signs of weak execution or key management turnover are bad for the business and stock.

To conclude, I reiterate a buy rating for LAZR. I like how management continues its consistent execution and has made significant progress toward profitability. Addressing concerns about cash burn, I anticipate a significant improvement in quarterly cash burn rates driven by increased volumes, improved margins, and easing launch-related costs. Management’s guidance for a 50% reduction in 4Q23 cash burn reinforces this outlook. Despite market uncertainties, LAZR’s execution track record and future growth prospects continue to bolster my buy rating.

Read the full article here