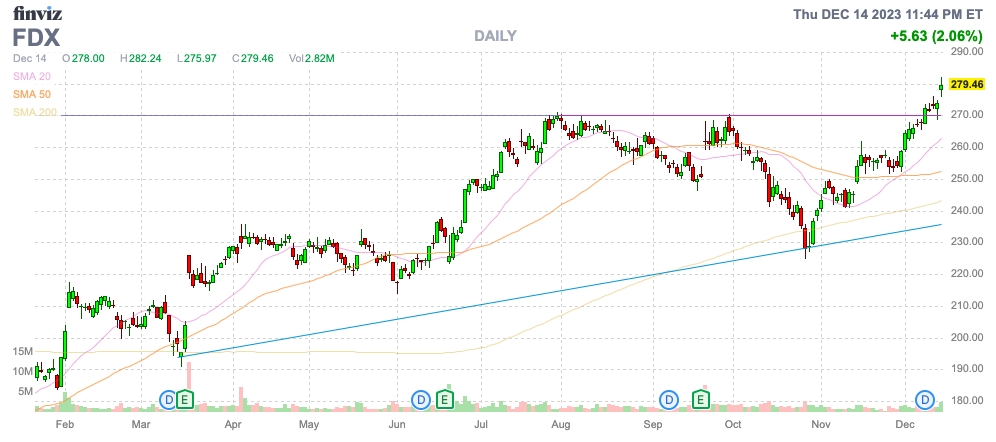

FedEx Corporation (NYSE:FDX) has come roaring back after a rough period in 2022. As predicted over a year ago, the new CEO appeared to “kitchen sink” the forecasts, and now the global shipping company is firing away heading into its fiscal Q2 2024 results expected post-market on Tuesday, December 19th. My investment thesis remains Bullish on the stock with the business finally heading back towards growth mode after eliminating substantial costs to improve margins.

Source: Finviz

Big Week Ahead

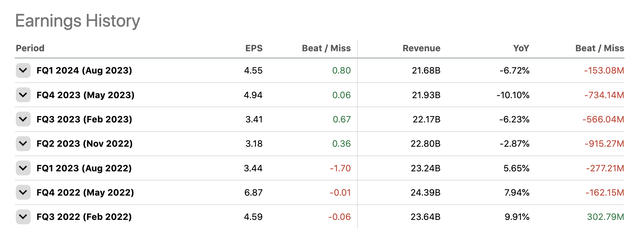

FedEx is set to report November quarterly earnings after the market close next Tuesday. The package delivery company is expected to report another quarter of revenue slipping nearly 2% to $22.4 billion, but the consensus estimates have EPS jumping 32% to $4.20.

The ironic part is that FedEx has missed consensus revenue estimates for the last 6 quarters. The stock has definitely traded volatile during the period, but the trend has been for the annual revenue declines to improve with a shift back towards growth over the holiday period pushing FedEx higher.

Source: Seeking Alpha

Remember, FedEx has rallied on the backs of constantly missing revenue targets. If the package delivery company finally beats estimates, the stock could have even more upside.

Our view became positive on FedEx following the preliminary FQ1’23 report that caused the stock to slump. The company hasn’t beaten revenue targets during this whole period, yet FedEx is already up over 70% during this period.

While revenue growth is crucial to long-term gains, FedEx has turned the profit picture around. The company guided to adjusted EPS targets of up to $18.50 for FY24.

The company has worked to structurally strip out $2 billion in operating expenses. For FQ1’24, FedEx boosted operating margins to 7.3% from 5.3% while United Parcel Service, Inc. (UPS) reported an operating margin of 7.7% for the similar quarter and set a target of 11% for the year.

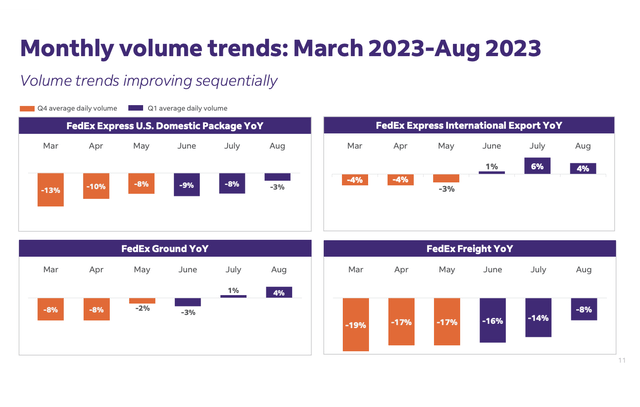

FedEx ended August with volumes improving dramatically after starting in 2023 with massive declines in all segments. The FedEx Ground and Express International units have already turned volumes around to print growth to the end of the last quarter.

Source: FedEx FQ1’24 presentation

Investors will want to track this trend. FedEx cut the forecast for flat revenue metrics in FY24, and any signs of improvement here will dramatically help the stock heading into 2024.

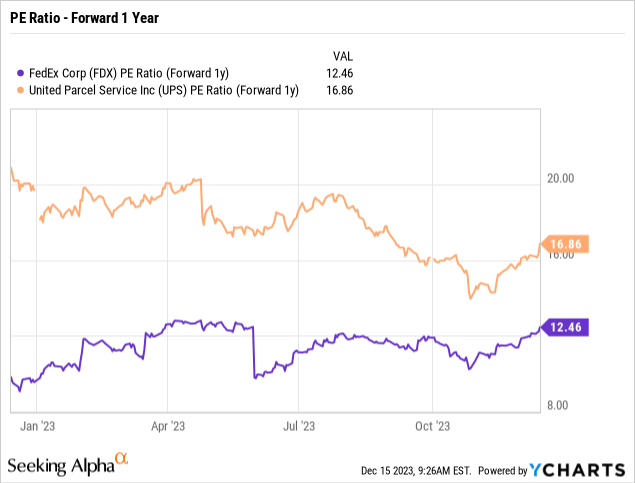

Still Cheap

The crazy part of the FedEx story is how cheap the stock is, if the company can hit FY25 EPS targets. As the package delivery company heads back towards revenue growth, profits have the potential to soar back to previous levels, making the stock still cheap despite jumping over $100 in the last year.

The consensus EPS targets have FedEx generating an amazing EPS boost to $22.44 next fiscal year for 23% growth. With the company having a recent pattern of beating EPS targets, the stock could see another EPS boost.

The stock only trades at 12.5x FY25 EPS targets. By comparison, United Parcel Service, Inc. (UPS) trades at 16.9x EPS targets and has traditionally traded at even higher forward P/E multiples.

The opportunity here is for FedEx to substantially boost profits and expand the P/E multiple to finally catch up with peer UPS. The 4-point multiple difference on an earnings stream of $22 is a nearly $90 difference in the stock price alone.

A big key to the investment story is the new CEO cutting out some excess costs via reducing Sunday deliveries, cutting unnecessary flights, and stripping out extra delivery trips. The company returning to growth is a big part of the proof these cost reductions aren’t costing FedEx with volumes in a trade-off.

The company plans to raise general package delivery rates by 5.9% in January. With improving volumes and the January rate hike, FedEx should finally be back in growth mode in FQ3.

Takeaway

The key investor takeaway is that FedEx Corporation should have another big step up in profits and the stock price ahead. Investors should watch for improving trends in package volumes and margins to signal an ability for the stock to close the valuation gap with UPS. The stock has a tendency to dip following earnings with a trend of revenue misses, but investors should clearly use such weakness to load up on FedEx, as long as the improving profit picture remains intact.

Read the full article here