Teledyne Technologies Incorporated (NYSE:TDY) is an American technology company that today specializes in digital imaging, instrumentation, aerospace and defense technology, and engineered systems. The original Teledyne has a storied history as one of the prominent conglomerates in the 60s, 70s, and 80s. During this period it was led by co-founder Henry Singleton and serves as one of the best case studies of capital allocation as the driving force behind market-beating returns over the long term.

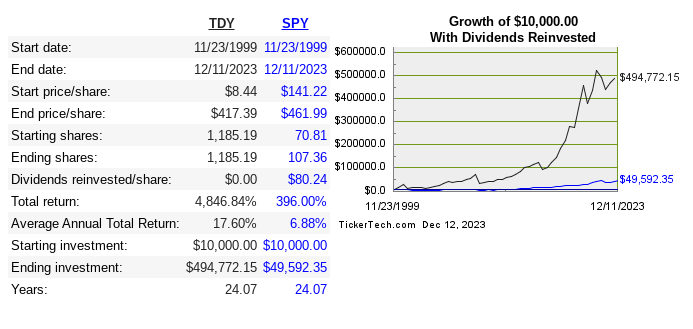

The current version of the company is quite different from the Singleton era. It was the result of a spinoff in 1999, and since then has delivered incredible compounded returns. Below is the share performance since the IPO:

Dividend Channel

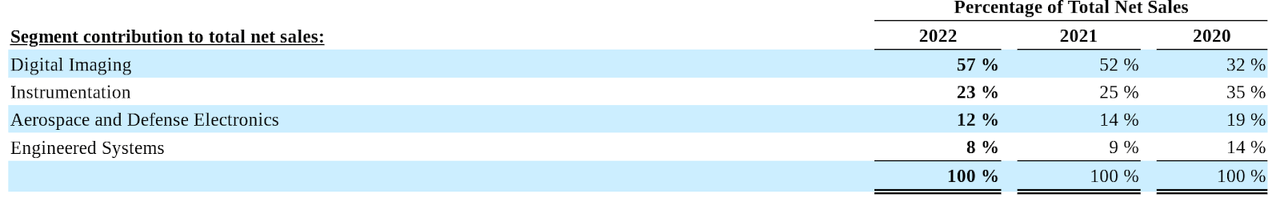

Below is the revenue breakdown:

TDY 10-K

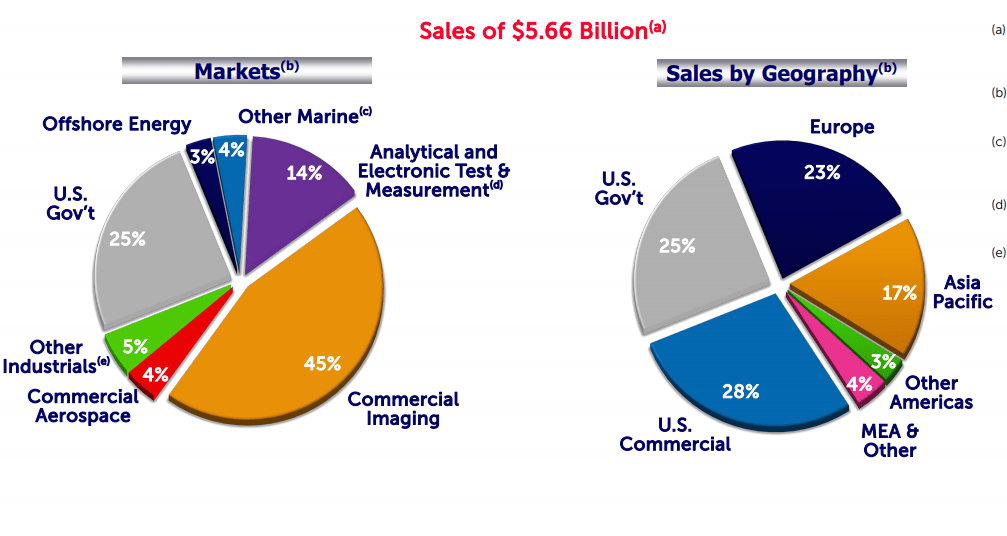

TDY investor presentation

With such a diversity of business segments, it’s hard to find peers that are replicas of TDY. So the competitors I’m listing are primarily in the imaging sector since this is where most of TDY’s revenue comes from. So then next is the return metrics versus peers:

|

Company |

Revenue 10-Year CAGR |

10-Year Median ROE |

10-Year Median ROIC |

EPS 10-Year CAGR |

FCF/Share 10-Year CAGR |

|

TDY |

9.9% |

13.6% |

9.2% |

14.2% |

9.1% |

|

CGNX |

12% |

16.8% |

16.7% |

12.2% |

10.6% |

|

KEYS |

6.6% |

23.9% |

15% |

8% |

5.9% |

|

RVTY |

4.6% |

9.8% |

6.3% |

22.1% |

|

|

NATI* |

3.8% |

10.2% |

8.5% |

3.7% |

*company acquired by EMR earlier this year

Capital Allocation

Over Teledyne’s entire history, it has been a long-term whirlwind of acquisitions and spinoffs. This current version of the company was the result of a spinoff from the Teledyne parent, and it has been a serial acquirer since its IPO.

|

Year |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|

EBIT |

240 |

295 |

282 |

241 |

322 |

417 |

492 |

480 |

624 |

972 |

|

FCF |

132 |

244 |

163 |

229 |

316 |

360 |

394 |

548 |

723 |

394 |

|

Acquisitions |

122 |

195 |

63 |

63 |

773 |

2 |

484 |

29 |

3,723 |

100 |

|

Debt Repayment |

5 |

103 |

169 |

139 |

318 |

137 |

101 |

1,172 |

175 |

|

|

Repurchases |

147 |

244 |

||||||||

|

SBC |

11 |

14 |

12 |

12 |

19 |

25 |

31 |

30 |

34 |

32 |

Source

They’ve never paid a dividend or meaningfully reduced share count. This has been a story of growth mostly by M&A.

Risk

A quick glance might see the growth of EPS and margin expansion, but ROE and ROIC have been trending down since 2019. We know they don’t consistently buy back shares, so the EPS growth is coming from an actual increase in net income. The problem is that debt levels have risen drastically and this is what is mostly contributing to lower ROIC.

2021 saw the company ramp up long-term debt from $681 million to $4 billion. To their credit, they have reduced the debt load since then, but it is still a key risk for me. The fact that margins at every level have expanded over the past decade is a sign that the acquisitions have been wisely chosen, but the debt used to finance these purchases has lowered the returns on capital. Long-term debt is currently at $2.79 billion, with cash and cash equivalents at $508 million.

The following line of thought is repeated often nowadays, but it happens to be accurate in this case. Much of the past growth can be attributed to the ZIRP era, especially considering their use of debt to acquire other businesses. This isn’t the company’s fault, and the low rates were not in any way masking the real quality of the business. The point here is that higher rates clearly raise the cost of capital, which makes most targets less attractive. I don’t expect as many acquisitions in the future for this reason.

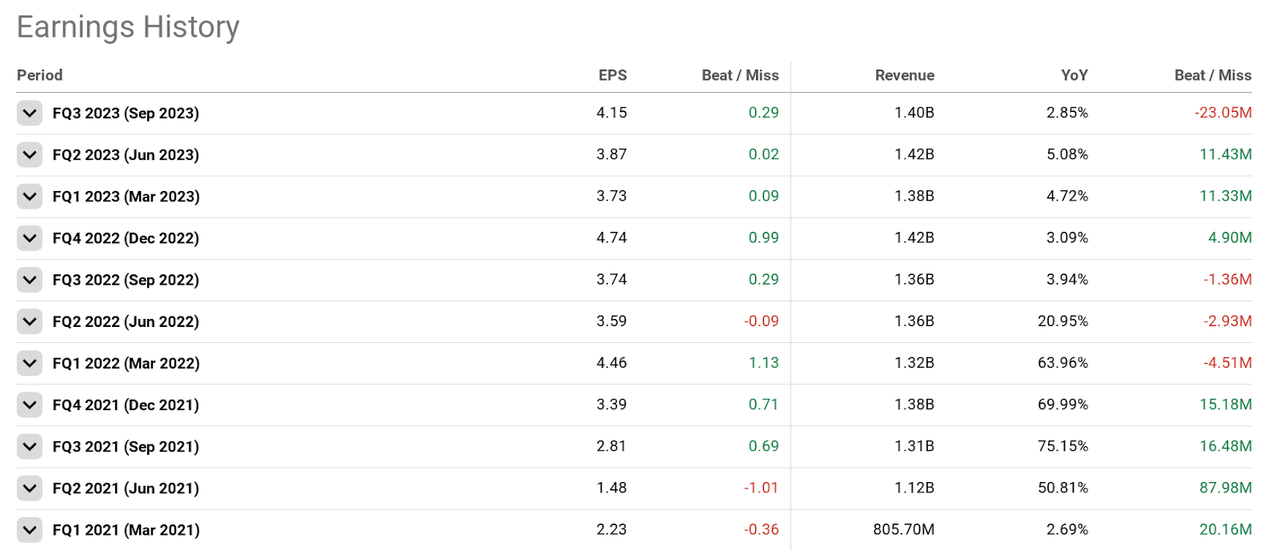

Q3 Earnings

Let’s next look at recent earnings:

Seeking Alpha

I expect the trend of beating earnings to continue, but the debt load is still a main concern of mine, and the potential negative effects of that debt will take longer to play out.

Valuation

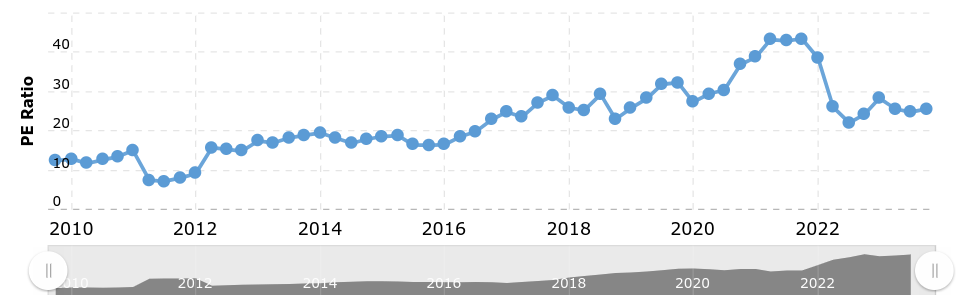

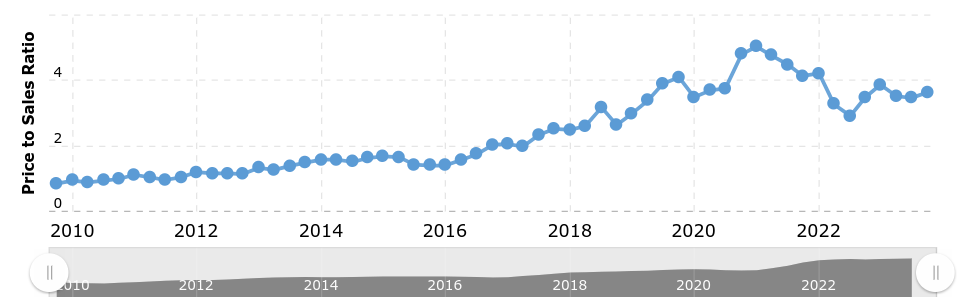

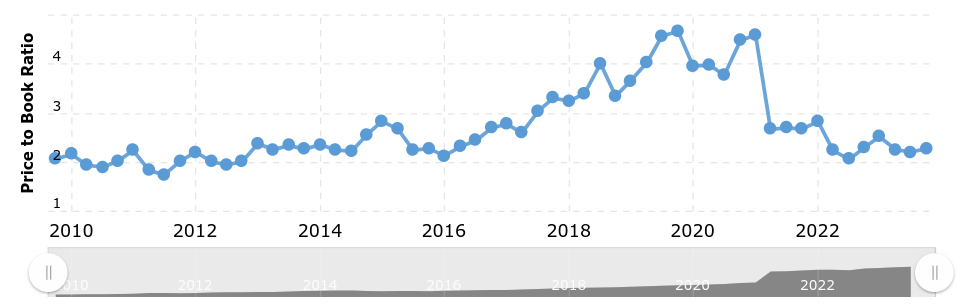

The stock price hit an all-time high in March 2022 and is now down 10% from that point. First, we will look at historical multiples, then a peer comp:

Macrotrends Macrotrends Macrotrends

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

Div Yield |

|

TDY |

3.9 |

16.3 |

27.6 |

2.3 |

n/a |

|

CGNX |

7 |

32.7 |

42.7 |

4.5 |

0.7% |

|

KEYS |

4.6 |

14.9 |

20.6 |

5.7 |

n/a |

|

RVTY |

5.2 |

18 |

296 |

1.5 |

0.2% |

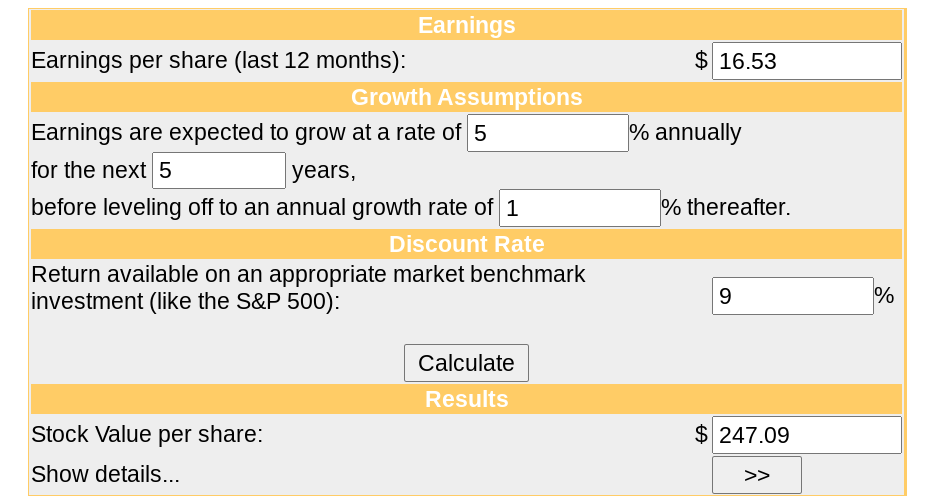

Because of how mixed TDY’s revenue is in comparison with its peers, looking at multiples doesn’t do us much good unfortunately, and looking back historically doesn’t show the full picture either. Next is the DCF model:

Moneychimp

I usually make more conservative EPS estimates if earnings are at all-time highs, due to the likelihood of mean reversion. Even without doing so this time, I see the company being quite overvalued today. TDY is a very good quality company and the acquisitions have been accretive as margins at all levels have expanded while EPS grows.

Conclusion

The current version of Teledyne has been one of the better-performing growth stories of the past 25 years, returning almost 50x since IPO’ing in 1999. The growth-by-acquisition strategy worked well in the past, but part of that amazing performance was due to the era of low rates that preceded us.

In spite of the margin expansion and growth of EPS, I think there is too much risk right now. Fundamentally I’m concerned with the heavy debt load, and valuation-wise I see the stock as being too expensive. This leads me to give the stock a “hold” rating.

Read the full article here