In its latest earnings report, LegalZoom (NASDAQ:LZ) raised its full-year guidance, reflecting baby steps forward in optimism about improving macroeconomic conditions. Despite the encouraging signs of growth, particularly in their revenue and EBITDA forecasts, the company is missing tangibly significant financial impacts from its broadening product portfolio. While I wait for the Q4 earnings report from LegalZoom to get some clarity on 2024 projected performance, I sit with the Q3 earnings report with a twinge of disappointment. For example, there was little discussion of generative AI initiatives. Moreover, the ongoing discussion of other new products and services delivered little clarity on their individual contributions to financial performance. Notably, some substantial sales from shareholders also weighed on my assessment of the quarter.

I review Q3 earnings starting with the clear good news in the full-year guidance.

Guidance

Just as in Q2, LegalZoom provided guidance that assumes “current macro trends continue.” Once again, the company nudged guidance higher, which suggests that macro conditions are incrementally improving from their vantage point. LegalZoom increased full-year revenue guidance from a range of $642M to $652M to a range of $657M to $659M, implying a 6% year-over-year growth rate at the midpoint. The company also raised full-year EBITDA from a range of $105M to $110M to a range of $114M to $116M, representing an improvement of 7% at the midpoint. LegalZoom expects Q4 revenue of $155M to $157M, implying 6% year-over-year growth at the midpoint.

While the higher guidance is encouraging, management has consistently created guidance with potential upside. The rest of earnings felt underwhelming, giving what felt like budding excitement from earlier earnings reports. In particular, the broadening portfolio of the newest products did not deliver major upside for 2023 financial performance. Apparently those rewards await in 2024.

New products

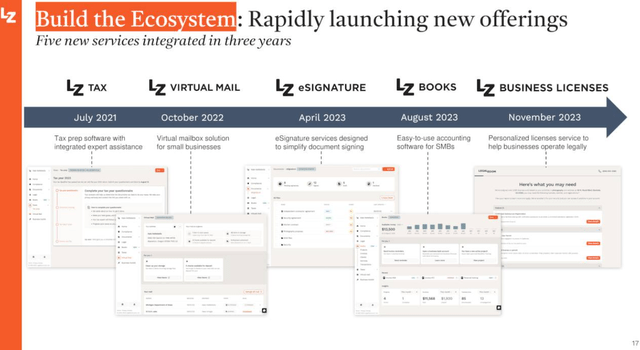

A review of new products once again dominated the earnings conference call. The chart below from the earnings presentation shows the evolution of the “build the ecosystem” portfolio from LZ Tax to the latest product LZ Business Licenses. The chart does not include LegalZoom’s new Legal Forms experience, which the company will promote as “a gateway to attorney-assisted solutions.”

LegalZoom is rapidly evolving its product and service portfolio. (LegalZoom Earnings Presentation)

LegalZoom also has “integrate the expert” offerings. Attorney led trademarks, business advisory plan, and LZ Tax (which overlaps with build the ecosystem) are the most mature offerings in this portfolio. Doc Assist, also a part of the expert offering, is in a beta phase. Doc Assist summarizes documents using generative AI. LZ offers this product for free, which makes sense given this kind of use case is quickly becoming commoditized. LZ offers its own domain-specific knowledge as a part of the model, but clearly the company does not think it can market that knowledge with a price premium. Unlike the last two earnings reports, LegalZoom did not provide a detailed update on the prospects for its generative AI efforts. It was not even clear if the company settled on this one product as its AI offering. The 10Q was similarly short on details.

LZ does not provide revenue breakdowns by product, so it is difficult to understand how product mix and complementarity are specifically impacting financial results (analysts on the call did not ask such questions either). There were a few relational nuggets. For example, over 40% of users who uploaded a document for summation clicked through to the attorney offering. Management did not indicate how much of that 40% is incremental demand, but the implication is that Doc Assist (which does the summation) is performing as a sales/marketing channel. Management indicated that they are still optimizing the portfolio and conducting tests on pricing, especially on the subscriptions that layer on top of the freemium product.

There is a spotlight on the freemium product because it has been suppressing average order value during 2023. From the 10Q: “Average order value decreased by 6% during the three months ended September 30, 2023, compared to the three months ended September 30, 2022, and decreased by 17% during the nine months ended September 30, 2023, compared to the nine months ended September 30, 2022. The decrease in average order value… for the three and nine months ended September 30, 2023, was primarily driven by a 21% and 14% decrease, respectively, in average order value related to our business formations due to the nationwide rollout of free LLC formations during the first quarter of 2023.” Once LegalZoom laps the freemium impact, I expect an easier time seeing core growth drivers.

While the freemium product is driving growth in subscriptions, average revenue per unit (ARPU) has been declining (on a year-over-year basis) since a 12% peak in Q3 2022. These dynamics are important because management indicated that “over half” of its customers now come through the freemium channel.

Management acknowledged the current tepid ARPU dynamics but seems optimistic about figuring out the growth formula (emphasis mine):

“We’re excited to see how active usage of LZ Books will lead to a seasonal cross-selling to LZ Tax, or how the usage of legal forms library will drive and upsell to our eSignature offering and attorney advice, or how forming your entity before operating can lead to pulling licenses and permits months later and just before a business opens their doors to the public. There are abundant opportunities to expand revenue per customer post formation. Today it is almost entirely unrealized.”

Fortunately, retention rates and attach rates are still “good.” In its 10Q, LegalZoom reported an annual small business retention rate of 63% (as of September 30, 2023). In the previous 10Q, LegalZoom reported the same retention rate (as of June 30, 2023). The company did not report specific attach rate numbers.

Revenue

Given all of the above, the revenue picture is relatively uninspiring. LegalZoom continues to grow year-over-year revenue in the single digits. The company is on a longer-term push to figure out how to upsell freemium customers into paying subscriptions of ancillary and complementary products. This push involves a lot of experimentation. Management held out Q4 as a potentially key test of its ability to drive growth from the new product offerings. From the prepared remarks in the conference call:

“There will be times when we make decisions that are counter to our share objectives because we’ve identified a new opportunity to drive incremental revenue or profit per customer. I anticipate a few of those opportunities to present themselves in Q4 as we continue to test price optimization for the subscription portion of our existing lineup, as well as introduce multiple new products in advance of our peak Q1 season.”

Average order value was $242 in the third quarter, down 6% year-over-year, driven by a lower priced lineup. From the 10Q:

“Average order value decreased by 6% during the three months ended September 30, 2023 compared to the three months ended September 30, 2022, and decreased by 17% during the nine months ended September 30, 2023 compared to the nine months ended September 30, 2022. The decrease in average order value for the three and nine months ended September 30, 2023 was primarily driven by a 21% and 14% decrease, respectively, in average order value related to our business formations due to the nationwide rollout of free LLC formations during the first quarter of 2023.”

LegalZoom expects year-over-year growth in average order value to improve going into year-end as it laps the early part of the rollout of free LLC formations.

Cost-cutting

One impact from portfolio optimization was a staffing reduction for the sales organization. LegalZoom plans to “more actively leverage LZ Books and MyLZ as vehicles for upselling from books to tax.” This strategy reduced the need for related sales activity. The expansion of the freemium offering removed the relevance of a sales model that “touched all…customers.” Going forward, LZ will focus its sales growth where the ROI makes sense (of course, that should have been the model before): “we’ll build it up over time as we continue to prove that we can do a better job of monetizing post formation.”

Margins and profits

Cost controls and improving operations keeps the LegalZoom story interesting. The company recorded Q3 adjusted EBITDA of $34M, producing a 20% margin. This is a significant increase year-over-year from Q3 2022 adjusted EBITDA of $17M and an 11% margin. In Q2 2023, LegalZoom earned $30M adjusted EBITDA with an 18% margin.

However, (non-GAAP) gross margins decreased slightly sequentially and year-over-year. Q2 gross margin decreased year-over-year from 67% to 65%. Q3 gross margin decreased year-over-year from 69% to 67%.

Buybacks

Buyback activity often underwrites a bullish narrative for a stock. However, in LegalZoom’s case, two secondary offerings in two months muddy the waters. In Q3, LegalZoom repurchased 4.7M shares for a total of $45.1M in a private transaction. At the same time (on September 11), a shareholder (the 10Q is not completely clear on whether this was the same shareholder in the repurchase agreement) sold 16.1M shares for $10.00 in a public offering. On the day following earnings, a shareholder announced the public offering of 15.1M shares (I could not find a press release or SEC filing associated with the sale of these shares). I am not sure what to make of all the selling, but at least LZ is trading above the $10 price of the September offering, which suggests an ample and bullish demand for shares. The other offsetting news is that LZ’s board authorized another $100M for share buybacks after the company exhausted the 2022 authorization.

LZ plans “to continue to opportunistically repurchase shares of our common stock as part of our balanced approach to capital allocation.” Thus, hopefully, the stock gets a firm floor while the company demonstrates the growth engine from its new product offerings.

Conclusion and the Trade

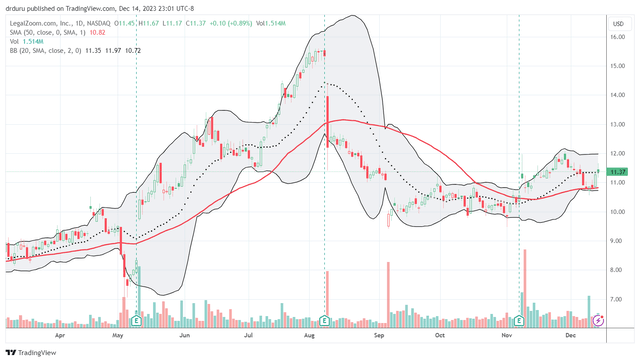

In my last report on LZ earnings, I claimed that “overall, I do not think nitpicking at the negatives in LegalZoom’s results and story justify the price volatility. I also think LZ will take time to return to pre-earnings levels. So, I consider LZ a buy on the dips with modest expectations for upside.” Accordingly, I bought back into shares as LZ drifted down to and tested support at its 50-day moving average (DMA). So far, so good, yet LZ is not likely to return to earlier highs until the company demonstrates financial momentum from its new product initiatives.

LZ has had a rollercoaster year. Stabilization may finally be underway ahead of a “prove it” 2024. (TradingView.com)

Be careful out there!

Read the full article here