In May 2024, I covered Mercury Systems (NASDAQ:MRCY) marking the stock a buy. However, since then the stock has lost 6.7% of its value compared to a nearly 15% gain for the S&P 500. In this report, I will discuss the reason for the stock price decline, review the company’s most recent earnings and guidance and provide a stock price valuation for MRCY stock.

Mercury Systems Fails To Find A Buyer

One of the reasons I put a buy rating on Mercury Systems stock is because the company was going through a strategic review and one of the options was an acquisition of the company. I wouldn’t say there is huge M&A momentum in the industry, but to me the current setting for defense budgets as well as rebuilding strength in the aerospace and defense supply chain provides a positive backdrop for defense contractors to seriously consider mergers and acquisitions. As a provider of microelectronics, I also believe that Mercury Systems is positioned rather well given that microelectronics components become more and more important in advancing weapon system capabilities.

While I did see a lot of positives for a takeover, Mercury Systems failed to find a buyer for the business and decided the right course for the business is to remain independent with a new management in place after the CEO decided to step down. That was most definitely not what I was hoping for and likely also not what investors had hoped for as it left investors exposed to the current challenges faced by the company.

Financial Results Reflect Supply Chain and Mix Pressures

Mercury Systems

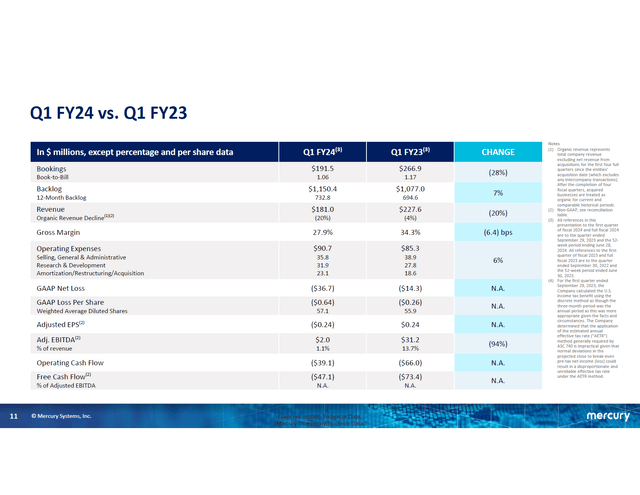

The Q1 FY2024 results clearly reflect the repressures. Order intake declined 28%, but that is not something I am particularly concerned about given the 7% higher backlog compared to a year ago. What seemingly is more concern is the 20% reduction in revenues and a drop in gross margins and adjusted EBITDA of $2 million compared to $31.2 million a year ago. Those are the realities of the business that had investors longing for a possible buyout of the company. The reality is that if management would have opted for a takeover investors would not have received a good price while I would say the pressures are understood quite well.

Mercury Systems currently is dealing with a higher share of development programs. Historically, 20 percent of the revenues was tied to development programs and currently that is 40 percent. Development programs tend to be lower margins, so that mix shift provides a significant margin pressure which was also visible in the gross margins and on top of that there is cost growth further pressuring margins. Furthermore, the supply chain issues are providing a pressure as stocking materials and applying labor by accounting standard trigger a portion of the revenue and earnings to be recognized while the cash is normally received upon delivery of the hardware. So, as Mercury tries to derisk the business by increasing inventory it is making the cash to revenue conversion less favorable.

The GAAP net loss stood at $36.7 million from a $14.3 million loss a year ago. The decline was driven by a $27.6 million decline in gross margin around $5.5 million in higher cost driven by higher R&D and restructuring costs offset by lower SG&A, lower amortization and lower acquisition costs. The rise in operating costs, lower gross profit and higher interest expenses was partially mitigated by a higher income tax benefit.

Mercury Systems Maintains Guidance

Mercury Systems

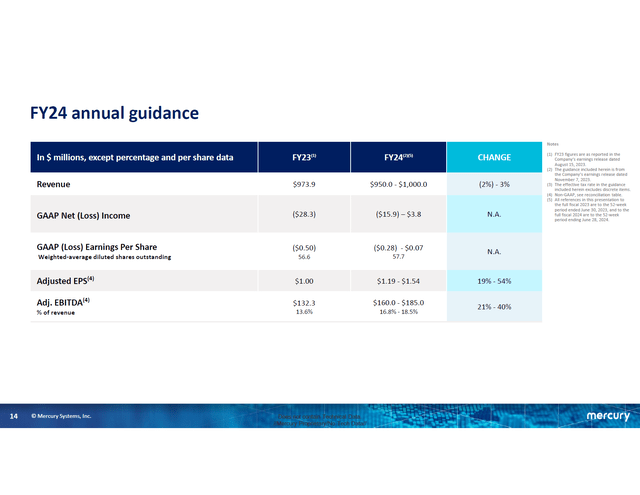

The issues that Mercury Systems currently faces are challenging, but I believe that the issues are quite well understood, and while I was hoping that there would be any bidders for the company, I also think that given the long-term demand drivers there is no clear reason for the company to sell itself for a low price. The 2024 guidance shows that revenues will be flat at the mid point, but adjusted EBITDA will be 20 to 40 percent better. So, significant improvement is already expected this year and beyond that I would expect improvements as low margin development contracts will shift towards higher margin phases, more hardware will be delivered, and long-term demand should be favoring micro-electronics demand.

Mercury Systems Offers Upside In A High Global Security Threat Environment

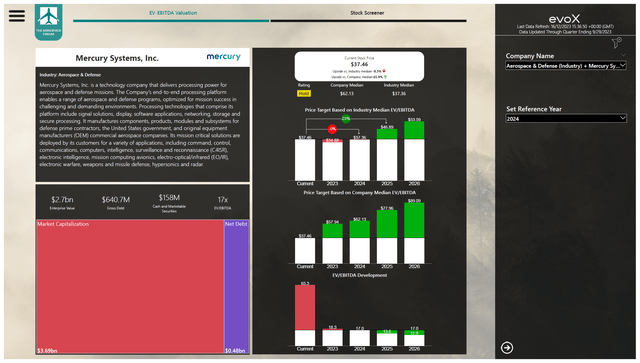

The Aerospace Forum

Given the challenges that Mercury faces with a rather slow collection of cash and an unfavorable margin mix, I can see why investors have a very difficult time constructing a positive stock price outlook for Mercury Systems. At the same time, I have processed analyst estimates and those show that at the EV/EBITDA of 17x for the aerospace and defense industry, there is upside but not for FY2024. Against 2024 earnings, the stock is slightly overvalued but with FY25 earnings in mind upside is there. Wall Street analysts have a $36.50 price target representing 2.6% downside with a low target of $30 and a high target of $48. My price target of $46.90 is at the high end of the range and comes with a Hold rating given the lack of upside for FY2024. The current price target by Wall Street analysts includes some factoring for execution risk and perhaps analysts are not wrong there and the fact the company did not find a buyer certainly has not helped analysts turning more bullish. The company has no debt due in the coming years, but $576.5 million is due in 2027 on a maturing revolver and Mercury will not be able to cover that with cash so it is likely that the company will look to extend that revolver or refinance. As a result, I do see the opportunity but I also see shortcomings in the form of debt coverage and lack of upside with FY2024 earnings in mind. As a result, I am marking the stock a Hold.

Conclusion: Mercury Systems Is A High Execution Risk Buy

I do see the challenges Mercury Systems faces but also believe that there is not enough eye for the fact that margins are pressured by higher share of development programs which in the near term provide margin pressure but over the longer time provide better margins. So, I am seeing those low margins as the investment that Mercury Systems has to make now for the future. Besides that, I also do believe that the global security threat environment provides solid support for expanding defense budgets while advancing weapon system capability in which microelectronics will play an increasingly bigger role. So, I do see the execution risk ahead as Mercury Systems tries to right the ship but I also do believe that over the mid to longer term, Mercury Systems plays an important role as sensor and electronic warfare packages which rely heavily on chips are becoming more important. So, demand is there, upside is there but so is the risk. I still believe the stock has upside that is fundamentally driven, but in the quarters ahead the company has to start showing its supply chain challenges are easing and inventory is being converted to cash.

Read the full article here