Topline Summary

Autolus Therapeutics (NASDAQ:AUTL) is a member of an increasingly large group of companies developing cell-based immunotherapy for cancer. In this case, their main target is CD19 in ALL, a disease that is already served by a few different CAR T-cell therapies out there. Their hope is that by using a tweaked version of this approach, they can improve efficacy while reducing the notable toxicities associated with other cell therapies in this line. For me, the potential approval of a therapy we still need more manufacturing capacity for is enough to be tempting, and I would definitely consider a buy on this stock at this time.

Pipeline Overview

Obecabtagene autoleucel (obe-cel)

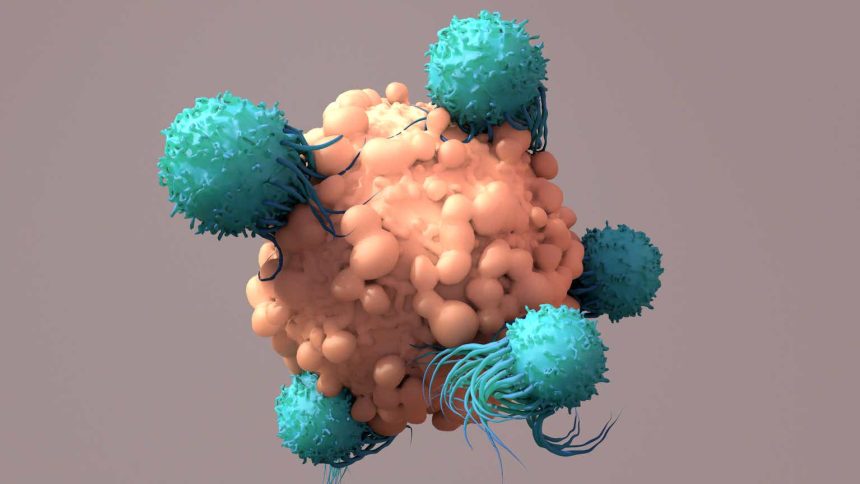

Obe-cel is the flagship developmental product that AUTL is working on. It is a CD19-directed CAR T-cell therapy similar in principle to the other CAR T-cell therapies that are approved for different B-cell cancers, including B-cell acute lymphoblastic leukemia (ALL).

AUTL submitted a BLA to the FDA for approval in patients with relapsed/refractory B-cell ALL. This submission will be based largely on the findings from the phase 1b/2 FELIX study, which was just updated at ASH 2023. Obe-cel was successfully manufactured and administered in 83% of the 152 patients who were enrolled and underwent leukapheresis.

The complete response rate in these patients who had treatment was 78%. Minimal residual disease was eliminated in 96% of evaluable patients. Grade 3 cytokine release syndrome occurred in 2% of patients, and grade 3 ICANS was observed in 7% of patients. In patients with low disease burden, none of these grade 3 events occurred.

These findings nominally compare favorably with other CD19 CAR T-cell approaches, which demonstrated comparable response rates in patients with relapsed/refractory B-cell ALL, but with grade 3/4 CRS and neurologic adverse events more in the range of 48% and 22%, respectively, giving a signal that obe-cel maybe be associated with less toxicity, a major concern of these therapies.

Obe-cel is also being evaluated in other settings, including B-cell non-Hodgkin lymphoma (B-NHL), chronic lymphocytic leukemia (CLL), and primary CNS lymphoma. All of these are the subject of various phase 1 trials that are ongoing. At ASH 2023, AUTL presented an update of ALLCAR19, which enrolled patients with relapsed/refractory B-NHL and CLL. The company touted high rates of durable response in these diseases, with low frequency of grade 3 or higher CRS or ICANS.

AUTO8

The next most recent update also came at ASH 2023, focused on a dual-targeted BCMA/CD19 CAR T-cell therapy called AUTO8. The phase 1 MCARTY study is enrolling patients with relapsed/refractory multiple myeloma. A total of 11 patients were included in the study, half of whom had been infused with CAR T cells expressing just the BCMA chimeric antigen receptor, and the other half being treated with AUTO8. All patients achieved a response to therapy, most of which were complete responses.

No grade 3 or higher CRS or ICANS was observed with either treatment approach. While it’s very early to talk about how this relates to, say, approved therapies (phase 1 studies are way too small to make definitive conclusions), if the results bear out, they might be an improvement over other BCMA CAR T cell therapies like ide-cel, since they are also associated with some high-grade CRS and neurotoxicity.

Financial Overview

As of their Q3 2023 filing, AUTL held $308 million in total current assets, including $256.4 million in cash and equivalents. Meanwhile, their total operating expenses reached $47.8 million, and after interest expense, interest income, and license revenue, the net loss before income tax was $50.8 million for the quarter.

At this rate, AUTL has approximately 6-7 quarters of cash left as a runway to fund operations. They have not had a public offering since December 2022.

Strengths and Risks

Considering we’re talking about trial designs on the order of tens of patients in size, it’s difficult to consider AUTL as anything but a rather early-stage company. However, the FDA has made it clear in the path that they’re willing to greatly accelerate the pipeline for CAR T-cell therapy if they have promising data, which AUTL does. Moreover, the FDA may continue with an attitude of “the more the merrier” in the CAR T space that has been plagued by long wait times due to manufacturing capacity in recent years.

Are these CAR T therapies better than the approved flavors? I don’t know that you can say that. The grade 3 toxicities of note do appear to be lower, but without a head-to-head comparison, even seemingly slam-dunk comparisons across trials can’t really be taken that seriously.

I think the main concern I have with AUTL is cash. 6 quarters of funds is a lot to see through some of the big news you should expect for a while, but it might not be enough to get them through approval and into a big launch of their drug, which itself may be slow to penetrate the market since there are several approved CD19-directed CAR T-cell therapies.

Some kind of financing arrangement is likely before they reach approval, and their current valuation might not grow with the same momentum with the risk of dilution on the table. There’s also the gnawing specter recently exposed to the possibility of a second cancer with currently approved CAR T-cell therapies. I don’t know what to make of this news, nor do many of the experts in the fields. But, real or not, the risk of rare but very serious complication could be enough for the FDA to demand more evidence from CAR T cell developers in the future, and that news would be catastrophic for AUTL.

Bottom-Line Summary

AUTL is already on the cusp of drug approval in the CAR T-cell space, which is expected to grow to over $80 billion by 2032. There’s still room for a “me too” in the CD19 and BCMA areas, to say nothing about the possibility that AUTL’s approach might be less toxic while maintaining efficacy. Based on that, there are a lot of reasons to be excited about AUTL’s prospects. They’re currently valued at a premium for a phase 2 biotech, but if they get approval, I believe there’s at least a 100% upside here. While the risks are real, I think you should consider a position in this one.

Read the full article here