Investment Rundown

The most recent earnings report from Southwest Gas Holdings, Inc. (NYSE:SWX) had some mixed results in my view. Firstly the company has made strong progress on building up the bottom line again. Last year during the Q3 quarter the bottom line was negative but it most recently came in at an EPS of $0.1. This puts the company at an FWD p/e of 19 which is slightly below where it has historically been trading at, about 6% lower. Despite the last quarter’s results, the estimates are that in 2023 SWX will be posting an EPS of $2.85 and with the last quarter beating predictions by $0.07 I think that there is room for a surprise there as well. However, I do have some concerns that are pressuring a potential buy thesis. With SWX I will be a little more conservative and rate the company a hold instead.

Company Segments

SWX derives its revenues from three distinct segments: Natural Gas Distribution, Utility Infrastructure, and Pipeline and Storage. In the most recent report, only the Natural Gas Distribution segment demonstrated positive revenue, while the remaining two segments reported negative revenues. This marks a disappointing departure from the positive results observed in the corresponding period of the previous year.

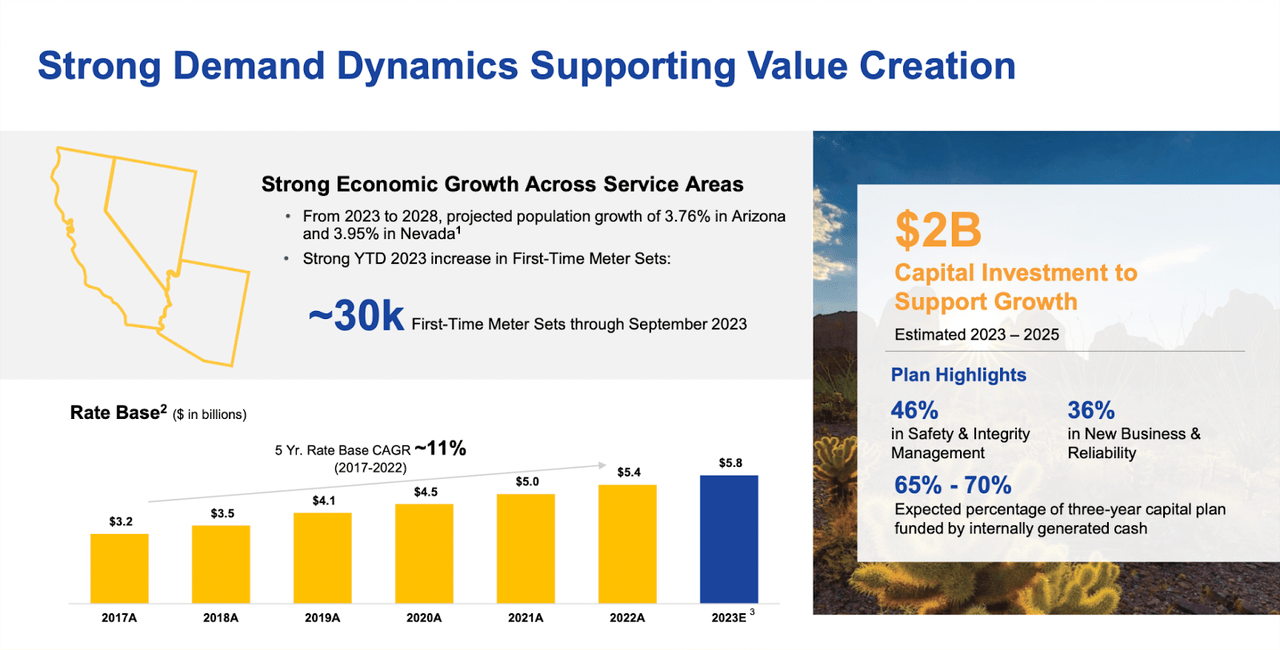

Value Creation (Investor Presentation)

In addition to the previously mentioned segments, SWX extends its services to include trenching, installations, and replacements of underground pipes, along with some maintenance services for energy distribution systems. SWX anticipates a growth catalyst in the form of an expanding population across the three states where it operates. To bolster its capital position, the company recently conducted a share offering, issuing close to 3.6 million shares at an offering price of $60.12 per share in March. While such financial maneuvers can raise capital for SWX, they may contribute to the downward pressure on the share price, impacting existing shareholders.

Markets They Are In

As highlighted earlier, SWX conducts its operations across three U.S. states: California, Nevada, and Arizona. SWX identifies certain favorable factors, including an expanding population, which is anticipated to drive up electricity demand, consequently leading to increased utilization of natural gas as well.

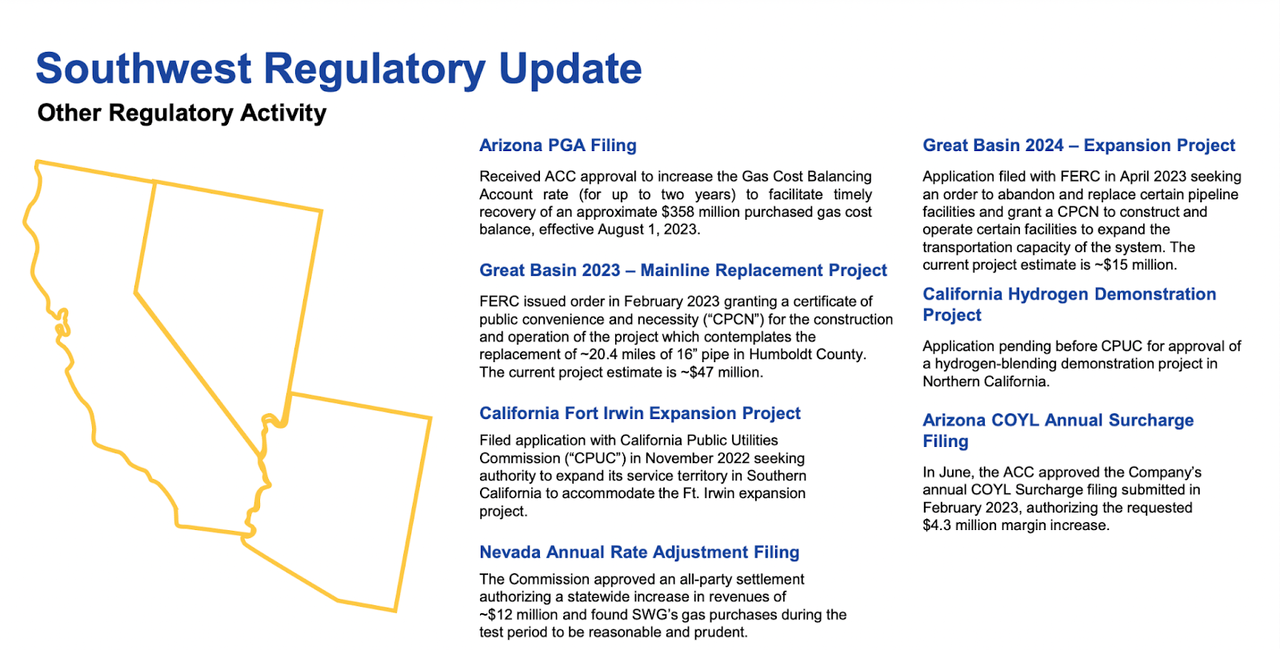

Market Update (Investor Presentation)

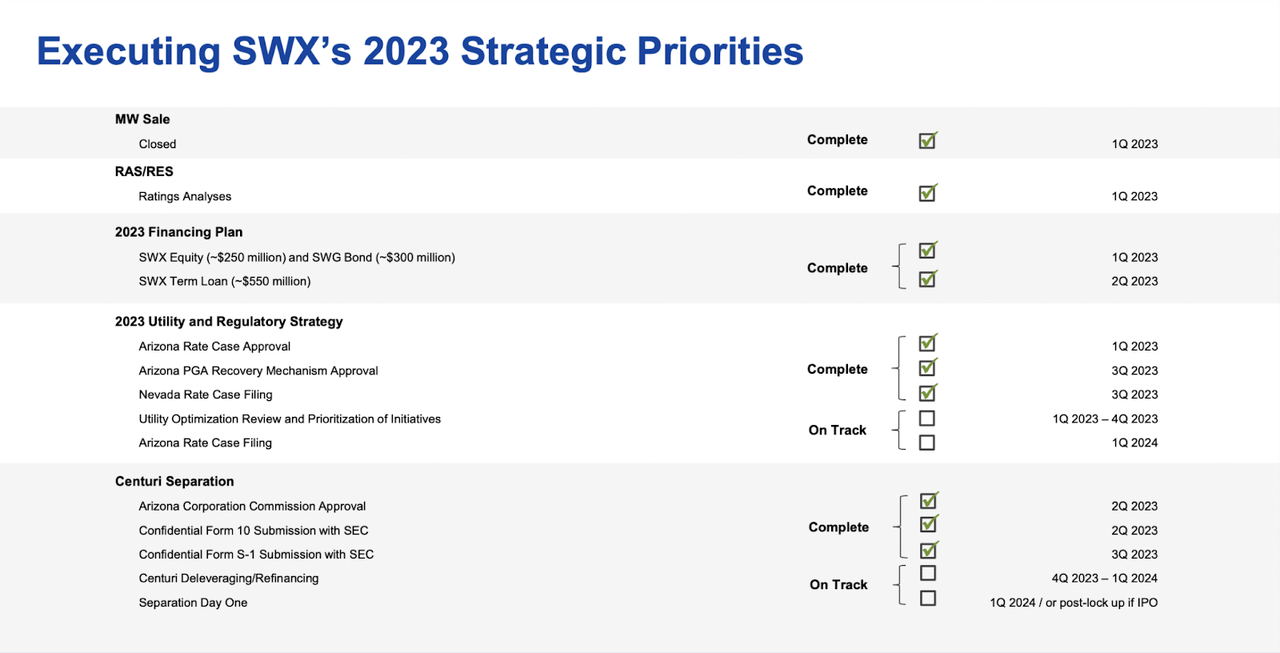

In the future, aligning investments with SWX will mean focusing on a pure-play natural gas venture as the company intends to spin off one segment, namely Centuri. The anticipated outcome for investors with this spinoff is a dividend reduction due to the Centuri divestment. This strategic move is designed to align the payout ratio more closely with industry peers. In the most recent earnings presentation, the company covered some of the updates it has had on its spinoff for the Centuri business.

Growth Targets (Investor Presentation)

Some of the key milestones for the separation of the Centuri business will be in Q4 of 2023 and Q1 of 2024. The next step is the deleveraging and refinancing of Centuri which will happen during those quarters which is why I think the next 6 months will be quite critical for SWX and the stock price.

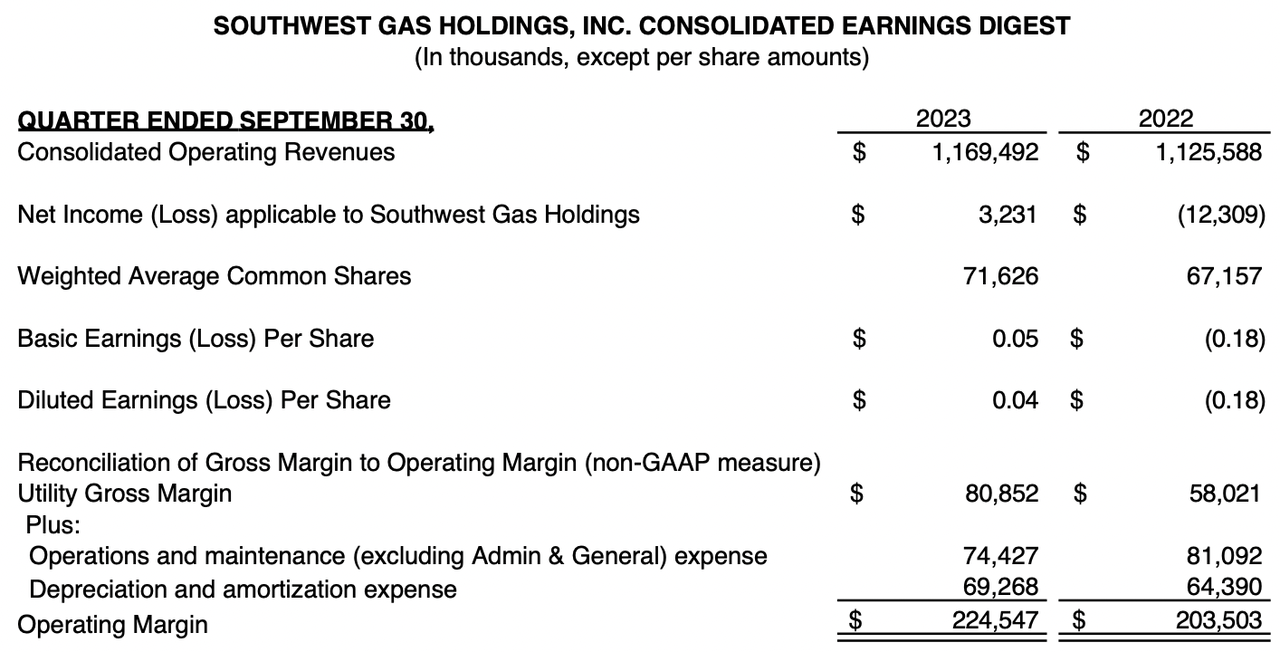

Earnings Highlights

Looking closer at the last report from the company there were some decent improvements by the business. The operating revenues for the quarter once again topped above $1 billion and produced a $40 million increase YoY.

Income Statement (Earnings Report)

The operating margins increased as well increasing to $20 million YoY. Where I continue to be worried though is how SWX is still diluting shareholders at a decent rate. YoY SWX increased the outstanding shares by close to 6% which is an amount that is right now suppressing a buy thesis. It speaks volumes that SWX doesn’t necessarily have the financial means to cover all expenses without dilution. The TTM debt repayment has been impressive which is positive, but it has not come from the best sources in my opinion. The near 6% increase in shares translates to over $200 million in additional capital for SWX. What baffles me as well is how they are also spending capital on buying back shares. It seems incredibly counterproductive and just a way to appeal to investors.

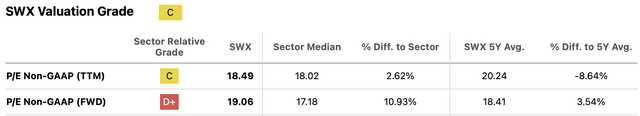

Valuation (Seeking Alpha)

When looking at the p/e for the company it’s trading below where it has historically been, just could suggest some upside but I do for a fact think that SWX will be trading at a lower multiple going forward seeing as they are more leveraged now as the debt position has grown rapidly. This has resulted in the interest expense reaching nearly $300 million in total in the last 12 months alone. I think the FED will continue to keep rates high and therefore anticipating this amount of interest expenses for the company in the next 12 months seems reasonable. But I also think that should rates go down prematurely as to what the market anticipates then SWX may see its valuation rise as the future earnings potential grows. This all boils down to me not being too impressed with the current situation and buying seems unreasonable but so does selling, which makes me land at a hold.

Risks

While the fluctuation in natural gas prices is inherent to commodity markets and doesn’t particularly concern me for SWX, the long-term outlook for natural gas as a substantial energy source in the country remains positive.

Natural Gas Prices (Tradingeconomics)

The outlook for natural gas remains positive, driven by its role in electricity generation, heating, and industrial processes. As a cleaner-burning fossil fuel, it aligns with environmental considerations and is expected to benefit from global efforts toward cleaner energy. Ongoing infrastructure development and its affordability compared to other sources contribute to a favorable market outlook. The growing population and rebounding economic activities further support the continued demand for natural gas. I think that this will be a great benefit to SWX and as they are paying down large amounts of debt and becoming more financially flexible I think they are in a position where they could be expanding themselves quite rapidly too.

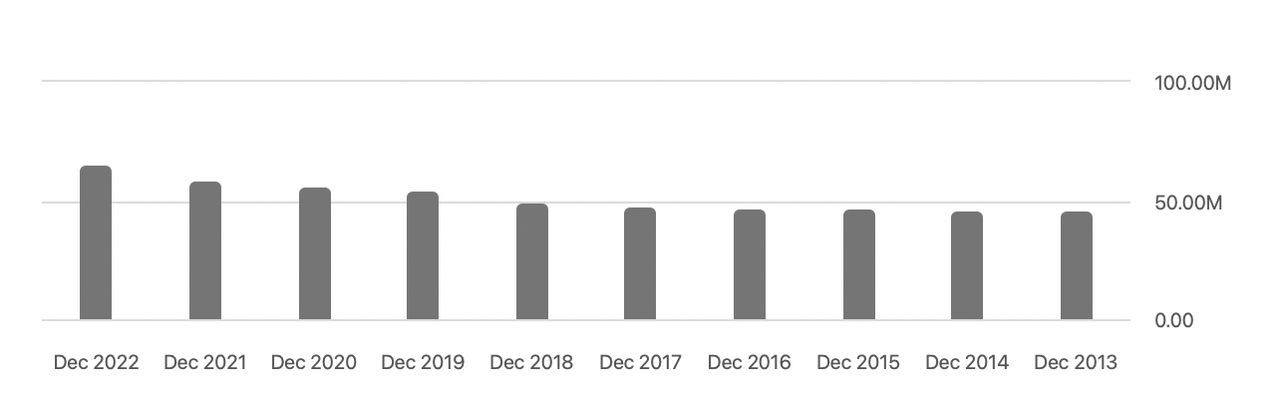

Share Dilution (Seeking Alpha)

However, a notable risk associated with SWX lies in its historical practice of share dilution. Over the past year, the outstanding shares increased by 13%, exacerbating the challenges faced by the share price, which witnessed a decline of around 26% during the same period. Looking forward, the trend of dilution might persist, given the company’s need to raise capital, especially in light of the substantial debt burden it has accumulated.

Financials

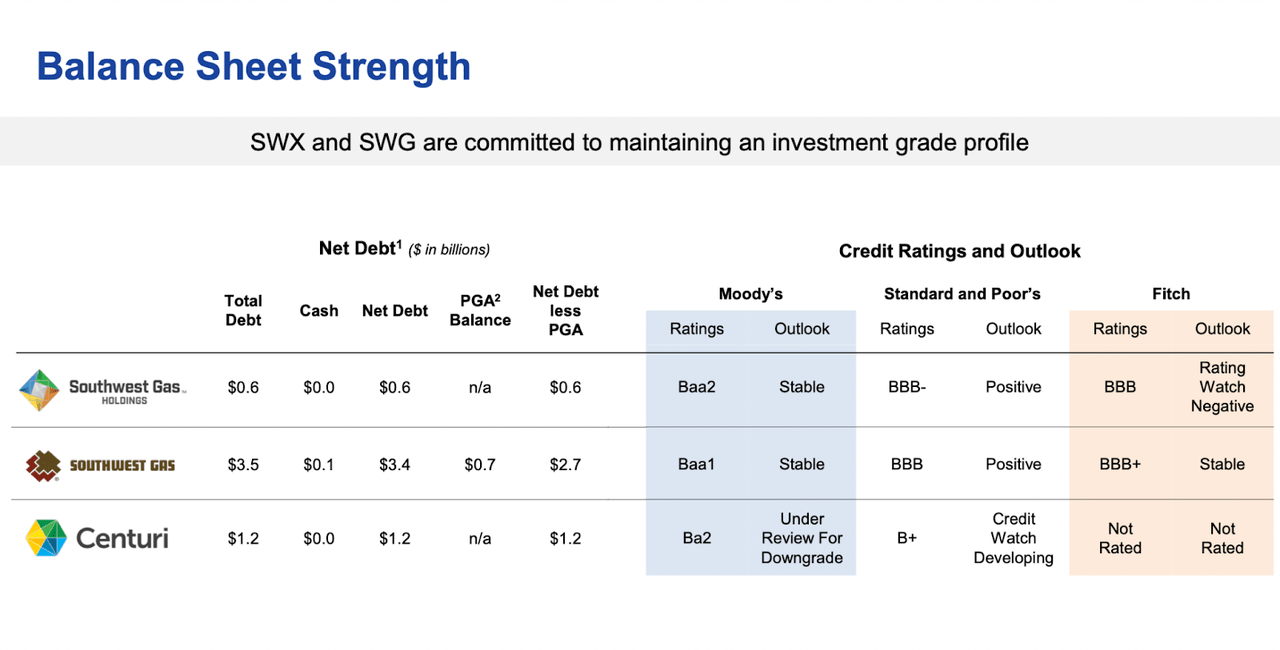

Looking at the balance sheet there are some prominent factors here that need to make improvements if we are to see the share price of SWX rebound and potentially justify its current valuation. For starters, the cash position sits at a measly $104 million as of the last report, down significantly from $222 million in 2021.

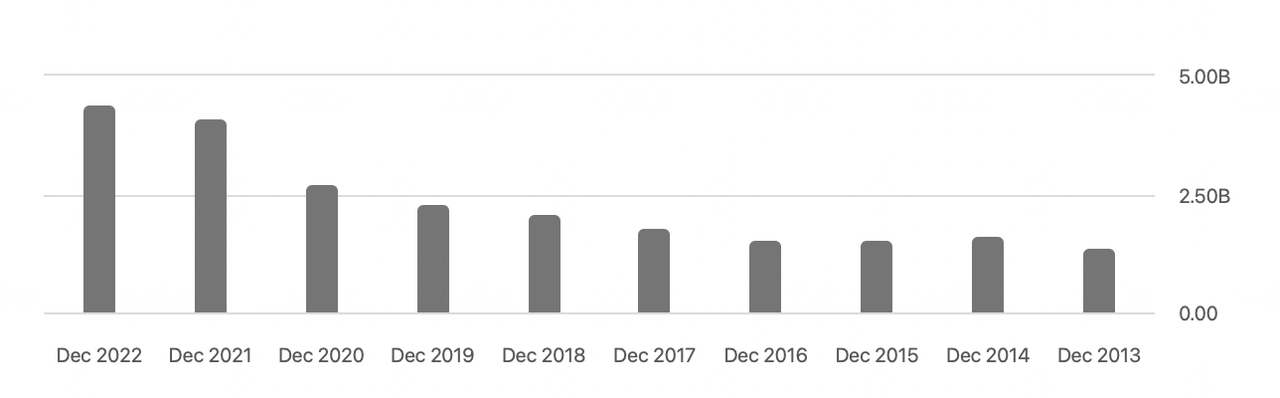

Debt Levels (Seeking Alpha)

The worrying part with the balance sheet isn’t necessarily the lower cash position, but instead the long-term debts moving in the completely wrong direction. They have nearly doubled from the 2019 levels and now sit at $4.5 billion, which is in line with the entire market cap of the business right now.

Balance Sheet Highlights (Investor Presentation)

In terms of the plan going forward the company does seem to prioritize paying down some of the debts and the net proceeds from the sale of MountainWest will be used for the paydown of term loans, which is valued at a little over $1 billion. Seeing improvements on the balance sheet and SWX getting into a more flexible position I think is very important for the long-term prospects of the business. The debt could otherwise very much be a hurdle in the way of growth and just a significantly lower share price to reflect the lower growth momentum.

Final Words

SWX has seen its stock price fall a fair bit in the last 12 months and underperform the broader markets. The rise in interest rates is taking a toll on the company’s earnings as expenses are at all-time highs of nearly $300 million. With dilution continuing I don’t think investors are getting a good enough value here. Despite trading below its historical earnings multiple, some factors make that justified right now. Until dilution stops and stronger earnings are posted I will be sticking with a hold rating here.

Read the full article here