This article is part of a series that provides an ongoing analysis of the changes made to Chase Coleman’s Tiger Global Management 13F stock portfolio on a quarterly basis. It is based on Tiger Global’s regulatory 13F Form filed on 11/14/2023. Please visit our Tracking Chase Coleman’s Tiger Global Portfolio series to get an idea of their investment philosophy and our last update for the fund’s moves in Q2 2023.

Chase Coleman’s 13F portfolio value increased from $11.97B to $13.56B this quarter. Recent 13F reports have shown 100+ positions. There are 33 stakes that are significantly large (more than 0.5% of the portfolio each) and they are the focus of this article. The largest five positions are Meta Platforms, Microsoft, Apollo Global, Take-Two Interactive, and Alphabet. Together, they add up to ~53% of the entire 13F portfolio.

Prior to founding Tiger Global Management in 2001, Chase Coleman was the technology analyst at Tiger Management from 1997 to 2000, making him a bona fide “tiger cub”. To know more about Julian Robertson and his legendary Tiger Management, check out Julian Robertson: A Tiger in the Land of Bulls and Bears.

New Stakes:

Alibaba Group Holdings (BABA), DoorDash (DASH), Elastic (ESTC), PDD Holdings (PDD), and Procore Technologies (PCOR): These are small (less than ~1% of the portfolio each) new stakes established this quarter.

Stake Increases:

Meta Platforms (META): META is currently the largest 13F position at ~20% of the portfolio. The stake was established in Q4 2016 at prices between $115 and $132. The buying continued through Q2 2019 at prices up to ~$200. Q4 2019 saw a ~25% selling at prices between $175 and $208. The three quarters through Q2 2021 had seen another ~42% selling at prices between ~$246 and ~$356. That was followed with a ~23% reduction in Q1 2022 at prices between ~$187 and ~$339. H2 2022 saw a stake doubling at prices between ~$89 and ~$183. That was followed by a ~15% stake increase last quarter. The stock currently trades at ~$344. This quarter also saw a ~4% stake increase.

Note: Meta has seen a previous roundtrip in the portfolio. A pre-IPO investment of ~54M shares was sold out by Q4 2012. The trade generated over $1B in profits.

Microsoft Corporation (MSFT): MSFT is currently the second largest position at 14.27% of the portfolio. It was established in Q4 2016 at prices between $57 and $63 and increased by ~400% in Q2 2017 at prices between $65 and $72. Q1 2018 also saw a ~38% stake increase at prices between $85 and $97. Q4 2019 saw a ~30% selling at prices between $135 and $159 while in Q1 2021 there was a ~15% stake increase at prices between ~$212 and ~$240. The three quarters through Q2 2022 saw a ~60% selling at prices between ~$242 and ~$343. The stock is now at ~$372. There was a ~13% increase during Q1 2023 and a ~8% increase this quarter.

Take-Two Interactive (TTWO): TTWO is a 5.44% position built during the last four quarters at prices between ~$94 and ~$154 and it is now above that range at ~$159.

Alphabet Inc. (GOOG): GOOG is a 5.15% of the portfolio position purchased during Q2 2022 at prices between ~$106 and ~$144 and the stock currently trades at ~$137. Q1 2023 saw a ~125% stake increase at prices between ~$87 and ~$109 while last quarter saw a ~55% selling at prices between ~$104 and ~$128. The position was increased by 40% this quarter at prices between ~$117 and ~$139.

Workday Inc. (WDAY): WDAY is a 4.47% of the portfolio stake built in 2020 at prices between ~$114 and ~$258. H1 2022 saw a ~68% selling at prices between ~$137 and ~$264. There was a ~135% stake increase in the next quarter at prices between ~$138 and ~$180. The last three quarters saw a ~37% selling at prices between ~$133 and ~$227. This quarter saw a similar increase at prices between ~$211 and ~$252. The stock currently trades at ~$273.

Sea Limited (SE): The 3.79% position in SE was first purchased in Q2 2018 at prices between $10.25 and $16.50. The next few quarters also saw further buying. Q4 2019 saw a ~40% selling at prices between $26.70 and $40.25 while in the next six quarters there was a ~60% stake increase at prices between ~$91 and ~$358. There was a ~40% selling in Q2 2022 at prices between ~$57 and ~$133. That was followed with a ~63% reduction during Q4 2022 at prices between ~$41 and ~$65. The position was rebuilt this quarter at prices between ~$35 and ~$67. The stock is now at $36.61.

Amazon.com Inc. (AMZN): AMZN is now a 3.69% of the portfolio stake. The position was established in Q2 & Q3 2015 at prices between ~$19 and ~$27. Q1 2016 had seen a two-thirds reduction at prices between ~$24 and $34. The following quarter saw a ~40% increase at prices between ~$29 and ~$37. There was a ~38% selling in Q4 2018 at prices between ~$67 and $101. Q4 2019 and Q1 2020 saw another ~22% reduction at prices between ~$85 and ~$109. The three quarters through Q2 2022 had seen the stake sold down by ~75% at prices between ~$102 and ~$185. Q4 2022 saw the position rebuilt at prices between ~$82 and ~$121. The last quarter saw a ~62% reduction at prices between ~$98 and ~$130. The stock is now at ~$154. There was a ~6% stake increase this quarter.

Eli Lilly & Company (LLY): LLY is a 3.64% of the portfolio position purchased in the last two quarters at prices between ~$343 and ~$599 and the stock currently trades at ~$580.

Grab Holdings (GRAB), Lam Research (LRCX), Nvidia (NVDA), and Uber Technologies (UBER): The 1.34% GRAB position saw a ~120% stake increase this quarter at prices between $3.24 and $3.83. The stock currently trades at $3.16. LRCX is a 1.71% of the portfolio position established last quarter at prices between ~$491 and ~$651 and it now goes for ~$770. There was a ~8% stake increase this quarter. The 3.56% NVDA stake was purchased during the last two quarters at prices between ~$262 and ~$494 and the stock currently trades at ~$501. UBER is a small 1.74% of the portfolio position established during the last two quarters at prices between ~$30 and ~$50 and it is now well above that range at $61.73.

Taiwan Semi (TSM): TSM is a 1.32% of the portfolio position established during Q1 2023 at prices between ~$74 and ~$98 and the stock currently trades above that range at ~$103. There was a ~18% stake increase last quarter and another ~10% increase this quarter.

Confluent Inc. (CFLT), HubSpot Inc. (HUBS), Novo-Nordisk (NVO), and NU Holdings (NU): These small (less than ~1% of the portfolio each) stakes were increased this quarter.

Stake Decreases:

Apollo Global (APO): The large (top three) ~8% APO stake was built during the last two quarters at prices between ~$57 and ~$77. The stock currently trades well above that range at $94.08. This quarter saw marginal trimming.

ServiceNow Inc. (NOW): NOW is a 2.45% of the portfolio position that saw a stake doubling in Q3 2020 at prices between ~$402 and ~$500. The two quarters through Q1 2021 had seen another ~45% stake increase at prices between ~$475 and ~$595. Q2 2022 saw a ~55% reduction at prices between ~$412 and ~$575. There was a similar increase during Q3 2022 at prices between ~$370 and ~$516. Q4 2022 saw a ~50% reduction at prices between ~$342 and ~$426. That was followed by a ~25% selling last quarter at prices between ~$431 and ~$574. The stock currently trades at ~$704. There was a minor ~4% trimming this quarter.

JD.com (JD): JD was a ~5M share position first purchased in Q4 2014 at prices between $23.50 and $27. The next two quarters saw the position built up to a huge ~70M share position (~25% of the 13F portfolio at the time) at prices between $24 and $38. H2 2018 also saw a ~42% increase at prices between $19.25 and $39.50. Q2 2022 saw a ~37% selling at prices between $48.70 and $66.50. That was followed with a ~27% reduction during Q4 2022 at prices between ~$37 and ~$60. This quarter saw another ~50% selling at prices between ~$29 and ~$41. The stock is now at $26.64 and the stake is at ~2% of the portfolio.

Intuit (INTU): The ~2% INTU position was built during the last two quarters at prices between ~$376 and ~$460 and it is now at ~$618. The stake was decreased by 52% this quarter at prices between ~$447 and ~$553.

Fleetcor Tech. (FLT) and Kanzhun Ltd. (BZ): These small (less than ~1.5% of the portfolio each) stakes were reduced during the quarter.

Kept Steady:

CrowdStrike Holdings (CRWD): CRWD is now a 1.11% of the portfolio stake. A large stake was established in Q2 2020 at prices between ~$55 and ~$105. Q3 2020 saw a ~50% stake increase at prices between ~$97 and ~$144. There was another ~17% stake increase in Q1 2022 at prices between ~$157 and ~$227. The two quarters through Q3 2022 saw a ~90% reduction at prices between ~$137 and ~$240. The stock currently trades at ~$260.

Snowflake Inc. (SNOW): The 0.89% SNOW stake was built over the six quarters through Q1 2022 at prices between ~$180 and ~$392. There was a ~70% reduction in the next quarter at prices between ~$113 and ~$241. Q3 2022 saw a ~22% stake increase while during Q1 2023 saw a similar reduction. There was another ~60% selling last quarter at prices between ~$135 and ~$191. The stock currently goes for ~$199.

ZoomInfo Technologies (ZI): ZI is a 0.82% of the portfolio position established during Q4 2022 at prices between ~$26 and ~$49 and the stock currently trades at $18.06.

Atlassian Corp plc (TEAM) and Datadog Inc. (DDOG): These very small (less than ~0.70% of the portfolio each) stakes were kept steady this quarter.

Note: In July 2018, it was reported that Tiger Global has taken a ~$1B stake in SoftBank (OTCPK:SFTBY). The stock was at ~$20 (split-adjusted) at the time and currently trades at $21.05.

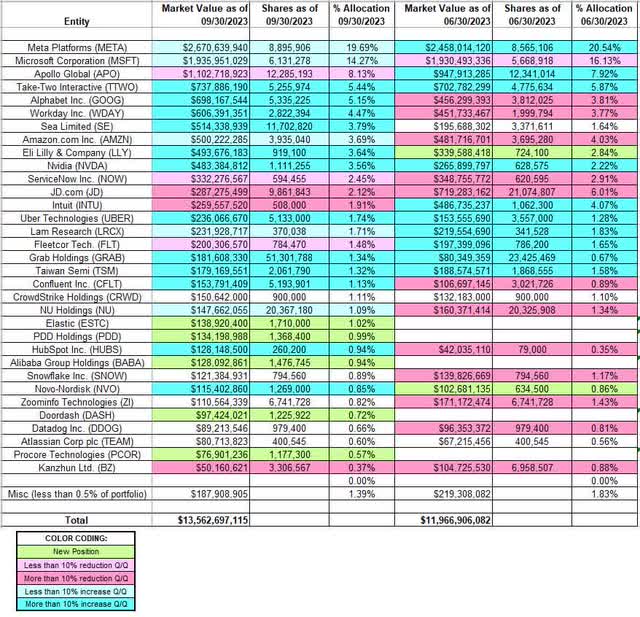

Below is a spreadsheet that shows the changes to Chase Coleman’s Tiger Global Holdings 13F portfolio holdings as of Q3 2023:

Chase Coleman – Tiger Global’s Q3 2023 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Tiger Global’s 13F filings for Q2 2023 and Q3 2023.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here