Shares of Darden Restaurants, Inc. (NYSE:DRI) have been a solid performer over the past year, rising nearly 20% with the stock rallying steadily over the past two months towards a 52-week high. On Friday, the company reported solid results, and improving profit margins should help support growth. While shares reflect much of the positive backdrop, I do expect moderate further upside, meaning existing investors should continue to hold shares.

Seeking Alpha

In its fiscal second quarter reported on December 15th, Darden earned $1.84, beating consensus by $0.10 with results 20% higher than last year. Same-restaurant sales rose a solid 2.8%, beating consensus by 0.1%. Revenue rose by 9.7% to $2.7 billion, aided by the $700 million acquisition of Ruth’s Chris. It now sees sales of $11.5 billion with inflation of 3-3.5% and same-restaurant sales growth of 2.5-3%. That should result in $8.75-$8.90 in EPS. That is up from $8.55-$8.85 previously even as DRI trimmed the top-end of its revenue forecast due to lower check inflation. However, with input prices falling more quickly than check inflation, this is actually a favorable backdrop.

While Darden operates several brands, Olive Garden remains the primary generator of earnings with $263 million in segment profits, followed by LongHorn at $112 million and fine-dining (home to Eddie Vs. owned Ruth’s Chris locations, and the Capital Grille) at $57 million. All segments posted double-digit gains. The company is seeing sales-growth decline at higher-end restaurants by 1.7% while Olive Garden jumped 4.1% and LongHorn 4.9%.

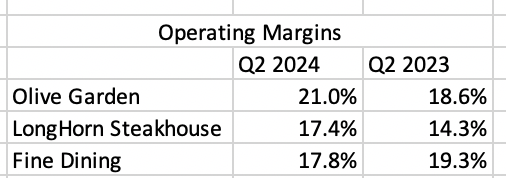

Consolidated restaurant EBITDA margins of 18.8% were up 230 BP from last year. As you can see below, Olive Garden and LongHorn reported quite strong margin expansions while fine dining faced pressure. Some of this was due to the onboarding of Ruth’s Chris, but lower same-store sales also reduced operating leverage.

Darden, my own calculations

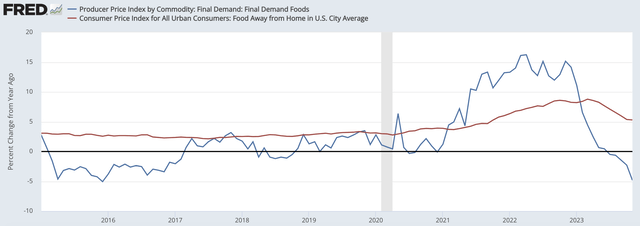

Overall, the company is seeing flat traffic with some weakness in the under-$50k customers. However, there are material cost tailwinds. As noted above, revenue rose by 9.7% while food and beverage costs rose by just 3.4%. There was also an 8.9% increase in labor costs, both below revenue growth. While restaurant prices to consumers (as measured by CPI) have been slowing over the past year, input prices for restaurants (food PPI) have turned negative.

St. Louis Federal Reserve

In 2021 and 2022, food prices were rising sharply, more quickly than restaurants could raise prices. This squeezed margins. On top of this, the tight labor market pushed up wages. Now, the labor market has normalized, and food prices are declining. This is allowing the company to recapture margins lost after COVID. 3% check inflation in a 0% cost inflation world is a superior outcome to 5% check inflation in an 8% cost inflation environment, even as it means slower top-line growth. That is exactly the environment we are moving into, which is why the company is raising EPS guidance while trimming revenue.

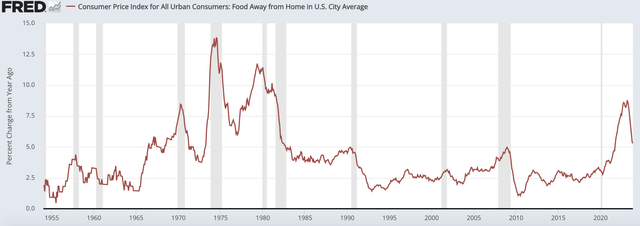

Now, there could be a concern that restaurants eventually have to give prices if food prices come down. However, dating back to the 1950s, restaurant prices have never once actually declined. Once they print new menus with higher prices, restaurants never bring back out the older menus. This is a reason I see incremental margin gains continuing, even if the lion’s share of the recovery has already occurred.

St. Louis Federal Reserve

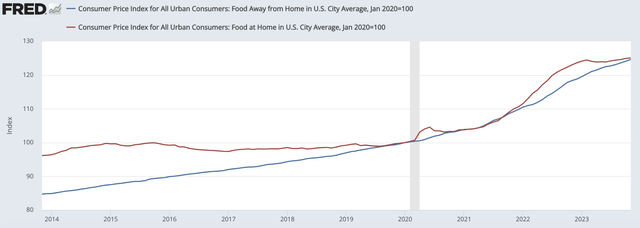

Moreover, restaurant pricing actually looks relatively cheap compared to grocery prices. This is a reason I believe Darden’s more value-oriented brands like Olive Garden and LongHorn are holding up quite well. Since 2020, grocery prices have risen slightly more than restaurant prices. This compares to the long-term trend, seen in the last decade, of restaurant prices rising more quickly. With grocery prices relatively high compared to restaurant prices, it is comparatively attractive for a family to eat out rather than cook at home. This should help support demand while also enabling them to continue to take price and recoup some of the lost pricing relative to groceries.

St. Louis Federal Reserve

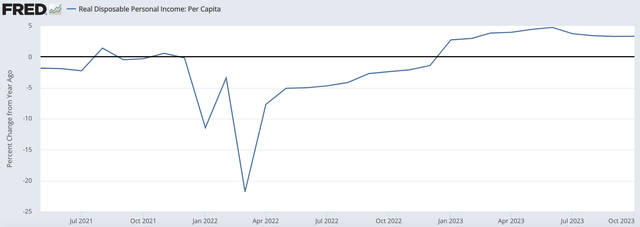

Of course, these things can be difficult to do if consumers pull back in a meaningful way. So far, we are not seeing that, and a soft landing does appear to be more probable than many expected with the Federal Reserve poised to pivot to rate cuts next year. A reason why I have remained more optimistic about a soft landing is that consumers are seeing real incomes rise.

As you can see below, in 2022 as government stimulus lapsed and energy prices surged, real per capita incomes declined, forcing consumers to dip into savings. With the labor market holding in and inflation moderating, real incomes are up 3.3% from last year. With consumers having higher real incomes, they should be able to continue spending. With attractive relative pricing, restaurants should benefit from this increased spending.

St. Louis Federal Reserve

Darden is also a highly cash generative business; excluding working capital, it has generated $376 million in first half free cash flow. With cap-ex H1-heavy, we should see ~$770-780 million in full-year free cash flow. Given this cash flow, it executed $181 million in share repurchases during the quarter with $328 million remaining on its share repurchase program. It also pays a 3.2% dividend. These returns are also supported by a strong balance sheet; while debt is up from last year due to Ruth’s Chris purchase, it is just $1.7 billion-less than 10% of its market capitalization.

As a result, I expect the company to continue returning free cash flow to investors via its dividend and modest buybacks. Shares are 18.7x earnings fiscal 2024 earnings with a 3.9% free cash flow yield. With consumers’ income rising, I think over the next few months, we may hear Darden speak about traffic beginning to grow again. There should also be an opportunity to bring Ruth’s Chris margins up as Darden consolidates operations. Further, fine dining has been hurt by difficult comparisons as business dinners recovered strongly from their COVID-lull last year. As these comps roll off, we should see some improvement here, and holiday bookings have been strong in this segment. With some traffic improvement and modest incremental margin growth, Darden should be well-positioned to grow earnings by 5-7% in fiscal 2025 (which begins in mid-2024 from a calendar perspective).

5+% growth with a 3.9% starting free cash flow yield can support a ~10% return over the next year. Given the favorable macro dynamics on margins and traffic, I view the restaurant sector as well positioned over the next year. At an 8-10% return, I do not see Darden as a compelling buy, but a name that should be held by existing investors, who can enjoy a stable dividend, with moderate price upside, especially if they have a large unrealized gain. Just given the magnitude of the recent move, I would wait for a pullback before adding more to the name or opening a position. With shares having shown strong support at roughly $150, I would be an incremental buyer at about $155 where the free cash flow yield would be closer to 4.25% and P/E below 17.5x.

Read the full article here